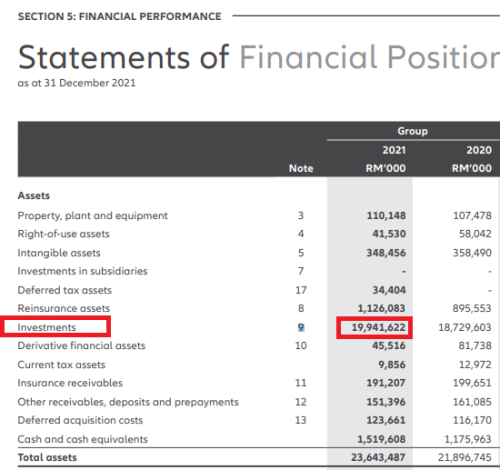

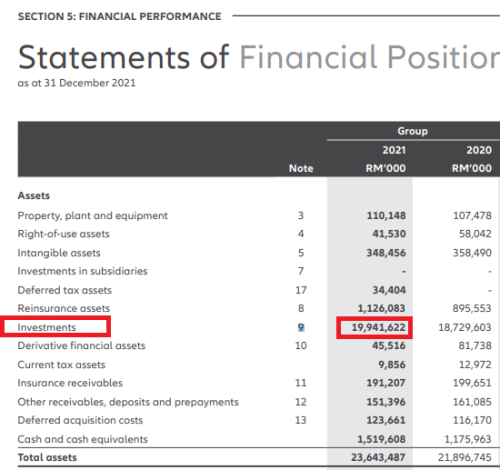

Example:Allianz Malaysia Berhad

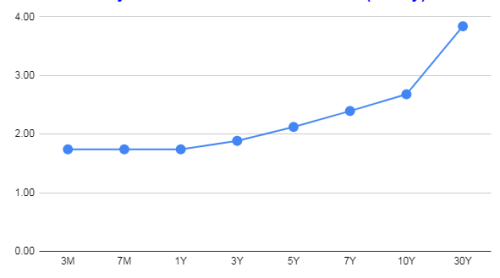

Bond Yield going up=Bond Price going down

As i know ,US Fed are going to increase interest rate few time this year,may be our BNM will be Follow.

My prediction=Their Equity Value going to tank so as their share price.

STOCK MARKET DISCUSSION V150

|

|

May 16 2022, 09:33 PM May 16 2022, 09:33 PM

Return to original view | Post

#1

|

Newbie

13 posts Joined: Sep 2012 |

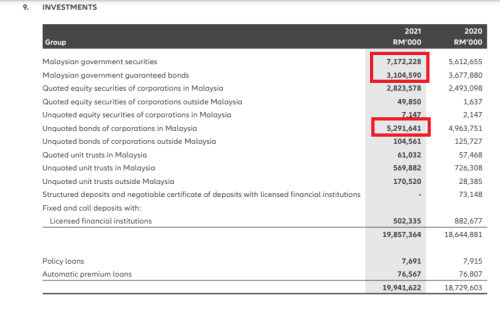

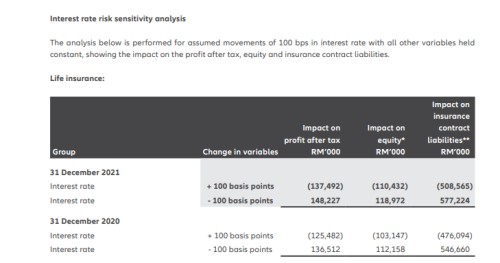

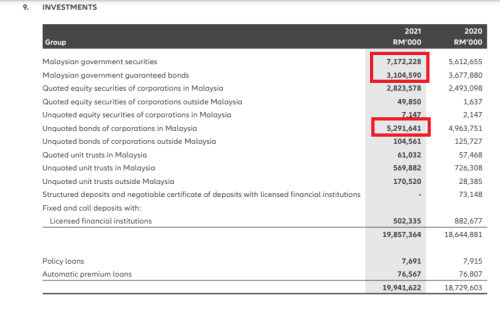

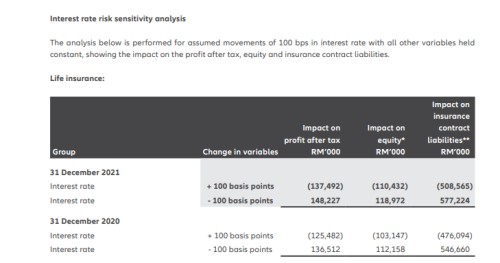

Impart on increasing Interest rate on insurance company Example:Allianz Malaysia Berhad     Bond Yield going up=Bond Price going down As i know ,US Fed are going to increase interest rate few time this year,may be our BNM will be Follow. My prediction=Their Equity Value going to tank so as their share price. Boon3 liked this post

|

|

|

|

|

|

May 19 2022, 03:35 PM May 19 2022, 03:35 PM

Return to original view | Post

#2

|

Newbie

13 posts Joined: Sep 2012 |

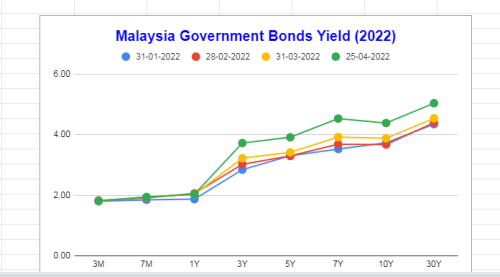

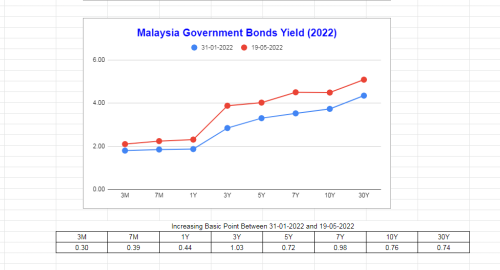

Case Study for incoming future interest rate up cycle in bank institution

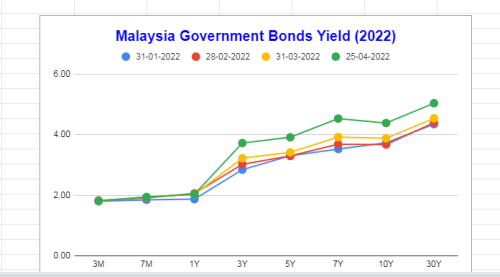

Ideally Interest Rate Yield Curve  Bank makes a profit from the difference between Short Term and Long Term interest rates,also known as interest rate spread. Bank borrow from pubic in the form of FD (Short Term) and lend out to the people (Car Loan,House Loan,Business Loan) Long Term. Newly MY Interest Rate Yield Curve  As you can see from the above chart,when BNM decide to up BLR,all year yield should be up correspondence. From the chart,3Y and 7Y Yield up the most. There are some inverted yield curve between 7Y and 10Y Ideally should be 10Y Yield >>> 7Y Yield Summary There are some potential risk to the economy in the short run.(Inverted Yield Curve Early Warning Sign) Interest Rate Spread getting lower affecting future bank earning. High interest Rate will cause non performing loans spike. This is only first time BNM increasing BLR this year,i believe more to came in the future. Thank for Reading. |

|

|

May 19 2022, 04:43 PM May 19 2022, 04:43 PM

Return to original view | Post

#3

|

Newbie

13 posts Joined: Sep 2012 |

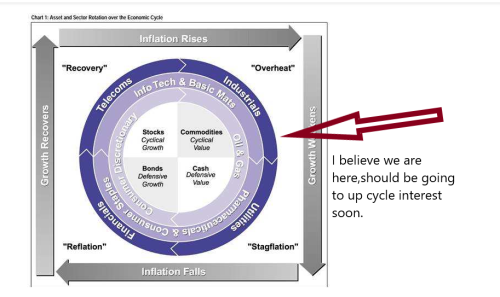

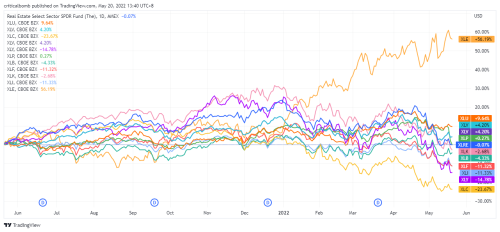

Many people say buy bank stock when interest rate up rising.

It is wrong ,should be the buy bank stock when the interest spread going higher.Even Warren Sell their Bank Stock this year and bet big on oil counter. |

|

|

May 20 2022, 02:24 PM May 20 2022, 02:24 PM

Return to original view | IPv6 | Post

#4

|

Newbie

13 posts Joined: Sep 2012 |

QUOTE(YH1234 @ May 20 2022, 12:12 PM) is interest spread a transparent information? bank not necessarily gain more when interest rate hike, but they are in better shape compare to rest relatively speaking, most choose to park their fund in bank or bank stock during slow down and inflation, thats the main reason i guess why bank stock goes up. recession could be another story.   For me,i hold same cash now while waiting opportunity to came. Oil/commodity counter both should be at peak earning,i believe inflation should be peak as we move though interest up cycle. |

|

|

Oct 1 2022, 08:57 PM Oct 1 2022, 08:57 PM

Return to original view | Post

#5

|

Newbie

13 posts Joined: Sep 2012 |

QUOTE(square2 @ Sep 21 2022, 12:27 PM) stock ideas to discuss when oil and gas price is low Dialog>>Price Target=1.50thong guan, bpplastic, tomypak, SLP and scientex packaging -Need more tanker storage for excess production.  Hibiscus >>Price Target=0.30-0.50 -If recession in 2023  In mean time,i am shorting in oil and nasdaq SCO And SQQQ To the moon |

| Change to: |  1.7440sec 1.7440sec

0.63 0.63

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 11:14 PM |