hi all, here's my 2019 employer

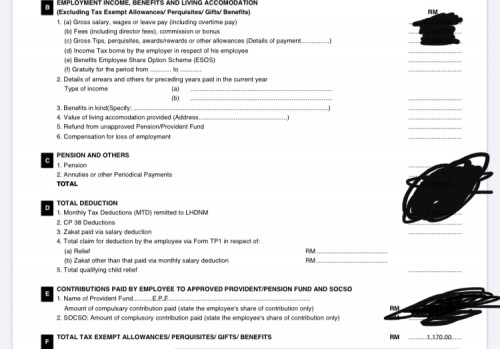

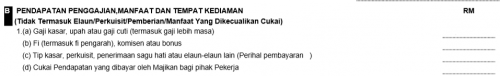

1. Employer A: Jan to May, got deduct salary for PCB

2. Employer B: May to Sept, got deduct salary for PCB

3. Employer C: Sept to Dec, NO deduct salary for PCB

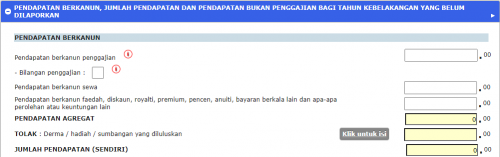

as filing for my 2019 tax, I've add all my income from Employer A to C, and input some deductions here and there, I had to pay extra 1.7k.

and I've found out Employer C doesn't deduct my salary from Sept to Dec, they only start to deduct in Jan 20 onwards.

Now the prob is i dont have 1.7k to pay for the tax, is there anyway to workaround this ?

Should I complaint to Employer C that they never deduct my Sept to Dec salary for PCB?

Employer C didnt deduct PCB... but did you received the "amount" right ?

You have to find ways to pay the taxes. That's your duty as Rakyat.

Maybe you can ask IRB for installment basis.

Mar 13 2020, 03:20 PM

Mar 13 2020, 03:20 PM

Quote

Quote

0.0339sec

0.0339sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled