QUOTE(Kerry1136 @ Apr 11 2020, 02:12 PM)

Yup I see it and I also see that there's also bayaran lebihan - RM x,xxx but it didn't mention anything bout tafsiran and what not.

Then it's either has not started or still under processing.Income Tax Issues v4, Scope: e-BE and eB only

|

|

Apr 11 2020, 02:13 PM Apr 11 2020, 02:13 PM

Return to original view | IPv6 | Post

#101

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 11 2020, 02:15 PM Apr 11 2020, 02:15 PM

Return to original view | IPv6 | Post

#102

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Kerry1136 @ Apr 11 2020, 02:15 PM) Ah okay thanks! Same LHDN branch?Just felt weird that I submitted both mine and hers on the same day (23rd March) and I've gotten mine on (4th April) And the funny thing is the amount excessive is much lower compared to mine but I got paid instead. How "close" are the BE serial number? |

|

|

Apr 12 2020, 09:15 PM Apr 12 2020, 09:15 PM

Return to original view | IPv6 | Post

#103

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(MrB9 @ Apr 12 2020, 09:13 PM) Hi all, would like to seek advise, in my EA form for example Section B: When I submit my income tax income declare as RM100k or 130k?(a) gaji kasar RM80,000 © tip kasar, perkuisit penerimaan sagu hati & elaun lain RM30,000 When I submit my income tax income declare as RM100k or 130k? I have travel allowances included at ©, can I exempt 6k from total salary? Seek for advise. Thank you. The grand total of Section (B). |

|

|

Apr 12 2020, 09:19 PM Apr 12 2020, 09:19 PM

Return to original view | IPv6 | Post

#104

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 12 2020, 09:21 PM Apr 12 2020, 09:21 PM

Return to original view | IPv6 | Post

#105

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(MrB9 @ Apr 12 2020, 09:19 PM) Noted, thanks. I study there is tax deduction for travel allowance RM6000. Do I directly deduct from my section (b) value? for eg. Rm130k-6k= RM124k in B1? Your HR/accounting/payroll/reimbursement team need to put that amount under Section F to be tax exempted; otherwise it's taxable. |

|

|

Apr 12 2020, 09:26 PM Apr 12 2020, 09:26 PM

Return to original view | IPv6 | Post

#106

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 12 2020, 09:33 PM Apr 12 2020, 09:33 PM

Return to original view | IPv6 | Post

#107

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 13 2020, 05:34 PM Apr 13 2020, 05:34 PM

Return to original view | IPv6 | Post

#108

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 14 2020, 02:10 PM Apr 14 2020, 02:10 PM

Return to original view | IPv6 | Post

#109

|

All Stars

12,387 posts Joined: Feb 2020 |

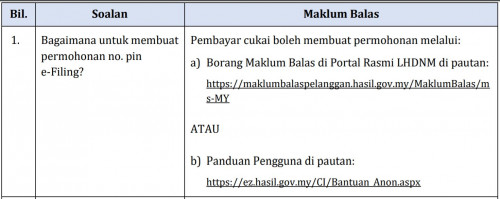

QUOTE(woodenpuppy @ Apr 14 2020, 02:08 PM) Hi need some help, first time tax filer. Is there anyway to get the online login pin during this MCO period ? You're in luck! http://lampiran1.hasil.gov.my/pdf/pdfam/faq_1.pdf https://maklumbalaspelanggan.hasil.gov.my/MaklumBalas/ms-MY https://ez.hasil.gov.my/CI/Bantuan_Anon.aspx This post has been edited by GrumpyNooby: Apr 14 2020, 02:15 PM |

|

|

Apr 14 2020, 03:28 PM Apr 14 2020, 03:28 PM

Return to original view | IPv6 | Post

#110

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 14 2020, 03:30 PM Apr 14 2020, 03:30 PM

Return to original view | IPv6 | Post

#111

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 14 2020, 03:39 PM Apr 14 2020, 03:39 PM

Return to original view | IPv6 | Post

#112

|

All Stars

12,387 posts Joined: Feb 2020 |

Bear in mind that receipt needs to keep for min 7 years!

|

|

|

Apr 20 2020, 01:57 PM Apr 20 2020, 01:57 PM

Return to original view | Post

#113

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 21 2020, 02:42 PM Apr 21 2020, 02:42 PM

Return to original view | Post

#114

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jiaen0509 @ Apr 21 2020, 02:38 PM) I have Personal Accidents Insurance with UOB Liberty insurance. If there's no breakdown into life/medical/education, it's very likely that you cannot claim it.The amount can tax exempt on which category? I just receive the statement with the gross premium paid amount stated upon request from the insurer. It does now look like GE have seperate like medical/life. |

|

|

Apr 22 2020, 09:21 PM Apr 22 2020, 09:21 PM

Return to original view | IPv6 | Post

#115

|

All Stars

12,387 posts Joined: Feb 2020 |

LHDN resumes operations on April 23, but only for some services

https://www.thestar.com.my/news/nation/2020...r-some-services |

|

|

Apr 22 2020, 09:36 PM Apr 22 2020, 09:36 PM

Return to original view | IPv6 | Post

#116

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(airflow @ Apr 22 2020, 09:34 PM) A question regarding income tax relief for internet subscription. Residential high speed internet - RM 69.00 onlyI'm currently subscribed to Unifi Lite Breakdown from the monthly bill is as follows - Residential high speed internet - RM 69.00 - Unifi PlayTV lite - RM 30.00 (which comes bundled with the package, like it or not) - Service tax - RM 5.95 Question is, can I claim the full RM104.95, or only the RM69.00? Thank you in advance |

|

|

Apr 28 2020, 12:28 PM Apr 28 2020, 12:28 PM

Return to original view | Post

#117

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(dummies @ Apr 28 2020, 12:24 PM) may i ask a question regarding “Has financial account(s) at financial institution(s) outside Malaysia” at our eBE form? Asked before in here. No definite answer.If i have a US E-trade share trading account, is it considered as “Has financial account(s) at financial institution(s) outside Malaysia”? Thanks! |

|

|

Apr 29 2020, 10:02 AM Apr 29 2020, 10:02 AM

Return to original view | Post

#118

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(maestrox_69 @ Apr 29 2020, 09:57 AM) Yes. May I know this statement is quoted from where?"The major categories of financial institutions include central banks, retail and commercial banks, internet banks, credit unions, savings, and loans associations, investment banks, investment companies, brokerage firms, insurance companies, and mortgage companies." |

|

|

Apr 29 2020, 07:15 PM Apr 29 2020, 07:15 PM

Return to original view | IPv6 | Post

#119

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 30 2020, 08:44 AM Apr 30 2020, 08:44 AM

Return to original view | Post

#120

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Chosen one @ Apr 30 2020, 08:02 AM) Hi guys newbie here First time login is YES.this is my first time submitting tax i still need the 16 digit pin for logging in for the first time already submitted a ticket for requesting pin number with my email on it but still havent got any reply yet did I miss any steps ? |

| Change to: |  0.2245sec 0.2245sec

0.81 0.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 12:26 AM |