WHat will be the bad consequence for having trading halt with unknown timeline?

Capital A Berhad /AirAsia (5099), Asia's largest LCC group

Capital A Berhad /AirAsia (5099), Asia's largest LCC group

|

|

Jul 8 2020, 11:59 AM Jul 8 2020, 11:59 AM

Show posts by this member only | IPv6 | Post

#921

|

Senior Member

1,624 posts Joined: May 2013 |

WHat will be the bad consequence for having trading halt with unknown timeline?

|

|

|

|

|

|

Jul 8 2020, 12:00 PM Jul 8 2020, 12:00 PM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

PN17!!!!

GEE GEE |

|

|

Jul 8 2020, 12:02 PM Jul 8 2020, 12:02 PM

Show posts by this member only | IPv6 | Post

#923

|

Senior Member

1,624 posts Joined: May 2013 |

|

|

|

Jul 8 2020, 12:05 PM Jul 8 2020, 12:05 PM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

Air Asia share resume trading 2.30 pm. Run? All in?

|

|

|

Jul 8 2020, 12:08 PM Jul 8 2020, 12:08 PM

|

Junior Member

214 posts Joined: Jan 2016 |

Perhaps merger le? MasAir? SinAir? ThaiAir? GarudaAir? VirginAir?

|

|

|

Jul 8 2020, 12:33 PM Jul 8 2020, 12:33 PM

|

Senior Member

1,134 posts Joined: Jan 2003 From: Seri Kembangan |

I managed to sell AirAsia shares at 1.02 last month, making around 30% profit. actually I'm not dare enough, I should have bought it at 0.55.

|

|

|

|

|

|

Jul 8 2020, 01:54 PM Jul 8 2020, 01:54 PM

|

Senior Member

3,498 posts Joined: Dec 2007 |

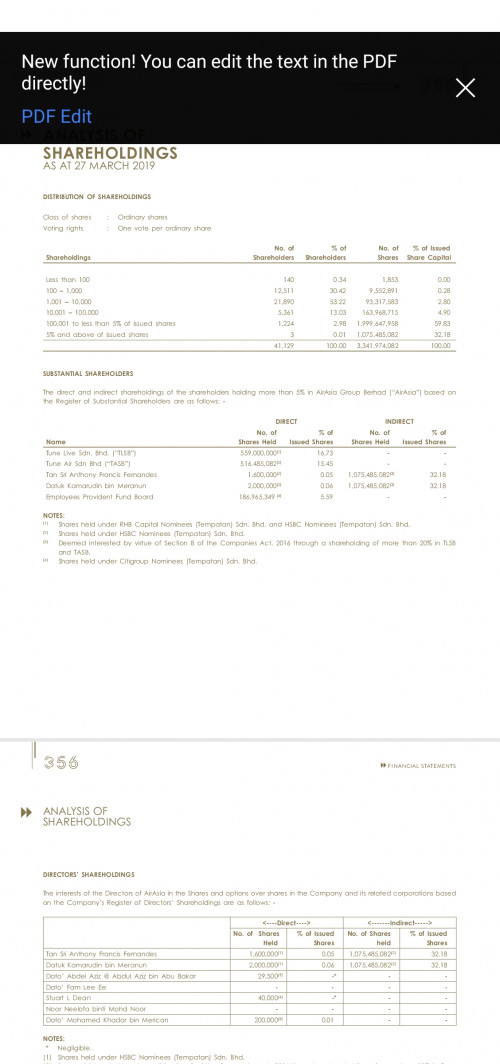

Airasia Share Holder Equity is @ 37%. Meaning 0.855 @ 37% = RM0.316 ya. Thus triggering the PN17 criteria.

This is for quarter ended 31st March. I can tell you, those that still hold this share after Q2 your share of AirAsia might become worthless or worth very little if there is a bail out / capital injection. Do correct me if my interpretation is wrong on the PN17 trigger. https://www.bursamalaysia.com/market_inform...?ann_id=3066780 Still many people say time to buy when people panic. Speechless ah |

|

|

Jul 8 2020, 02:05 PM Jul 8 2020, 02:05 PM

Show posts by this member only | IPv6 | Post

#928

|

Senior Member

3,498 posts Joined: Dec 2007 |

Instead of a bank run we going to have a plane ticket run now 😂

|

|

|

Jul 8 2020, 03:09 PM Jul 8 2020, 03:09 PM

|

Senior Member

600 posts Joined: Apr 2017 |

In a tough business environment, you need to have rock solid balance sheet to come out of it stronger.

No doubt AA is very well run and made MY proud, but this will be their biggest ever crisis - they need CASH injection to survive next 2-3 Qtr. Any cash injection will ultimately dilute the existing shareholders' value. |

|

|

Jul 8 2020, 03:13 PM Jul 8 2020, 03:13 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Sand Dust @ Jul 8 2020, 03:09 PM) In a tough business environment, you need to have rock solid balance sheet to come out of it stronger. Contradictory statement boss.No doubt AA is very well run and made MY proud, but this will be their biggest ever crisis - they need CASH injection to survive next 2-3 Qtr. Any cash injection will ultimately dilute the existing shareholders' value. If the company is very well run.. it wouldn't need any cash injection right? If the company is very well run.. it wouldn't be starring at over 1 billion in paper loss from hedging as at 31st March 2020. If the company is very well run.. it boss wouldn't have been accused of the bribery scandal... i could go on and on....... yummymommy liked this post

|

|

|

Jul 8 2020, 03:49 PM Jul 8 2020, 03:49 PM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

QUOTE(Boon3 @ Jul 8 2020, 03:13 PM) Contradictory statement boss. well many delusional people still think AirAsia is better run than MASIf the company is very well run.. it wouldn't need any cash injection right? If the company is very well run.. it wouldn't be starring at over 1 billion in paper loss from hedging as at 31st March 2020. If the company is very well run.. it boss wouldn't have been accused of the bribery scandal... i could go on and on....... |

|

|

Jul 8 2020, 04:32 PM Jul 8 2020, 04:32 PM

|

Senior Member

600 posts Joined: Apr 2017 |

QUOTE(Boon3 @ Jul 8 2020, 03:13 PM) If the company is very well run.. it wouldn't need any cash injection right? If the company is very well run.. it wouldn't be starring at over 1 billion in paper loss from hedging as at 31st March 2020. If the company is very well run.. it boss wouldn't have been accused of the bribery scandal... 1) SIA received $13bn cash injection to support it to go through this unprecedented crisis. This is the industry that will see much slower recovery for many quarters ahead. 2) Hedging is part of business, especially for airline. Ryannair 90%, SIA 73%, Airasia X 80%, KLM 65%. I dont know based on hindsight, how much they should have hedge. But airline need to continue hedge to mitigate their operation risks. 3) Bribery - I completely agree with you. All company should held high esteem on integrity. |

|

|

Jul 8 2020, 04:38 PM Jul 8 2020, 04:38 PM

|

Junior Member

650 posts Joined: Jun 2020 |

gg habis the free fall, -17% since resumption of trading

|

|

|

|

|

|

Jul 8 2020, 05:02 PM Jul 8 2020, 05:02 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Sand Dust @ Jul 8 2020, 04:32 PM) My view as below Point 2) Don't really agree. If the company is good, it should not have followed what other companies, right? When you place the those hedges, the well run company needs to understand that there is always a chance that they might lose money. The well run company should have realise that. Acknowledging the possible risks and managing the downside risk is most important. Look at it now. It has cut loss on some positions but despite that, as at 31st March, it's starring at those massive paper loss of over 1 billion! How could a well run company leave themselves exposed to such massive losses if their hedges go bad? 1) SIA received $13bn cash injection to support it to go through this unprecedented crisis. This is the industry that will see much slower recovery for many quarters ahead. 2) Hedging is part of business, especially for airline. Ryannair 90%, SIA 73%, Airasia X 80%, KLM 65%. I dont know based on hindsight, how much they should have hedge. But airline need to continue hedge to mitigate their operation risks. 3) Bribery - I completely agree with you. All company should held high esteem on integrity. In 2009, they lost over 640 million in hedges. Am I wrong to say history repeated itself and that the company never learned from their mistakes? In the corporate world, are there not companies who abuses their hedges and turn their hedges into a form of gambling? Point 1) ... I would not compare it to SIA because of AA shareholding structure..  Due to the size of shares owned by boss 1 and boss 2.... for me, a bailout would be a bailout of boss 1 and boss 2. Do they deserve the bailout? I would also ask why must bailout? Boss 1 and boss 2 farked up. They had their chance.... so why can't we just let it fail? Is it all that bad to let it fail? Perhaps another better company could be born from AirAsia failure! |

|

|

Jul 8 2020, 05:13 PM Jul 8 2020, 05:13 PM

|

All Stars

24,450 posts Joined: Nov 2010 |

QUOTE(Boon3 @ Jul 8 2020, 05:02 PM) I would also ask why must bailout? Boss 1 and boss 2 farked up. They had their chance.... so why can't we just let it fail? Is it all that bad to let it fail? u know the answer la...Perhaps another better company could be born from AirAsia failure! thousands of jobs lost, votes lost... there have been so many bailouts, so many billions thrown out, incl so many times with MAS. why not this one?!! |

|

|

Jul 8 2020, 05:22 PM Jul 8 2020, 05:22 PM

|

Senior Member

1,259 posts Joined: Jan 2018 |

QUOTE(AVFAN @ Jul 8 2020, 05:13 PM) u know the answer la... Mas is glc, Aa diff. More likely gov will grab the opportunity to seize control of Aa at this price from the two loudmouth bosses (maybe merge with mas?) while looking nice and pretty like a saviour of the company.thousands of jobs lost, votes lost... there have been so many bailouts, so many billions thrown out, incl so many times with MAS. why not this one?!! |

|

|

Jul 8 2020, 05:24 PM Jul 8 2020, 05:24 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Jul 8 2020, 05:13 PM) u know the answer la... Cos boss 1 and boss 2 each owns for than 30% shares of AA.thousands of jobs lost, votes lost... there have been so many bailouts, so many billions thrown out, incl so many times with MAS. why not this one?!! Adding it up, they owned more than 60%. Bailing the company out is like bailing them out. Less not forget how boss 1 and boss 2 shareholding got so big. They did a 30% placement of new shares to THEMSELVES... Then started AA on its sale and leaseback. The money from the sale of planes is supposed to be a safety net but instead they gave out huge dividends which benefited boss 1 and boss 2 since they got a huge chunk of new shares.. Now company is so asset light... And burning cash so fast... All the main problem stems from boss 1 and boss 2 piss poor management... You seriously think they should be bailed out? I don't. |

|

|

Jul 8 2020, 05:34 PM Jul 8 2020, 05:34 PM

|

All Stars

24,450 posts Joined: Nov 2010 |

QUOTE(Boon3 @ Jul 8 2020, 05:24 PM) All the main problem stems from boss 1 and boss 2 piss poor management... i don't think they should be but u and i don;t get to decide! You seriously think they should be bailed out? I don't. same gomen, same style, same motives... i say it is a foregone conclusion. |

|

|

Jul 8 2020, 05:35 PM Jul 8 2020, 05:35 PM

Show posts by this member only | IPv6 | Post

#939

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Jul 8 2020, 05:13 PM) u know the answer la... BTW... the two options I would prefer....thousands of jobs lost, votes lost... there have been so many bailouts, so many billions thrown out, incl so many times with MAS. why not this one?!! 1. Share placement to raise money. 2. Rights issue I would prefer to see a rights issue... |

|

|

Jul 8 2020, 05:38 PM Jul 8 2020, 05:38 PM

Show posts by this member only | IPv6 | Post

#940

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Jul 8 2020, 05:34 PM) i don't think they should be but u and i don;t get to decide! Of course but since this is a forum, I am only sharing my 4 sen opinion lo. same gomen, same style, same motives... i say it is a foregone conclusion. Blow steam mah... Oh... and i have always been negative on AirAsia for a couple of years already. It's in this thread.. somewhere... lol... |

| Change to: |  0.0182sec 0.0182sec

0.29 0.29

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 29th November 2025 - 06:54 AM |