Hearsay they will re-open PIOF for subscriptions for limited time

Public Mutual Funds, version 0.0

Public Mutual Funds, version 0.0

|

|

Aug 29 2016, 01:26 PM Aug 29 2016, 01:26 PM

Show posts by this member only | IPv6 | Post

#701

|

Senior Member

10,001 posts Joined: May 2013 |

Hearsay they will re-open PIOF for subscriptions for limited time

|

|

|

|

|

|

Aug 29 2016, 02:29 PM Aug 29 2016, 02:29 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

The 1-yr performance chart for PIOF is pretty poor; dropped about 10% off its peak & underperformed its benchmark badly (benchmark +11.2%, PIOF +3.9%)

I think many have been selling/switching out of the fund - since those investors in the accumulation stage can't do DCA on it as it was closed; and those in the matured passive-income stage can't rely on it for either growth or income. (No income distribution was announced on its financial year-end on 31/July.) |

|

|

Aug 29 2016, 02:39 PM Aug 29 2016, 02:39 PM

Show posts by this member only | IPv6 | Post

#703

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(j.passing.by @ Aug 29 2016, 02:29 PM) The 1-yr performance chart for PIOF is pretty poor; dropped about 10% off its peak & underperformed its benchmark badly (benchmark +11.2%, PIOF +3.9%) Their 5 & 10 years return is very competitiveI think many have been selling/switching out of the fund - since those investors in the accumulation stage can't do DCA on it as it was closed; and those in the matured passive-income stage can't rely on it for either growth or income. (No income distribution was announced on its financial year-end on 31/July.) |

|

|

Aug 29 2016, 03:16 PM Aug 29 2016, 03:16 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(wil-i-am @ Aug 29 2016, 02:39 PM) 10-yr total returns annualised to 12.4%, 5-yr 11.74%, and 3-yr 7.29%.The problem is that the impressive growth is only for those who had started buying it years ago. Those who started buying it 2 years ago see it shoot up 18% last year, dropped off its peak by 10%, and YTD growth of -8.4%. I have this fund, switched in in 2014 before it closed, IRR peaked at 15%, current IRR less than 4%. Was very tempted to switch some units out to bond funds, but having this dilemma of not able to switch back in after switching out for short term gains. Oh well, will get more units if it is open... |

|

|

Aug 29 2016, 03:28 PM Aug 29 2016, 03:28 PM

|

All Stars

48,446 posts Joined: Sep 2014 From: REality |

wonder why re-open PIOF for limited time subscriptions

|

|

|

Aug 29 2016, 03:47 PM Aug 29 2016, 03:47 PM

|

Senior Member

555 posts Joined: Oct 2009 |

Public Mutual funds are a no no for me, the high sales charge goes up to 5%.. investors who enter are already at an initial loss

|

|

|

|

|

|

Aug 29 2016, 03:51 PM Aug 29 2016, 03:51 PM

Show posts by this member only | IPv6 | Post

#707

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(j.passing.by @ Aug 29 2016, 03:16 PM) 10-yr total returns annualised to 12.4%, 5-yr 11.74%, and 3-yr 7.29%. Perhaps u can consider DCA from 1/9 onwardsThe problem is that the impressive growth is only for those who had started buying it years ago. Those who started buying it 2 years ago see it shoot up 18% last year, dropped off its peak by 10%, and YTD growth of -8.4%. I have this fund, switched in in 2014 before it closed, IRR peaked at 15%, current IRR less than 4%. Was very tempted to switch some units out to bond funds, but having this dilemma of not able to switch back in after switching out for short term gains. Oh well, will get more units if it is open... |

|

|

Aug 29 2016, 04:11 PM Aug 29 2016, 04:11 PM

Show posts by this member only | IPv6 | Post

#708

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Aug 29 2016, 04:40 PM Aug 29 2016, 04:40 PM

|

All Stars

48,446 posts Joined: Sep 2014 From: REality |

|

|

|

Aug 29 2016, 04:47 PM Aug 29 2016, 04:47 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Aug 30 2016, 10:59 AM Aug 30 2016, 10:59 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

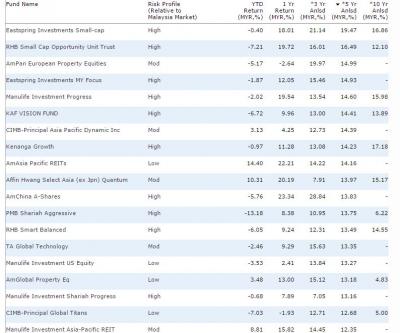

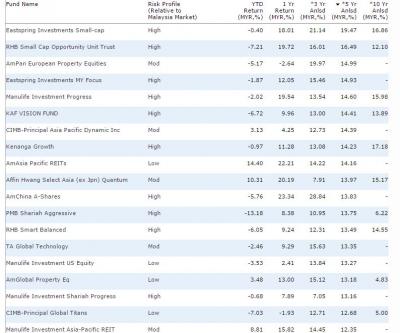

QUOTE(nexona88 @ Aug 29 2016, 04:40 PM) QUOTE(wongmunkeong @ Aug 29 2016, 04:47 PM) Time for me to kacau this thread again Actually, if the funds can outperform its peers in other asset management companies over long term, even if they charge more than 5.5% sales charge it'll be worth while. 5.5% sales charge annualised also less than 1% per year over 5 years Question is, how does PM funds returns compare to its peers? According to my trusted morningstar fund selector, Public mutual does not even made the first page of the 5 year annualised returns

Even 10 year annualised return also only 2 PM funds that made the list, small cap and islamic opportunities. For an asset management company that manages more than 50% of the AUM in the unit trust industry in Malaysia.... I'm more than disappointed Honestly the argument is becoming stale, and PM is becoming irrelevant to the industry if they don't do anything about it. The only thing I can do as a consumer is to put my money elsewhere, and tell everyone I know to do the same |

|

|

Aug 30 2016, 11:45 AM Aug 30 2016, 11:45 AM

Show posts by this member only | IPv6 | Post

#712

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(dasecret @ Aug 30 2016, 10:59 AM) Time for me to kacau this thread again I'm keen to know whether PM will change as the UT landscape is changing rapidly with new players namely Fintech making headlinesActually, if the funds can outperform its peers in other asset management companies over long term, even if they charge more than 5.5% sales charge it'll be worth while. 5.5% sales charge annualised also less than 1% per year over 5 years Question is, how does PM funds returns compare to its peers? According to my trusted morningstar fund selector, Public mutual does not even made the first page of the 5 year annualised returns

Even 10 year annualised return also only 2 PM funds that made the list, small cap and islamic opportunities. For an asset management company that manages more than 50% of the AUM in the unit trust industry in Malaysia.... I'm more than disappointed Honestly the argument is becoming stale, and PM is becoming irrelevant to the industry if they don't do anything about it. The only thing I can do as a consumer is to put my money elsewhere, and tell everyone I know to do the same |

|

|

Aug 30 2016, 11:49 AM Aug 30 2016, 11:49 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(wil-i-am @ Aug 30 2016, 11:45 AM) I'm keen to know whether PM will change as the UT landscape is changing rapidly with new players namely Fintech making headlines So far they seem uninterested to change, at the end of the day, they have a sales force of 30,000. Even if only 1/3 is active, that's 10,000 agent who depend on the job to cari makan... if PM starts to offer lower SC or tier charges on different platform, these agents would probably mogokThat's what I observed that's stopping the life insurance industry to evolve Still waiting for the robo advisors to come in and give FSM some competition |

|

|

|

|

|

Aug 30 2016, 11:54 AM Aug 30 2016, 11:54 AM

Show posts by this member only | IPv6 | Post

#714

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(dasecret @ Aug 30 2016, 11:49 AM) So far they seem uninterested to change, at the end of the day, they have a sales force of 30,000. Even if only 1/3 is active, that's 10,000 agent who depend on the job to cari makan... if PM starts to offer lower SC or tier charges on different platform, these agents would probably mogok I presume changes will take place once the #1, Tan Sri Teh is no longer aroundThat's what I observed that's stopping the life insurance industry to evolve Still waiting for the robo advisors to come in and give FSM some competition |

|

|

Aug 30 2016, 12:54 PM Aug 30 2016, 12:54 PM

|

All Stars

48,446 posts Joined: Sep 2014 From: REality |

QUOTE(dasecret @ Aug 30 2016, 11:49 AM) So far they seem uninterested to change, at the end of the day, they have a sales force of 30,000. Even if only 1/3 is active, that's 10,000 agent who depend on the job to cari makan... if PM starts to offer lower SC or tier charges on different platform, these agents would probably mogok when we can expect robo advisors to come in?? any idea That's what I observed that's stopping the life insurance industry to evolve Still waiting for the robo advisors to come in and give FSM some competition normally how much SC they charge? |

|

|

Aug 30 2016, 06:36 PM Aug 30 2016, 06:36 PM

|

All Stars

48,446 posts Joined: Sep 2014 From: REality |

Public Mutual declares RM119m distrbutions for 11 funds

http://www.thestar.com.my/business/busines...s-for-11-funds/ |

|

|

Sep 1 2016, 09:43 AM Sep 1 2016, 09:43 AM

|

Senior Member

2,661 posts Joined: Jan 2003 |

QUOTE(nexona88 @ Aug 30 2016, 06:36 PM) Public Mutual declares RM119m distrbutions for 11 funds The distributions (as usual) are a joke to me. PSMALLCAP is one of the best funds just 5 cents?http://www.thestar.com.my/business/busines...s-for-11-funds/ |

|

|

Sep 1 2016, 10:53 AM Sep 1 2016, 10:53 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Sep 1 2016, 10:58 AM Sep 1 2016, 10:58 AM

|

Senior Member

2,661 posts Joined: Jan 2003 |

QUOTE(Pink Spider @ Sep 1 2016, 10:53 AM) Bro, go to FSM thread and read Post #1 for explanation of what distributions mean in the context of mutual funds - it's meaningless. I understand. It's virtually nothing as it's a distribution, not a dividend. However, looking at the amount declared as 5 cents is a joke. PSMALLCAP distribution used to be like > 5 cents in the past. |

|

|

Sep 1 2016, 11:24 AM Sep 1 2016, 11:24 AM

|

Junior Member

627 posts Joined: Sep 2011 |

QUOTE(wil-i-am @ Aug 29 2016, 04:11 PM) but still i keep on hearing from agent, u can make 40% profit easily lar, and blar blar, dividend is great lar... and then they point to you the straight line chart, naik naik naik, and then u can guna epf hentam, no need cash upfront and blar blar... This post has been edited by LDP: Sep 1 2016, 11:27 AM |

| Change to: |  0.0408sec 0.0408sec

0.26 0.26

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 09:48 PM |