QUOTE(starry @ Feb 19 2016, 11:04 PM)

According to the fund performance chart, BM for PDSF: total returns from 17 May 2005 to 18 Feb 2016 = 93.96%

What is BM?

BenchmarkWhat is BM?

Public Mutual Funds, version 0.0

|

|

Feb 19 2016, 11:16 PM Feb 19 2016, 11:16 PM

Return to original view | Post

#1

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

|

|

|

Jun 1 2016, 12:24 PM Jun 1 2016, 12:24 PM

Return to original view | Post

#2

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(md_aie @ Jun 1 2016, 12:05 PM) Kenanga Investors declared distributions of 10.11 sen for its Syariah Growth Fund. Anyone interested, please pm me. This is public mutual post.... if you would like to update forummers on funds in other fund house you are welcome to do it in fund investment corner or even FSM post. But good luck trying to sell to FSM thread followers |

|

|

Jun 1 2016, 02:37 PM Jun 1 2016, 02:37 PM

Return to original view | Post

#3

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(wongmunkeong @ Jun 1 2016, 02:16 PM) er.. WRONG DISTRIBUTION, not dividend. The right word and differences between them also dunno, wanna people to contact U pulak... Supersound should sooooo contact U QUOTE(wil-i-am @ Jun 1 2016, 02:20 PM) If u refer to Dividend, there is no difference to your investment value b4 n after Kenanga declared Dividend We must be too bored to entertain every last agent that come cari makan in UT threadsSad thing is, so many of them out there |

|

|

Jun 1 2016, 03:15 PM Jun 1 2016, 03:15 PM

Return to original view | Post

#4

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(wongmunkeong @ Jun 1 2016, 02:43 PM) it's a "fun" past time Maybe we should maintain a scoreboard of agents; one for UT and one for insurance to 'encourage competition' this one no fun though - right on the onset, already shot self in foot liao. no "play", no "giving longer rope to..", etc. sigh. Seriously too bored la me |

|

|

Jun 9 2016, 06:39 PM Jun 9 2016, 06:39 PM

Return to original view | Post

#5

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(nexona88 @ Jun 9 2016, 05:49 PM) The sales team need to cari makan la, show people fund returns of the loss making funds who will buyNeed new funds with 'new strategies' then sell 'hope' to the customers that this will be better than the last fund lor But honestly.... damn sien looking at the performance |

|

|

Jun 9 2016, 08:08 PM Jun 9 2016, 08:08 PM

Return to original view | Post

#6

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

|

|

|

Jun 10 2016, 09:37 AM Jun 10 2016, 09:37 AM

Return to original view | Post

#7

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(adam1122 @ Jun 9 2016, 08:15 PM) QUOTE(MUM @ Jun 9 2016, 09:22 PM) On top of the high sales charge, the returns for their funds are bad across the board. Why do I say that?I compare the available funds in Msia for each segment and non of the segment where Public Mutual emerge as the high performer, at least for 1-3 years returns; they used to be better, so some of the 5 - 10 years results still look decent but definitely not the highest So when I look at the portfolio and try to switch to better performing funds, I have a tough time doing so, because no matter how I switch it still sucks This is coming from personal experience, I switched some funds last year to foreign equities from local equities. Now I compare the results between after switching and if I remained status quo, both also abang adik jer. And for the past 18 months, the returns is about -9% IRR This is a stark comparison against the portfolio I maintained in fundsupermart where even at the worst time I made about -4% IRR; and at the moment it's 2.5% IRR. To be fair the FSM portfolio is more balanced with substantial allocation in bonds... but comparing individual funds by category PM also lost big time. And there's no sales charge or switching charge for the PM funds; imagine if you start off 5% lower... even worse lor I'm waiting for the PM agents to come assassinate me |

|

|

Jun 11 2016, 04:54 PM Jun 11 2016, 04:54 PM

Return to original view | Post

#8

|

Senior Member

1,498 posts Joined: Nov 2012 |

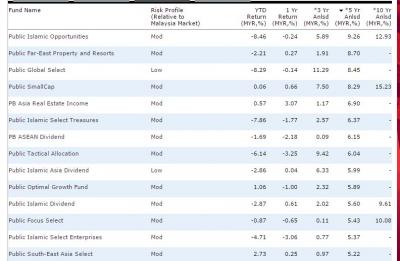

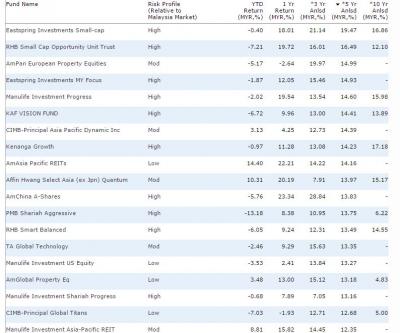

QUOTE(kradun @ Jun 11 2016, 02:58 PM) When u top up the one off service charge will only applied on additional units. I totally get what you are trying to say. Now, since sales charge is not necessarily that important in the long run, lets talk returns.ie. Initially invest RM10,000 in Jan'16 then RM9,479 will be capital while RM521 will be service charge. Then subsequently Jan'17 top up RM1,000 then RM948 will be capital while RM52 will be service charge. Assume every year consistently earn net 6%. By Jan'19 the amount will be about (RM9,479 X 1.06 X 1.06 X 1.06) + (RM948 X 1.06 X 1.06) = RM12,355 If same amount put in fd at 4% then will be (RM10,000 X 1.04 X 1.04 X 1.04) + (RM1,000 X 1.04 X 1.04) = RM12,374 Take additional 1 more year then the one invest in FD will lose out on fund that could consistently generate 6% return. U could even save half of investment cost through applied ur own UT license. Then u will just need 5% consistent return then can beat the 4% FD in subsequent year illustrated above. So I went to Morningstar to pick up 5 years fund returns; took the highest ones

Now, let's contrast this with funds distributed in FSM

Do I need to say another word? Thought I would.... Now, this is the 10 year highest returns funds. You can clearly see how the returns deteriorated over the years.

How to not lose faith in Public Mutual la This post has been edited by dasecret: Jun 11 2016, 04:57 PM |

|

|

Jun 12 2016, 02:20 AM Jun 12 2016, 02:20 AM

Return to original view | Post

#9

|

Senior Member

1,498 posts Joined: Nov 2012 |

Deleted double post

This post has been edited by dasecret: Jun 12 2016, 02:26 AM |

|

|

Jun 12 2016, 02:23 AM Jun 12 2016, 02:23 AM

Return to original view | Post

#10

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(kradun @ Jun 11 2016, 08:54 PM) When the buying decision is came from the investor themselves or through agent will achieve very different result, mainly because of the timing of buying. Well, FSM has RSP option which is dollar averaging and takes away the emotional and time constraint. If "A" DIY but did not buy any unit at certain low season period due to busy or whatever reason as his daily routine have less exposure on these financial information, while "B" get reminded from agent to top up some unit at the same period, then end result will be very different even required to pay for service charge. Majority of people will just want to invest but wouldn't want to spend their precious time to know too much on these financial products. Most important is achieve the financial objective, if can achieve superior result then that would be bonus. like I mention in the previous post. Even if I disregard the sales charge difference, the returns is the killer. On your point of risk return and investor risk appetite, please feel free to highlight any PM fund within different segment that performed better than non-PM funds. I tried really hard to look and failed. And why do I keep harping on it? I think the sales force should bring this feedback back to public mutual that they need to buck up and deal with the root cause that resulted in lackluster results. Otherwise investors will get smarter and the agent's job will be increasingly difficult to do. To be honest, I do actively tell friends how public mutual is no longer an ideal place to put their money with. Just as how I tell friends to stay away from scams. N sure, they can always use agent if they don't want to DIY. Just don't buy PM funds. There r agents distributing funds from various fund house ma. This post has been edited by dasecret: Jun 12 2016, 02:29 AM |

