QUOTE(heavensea @ Jan 26 2017, 03:31 AM)

Hi guys, I've few questions regarding this AIA investment plan I've mentioned in tgis thread (few months ago).

Regarding insurance:

1) What's Basic Cash value? Do I get it when I decided to stop this plan?

2) How much of money that I can get if I surrender as at 33 years old?

3) Why this investment plan (projection returns) like not growing money?

Regarding money invested vs Returns:

4) How it's calculated? I feel like I would "lose more money" if I didn't surrender asap...

5) I've do many calculations before (based on my shallow knowledge). The returns of my plan is worse than I park my money in FD = 5915.5 x 10 years FD (3.5% per annum)

6) Should I surrender it ASAP to "admit lose" to cut lose?

Thanks everyone for read this, good night.

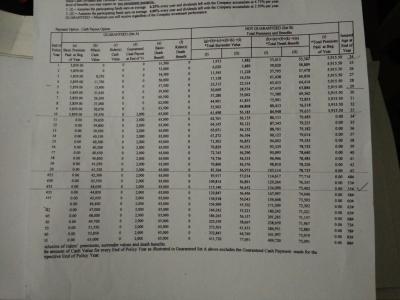

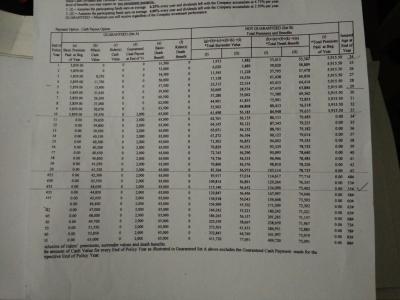

1) Basic Cash Value is when you surrender, that's the

minimum you will get. There's also the dividends, which are not guaranteed.

2) Minimum 39550. If you wait long enough and get the cash payment, another 2000. (there might be some pro-rate if you pay in monthly mode, etc, or deduct some in return, but this is the general idea)

+ you may get dividends projected at additional 15k to 20k (the 61k and 56k is inclusive of the 39k and 2k mentioned above).

3) Cause you get back the RM2000. you need to take into account the RM2000 that you get back

4) the later you surrender, the bigger quantum of money you lose. but if you continue to keep the money with AIA, you are projected to get 400k when you are 88.

5) so based on my calculation of 5915.5 for 10 years, and getting back that 400k when you are 88, plus the in between the 2k you get every year, your return is about 4.6%. Refer attachment.

6) depends. you need to do a cost-benefit analysis. My advice is your analysis, should take a greater focus on what you can do with the money now.

(but in a nut shell, if you bought this policy for 9 years already, of course, just pay the final year, keep it until you are 88, but if just bought for 1 year, then you want better returns, i think plenty out there)

This post has been edited by adele123: Jan 26 2017, 08:28 AM Attached File(s) IRR.pdf

IRR.pdf ( 23.43k )

Number of downloads: 11

Jan 11 2017, 04:50 PM

Jan 11 2017, 04:50 PM

Quote

Quote

0.0312sec

0.0312sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled