QUOTE(Hansel @ Jan 29 2017, 09:21 PM)

Hmm,... I was thinking too along this line earlier,... but what to do,... at least run away from the one who is charging first,...

Worse come to worse buy from FSM, transfer to DBS lo.Fundsupermart Singapore, Let's have a separate thread

|

|

Jan 29 2017, 09:27 PM Jan 29 2017, 09:27 PM

|

All Stars

24,351 posts Joined: Feb 2011 |

|

|

|

|

|

|

Feb 2 2017, 12:06 PM Feb 2 2017, 12:06 PM

|

All Stars

24,351 posts Joined: Feb 2011 |

Hansel I think I found out how Phillip is making extra money. You know FSM have this annual event "What and where to Invest in 201x?'

Phillip have them too. Except unlike FSM SG which is free, Phillip charge SGD40/person. If there is a promo it's SGD10 (got it in my email) |

|

|

Feb 7 2017, 08:28 AM Feb 7 2017, 08:28 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

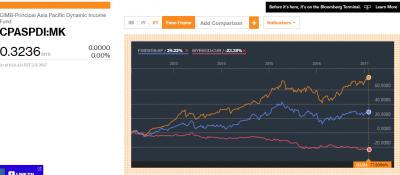

QUOTE(AIYH @ Jan 25 2017, 04:25 PM) From here you can observe that as MYR depreciate against USD, ponzi 2 rise. So for this one, which one is better? Higher or lower is better?So taking this into consideration, assumae you hold this fund for 5 years, what is the real gain? you take the (1+ponzi 2 performance) * (1-myrusd performance) to see the real performance in USD term Do this similarly for frist state dividend. For ponzi 2, your 5 year real gain in USD term is about 22.6% For first state, your 5 year real gain in USD term is about 15.9% |

|

|

Feb 7 2017, 08:49 AM Feb 7 2017, 08:49 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Feb 7 2017, 10:19 AM Feb 7 2017, 10:19 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

QUOTE(AIYH @ Feb 7 2017, 08:49 AM) Return higher or lower better? Higher. So moral of the story buy Ponzi 2 SGD class

From what I observe, even after factoring MYR depreciation against SGD, ponzi 2 still perform better But if you look 1 year performance First State Dividend vs Ponzi 2 SGD class, First state dividend still win over Ponzi 2 SGD class |

|

|

Feb 7 2017, 10:35 AM Feb 7 2017, 10:35 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Feb 7 2017, 10:19 AM) Higher. So moral of the story buy Ponzi 2 SGD class Bloomberg and FSMone shows different results But if you look 1 year performance First State Dividend vs Ponzi 2 SGD class, First state dividend still win over Ponzi 2 SGD class

You may consider rading their FFS: Ponzi 2 SGD FFS First State Dividend Advantage SGD FFS |

|

|

|

|

|

Feb 7 2017, 10:37 AM Feb 7 2017, 10:37 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

QUOTE(AIYH @ Feb 7 2017, 10:35 AM) Bloomberg and FSMone shows different results Who to trust?

You may consider rading their FFS: Ponzi 2 SGD FFS First State Dividend Advantage SGD FFS This post has been edited by Ramjade: Feb 7 2017, 10:44 AM |

|

|

Feb 14 2017, 07:47 AM Feb 14 2017, 07:47 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

AIYH who to trust? FSM/bloomberg?

dasecret, AIYH any bond fund like our Ester bond counterpart in SG? I only found one. ~5%pa returns with volatility of 2.xx. |

|

|

Feb 14 2017, 09:03 AM Feb 14 2017, 09:03 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Feb 14 2017, 07:47 AM) AIYH who to trust? FSM/bloomberg? FSM, sometimes bloomberg didnt get the distribution data, so the graph might be distorted dasecret, AIYH any bond fund like our Ester bond counterpart in SG? I only found one. ~5%pa returns with volatility of 2.xx. but they are really close for 1 year data

For bond, I suggest United Asian High Yield bond, given similar risk return ratio with the top RRR bond fund, it provides 1x.xx% annualized profit |

|

|

Feb 14 2017, 09:22 AM Feb 14 2017, 09:22 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

QUOTE(AIYH @ Feb 14 2017, 09:03 AM) FSM, sometimes bloomberg didnt get the distribution data, so the graph might be distorted Thanks.but they are really close for 1 year data

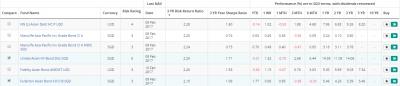

For bond, I suggest United Asian High Yield bond, given similar risk return ratio with the top RRR bond fund, it provides 1x.xx% annualized profit Actually, I was considering this Fullerton Asian Bond Fd Cl B SGD This post has been edited by Ramjade: Feb 14 2017, 09:22 AM |

|

|

Feb 14 2017, 09:25 AM Feb 14 2017, 09:25 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Feb 14 2017, 09:22 AM) Thanks. if you divide the return by risk, United asian hy bond is betterActually, I was considering this Fullerton Asian Bond Fd Cl B SGD

btw, whats your pick between the 2 asia pac equity? This post has been edited by AIYH: Feb 14 2017, 09:25 AM |

|

|

Feb 14 2017, 09:27 AM Feb 14 2017, 09:27 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

QUOTE(AIYH @ Feb 14 2017, 09:25 AM) if you divide the return by risk, United asian hy bond is better United give 2.203442879499218 vs

btw, whats your pick between the 2 asia pac equity? Fullerton give 2.09727626459144 So higher no is better? What is this formula/ratio call? I have no idea as it's too close to call. On one side we have Cimb which actually visit the companies to get first hand look and feel. I am not sure if First state does that or not. If we look at fund size, First state is the winner. If we don't look at currency, both Cimb (MY class) and First state is almost the same at over 1b+. I would like to see their 3 years volatility when it's release (Cimb). Who knows good old Ponzi 2 can deliver in SG. This post has been edited by Ramjade: Feb 14 2017, 09:31 AM |

|

|

Feb 14 2017, 09:31 AM Feb 14 2017, 09:31 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Feb 14 2017, 09:27 AM) United give 2.203442879499218 vs Higher means the fund provides a better return given its risk, provided you compare them within the same class (bond funds in this case)Fullerton give 2.09727626459144 So higher no is better? What is this formula/ratio call? For similar risk return ratio, look at the performance data

It also help to understand each fund (for example the united one is invested in riskier high yield bonds) |

|

|

|

|

|

Feb 14 2017, 09:34 AM Feb 14 2017, 09:34 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

QUOTE(AIYH @ Feb 14 2017, 09:31 AM) Higher means the fund provides a better return given its risk, provided you compare them within the same class (bond funds in this case) I know about the risk with United. This bond fund is used to pay DBS MCA so it must give me >SGD60/year. Anything more than that is good enough for me.For similar risk return ratio, look at the performance data

It also help to understand each fund (for example the united one is invested in riskier high yield bonds) This post has been edited by Ramjade: Feb 14 2017, 09:35 AM |

|

|

Feb 14 2017, 09:36 AM Feb 14 2017, 09:36 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Feb 14 2017, 09:27 AM) United give 2.203442879499218 vs Its a flip of the coin then, if you worry, you may invest in first state first since it is more established in SG.Fullerton give 2.09727626459144 So higher no is better? What is this formula/ratio call? I have no idea as it's too close to call. On one side we have Cimb which actually visit the companies to get first hand look and feel. I am not sure if First state does that or not. If we look at fund size, First state is the winner. If we don't look at currency, both Cimb (MY class) and First state is almost the same at over 1b+. I would like to see their 3 years volatility when it's release (Cimb). Who knows good old Ponzi 2 can deliver in SG. Wait until cimb one has 3 years in SG then you can compare between them (assume you haven't found a viable ETF or stocks portfolio for this region by then QUOTE(Ramjade @ Feb 14 2017, 09:34 AM) I know. This bond fund is used to pay DBS MCA so it must give me >SGD60/year. Anything more than that is good enough for me. But annualized 10% is more than that, can take some profit also beside paying the fee |

|

|

Feb 14 2017, 09:42 AM Feb 14 2017, 09:42 AM

|

All Stars

24,351 posts Joined: Feb 2011 |

QUOTE(AIYH @ Feb 14 2017, 09:36 AM) Its a flip of the coin then, if you worry, you may invest in first state first since it is more established in SG. Most likely no ETFs for asia pacific.Wait until cimb one has 3 years in SG then you can compare between them (assume you haven't found a viable ETF or stocks portfolio for this region by then But annualized 10% is more than that, can take some profit also beside paying the fee But with rising interest, bond will suffer. If ordinary bond suffer, what more these HY bond. Am I right? |

|

|

Feb 14 2017, 09:49 AM Feb 14 2017, 09:49 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Feb 14 2017, 09:42 AM) Most likely no ETFs for asia pacific. From Investopedia : Are High-Yield Bonds Too Risky?But with rising interest, bond will suffer. If ordinary bond suffer, what more these HY bond. Am I right? QUOTE High-yield bonds do not correlate exactly with either investment-grade bonds or stocks. Because their yields are higher than investment-grade bonds, they're less vulnerable to interest rate shifts, especially at lower levels of credit quality, and are similar to stocks in relying on economic strength. You should care more about the default risk for high yield bond, because those companies with low credit rating are the ones that provide the high bond yield to attract capital investment to compensate their higher risk of defaultThis post has been edited by AIYH: Feb 14 2017, 09:50 AM |

|

|

Feb 20 2017, 07:50 PM Feb 20 2017, 07:50 PM

|

Junior Member

255 posts Joined: Apr 2008 |

Hi guys, reporting in as new investor as educated by @Ramjade. Any "starter kit" for SG funds? BTW Ramjade, since you mentioned in SG POEMS is better than FSM why didn't the members here create a POEMS SG thread instead, just curious.

This post has been edited by Steven7: Feb 20 2017, 07:50 PM |

|

|

Feb 20 2017, 08:19 PM Feb 20 2017, 08:19 PM

|

All Stars

24,351 posts Joined: Feb 2011 |

QUOTE(Steven7 @ Feb 20 2017, 07:50 PM) Hi guys, reporting in as new investor as educated by @Ramjade. Any "starter kit" for SG funds? BTW Ramjade, since you mentioned in SG POEMS is better than FSM why didn't the members here create a POEMS SG thread instead, just curious. Because at that time, we all only know FSM SG. All the people here have FSM SG except me. lolI am sorry. No starter kit. Let's why I said this thread is "very dead" FSM MY already v18. THis thread only v1. lol Funds recommendation: Asia Pacific - First State Dividend Advantage/Ponzi 2 (return almost same as First state but we do not know what's the 3 years volatility yet) US - Fidelity America Feel free to browse funds on FSM SG which suit your taste then check and see if POEMS have them. Not everything on FSM SG is available of POEMS SG Remember the basic and you ought to do fine. This post has been edited by Ramjade: Feb 20 2017, 08:21 PM |

|

|

Feb 20 2017, 08:34 PM Feb 20 2017, 08:34 PM

|

Junior Member

255 posts Joined: Apr 2008 |

QUOTE(Ramjade @ Feb 20 2017, 08:19 PM) Because at that time, we all only know FSM SG. All the people here have FSM SG except me. lol Ok thanks I will go do my homework and hopefully you can take a look at my portfolio soonafterI am sorry. No starter kit. Let's why I said this thread is "very dead" FSM MY already v18. THis thread only v1. lol Funds recommendation: Asia Pacific - First State Dividend Advantage/Ponzi 2 (return almost same as First state but we do not know what's the 3 years volatility yet) US - Fidelity America Feel free to browse funds on FSM SG which suit your taste then check and see if POEMS have them. Not everything on FSM SG is available of POEMS SG Remember the basic and you ought to do fine. |

| Change to: |  0.0189sec 0.0189sec

0.44 0.44

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 02:37 PM |