|

|

Jun 12 2016, 05:12 PM Jun 12 2016, 05:12 PM

Return to original view | Post

#11

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(j.passing.by @ Jun 12 2016, 03:31 PM) I read all the posts here, and sometimes I feel the urge to put in my 2 cents opinion but most of the time, am too lazy to log in and reply. Other times, I see the need to correct some misleading info... and then again did not comment because the info was obviously wrong to most of the readers too, so rather let the poster alone to believe in his own misinformation. To be honest, I too find that the service charge in Public Mutual is (and other local fund companies as well) too excessive at 5.5% compared to online investment platforms like FSM and eUnittrust. It is even more ridiculous when it is only 3% when it is via the EPF withdrawal scheme - which entails more paper work. When I first joined this forum, one of my personal objective was to spread a bit of negative propaganda and also enlightend people that there are online UT platforms with lower and discounted service charges... in the vain hope of driving market away from Public Mutual, and maybe they will see the need to lower their service charge to recapture their market share. (So far, there's no indication that my private and personal crusade is working. LOL. It would be a disservice to some new UT investors or would-be investors coming to this thread for some extra info if I don't present the positive side too. (But it will only be said once, this time only and will not ever be repeated here or elsewhere, as the private and personal cursade is still ongoing. Haha.) The service charge is a one-time charge; it was explained further in a previous post on amortizing it over the years and its effect on the total returns over the long term. Yes, it is discounted and reduced by holding the investment over many years or better still, several or many decades. Another aspect of the service charge is that it is an entry cost. Just stating the obvious... and it is obvious that a higher entry cost will deter entrance. Here's the positive side of a high entry cost - it will also deter exit. But how is that positive, you may ask? Well, there are fund's returns and investor's returns. The fund's returns are stats and data from the past 5 or 10 years, as like those in dasecret's post. They are the stats and data that you reviewed in making the decision for your entrance into the fund. They are the fund's returns for the past 5 or 10 years. Needless to say, when you buy into any fund, you will be getting your own "investor's returns". Not the fund's returns. 'Cos you are buying into the fund now, you are not buying into the fund 5 or 10 years ago. If each of us were buying into the same fund at various times, each of us will be getting different returns - which is the individual investor's returns. (If you want the same return as the fund and other investors, go buy fixed-price UT which is RM1/unit with 'real' annual dividends and given prorata to those investments held less than 1 year.) Some of us would be getting better investor's returns than others because of the timing of the purchase. A lot have been said about "timing" - and the reason for using regular purchases strategy like DCA and VA. In general, timing is not easy and not every DIY investors' cup of tea to time his/her purchases. (And please la, UTC agents and fund managers don't have secret crystal balls to time the entrance and exit either. Some investors may be enticed to do timing if there is no entry cost... well, some were already doing exactly that - entering and exiting - when the entry cost is very low like 0.5 or 1.0%... so IMHO, a high entry cost will deter the finicky and kiasu investor from exiting in a down market and give him a reason to hold and maintain the investment when he is already feeling kiasi after his investment dropped 15% and could maybe dropped another 25% in the coming months. I supposed I also have my own agenda to be actively talking about personal finance and investing in unit trust. Main reason is I couldn't do local stock investing and therefore it seems sensible to put money in unit trust. I don't like to whack UTC, just like I don't like to whack insurance agent; I think the profession exist because there's a demand. But since they are paid to do a job, I expect it to be done well, or at the very least, do it better than me As with Public Mutual, why do I complain so much? simple. I think unit trust is a good investment tool for people who are not very financially savvy, definitely better than to punt in the stock market listening to rumours. And if people have bad experience with PM, where after fees their returns are about FD rate or less after 3-5 years, chances are they would shy away from this product. And therefore the industry as a whole would not grow and we won't see more competition and the retail investors would lean back on the FDs, ASx fixed price funds, EPF and refuse to learn about investments This would take the entire nation backwards in terms of financial literacy, just like everything else... So I try lor, every little bit that I can. Boss j.passing.by, let's join forces |

