QUOTE(andrekua2 @ Dec 15 2021, 01:07 PM)

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Dec 15 2021, 01:16 PM Dec 15 2021, 01:16 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Dec 15 2021, 01:37 PM Dec 15 2021, 01:37 PM

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Dec 15 2021, 01:39 PM Dec 15 2021, 01:39 PM

|

All Stars

13,476 posts Joined: Jan 2012 |

|

|

|

Dec 15 2021, 02:14 PM Dec 15 2021, 02:14 PM

|

Senior Member

1,019 posts Joined: Sep 2018 |

|

|

|

Dec 15 2021, 02:26 PM Dec 15 2021, 02:26 PM

Show posts by this member only | IPv6 | Post

#58725

|

All Stars

12,269 posts Joined: Oct 2010 |

|

|

|

Dec 15 2021, 04:55 PM Dec 15 2021, 04:55 PM

|

Junior Member

432 posts Joined: Jan 2013 |

QUOTE(Boon3 @ Dec 15 2021, 01:02 PM) The academics teaches that share buybacks are good. In theory yes. And actually I do agree....the theory. Are there any in real life example where SBB actually do the shareholders good? or most of them just fails.But in examples I have seen (like MPI's buyback during the dotcom/semicon crash) ? My answer is no. Share buybacks still involves the process of buying the shares from the market. If the process is badly executed then it's a pure waste of shareholder funds. As it is, TG splashed 1.4 billion in share buybacks this round. At this moment, TG shares is worth only 1.98. Meaning those shares bought is only worth 391 million. 1.020 billion of the shareholder funds is gone... poooof! ....... just like that... Good SBB Example |

|

|

|

|

|

Dec 15 2021, 05:03 PM Dec 15 2021, 05:03 PM

|

Senior Member

2,116 posts Joined: Mar 2009 |

|

|

|

Dec 15 2021, 06:04 PM Dec 15 2021, 06:04 PM

|

Senior Member

8,652 posts Joined: Sep 2005 From: lolyat |

QUOTE(Boon3 @ Dec 15 2021, 08:54 AM) Kossan and Harta reacts slowest to changes to ASP .... ie they are the slowest to change their ASP compared to the top 2 glove makers... Harta order normally 6 months or longer, majority of their order already taken up ahead with future price factor in. As for the ASP drop, it is affecting the spot order the most whereby future order is quite likely depends on various figure/countries. hence their profits rises/falls slower compared to other glove makers... which means... one really do not know YET how bad their profits will fall..... so if one buys now, one has to be prepared for the incoming decline in profits.... would the market be gentle/kind for the poor results in the future? yea... lots of cash on hand... but hasn't this the case for both of them? one can invest and assume that the company could be generous with their dividends but .... end of the day that's the 'assumption' one makes... the company could always use the cash for something else... Several years ago i notice Topglove is losing market share in EU/US market year by year whereby their standard is quite stringent, or it could be the expansion of glove and shrink EU/US market. Market circulating around China has mass expansion in glove production but i can frankly tell u only a few manage to met US/EU market requirement. Harta has the best cost control and majority of their capacity for US/EU market, Kossan on the other hand is mainly at US/EU surgical glove, Supermax also has fair share in US/EU and mainly at South America. If u ask me China massive expansion will hurt which one, i would say Topglove. Just my 2 cent only |

|

|

Dec 15 2021, 06:14 PM Dec 15 2021, 06:14 PM

Show posts by this member only | IPv6 | Post

#58729

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(yhtan @ Dec 15 2021, 06:04 PM) Harta order normally 6 months or longer, majority of their order already taken up ahead with future price factor in. As for the ASP drop, it is affecting the spot order the most whereby future order is quite likely depends on various figure/countries. The chances are great that the glove sector will become a sunset industry again... Several years ago i notice Topglove is losing market share in EU/US market year by year whereby their standard is quite stringent, or it could be the expansion of glove and shrink EU/US market. Market circulating around China has mass expansion in glove production but i can frankly tell u only a few manage to met US/EU market requirement. Harta has the best cost control and majority of their capacity for US/EU market, Kossan on the other hand is mainly at US/EU surgical glove, Supermax also has fair share in US/EU and mainly at South America. If u ask me China massive expansion will hurt which one, i would say Topglove. Just my 2 cent only |

|

|

Dec 15 2021, 06:20 PM Dec 15 2021, 06:20 PM

|

Senior Member

8,652 posts Joined: Sep 2005 From: lolyat |

QUOTE(Boon3 @ Dec 15 2021, 06:14 PM) i don't think so will become sunset industry, for the past 20 years a lot of M&A and left the big 4 around in Malaysia, with the economy of scale i doubt other can dethrone them within a short period. Most importantly is, glove demand is still there and increasing year by year, now the main problem is oversupply. |

|

|

Dec 15 2021, 06:43 PM Dec 15 2021, 06:43 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(yhtan @ Dec 15 2021, 06:20 PM) i don't think so will become sunset industry, for the past 20 years a lot of M&A and left the big 4 around in Malaysia, with the economy of scale i doubt other can dethrone them within a short period. Most importantly is, glove demand is still there and increasing year by year, now the main problem is oversupply. Just as late as 2018, research reports still talked about how the industry was still facing Sars issues such as oversupply and price wars. This round, the oversupply impact will be greater... as such.. Asp will be on a longer decline... that's my opinion. |

|

|

Dec 15 2021, 07:05 PM Dec 15 2021, 07:05 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Dec 15 2021, 06:43 PM) Just as late as 2018, research reports still talked about how the industry was still facing Sars issues such as oversupply and price wars. This round, the oversupply impact will be greater... as such.. Asp will be on a longer decline... that's my opinion. yhtanCorrection it was 2019 and not 2018. Can refer to this post... post #55824 or see inside... » Click to show Spoiler - click again to hide... « |

|

|

Dec 16 2021, 05:28 PM Dec 16 2021, 05:28 PM

Show posts by this member only | IPv6 | Post

#58733

|

Junior Member

460 posts Joined: Oct 2008 |

Wah, no post today.

Really quiet day. All holiday already or planning for 2022? |

|

|

|

|

|

Dec 16 2021, 05:51 PM Dec 16 2021, 05:51 PM

Show posts by this member only | IPv6 | Post

#58734

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Dec 16 2021, 06:18 PM Dec 16 2021, 06:18 PM

Show posts by this member only | IPv6 | Post

#58735

|

Senior Member

2,940 posts Joined: Jan 2010 |

|

|

|

Dec 17 2021, 08:29 AM Dec 17 2021, 08:29 AM

|

Senior Member

1,450 posts Joined: Jul 2012 |

|

|

|

Dec 17 2021, 09:26 AM Dec 17 2021, 09:26 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

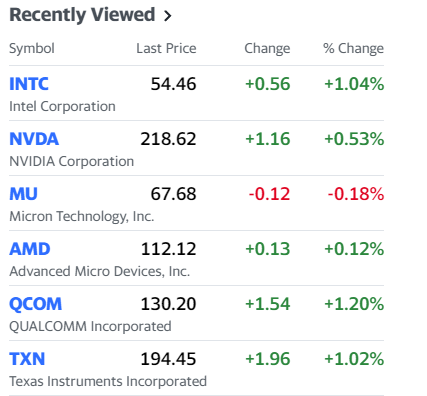

QUOTE(Boon3 @ Oct 16 2021, 09:37 AM) since I had searched those stocks via yahoo finance, I can easily refer back at a quick glance... the prices during that 'divergence'.. 1. Intel stock closing price on 6th Oct = 53.98 2. NVIDIA stock closing price on 6th Oct = 207 3. Micron tech stock closing price on 6th Oct = 69.94 4. AMD stock closing price on 6th Oct = 103.64 5. Qualcom stock closing price on 6th Oct = 128.06 6. Texas Ins stock closing price on 6th Oct = 194.39 prices right now...   if one had sold based on that 'macd divergence' thingee on 6th Oct ... one would had let some big winners lari ayam..... |

|

|

Dec 17 2021, 09:48 AM Dec 17 2021, 09:48 AM

Show posts by this member only | IPv6 | Post

#58738

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Dec 17 2021, 09:26 AM) and since Nasdaq errr .... 'mati' or had a correction last night... i thought i look see.. But nice what. 4 of your stocks went up a lot in 2 months time. Would suggest to stay off Intel they are facing a lot of competition from AMD. High cost of operating their business also. I worked there for a brief period last time so I know their company challenges. Is like big elephant la so use to all the goodies and being monopoly.. Suddenly this AMD underdog come in and steal much biz away.. Hard for them to adapt. if one had sold based on that 'macd divergence' thingee on 6th Oct ... one would had let some big winners lari ayam..... AMD new chips pose a treat to them also especially in the gaming market. If one day AMD even exceeds them in the corporate and server market then gg liao. AMD being really innovative and aggressive all these while. AMD buying over ATI last time is also a good move. This post has been edited by Davidtcf: Dec 17 2021, 09:56 AM |

|

|

Dec 17 2021, 09:58 AM Dec 17 2021, 09:58 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Davidtcf @ Dec 17 2021, 09:48 AM) But nice what. 4 of your stocks went up a lot in 2 months time. Would suggest to stay off Intel they are facing a lot of competition from AMD. High cost of operating their business also. I worked there for a brief period last time so I know their company challenges. Is like big elephant la so use to all the goodies and being monopoly.. Suddenly this AMD underdog come in and steal much biz away.. Hard for them to adapt. Err.... nice?AMD new chips pose a treat to them also especially in the gaming market. If one day AMD even exceeds them in the corporate and server market then gg liao. AMD being really innovative and aggressive all these while. AMD buying over ATI last time is also a good move. The original idea was to SELL upon seeing the MACD divergence on the NASDAQ chart... this post was merely a simple test to TEST OUT such theories..... but ya... unless you click on the small arrow on the right .... you probably would not realise what the post is all about.... This post has been edited by Boon3: Dec 17 2021, 10:00 AM |

|

|

Dec 17 2021, 10:07 AM Dec 17 2021, 10:07 AM

Show posts by this member only | IPv6 | Post

#58740

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Dec 17 2021, 09:58 AM) Err.... nice? Theories can work or not work. The original idea was to SELL upon seeing the MACD divergence on the NASDAQ chart... this post was merely a simple test to TEST OUT such theories..... but ya... unless you click on the small arrow on the right .... you probably would not realise what the post is all about.... Most important is to know the company well before buying. For me I buy and hold long. If trader then more risk involved. Good luck. |

| Change to: |  0.1137sec 0.1137sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 11:54 PM |