Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

river.sand

|

Jan 11 2016, 07:08 PM Jan 11 2016, 07:08 PM

|

|

QUOTE(joshng @ Jan 11 2016, 06:54 PM) hi guys, any idea why is AmAsia Pacific Equity Income fund so volatile? Drop so much compared to other funds e.g. CIMB Asia Pacific Dynamic Income Fund, Kenanga Asia Pacific Total Return Fund.. regretted choosing this fund. 24% of the asset was invested in China as of last November. That could be the reason. |

|

|

|

|

|

MUM

|

Jan 11 2016, 07:10 PM Jan 11 2016, 07:10 PM

|

|

QUOTE(joshng @ Jan 11 2016, 06:54 PM) hi guys, any idea why is AmAsia Pacific Equity Income fund so volatile? Drop so much compared to other funds e.g. CIMB Asia Pacific Dynamic Income Fund, Kenanga Asia Pacific Total Return Fund.. regretted choosing this fund. AmAsia Pacific Equity Income fund has the highest 3 yr Annualised Volatility(%) among the 3. it is at 12.75 compared to 7.65 of CIMB. btw,...why do you select it rather than CIMB? |

|

|

|

|

|

MUM

|

Jan 11 2016, 07:16 PM Jan 11 2016, 07:16 PM

|

|

just read the handout from the seminar....

Market Favoured by FSM

China: > 75% upside potential by 2017

Asia X Jpn: > 50% upside potential by 2017

single country/region:

EM: 52% upside potential by 2017

M'sia: 24% upside potential by 2017

Japan: 16% upside potential by 2017

US: 11% upside potential by 2017

Europe: 10% upside potential by 2017

|

|

|

|

|

|

MUM

|

Jan 11 2016, 07:23 PM Jan 11 2016, 07:23 PM

|

|

QUOTE(TakoC @ Jan 11 2016, 06:13 PM) My topped up SHCOMP and HSI big jump. Good news for today. Hope it stay up for the next few days. It seems to be whoever top up later these days benefit  Who can be patient reap the benefit.  why is that so? Both mkts badly in RED today wor.... |

|

|

|

|

|

T231H

|

Jan 11 2016, 07:27 PM Jan 11 2016, 07:27 PM

|

|

Wells Fargo Asset Management - Believe in China despite the New Year’s sell-off https://secure.fundsupermart.com/main/artic...-sell-off-11193 |

|

|

|

|

|

TakoC

|

Jan 11 2016, 07:33 PM Jan 11 2016, 07:33 PM

|

|

QUOTE(MUM @ Jan 11 2016, 07:23 PM)  why is that so? Both mkts badly in RED today wor.... Weekend top up is today NAV price ma. Market down = NAV drop = more units. |

|

|

|

|

|

MUM

|

Jan 11 2016, 07:40 PM Jan 11 2016, 07:40 PM

|

|

QUOTE(TakoC @ Jan 11 2016, 07:33 PM) Weekend top up is today NAV price ma. Market down = NAV drop = more units. OIC missed the word....big jump "in units" good for you  |

|

|

|

|

|

TakoC

|

Jan 11 2016, 07:44 PM Jan 11 2016, 07:44 PM

|

|

QUOTE(MUM @ Jan 11 2016, 07:40 PM) OIC missed the word....big jump "in units" good for you  Have to look at the next 4 days. Imagine everyday drop 6%  Those that top up last is likely to get the best ROI at the end of the year. |

|

|

|

|

|

T231H

|

Jan 11 2016, 07:52 PM Jan 11 2016, 07:52 PM

|

|

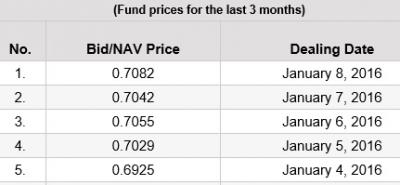

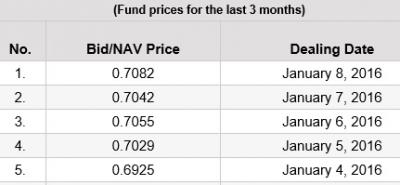

QUOTE(TakoC @ Jan 11 2016, 07:44 PM) Have to look at the next 4 days. Imagine everyday drop 6%  Those that top up last is likely to get the best ROI at the end of the year. there are some funds that keeps going up in the last few days...  no chance to get more units....  This post has been edited by T231H: Jan 11 2016, 07:53 PM Attached thumbnail(s) This post has been edited by T231H: Jan 11 2016, 07:53 PM Attached thumbnail(s)