|

|

Jun 13 2016, 11:46 AM Jun 13 2016, 11:46 AM

Return to original view | Post

#12

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(j.passing.by @ Jun 12 2016, 07:50 PM) Sometimes to remind self to be grounded to earth, and not flying high into dreamland and chasing high returns, I looked into this site showing the top funds, which shows the worse funds too. https://www.eunittrust.com.my/fundInfo/5top_worst_funds.asp For example, Top 5 Funds 1 Year Fund Name % RHB Gold And General Fund 38.80 AmPrecious Metals 27.68 AmPan European Property Equities 21.65 RHB Energy Fund 19.65 AmGlobal Property Equities 18.84 Worst 5 Funds 1 Year Fund Name % Affin Hwang China Growth Fund -33.81 AmConstant Multi Maturity -24.46 Manulife China Equity Fund -22.40 RHB Big Cap China Enterprise Fund -17.70 BIMB Dana Al-Falah -17.61 edit: correction - that should be "5 top funds from 3 different companies", not 4. And all except the balanced fund seemed to be in the same equity sector. https://www.fundsupermart.com.my/main/fundi...orst_Funds.svdo The truth is firstly there are not many foreign funds that has 10 years results so it did not come as a surprise that most of the top performing funds are coming from Malaysia equities, particularly the small cap segment that did very well in the past many years I did not show the comparison between funds within different segments although I did compare them while looking for better funds to go with; almost no PM funds come up to be more attractive than other fund houses for 5 years and shorter term. The question is, what are the fund managers in PM doing about this? This link does a limited comparison with funds not carried by FSM but a better comparison would be on Morningstar and Lipper https://www.fundsupermart.com.my/main/fundi...torareacode=FEY Sorry, I'm not trying to shoot the messenger but rather I hope PM agents or corporate picks this up and really put pressure on the fund managers so that they don't lose their top of the asset management position; and to me that position is more than AUM and sales force |

|

|

Jul 10 2016, 11:25 AM Jul 10 2016, 11:25 AM

Return to original view | Post

#13

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(tboontan @ Jul 9 2016, 11:59 PM) at first glance of a few treads , i thought that you are an utc , Hop over to fundsupermart thread, there r more investors who know as much if not more than the average UTCs. N time to see how the competitors r doing toobut after more reading , only realized you are not. fantastic, your level is above many many utcs, especially those who are not full time . cheers |

|

|

|

|

|

Jul 21 2016, 11:56 AM Jul 21 2016, 11:56 AM

Return to original view | Post

#14

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(cplai8791 @ Jul 21 2016, 11:43 AM) Thanks Luken for quick reply. I try to do a little research this morning and I found this seems contradict with yours. The link here: https://thebillionairesquad.wordpress.com/ While the information on the link attached is 100% legit, I don't think what lukenn contradict with it at all18. Should we only buy the fund with high historical distribution? No. Distribution is not indicating the performance of the fund. The real value of the investment is still same. After distribution, the fund price will drop as the distribution is from the NAV of the fund. So, appreciated you or someone confirm on this? Besides that, I read on switching fee. Just wonder will PM UTC still earning money if we only switch our fund? Or because that they keep triggering us "Buy" "Buy" "Buy"? Thanks. performance takes into consideration the effects of distribution means it doesn't just take the fund price changes but also the additional units distributed; otherwise you would end up with much lower returns when the fund price become lower after distribution Can't help on PM UTC commission, I've no clue |

|

|

Jul 21 2016, 05:26 PM Jul 21 2016, 05:26 PM

Return to original view | Post

#15

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(cplai8791 @ Jul 21 2016, 05:14 PM) Thanks for such long reply. Ya... Takes me whole day to complete 34 pages comments in this thread. @@ You can hop over to fundsupermart thread next.... very relevant information about funds and your options outside of public mutualNot going to read the old one... lol Thanks for all who contributing in the thread... Understand more now *run away before the TS chase me away for kacau-ing* |

|

|

Aug 30 2016, 10:59 AM Aug 30 2016, 10:59 AM

Return to original view | Post

#16

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(nexona88 @ Aug 29 2016, 04:40 PM) QUOTE(wongmunkeong @ Aug 29 2016, 04:47 PM) Time for me to kacau this thread again Actually, if the funds can outperform its peers in other asset management companies over long term, even if they charge more than 5.5% sales charge it'll be worth while. 5.5% sales charge annualised also less than 1% per year over 5 years Question is, how does PM funds returns compare to its peers? According to my trusted morningstar fund selector, Public mutual does not even made the first page of the 5 year annualised returns

Even 10 year annualised return also only 2 PM funds that made the list, small cap and islamic opportunities. For an asset management company that manages more than 50% of the AUM in the unit trust industry in Malaysia.... I'm more than disappointed Honestly the argument is becoming stale, and PM is becoming irrelevant to the industry if they don't do anything about it. The only thing I can do as a consumer is to put my money elsewhere, and tell everyone I know to do the same |

|

|

Aug 30 2016, 11:49 AM Aug 30 2016, 11:49 AM

Return to original view | Post

#17

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(wil-i-am @ Aug 30 2016, 11:45 AM) I'm keen to know whether PM will change as the UT landscape is changing rapidly with new players namely Fintech making headlines So far they seem uninterested to change, at the end of the day, they have a sales force of 30,000. Even if only 1/3 is active, that's 10,000 agent who depend on the job to cari makan... if PM starts to offer lower SC or tier charges on different platform, these agents would probably mogokThat's what I observed that's stopping the life insurance industry to evolve Still waiting for the robo advisors to come in and give FSM some competition |

|

|

Sep 1 2016, 03:44 PM Sep 1 2016, 03:44 PM

Return to original view | Post

#18

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Drian @ Sep 1 2016, 02:50 PM) Just looked at my EPF Public mutual(didn't bother checking for so many years ) and I only got like 15% after 5 years. That is even lower than EPF rate. Before 1 August 2016, I can safely conclude that none of the EPF MIS investment into public mutual funds in the past 5 years exceeded EPF's own returns. This is not even taking the sales charge into considerationBTW is it possible to switch funds to FSM from public mutual from EPF side? From 1 August 2016 however, more funds are approved as MIS investments and therefore the conclusion may be different. So I've been telling people to either 1) don't use EPF investments to invest in Public Mutual; or 2) switch funds into the higher returns ones - Public Small Cap and PIOF which historically have done better, and pray that it would exceed EPF returns |

|

|

Sep 9 2016, 01:41 PM Sep 9 2016, 01:41 PM

Return to original view | Post

#19

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Sarah Jessica @ Sep 7 2016, 01:32 PM) QUOTE(monara @ Sep 8 2016, 01:10 AM) Hi guys, googling epf vs pm brought me here lol.. Reading last few pages it looks like better to let our epf money there than put it into PM unit trust, is it? Errm, so is there other better option to invest in than just let our money in epf? QUOTE(PrincZe @ Sep 8 2016, 01:33 AM) Hi all, looks like last few reply Macam not so good So got EPF sitting here, not recommend to invest? QUOTE(honkkydorry @ Sep 9 2016, 09:26 AM) I have several portfolio. Last year all increase in IRR but early this year I saw a drop in a couple of them. Need to check with my agent again on the latest report. Over the years I do make profit though amount is not as high as I would like it to be. I am just wondering if I should risk maintaining it or selling it off and just relying n EPF dividend rate. Hmm, suddenly so many people want to withdraw from PM. Can I claim credit for tarnishing their reputation? Well, if the top management of Public Mutual thinks the comments in forum and fintech means nothing... let them lor; I firmly believe in market forces in a free market The ones who don't adapt to the new norm would be the one to be left behind, no matter how big and important you are |

|

|

Sep 10 2016, 10:24 PM Sep 10 2016, 10:24 PM

Return to original view | Post

#20

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

| Change to: |  0.1072sec 0.1072sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 05:09 PM |