QUOTE(dino89 @ Nov 6 2018, 12:50 PM)

my understanding is....repurchase is sell to FH, FH purchase

withdraw is withdraw from trust fund

redemption is sell holdings to get back money

so to me, they the same.

Public Mutual Funds, version 0.0

|

|

Nov 6 2018, 12:57 PM Nov 6 2018, 12:57 PM

Return to original view | Post

#81

|

All Stars

14,867 posts Joined: Mar 2015 |

|

|

|

|

|

|

Dec 3 2018, 09:55 PM Dec 3 2018, 09:55 PM

Return to original view | Post

#82

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(W_Lenovo @ Dec 3 2018, 09:30 PM) is it possible that your risk assessment profile determined during your filing of the "INVESTOR SUITABILITY ASSESSMENT FORM"....assessed that you are not suitable for high risk fund? and that you did not "tick" the "override" box in the form? mine too...cannot see that fund This post has been edited by MUM: Dec 4 2018, 07:47 AM |

|

|

Dec 17 2018, 03:47 PM Dec 17 2018, 03:47 PM

Return to original view | Post

#83

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(capsulr @ Dec 17 2018, 03:39 PM) Put in 8K lose 1K, ouch my heart.. I thought of just putting it as an investment, but at this rate i just feel like an idiot if I leave it there for any longer, any advice? I guess the most important is what you felt..... it is your money and your feeling after all..... |

|

|

Feb 9 2019, 02:44 PM Feb 9 2019, 02:44 PM

Return to original view | Post

#84

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(shodan11 @ Feb 9 2019, 02:38 PM) Anyone tried PB Asia Consumer Fund, launched last month? if the amount that you gonna spend on this fund is insignicant to your net worth, or like "loose" pocket change ...then just buy it since you are "Intrigued by its profile of investing in consumer markets across Asia."I dont have any UT portfolio but somehow quite interested in this fund as my first venture (possibly one-off buy). Intrigued by its profile of investing in consumer markets across Asia. Or should I choose other established funds instead. it is your money and you deserve to spend it as you liked ...(for it is just loose change) This post has been edited by MUM: Feb 9 2019, 02:47 PM |

|

|

Feb 9 2019, 02:48 PM Feb 9 2019, 02:48 PM

Return to original view | Post

#85

|

All Stars

14,867 posts Joined: Mar 2015 |

|

|

|

Feb 9 2019, 02:57 PM Feb 9 2019, 02:57 PM

Return to original view | Post

#86

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(shodan11 @ Feb 9 2019, 02:52 PM) Oh..okay.. what I meant was diversification on my disposable income. Put here, there and not just into EPF,ASNB funds & gold (currently). but just remember to go into those that suits your risk appetite and expectation.... if this is your first venture into UT....may i suggest that you try go into the funds that has more historical track records..... at least you can see how the fund performed (especially in year 2018),...see their performance and determine if these losses is ok with you..... |

|

|

|

|

|

Feb 27 2019, 03:32 PM Feb 27 2019, 03:32 PM

Return to original view | Post

#87

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(xngjn @ Feb 27 2019, 03:29 PM) Hi. I new to UT. I would think that it suits those that knows what to expects....What u all think about public china access equity fund (pcasef). Invest in China market and blue chip stock. some found out about it last year.... check out the returns of last year.... do you think it suits most people? |

|

|

Mar 11 2019, 04:49 PM Mar 11 2019, 04:49 PM

Return to original view | Post

#88

|

All Stars

14,867 posts Joined: Mar 2015 |

|

|

|

Mar 12 2019, 09:01 PM Mar 12 2019, 09:01 PM

Return to original view | Post

#89

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(babyphie @ Mar 12 2019, 08:28 PM) Dear all sifus, The fund is suitable for short-term investors who seek capital preservation. What is your opinion on Public E cash deposit? It function like REPO. Min investment is suitable for newbie like me.. Notes: This is neither a capital guaranteed nor a capital protected fund. Short term refers to a period of less than 3 years. looking at the returns....it looks like almost similar with Bank's Fixed Deposit board rates.... Minimum initial investment*: RM100. Minimum additional investment*: RM10. https://www.publicmutual.com.my/LinkClick.a...M%3D&portalid=0 This post has been edited by MUM: Mar 12 2019, 09:01 PM |

|

|

Mar 12 2019, 09:28 PM Mar 12 2019, 09:28 PM

Return to original view | Post

#90

|

All Stars

14,867 posts Joined: Mar 2015 |

|

|

|

Mar 19 2019, 07:36 PM Mar 19 2019, 07:36 PM

Return to original view | Post

#91

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(engyr @ Mar 19 2019, 07:02 PM) I requested to switch funds on 16/3/19. while waiting for experienced sifus responses,Until now, transaction status still floating. How many days Public mutual process normally? my wild guess is.... you apply to sell on 16/3 (Saturday) depending on the fund itself, the actual sell may just trigger on Monday. (18/3) the Nav of Monday will only be known most probably on Tuesday 19/3 the fund house can just do the transaction based on the known Monday's Nav |

|

|

May 21 2019, 11:00 PM May 21 2019, 11:00 PM

Return to original view | Post

#92

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(1282009 @ May 21 2019, 10:55 PM) Hi All, side track a bit. I purchased a new fund recently from my agent. I used EPF withdrawal for this purpose. the money from EPF to EPF MIS is quite save...for it has transaction tracking....Since finger print and signature is required, he advised me to do the same in 2-3 forms in case there is issue on my finger print. The additional forms are for backup purposes. Is this practice normal and safe? I believe the form is only for EPF withdrawal for unit trust investment and will be directly creditted to my unit fund account. Should I be concern at all? the number of forms "Pre signed" will be more of a concern when the agent "auto" periodic withdraw from yr EPF for repurchase/top up of EPF MIS funds. Investors must never pre-sign or place their thumbprints on investment forms to transfer funds from the EPF account to the PRS or unit trust fund under the MIS, he said. “Some unscrupulous consultants are using the forms to further invest without telling the investor,” he said, adding that the FIMM has a complaints management and disciplinary committee that gathers evidence whenever a complaint is lodged. Read more at https://www.thestar.com.my/news/nation/2016...1dTxtOz8rzgc.99 This post has been edited by MUM: May 21 2019, 11:03 PM |

|

|

Jul 18 2019, 12:22 PM Jul 18 2019, 12:22 PM

Return to original view | Post

#93

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(JokerNymous @ Jul 18 2019, 11:46 AM) any PBM Agent here? pls dm me i have few question to ask and is that worth joining as agent for this time period because my sister is going for the PBM test next week onward previously I heard that a PM UTC must maintain RMxx,000 amount of sales pa....else tak boleh kerja.not sure the actual amount and the latest update about this working clause. usually they will get their family members to do periodic investment by cash/epf to try to maintain that yearly quota |

|

|

|

|

|

Aug 6 2019, 11:07 PM Aug 6 2019, 11:07 PM

Return to original view | Post

#94

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(YoungMan @ Aug 6 2019, 10:51 PM) Thank you... Another question: how does DDA/DCA actually help in growing the fund when each transaction is charged 5%? Say I start with 2k in fund A, and then consistently put in RM200 monthly, but each rm200 there is a 5% fee. I tend to feel like I am losing the game to the sc. Forgive this newcomer with very limited knowledge in mutual fund. for that, you can opt to reduce the 5.25%SC fees to 1.75% by choosing another platform or Secondly what will happen if I choose none from the name of agent when making a new investment online? Will it randomly put to another PM agent? Finally... Wish me luck in Public U.S Equity. 0%SC (read post 496 then 484, page 25 by forummer Roarus for tip and way to this 0%SC) at eUT / POEMs / Phillip Mutual Berhad UT discussion, Coz' Fundsupermart not cheapo enuf'! https://forum.lowyat.net/topic/4268975/+480#entry93482961 This post has been edited by MUM: Aug 7 2019, 07:09 AM |

|

|

Aug 21 2019, 12:08 AM Aug 21 2019, 12:08 AM

Return to original view | Post

#95

|

All Stars

14,867 posts Joined: Mar 2015 |

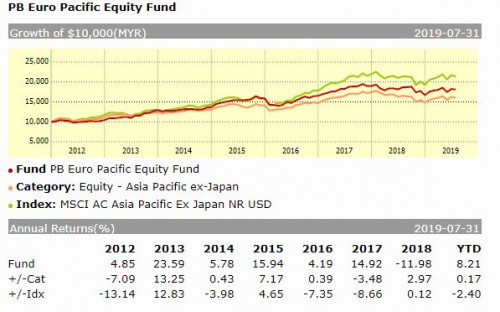

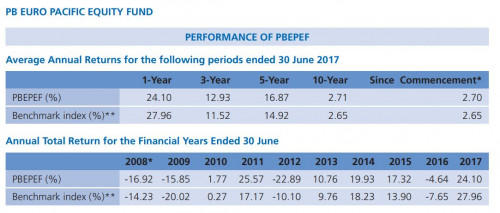

QUOTE(RigerZ @ Aug 20 2019, 11:51 PM) Hi, I am new to investing and I have a question. while waiting for replies from reliable sourcesTaking for example PB Euro Pacific Equity Fund, how come the annualized returns from PB's PHS is different from what is shown on Morning Star? PB PHS link Morningstar link   my agar agar guess is the reporting date/month variance... the morning star one maybe is reporting from 1 Jan to 31 Dec, while the PB one is from 1 June to next year 30 June.... and also is the number showns in the morning star chart, include dividend reinvested into the fund? you can cross check by using the fund performance like this.... https://www.publicmutual.com.my/Home/Fund-Performance i think the variance will not be that big (if includes dividend reinveted into it) well that is my agar agar guess only |

|

|

Aug 25 2019, 05:52 PM Aug 25 2019, 05:52 PM

Return to original view | Post

#96

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(RigerZ @ Aug 25 2019, 05:24 PM) Hi again. I'm back with more questions now (still very new so hope you can bear with me) while waiting for responses, if you want, you can select and read these articles from Public Mutual for some added info while you waitWhen I was in school, me and my mum joined up, invested in PB Euro Pacific (PBEP) and also China Pacific (PBCP) equity funds. We put in the minimum RM1000 for each and totally forgot about it all these years. Since the account is under my mum's name only she can check on the current value of our account, but she has been unable to drop by the bank and check. I have read up both their PHS and saw their averaged annual returns look decent, more so for China Pacific. (unless I have been wrongly reading) Lately I've become more aware on investing and looking at options to put money in besides FD, EPF and ASNB. Am I right in saying that PBEP and PBCP can be additional investment options? I do understand these are both high risk funds. Risk appetite? I would say I'm looking at building funds for the the next 10-25 years. I reckon my retirement funds are settled with EPF self contribution, I have a couple of insurance policies for medical + death/TPD/critical illness. If you have extra kindness to highlight suitable funds from PB it would be extra appreciated. I have a PBe account so I can link with PMO. What You Need to Know https://www.publicmutual.com.my/Prospective...ou-Need-To-Know |

|

|

Sep 11 2019, 03:57 PM Sep 11 2019, 03:57 PM

Return to original view | Post

#97

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(frankzane @ Sep 11 2019, 01:40 PM) Investments and distribution reinvestments for partial-load units, low-load units and zero-load units are not entitled for MGQP. Computation of Mutual Gold Qualifying Points (MGQP): ........... ........... https://www.publicmutual.com.my/Priority-Se...ces/Mutual-Gold |

|

|

Oct 4 2019, 07:42 PM Oct 4 2019, 07:42 PM

Return to original view | Post

#98

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(coolbuddha91 @ Oct 4 2019, 07:02 PM) HI, would like to know what 'distribution is in the form of cash' means? Does it mean once distribution date come, it will bank in the dividend/interest directly to my bank account? i saw this type of distribution in bond fund. Thanks. read this while you wait for responses?hope you could get some info from it while you wait https://www.publicmutual.com.my/LinkClick.a...A%3d&portalid=0 Attached thumbnail(s)

|

|

|

Oct 6 2019, 09:14 PM Oct 6 2019, 09:14 PM

Return to original view | Post

#99

|

All Stars

14,867 posts Joined: Mar 2015 |

|

|

|

Oct 6 2019, 09:36 PM Oct 6 2019, 09:36 PM

Return to original view | Post

#100

|

All Stars

14,867 posts Joined: Mar 2015 |

|

| Change to: |  0.1027sec 0.1027sec

0.33 0.33

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:54 AM |