PUBLIC ISLAMIC OPPORTUNITIES FUND 5.29%

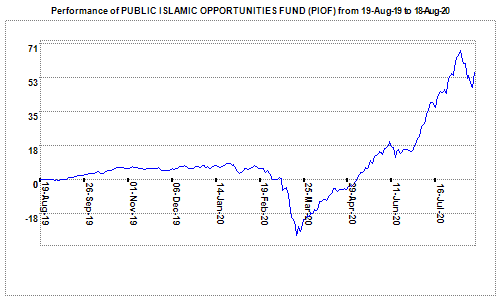

If you look into its 1-yr performance... equally amazing.

From 19-Aug-2019 to 18-Aug-2020, it is 55.8%, 68% at the peak.

If bought at the bottom on 19-Aug-2020 (5 months ago), the gains is 120%.

And the peak gain is 136%.

=======

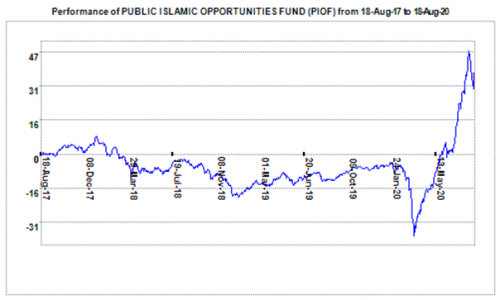

Now look at the 3-yr performance...

The returns since 18-Aug-2017 is 37.50%.

(Which annualised to 11.2%... still a very good annual returns).

But look at the downward trend till 19-March-2020...

The question is, as an investor, can you hang onto to the fund during its downward trend? Especially if you made a lump sum purchase.

This reminded me of an old read years ago on chasing hot volatile funds... volatile funds would shake off some investors when the ride is wild.

Which brings us to the importance of timing - buying and selling or market entry and exit. And ultimately, the difference between the fund's performance and the investor's performance.

Cheers.

Aug 19 2020, 05:04 PM

Aug 19 2020, 05:04 PM

Quote

Quote

0.0397sec

0.0397sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled