Take advantage of short sellers covering their position next month on Supermx and get out. Honest advice.

This post has been edited by chromatino_hex: Dec 29 2020, 10:42 AM

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Dec 29 2020, 10:42 AM Dec 29 2020, 10:42 AM

|

Junior Member

176 posts Joined: Aug 2020 |

Take advantage of short sellers covering their position next month on Supermx and get out. Honest advice.

This post has been edited by chromatino_hex: Dec 29 2020, 10:42 AM |

|

|

|

|

|

Dec 29 2020, 10:42 AM Dec 29 2020, 10:42 AM

|

Junior Member

24 posts Joined: Nov 2020 |

|

|

|

Dec 29 2020, 10:42 AM Dec 29 2020, 10:42 AM

|

Senior Member

2,940 posts Joined: Jan 2010 |

QUOTE(Duckies @ Dec 28 2020, 02:21 PM) I see the company's fundamental is quite okay although I haven't delve deep into the QR report. If I am not mistaken, Inari is doing 5G chips or I might be wrong. Inari now at 2.70, went 2.72 earlier but strong resistance seen.I am looking to go into it once it broke over the resistance around 2.7 or if it drops to the support level around 2.47-2.5 Just checking here to see if there's any insights from all sifus here. QUOTE(ChAOoz @ Dec 29 2020, 10:37 AM) If got sharp one day plunge like those -10% day maybe la will have a nice rebound. I agree with you here.But this kind of slow decline, meant that seller has already think over few days / week and only sell out. This kind of drop are those that are scary and eats away your capital slowly. People see what they want to see, no matter the signs. As you said, the slow decline is ominous. Side bets if TG or SPMX will breach the 6.00 mark today. |

|

|

Dec 29 2020, 10:45 AM Dec 29 2020, 10:45 AM

|

Junior Member

176 posts Joined: Aug 2020 |

The opportunity cost of being stuck in Supermx isn’t worth it.

|

|

|

Dec 29 2020, 10:45 AM Dec 29 2020, 10:45 AM

|

Junior Member

24 posts Joined: Nov 2020 |

|

|

|

Dec 29 2020, 10:46 AM Dec 29 2020, 10:46 AM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(statikinetic @ Dec 29 2020, 10:42 AM) Inari now at 2.70, went 2.72 earlier but strong resistance seen. Next support lineI agree with you here. People see what they want to see, no matter the signs. As you said, the slow decline is ominous. Side bets if TG or SPMX will breach the 6.00 mark today. Topglov: 5.7 Supermax: 4.4 howyoulikethat liked this post

|

|

|

|

|

|

Dec 29 2020, 10:46 AM Dec 29 2020, 10:46 AM

|

Junior Member

897 posts Joined: May 2019 |

QUOTE(ChAOoz @ Dec 29 2020, 10:25 AM) I wonder after warrant expired and the price still go down will all those warrant blamers rush for the exit door or not, or if they come out with other factor to attribute the price drop. Next year RSS is lifted, so another new reason. Smart one already chao early early. Probably all the money they make from glove already safely tuck into Maybank. PBB, Nestle, or just holding cash waiting for crash HereToLearn liked this post

|

|

|

Dec 29 2020, 10:48 AM Dec 29 2020, 10:48 AM

Show posts by this member only | IPv6 | Post

#41668

|

Senior Member

4,083 posts Joined: Apr 2006 |

QUOTE(HereToLearn @ Dec 29 2020, 10:46 AM) The way it is dropping is scary, when the profits are still more than the previous quarters. howyoulikethat liked this post

|

|

|

Dec 29 2020, 10:50 AM Dec 29 2020, 10:50 AM

|

Senior Member

2,116 posts Joined: Mar 2009 |

QUOTE(HereToLearn @ Dec 29 2020, 10:41 AM) Maybe lol, bursa is a place where anything can be gorenged. But fly high a bit harder for big market cap stocks. based on this reasoning, kossan should be better since it only went up abount 200% so far..But, I buy according to fundamentals and with technical for entry la. It is much safer this way. My personal fair value for entry, if below I will consider. But, I am not expecting it to reach my entry price soon la, maybe about 1 more year. Topglov: 3.27 Supermax: limited latest data You might say it is way too low, but to me it is sensible because before pandemic Topglov: 1.5 ish Supermax: .7 ish As of today, supermax is still up about 900% compared to prepandemic, topglov is about 400% My desired entry price is even lower than JPmorgan |

|

|

Dec 29 2020, 10:52 AM Dec 29 2020, 10:52 AM

|

Junior Member

24 posts Joined: Nov 2020 |

|

|

|

Dec 29 2020, 10:53 AM Dec 29 2020, 10:53 AM

|

Senior Member

2,940 posts Joined: Jan 2010 |

|

|

|

Dec 29 2020, 11:00 AM Dec 29 2020, 11:00 AM

|

Junior Member

587 posts Joined: May 2016 |

This Bursa so boring...

|

|

|

Dec 29 2020, 11:01 AM Dec 29 2020, 11:01 AM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(jianwei90 @ Dec 29 2020, 10:50 AM) The fair value is calculated based on 2023 forward PE (when the ASP has normalized). Not based on %increase/decrease. Didnt calculate for kossan yet, price still too high, I can do my homework next 6 months/1year when I have more updated data. QUOTE(statikinetic @ Dec 29 2020, 10:53 AM) Even among the bears, you are now Papa Bear. Value investors play it safe That's ugly. Makes me wonder if there are institutions currently disposing. |

|

|

|

|

|

Dec 29 2020, 11:05 AM Dec 29 2020, 11:05 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

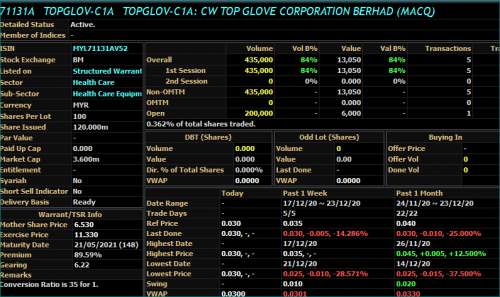

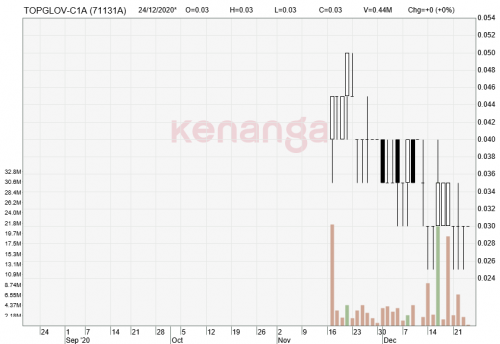

Blame on MacQuarie SELL call

C69 was in the money ... Conversion price 2.293 Conversion 8 for 1 Died on 18th Dec. Closing price is 6.64 1. How many warrants that would MACQ stand to lose? This warrant was issued Feb 2020 See the charts...   heaviest volume is 11th March. Low of 12 sen. Closed at 14 sen. For structured warrants, ask yourself, how many punters, how many buy and hold? Did they have a chance to cash out and instead of hold till expiry? Answer is YES. With a 8:1 conversion, punter would have made so much more if they sold it in the market than holding till expiry. So if punters/buyers have the option of cashing out for a bigger profit, why would they hold until expiry? Maybe some did... but if you look at the charts ... volume wasn't there to even suggest that MACQ would lose its pants ... All in giving a benefit of doubt... say MACQ would lose XXX money. How much ? 5 million? 10 million? 2. MACQ is a pro in the structured warrant. It sells so many others warrants. Warrants that they make $$$$$$$$$. Let's examine: Okay , this is C1A ... which is also issued by MACQ  hopelessly out of money..... punter buy ... got very, very, very good chance if punter intention is to buy and hold till die, you will lose money. Now C1A is relatively new.... listed 17 Nov 2020..  21 million shares done on that listing day .... How about trying to count Macquarie's profit instead? Any others call warrants on TG beside C1A from MACQ? 2) C1B. Exercise price 8.88 conversion 30:1 3) C76. Exercise price 4.667 conversion 6:1 4) C79 Exercise price 8.667 conversion 7.33:1 5) C80 Exercise price 6.627 conversion 7.33:1 6) C85 Exercise price 10:33 conversion 6.67:1 7) C89 Exercise price 12.667 conversion 13.33:1 8) C90 Exercise price 13.33 conversion 13.33:1 9) C91 Exercise price 15.00 conversion 16.66:1 So counting C69 ... there are 10 Call warrants from MACQ .... MACQ lost 1 .... win 9 .... Yup... that's how good MacQ is in the structured warrant market .... it's so lopsided. Ask the logical question la... would MACQ fudge one call warrant (which we clearly cannot say that MACQ will lose all) by manipulating the shorts when it's the KING in the market? If you still insist ... better don't trade or invest in stocks like TOPG. Why? Trust me .... come next year .... after the current outstanding warrants expire, they will issue many more call warrants. They are the bankers.....they will still be there. If they are still there ... you still want to touch TG ah? Doesn't make sense to me! This post has been edited by Boon3: Dec 29 2020, 11:26 AM |

|

|

Dec 29 2020, 11:07 AM Dec 29 2020, 11:07 AM

|

All Stars

24,477 posts Joined: Nov 2010 |

QUOTE(nauticat99 @ Dec 29 2020, 11:00 AM) This Bursa so boring... let's see what happens in pm session.the selling may intensify... or recover? we then have an idea what will come next 2 days before the year close. do we know if there is any margin call from any broker for gloves? small gloves are just as bad if not worse than big ones! immobile liked this post

|

|

|

Dec 29 2020, 11:08 AM Dec 29 2020, 11:08 AM

|

Junior Member

587 posts Joined: May 2016 |

[quote=HereToLearn,Dec 29 2020, 11:01 AM]

The fair value is calculated based on 2023 forward PE (when the ASP has normalized). Not based on %increase/decrease. Didnt calculate for kossan yet, price still too high, I can do my homework next 6 months/1year when I have more updated data. Why calculate based on 2023? 2020 also not over yet, you still have 2021 and 2022. Lots of things can happen in between those years. I am happy if i can even see 6 months ahead for this covid pandemic outcome. On a brighter note, MGRC is still on its merry way up |

|

|

Dec 29 2020, 11:08 AM Dec 29 2020, 11:08 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Dec 29 2020, 11:10 AM Dec 29 2020, 11:10 AM

|

Senior Member

1,360 posts Joined: Mar 2010 |

anyone watch the many homily chart videos on youtube? the 'teachers' said supermax and top glove are left with mostly retailers - represented by the green. |

|

|

Dec 29 2020, 11:12 AM Dec 29 2020, 11:12 AM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(nauticat99 @ Dec 29 2020, 11:08 AM) Why calculate based on 2023? 2020 also not over yet, you still have 2021 and 2022. Lots of things can happen in between those years. I am happy if i can even see 6 months ahead for this covid pandemic outcome. On a brighter note, MGRC is still on its merry way up This post has been edited by HereToLearn: Dec 29 2020, 11:13 AM |

|

|

Dec 29 2020, 11:15 AM Dec 29 2020, 11:15 AM

Show posts by this member only | IPv6 | Post

#41680

|

Junior Member

138 posts Joined: Oct 2012 |

QUOTE(AVFAN @ Dec 28 2020, 06:21 PM) that is possible. I try and wait for the bottom to be confirmed I guess.when and if EPF continues dumping, and i think they are. https://www.bursamalaysia.com/market_inform...?ann_id=3117021 becos i see some support there. but i buy and sell quite frequently... what i do may not mean much for others. |

| Change to: |  0.0314sec 0.0314sec

1.52 1.52

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 05:35 AM |