This post has been edited by backspace66: Jul 25 2020, 08:25 AM

Public Mutual Funds, version 0.0

|

|

Jul 25 2020, 08:23 AM Jul 25 2020, 08:23 AM

Show posts by this member only | IPv6 | Post

#2121

|

Senior Member

2,139 posts Joined: Nov 2007 |

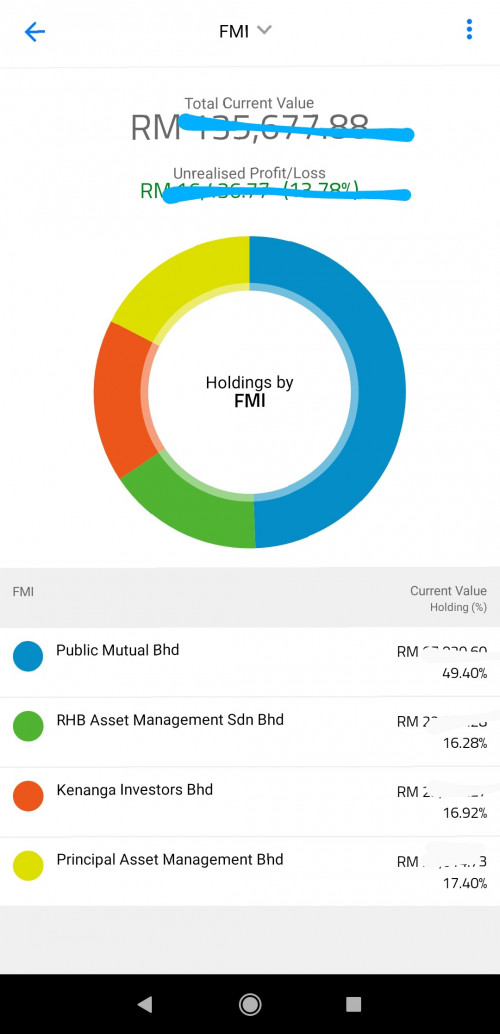

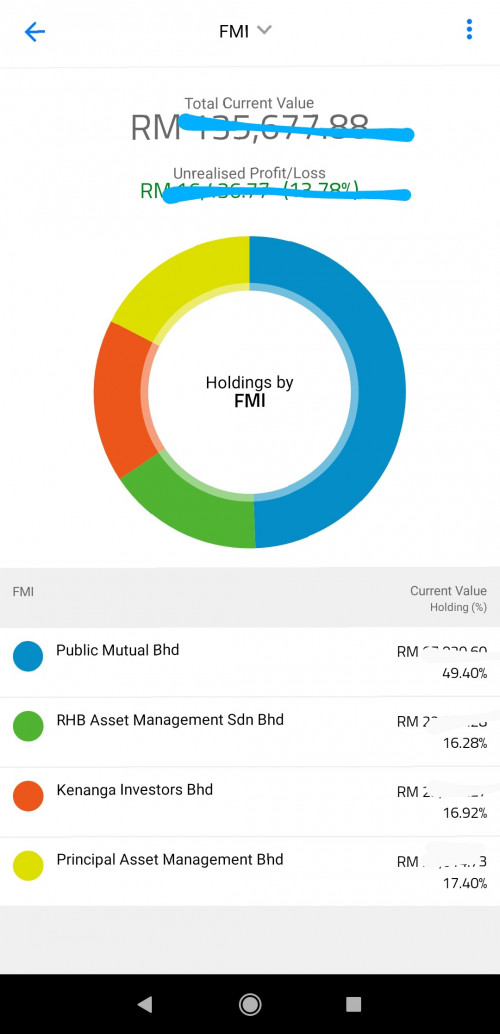

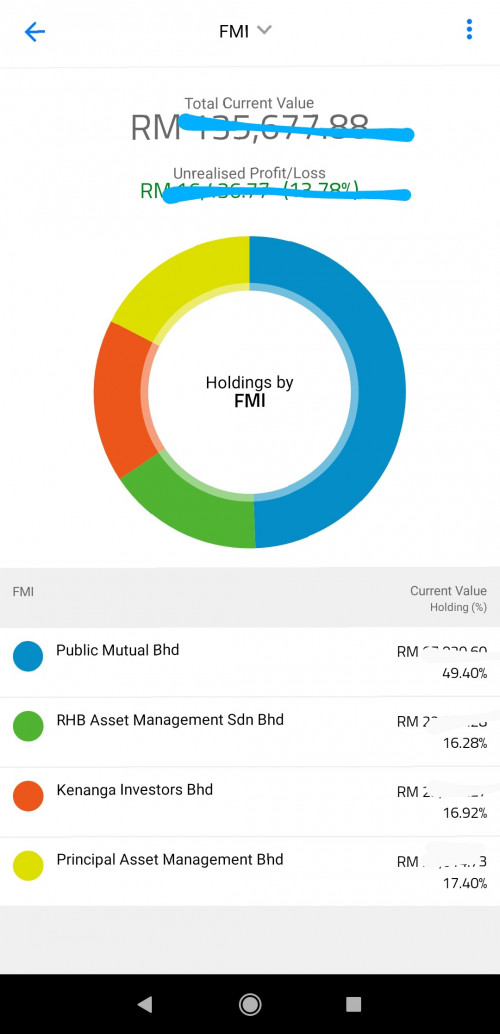

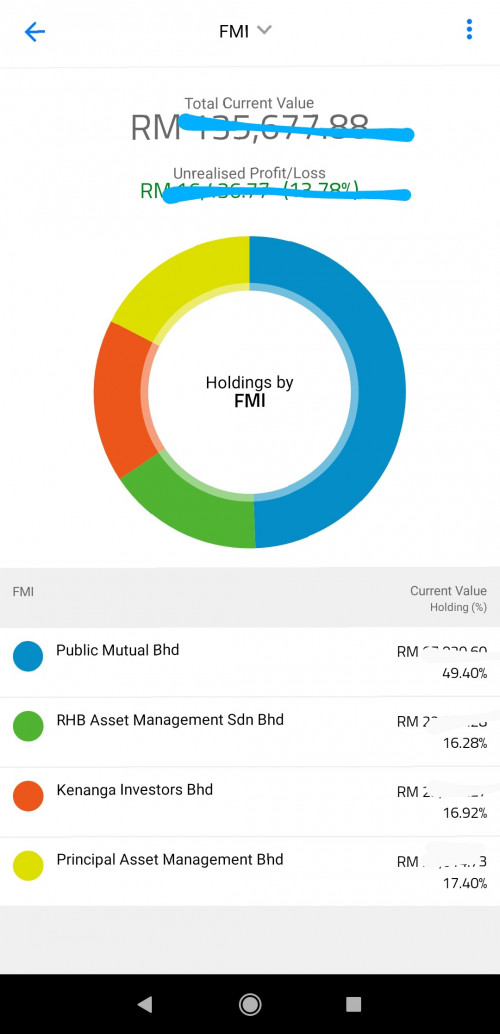

Started with almost 60% allocation in public mutual fund but now has become less than 50%. My other investment in FSM perform so much better. But still have to mention i did make a decent amount in PGSF. Btw the profit in epf app does not show net profit but only unrealized profit, if you redeem or switch to another fund then it will not be considered as it is already "realized".

This post has been edited by backspace66: Jul 25 2020, 08:25 AM |

|

|

|

|

|

Jul 25 2020, 12:40 PM Jul 25 2020, 12:40 PM

Show posts by this member only | IPv6 | Post

#2122

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(backspace66 @ Jul 25 2020, 08:23 AM) Started with almost 60% allocation in public mutual fund but now has become less than 50%. My other investment in FSM perform so much better. But still have to mention i did make a decent amount in PGSF. Btw the profit in epf app does not show net profit but only unrealized profit, if you redeem or switch to another fund then it will not be considered as it is already "realized". when you can withdraw that time gonna be really nice 100k and over nice you take everything out from EPF to put into investment? |

|

|

Jul 25 2020, 01:06 PM Jul 25 2020, 01:06 PM

Show posts by this member only | IPv6 | Post

#2123

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(majorarmstrong @ Jul 25 2020, 12:40 PM) when you can withdraw that time gonna be really nice What do you mean by taking everything out? I still have around 20 years to retirement age100k and over nice you take everything out from EPF to put into investment? https://www.kwsp.gov.my/en/member/investment#eligibility Only 30% of the amount above minimum saving for your current age in account 1 can be invested (every 3 months). |

|

|

Jul 25 2020, 02:45 PM Jul 25 2020, 02:45 PM

Show posts by this member only | IPv6 | Post

#2124

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(backspace66 @ Jul 25 2020, 01:06 PM) What do you mean by taking everything out? I still have around 20 years to retirement age Good good grow your retirement fundhttps://www.kwsp.gov.my/en/member/investment#eligibility Only 30% of the amount above minimum saving for your current age in account 1 can be invested (every 3 months). Else later don't have enough as now eve with RM1.0M retirement fund also not enough |

|

|

Jul 25 2020, 04:38 PM Jul 25 2020, 04:38 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(backspace66 @ Jul 25 2020, 08:23 AM) Started with almost 60% allocation in public mutual fund but now has become less than 50%. My other investment in FSM perform so much better. But still have to mention i did make a decent amount in PGSF. Btw the profit in epf app does not show net profit but only unrealized profit, if you redeem or switch to another fund then it will not be considered as it is already "realized".  QUOTE(backspace66 @ Jul 25 2020, 01:06 PM) What do you mean by taking everything out? I still have around 20 years to retirement age Thanks for sharing your experince in investing into unit trusts using the EPF app and purchasing of funds using EPF i-invest. Very much appreciated. Please continue posting and sharing your personal investments into ut funds.https://www.kwsp.gov.my/en/member/investment#eligibility Only 30% of the amount above minimum saving for your current age in account 1 can be invested (every 3 months). When EPF launched its i-invest in August 2019, I have anticipated that it will compete with other agents and will pull business away to i-invest. Since it is within EPF and linked to its internal system, it will immediately show the available amount without needing any manual calculation on the excess money above the basic savings table in EPF Account 1. Every eligible funds from all fund houses approved by EPF can be bought there, and at the same low sales charge of up to 0.5%. Due to the covid-19 pandemic and to boost the economy, the sales charge is reduced to 0% effective from 1.05.2020 to 30.04.2021. Older investors like me don't have this option when we were younger. wongmunkeong liked this post

|

|

|

Jul 25 2020, 05:18 PM Jul 25 2020, 05:18 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

Further short pointers regarding EPF-MIS (Members Investment Scheme): EPF members can withdraw from Account 1 to purchase mutual fund, only one withdrawal every 3 months, the maximum withdrawal is based on a “basic savings table”. The basic savings table is a table showing the amount that the member must have at his age. The amount increases as he gets older. The eligible amount that can withdraw is 30% of the amount that is in excess of the basic savings. In short, Maximum Withdrawal = 30% x (Amount in Account 1 – Basic Savings Amount) EPF can adjust (and have adjusted) the “basic savings table” every few years to reflect the basic savings in Account 1 that each EPF member should have at his age group. KUALA LUMPUR 28 November 2018: The Employees Provident Fund (EPF) announces that the quantum for the Basic Savings will be revised from the current RM228,000 to RM240,000 effective 1 January 2019. The amount will be set as the minimum target EPF basic savings members should have upon reaching Age 55. The Basic Savings refers to the amount that is considered sufficient to support members’ basic needs for 20 years upon retirement, from Age 55 to 75 aligned with the Malaysian life expectancy. The new quantum (refer to Table 1) is benchmarked against the minimum pension for public sector employees, which has been raised from RM950 to RM1,000 per month. ======= PS. If the fund is sold, the money will revert back to EPF Account 1 as it is still under EPF. Only upon age 55, is the fund released to the investor. Within Public Mutual Fund online service, PMO, the funds are separate into cash scheme and EPF scheme. At age 55, the funds under EPF scheme will switch into cash scheme, and if the fund is sold, it will go into the investor's bank account. This post has been edited by j.passing.by: Jul 25 2020, 05:40 PM backspace66 liked this post

|

|

|

|

|

|

Jul 26 2020, 07:53 AM Jul 26 2020, 07:53 AM

Show posts by this member only | IPv6 | Post

#2127

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(j.passing.by @ Jul 25 2020, 04:38 PM) Thanks for sharing your experince in investing into unit trusts using the EPF app and purchasing of funds using EPF i-invest. Very much appreciated. Please continue posting and sharing your personal investments into ut funds. Yes, the epf i-invest portal definitely came just in time for me to dwell into unit trust using epf-mis, i could not bear paying UT agent and the dificulty and the paperwork involved before this.When EPF launched its i-invest in August 2019, I have anticipated that it will compete with other agents and will pull business away to i-invest. Since it is within EPF and linked to its internal system, it will immediately show the available amount without needing any manual calculation on the excess money above the basic savings table in EPF Account 1. Every eligible funds from all fund houses approved by EPF can be bought there, and at the same low sales charge of up to 0.5%. Due to the covid-19 pandemic and to boost the economy, the sales charge is reduced to 0% effective from 1.05.2020 to 30.04.2021. Older investors like me don't have this option when we were younger. I have given the thought to invest back in 2012 but the initial sales charge really put me off and not to mention the paperwork, now it is too easy for me to buy and switch myself with zero charge or very low cost for switching. |

|

|

Jul 26 2020, 07:59 AM Jul 26 2020, 07:59 AM

Show posts by this member only | IPv6 | Post

#2128

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(majorarmstrong @ Jul 25 2020, 02:45 PM) Good good grow your retirement fund Yes, my intention exactly, but seriously i dont believe in long term investment in unit trust. I only put in money when i see an opportunity and get out when i have enough. Else later don't have enough as now eve with RM1.0M retirement fund also not enough Only started in epf-mis through epf i-invest portal back in mid march 2020, i did not invest lump sum, could have made more if invested in lump sum instead of DCA but you knos what they say, hindsight is always 20/20. Just for clarity, i have been in the stock market since 2008, so investing is not new to me but investing in unit trust is something new to me though. What i am trying to say is that some people might still need advise from a good agent instead of a salesman This post has been edited by backspace66: Jul 26 2020, 08:56 AM |

|

|

Jul 26 2020, 01:09 PM Jul 26 2020, 01:09 PM

Show posts by this member only | IPv6 | Post

#2129

|

Senior Member

8,259 posts Joined: Sep 2009 |

To register my phone number in order to create PMO account, I still need to go to Public Mutual branch?

Can do by calling customer service or from the website? |

|

|

Jul 26 2020, 01:21 PM Jul 26 2020, 01:21 PM

|

All Stars

14,889 posts Joined: Mar 2015 |

QUOTE(Kaka23 @ Jul 26 2020, 01:09 PM) To register my phone number in order to create PMO account, I still need to go to Public Mutual branch? googled and found this...Can do by calling customer service or from the website? How do I register for Public Mutual Online Services? https://www.publicmutualonline.com.my/General/online_app.htm |

|

|

Jul 26 2020, 01:42 PM Jul 26 2020, 01:42 PM

Show posts by this member only | IPv6 | Post

#2131

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(MUM @ Jul 26 2020, 01:21 PM) googled and found this... Thanks.. How do I register for Public Mutual Online Services? https://www.publicmutualonline.com.my/General/online_app.htm But I tried last night online, saw it wants your phone number to be registered with them first. Maybe later I re check again.. Thanks bro.. |

|

|

Jul 26 2020, 03:29 PM Jul 26 2020, 03:29 PM

Show posts by this member only | IPv6 | Post

#2132

|

Senior Member

2,139 posts Joined: Nov 2007 |

|

|

|

Jul 28 2020, 11:45 PM Jul 28 2020, 11:45 PM

|

Senior Member

2,239 posts Joined: Aug 2009 |

wah my money grow a tiny tiny bit

hahahaha  ----------------- my e-income fund i invested is not even on their weekly report yet my P BOND doing so so as usual  This post has been edited by majorarmstrong: Jul 29 2020, 01:02 AM |

|

|

|

|

|

Aug 18 2020, 01:54 PM Aug 18 2020, 01:54 PM

|

Junior Member

116 posts Joined: Jun 2020 |

QUOTE(majorarmstrong @ Jul 28 2020, 11:45 PM) wah my money grow a tiny tiny bit u can consider buy tech fund more high return Public e-Artificial Intelligence Technology Fundhahahaha  ----------------- my e-income fund i invested is not even on their weekly report yet my P BOND doing so so as usual  https://www.publicmutual.com.my/Menu/Campai...-Global-Markets |

|

|

Aug 18 2020, 03:26 PM Aug 18 2020, 03:26 PM

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(wendygoh @ Aug 18 2020, 01:54 PM) u can consider buy tech fund more high return Public e-Artificial Intelligence Technology Fund yeah thinking of throwing RM25k inside for this onehttps://www.publicmutual.com.my/Menu/Campai...-Global-Markets |

|

|

Aug 18 2020, 03:30 PM Aug 18 2020, 03:30 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Aug 18 2020, 03:26 PM) Your heart can take or not?This is a sector based fund; volatility is certainly very high compared to your PBOND. T231H liked this post

|

|

|

Aug 18 2020, 03:32 PM Aug 18 2020, 03:32 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

25k@3.75% = 937.5

25k on RHB GLOBAL ARTIFICIAL INTELLIGENCE FUND - MYR HEDGED @ 1.75% = 437.5 |

|

|

Aug 18 2020, 03:35 PM Aug 18 2020, 03:35 PM

|

Junior Member

116 posts Joined: Jun 2020 |

|

|

|

Aug 18 2020, 07:14 PM Aug 18 2020, 07:14 PM

|

Senior Member

6,802 posts Joined: Oct 2008 From: Kuala Lumpur |

QUOTE(GrumpyNooby @ Aug 18 2020, 04:30 PM) Your heart can take or not? Indeed. Tech fund in general is good but to focus specifically on AI, not sure how will AI-base sector do in the coming year.This is a sector based fund; volatility is certainly very high compared to your PBOND. QUOTE(T231H @ Aug 18 2020, 04:32 PM) Good comparison. Is the fact sheet out and how do these both funds allocate their portion? |

|

|

Aug 18 2020, 07:38 PM Aug 18 2020, 07:38 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

Investors should be careful in purchasing new funds that are yet to start trading:

i) buy today, money stuck there for 2-3 weeks. (The above new fund e-AI starts on 9th Sept.) ii} new funds, no track record. iii) PM has a knack of selling new funds when the market is hot. Easier to sell as people have FOMO (fear of missing out). (NASDAC index is at record high.) REUTERS(Aug 18): The Nasdaq surged to a record high close on Monday, while the S&P 500 approached its own record level, with both indexes lifted by Nvidia and other technology stocks. |

| Change to: |  0.7923sec 0.7923sec

0.36 0.36

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 10:34 AM |