|

|

|

|

|

|

nexona88

|

Jan 11 2016, 07:58 PM Jan 11 2016, 07:58 PM

|

|

QUOTE(MUM @ Jan 11 2016, 07:16 PM) just read the handout from the seminar.... Market Favoured by FSM China: > 75% upside potential by 2017 Asia X Jpn: > 50% upside potential by 2017 single country/region: EM: 52% upside potential by 2017 M'sia: 24% upside potential by 2017 Japan: 16% upside potential by 2017 US: 11% upside potential by 2017 Europe: 10% upside potential by 2017 thanks for sharing  |

|

|

|

|

|

river.sand

|

Jan 11 2016, 08:28 PM Jan 11 2016, 08:28 PM

|

|

QUOTE(MUM @ Jan 11 2016, 07:10 PM) AmAsia Pacific Equity Income fund has the highest 3 yr Annualised Volatility(%) among the 3. it is at 12.75 compared to 7.65 of CIMB. btw,...why do you select it rather than CIMB? Bro, have you got cause and effect confused  In centuries past, people hearing the rooster crow as the sun came up decided that the crowing caused the sunrise. - Peter Lynch, One Up On Wall Street |

|

|

|

|

|

MUM

|

Jan 11 2016, 08:31 PM Jan 11 2016, 08:31 PM

|

|

QUOTE(river.sand @ Jan 11 2016, 08:28 PM) Bro, have you got cause and effect confused  In centuries past, people hearing the rooster crow as the sun came up decided that the crowing caused the sunrise. - Peter Lynch, One Up On Wall Street maybe yes / no u tell me then  .... This post has been edited by MUM: Jan 11 2016, 08:32 PM |

|

|

|

|

|

river.sand

|

Jan 11 2016, 08:51 PM Jan 11 2016, 08:51 PM

|

|

So these are not your views, but what you heard from the seminar hor? I read some conflicting views. Now, to make everyone more confused  QUOTE(xuzen @ Jan 11 2016, 02:34 PM) e) China fundamental is strong, despite its slowdown. At its , planned slowdown to 6.5 - 7% p.a. growth, is still much higher than its regional countries. Take M'sia for example, our growth rate is only at 4.5%, and that is not a planned slowdown. Some economists suspect China's regional governments cook up their economic data. The actual growth rate could be 1%-2% lower  » Click to show Spoiler - click again to hide... « China's GDP figures are "man-made" and therefore unreliable, the man who is expected to be the country's next head of government said in 2007, according to U.S. diplomatic cables released by WikiLeaks. Li Keqiang, head of the Communist Party in northeastern Liaoning province at the time, was unusually candid in his assessment of local economic data at a dinner with then-U.S. Ambassador to China Clark Randt, according to a confidential memo sent after the meeting and published on the WikiLeaks website. The U.S. cable reported that Li, who is now a vice premier, focused on just three data points to evaluate Liaoning's economy: electricity consumption, rail cargo volume and bank lending. "By looking at these three figures, Li said he can measure with relative accuracy the speed of economic growth. All other figures, especially GDP statistics, are 'for reference only,' he said smiling," the cable added. sourcef) On RMB devaluation; China has such a huge forex reserves (USD 3,400 Billion) worth versus USD 115 Billion for USA. With such massive forex reserve, China can basically dictate how much they want the RMB to be wrt USD. If China wants to devalue RMB, they can. If they want to increase RMB value, they can. But China knows that they cannot devalue RMB too much, and if they do that, the rest of the region will suffer. It serves China no purpose to be surrounded by unhappy neighbours. If China wants to defend Yuan, it certainly has more than enough bullet to do so. However, some economists are concerned that China may intentionally devalue Yuan in order to boost export

And, China has been making its neighbors, Vietnam and Philippines, very unhappy.Xuzen Disclaimer: I am stilling holding on to Ponzi 2.0  This post has been edited by river.sand: Jan 11 2016, 08:52 PM This post has been edited by river.sand: Jan 11 2016, 08:52 PM |

|

|

|

|

|

T231H

|

Jan 11 2016, 09:11 PM Jan 11 2016, 09:11 PM

|

|

QUOTE(kimyee73 @ Jan 11 2016, 04:48 PM) Maybe I'm too heavy on fixed income at 61%. 9% in RHB Islamic bond, 8.5% in RHB EM bond, 8.5% in RHB ATR, 30% in CMF and the rest in various bond funds for switching purpose. Follow FSM advice, cut back on equity allocation.  Good for you.... by just a note...not all funds are created equal...  2015 Top and Bottom Fixed Income Funds: http://www.fundsupermart.com.my/main/resea...-to-Shine--6688 |

|

|

|

|

|

joshng

|

Jan 11 2016, 09:16 PM Jan 11 2016, 09:16 PM

|

New Member

|

QUOTE(MUM @ Jan 11 2016, 07:10 PM) AmAsia Pacific Equity Income fund has the highest 3 yr Annualised Volatility(%) among the 3. it is at 12.75 compared to 7.65 of CIMB. btw,...why do you select it rather than CIMB? i started investing in it in April. 3yr volatility then 11.0, was also attracted to the quarterly distributions. Thought CIMB Asia Pacific Dynamic Income fund size was already too big. Regretting now.. should have waited a couple of months before I started investing.. |

|

|

|

|

|

xuzen

|

Jan 11 2016, 09:16 PM Jan 11 2016, 09:16 PM

|

|

Pasir Sungai,

I may be finance trained, but am certainly not a fund manager nor analyst to have the inside numbers to make my own report. Hence I have to listen to these fund managers and / or fund house Chief Investment Officer seminars. I am sharing what I heard.

My caveat is this, opinions are like arseholes, everyone got one. But as an investor, you must know your numbers well enough and place your bet with the best probability of winning.

Xuzen

|

|

|

|

|

|

brotan

|

Jan 11 2016, 09:18 PM Jan 11 2016, 09:18 PM

|

|

QUOTE(kimyee73 @ Jan 11 2016, 06:37 PM) Malaysia got ETF? |

|

|

|

|

|

xuzen

|

Jan 11 2016, 09:24 PM Jan 11 2016, 09:24 PM

|

|

QUOTE(joshng @ Jan 11 2016, 09:16 PM) i started investing in it in April. 3yr volatility then 11.0, was also attracted to the quarterly distributions. Thought CIMB Asia Pacific Dynamic Income fund size was already too big. Regretting now.. should have waited a couple of months before I started investing.. May you learn you lessons well! Distribution means SH1T to a savvy investor. Pink Spider shall be here in a short while to give you Biawak SH1T! CIMB APDIF as of 30/11/2015 fund size is MYR 2,620 million only, i.e., Eqv to USD 600 million only. In a global context, USD 600 million fund size is consider kacang putih aje! Xuzen |

|

|

|

|

|

apathen

|

Jan 11 2016, 09:25 PM Jan 11 2016, 09:25 PM

|

|

|

|

|

|

|

|

brotan

|

Jan 11 2016, 09:27 PM Jan 11 2016, 09:27 PM

|

|

QUOTE(apathen @ Jan 11 2016, 09:25 PM) ic thanks so anyway invest in ETF? local or abroad |

|

|

|

|

Jan 11 2016, 07:08 PM

Jan 11 2016, 07:08 PM

Quote

Quote

0.0310sec

0.0310sec

0.91

0.91

6 queries

6 queries

GZIP Disabled

GZIP Disabled