QUOTE(sadlyfalways @ Apr 10 2025, 11:37 AM)

hello all,

still dont know which card is best for miles

just got cimb twe, thought it was good buy 4ok to 1k miles is a lot, especially when its very hard to get points for that card

hsbc premier easiest to get points but 50k for 1k mile only enrich

so far uob zenith 7400 for 1k point seems best, but i dont recall how to get points there

just transferred over from citibank, and they used to give 250k points if use more than 500k or something, which was easy because of foreign uni fees.

Responding to item highlighted in bold:still dont know which card is best for miles

just got cimb twe, thought it was good buy 4ok to 1k miles is a lot, especially when its very hard to get points for that card

hsbc premier easiest to get points but 50k for 1k mile only enrich

so far uob zenith 7400 for 1k point seems best, but i dont recall how to get points there

just transferred over from citibank, and they used to give 250k points if use more than 500k or something, which was easy because of foreign uni fees.

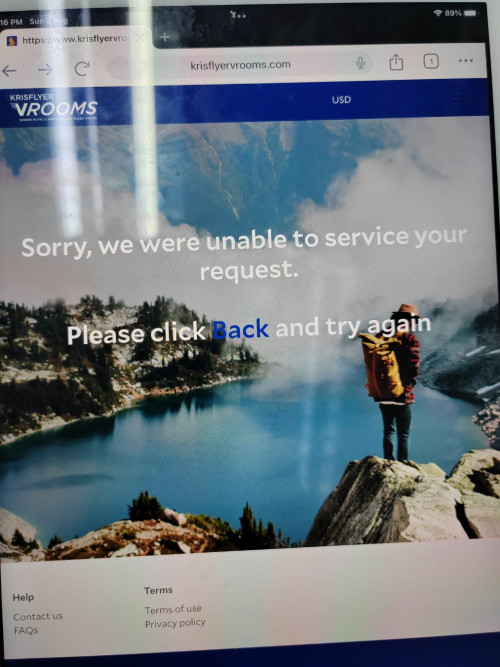

You can redeem miles from UOB Tmrw App or via website (https://unirm.my/Member/Products/Product_Catalogue_Air_Miles.aspx?ProdCatType=MDM%3D-ggfPKM3Lu1w%3D&ProdSubCatType=&Channel=TQ%3D%3D-64av4ybp918%3D)

About your second question, it's 250K points provided you have a cumulative annual retail spend of RM 240K

Subject to these terms and conditions, the Cardmember shall receive 250,000 UNIRM (“Spend Bonus Points”) if the: -

(i) Cardmember meets the cumulative annual retail spend of RM240,000 and above.

b. For purposes of Clause 1(A)(II)(a)(i) above, “cumulative annual retail spends” means the total

retail spending of a Principal and Supplementary UOB Zenith card in last ONE (1) anniversary

year, excluding the following transactions: -

(i) transactions made on Balance Transfer (BT), Easi Payment Plan (EPP), Flexi Credit

Plan and 0% Interest-Free Instalment Payment Plans;

(ii) refunded, disputed, unauthorized or fraudulent retail transactions;

(iii) cash withdrawals or cash advance;

(iv) payment of annual card membership fees, interest payments, late payment fees, charges

for cash withdrawals, government service tax and any other form of

service/miscellaneous fees; and/or

(v) premium for Credit Shield or Credit Shield Plus or any other credit insurance.

May 16 2025, 05:06 PM

May 16 2025, 05:06 PM

Quote

Quote

0.0192sec

0.0192sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled