Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

ronnie

|

Nov 15 2021, 09:37 PM Nov 15 2021, 09:37 PM

|

|

QUOTE(joeaverage @ Nov 15 2021, 11:03 AM) I'm shopping for a new smartphone but wonder if I should wait until 2022 to benefit from the claim. Anyone knows that 2.5k for laptop/smartphone extended to 2022.. Is that available to even those who claim previously in 2021? I didn't buy a new device in 2020 but did this year. No such things to bring forward unused tax relief. The best way is to buy a new smartphone every year @ RM2,500 |

|

|

|

|

|

ronnie

|

Feb 16 2022, 12:56 PM Feb 16 2022, 12:56 PM

|

|

QUOTE(Barricade @ Feb 13 2022, 11:28 PM) I have a lot of physical receipts for tax relief (eg: child kindergarden fee). Can I scan and keep it as digital and throw the original copy away? I hate maintaining physical copy. Wrong move.... best to keep both |

|

|

|

|

|

ronnie

|

Mar 5 2022, 09:36 PM Mar 5 2022, 09:36 PM

|

|

QUOTE(Noorange @ Mar 5 2022, 07:28 PM) thanks. saw it. but does it mean i also cannot claim this part? Perbelanjaan rawatan perubatan, keperluan khas dan penjaga untuk ibu bapa (keadaan kesihatan disahkan oleh pengamal perubatan) coz got the word penjaga ibu bapa? No more "healthy parents tax relief" from YA2021 onwards". Govt should maintain or increase it.... |

|

|

|

|

|

ronnie

|

Mar 9 2022, 12:15 PM Mar 9 2022, 12:15 PM

|

|

QUOTE(spreeeee @ Mar 8 2022, 01:51 PM) monthly swimming class for kid, eligible for tax relief? as below context, looks like can? I would say cannot claim. That's tax relief is to claim if you pay entry fee to public swimming pool |

|

|

|

|

|

ronnie

|

Mar 9 2022, 03:33 PM Mar 9 2022, 03:33 PM

|

|

If I buy revision school books from Shopee vendors, can I use the Shopee receipt to claim Tax Relief under Books & Magazines ?

|

|

|

|

|

|

ronnie

|

Mar 9 2022, 04:33 PM Mar 9 2022, 04:33 PM

|

|

Where can we find the breakdown of which ethnic groups pays the most taxes.

|

|

|

|

|

|

ronnie

|

Apr 4 2022, 11:26 AM Apr 4 2022, 11:26 AM

|

|

QUOTE(uglyduckling422 @ Mar 28 2022, 05:22 PM) The buying of self test kit can claim for tax reduction. Can submit for year 2021 e filing even receipt is 2022? Or wait 2022 e filing? Follow date of receipt = Year of Assessment (YA) Bought with receipt dated 2022 = YA 2022 (not for YA2021)... Now we are submitting for YA 2021 |

|

|

|

|

|

ronnie

|

Apr 4 2022, 04:48 PM Apr 4 2022, 04:48 PM

|

|

Unverified "good" news: Your mobile phone plans (Digi, Celcom, Maxis, Umobile etc) can be claimed for tax relief as Internet too, as nowadays mobile phone plans come bundled with data, which LDHN recognises as Internet. but make sure it must be billed under your name

|

|

|

|

|

|

ronnie

|

Apr 12 2022, 02:33 PM Apr 12 2022, 02:33 PM

|

|

QUOTE(davidletterboyz @ Apr 10 2022, 01:15 AM) Where did you get this news? I subscribe to Maxis home fibre (RM89/mth) and also a postpaid mobile plan with 3 supplementary lines. AFAIK, before this, we could not include the postpaid plan because they have voice plan and was not counted as an independent data plan. However, Maxis sent me the year 2021 statement when I requested it via Maxis app. And they lump everything together (all bills). It was given by a talk by LHDN officer... from a Q&A session |

|

|

|

|

|

ronnie

|

May 6 2022, 11:54 PM May 6 2022, 11:54 PM

|

|

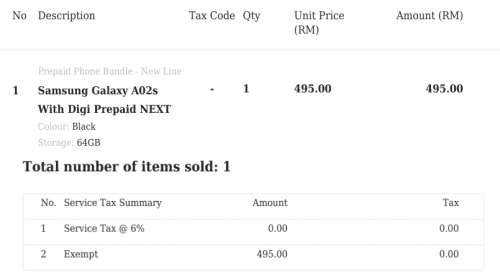

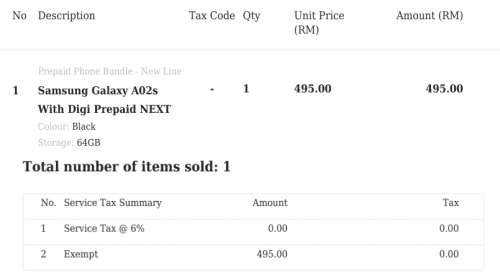

QUOTE(rocketaz @ May 6 2022, 07:28 PM) Hello tax-xpert  Bought a phone from Digi last year. Can this be included for tax relief? What does Exempt means on the invoice? Thanksss  The smartphone has no 6% SST(i.e. Exempt) |

|

|

|

|

|

ronnie

|

Feb 23 2023, 10:01 AM Feb 23 2023, 10:01 AM

|

|

Have Maxis allow to generate the receipt for the Income Tax Filing for Lifestyle tax relief ?

Where can i download it ?

|

|

|

|

|

|

ronnie

|

Mar 5 2023, 08:43 PM Mar 5 2023, 08:43 PM

|

|

QUOTE(CANONPIXMA @ Mar 5 2023, 09:57 AM) Still doesn't answer my question. Fishing gear falls under sports equipment? of course not la... not listed in the attached above it's not sports...not in Olympics, Commonwealth Games, Asian Games, SEA Games, SUKMA  This post has been edited by ronnie: Mar 5 2023, 08:44 PM This post has been edited by ronnie: Mar 5 2023, 08:44 PM |

|

|

|

|

|

ronnie

|

Mar 6 2023, 03:09 PM Mar 6 2023, 03:09 PM

|

|

QUOTE(babylon52281 @ Mar 6 2023, 09:56 AM) Hi, want to ask, I pay yearly on medical checkup for my PSV license renewal (its about Rm80), so can I claim that under Medical Self G7 (i)? Not eligible..only those full medical exams with blood, urine, lungs, ECG, top-to-toe which is worth RM1k or more. Simple blood & urine test is not eligible also. |

|

|

|

|

|

ronnie

|

Mar 6 2023, 03:10 PM Mar 6 2023, 03:10 PM

|

|

QUOTE(miyakochan89 @ Mar 6 2023, 02:41 PM) Hi hi, wanna ask about the medical expenses for parents. That one the receipt has to be under my name who paid for it? One of my parents recently went for a big surgery. Patient = parents name must be shown on the receipt/invoice |

|

|

|

|

|

ronnie

|

Mar 7 2023, 02:14 PM Mar 7 2023, 02:14 PM

|

|

QUOTE(Bonjitettei @ Mar 7 2023, 01:32 PM) Yes, I do have main job. If I total up my yearly P&L from my trading, it's around 30-40% from my yearly salary. E.g.; if my yearly salary is RM100k, my trading income ~30 - 40k Since my main job salary is more than trading income, no need to declare right. For me, I think you need to declare BOTH source of income. RM100k salary RM30k trading (if it's regular) total income RM130k This post has been edited by ronnie: Mar 7 2023, 02:17 PM |

|

|

|

|

|

ronnie

|

Mar 8 2023, 04:18 PM Mar 8 2023, 04:18 PM

|

|

Instead of waiting for refund of taxes, learn how to use TP1 to "pay income tax every 30/4 instead.

Taxes you overpaid over the months will not get interest also.

|

|

|

|

|

|

ronnie

|

Mar 8 2023, 04:58 PM Mar 8 2023, 04:58 PM

|

|

QUOTE(ccschua @ Mar 8 2023, 04:36 PM) I have a child 18 years and above and studying in college. do i claim relief for 1x8000 and also 1x 2000 ? or if I claim 1x8000, i cant claim the 1x2000 ? since I contribute to EPF (more than RM 4000), can I claim the contribution to EPF / approve scheme RM 4000 ? RM8000 is which tax relief ? |

|

|

|

|

|

ronnie

|

Mar 8 2023, 05:21 PM Mar 8 2023, 05:21 PM

|

|

QUOTE(imranzero @ Mar 8 2023, 05:04 PM) 15a. child below 18 15b. child above 18 so it's either one. So if you have child genius who goes to university at 14 years old, you cannot claim 15b. Super stupid lo This post has been edited by ronnie: Mar 8 2023, 05:22 PM |

|

|

|

|

|

ronnie

|

Mar 9 2023, 10:04 AM Mar 9 2023, 10:04 AM

|

|

QUOTE(coolguy99 @ Mar 9 2023, 09:37 AM) Guys just wondering if LHDN accepts scanned copy of receipts? you should keep both physical & scanned copies. Even if the physical is faded to white paper. |

|

|

|

|

|

ronnie

|

Mar 10 2023, 01:03 PM Mar 10 2023, 01:03 PM

|

|

QUOTE(coolguy99 @ Mar 10 2023, 11:24 AM) For medical expense, say we have insurance to cover, we can only claim the part that we paid right? Say I have RM500 co-insurance + some expenses that are not covered under insurance plan, I should be able to claim this? Typically yes... those you paid with your name on the receipt. It also depends on the illness also, |

|

|

|

|

Nov 15 2021, 09:37 PM

Nov 15 2021, 09:37 PM

Quote

Quote

1.8305sec

1.8305sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled