What's the meaning of keeping insurance saving plan of "guaranteed income provider"/GIP?

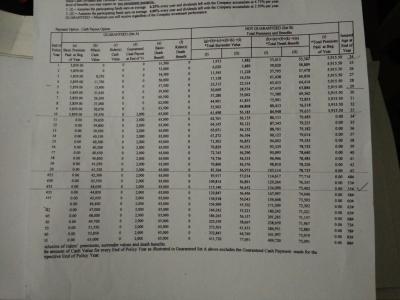

I've done calculations thoroughly, the return of such plan is in par / even slightly lower than projection returns of FD? At least I've liquidity in fd but what's the meaning of such GIP plan?

Not to mention if I park those money in "funds", it would give me much much more returns with compounding effects.. in short, I would suffered of more lose as the longer insurance company has my money.

This plan comes with death benefits though...

I've decided to surrender this GIP plan once I can got back the initial money I invested (break even point), I don't mind to lose interest (opportunity cost they had my money..) as long as I can get back the lumsum without single cent of lose.

As i mentioned, I've done many comparison based on my calculations... this plan doesn't good at all, returns/protection of death benefits is low..

I will definitely surrender it once "break even" to get back my capital. Am I doing the right thing? Or I've missed up any pros of such plan?

Please advise me, tqvm.

This post has been edited by heavensea: Oct 27 2016, 08:41 PM

Insurance Talk V3, Anything and everything about insurance

Oct 27 2016, 08:40 PM

Oct 27 2016, 08:40 PM

Quote

Quote

0.0857sec

0.0857sec

0.21

0.21

7 queries

7 queries

GZIP Disabled

GZIP Disabled