QUOTE(cherroy @ Jul 20 2016, 10:55 AM)

A reminder,

1. Please use spoiler function to if the quoted posts/article/info is lengthy.

Too lengthy quote may result inconvenience for reader, especially those with small screen, or using table/smartphone one.

2. Please fully use the multi quote function.

No problem mate

Cheers

QUOTE(Asmasw2020 @ Jul 20 2016, 11:34 AM)

Rental 1.7k

Side income not consistent. But will have around total 4k received from few parties.

Nett income from real job around 2.8k (allowance added-payslip)

For rental yea. They will bank in to me everymonth.

Dear

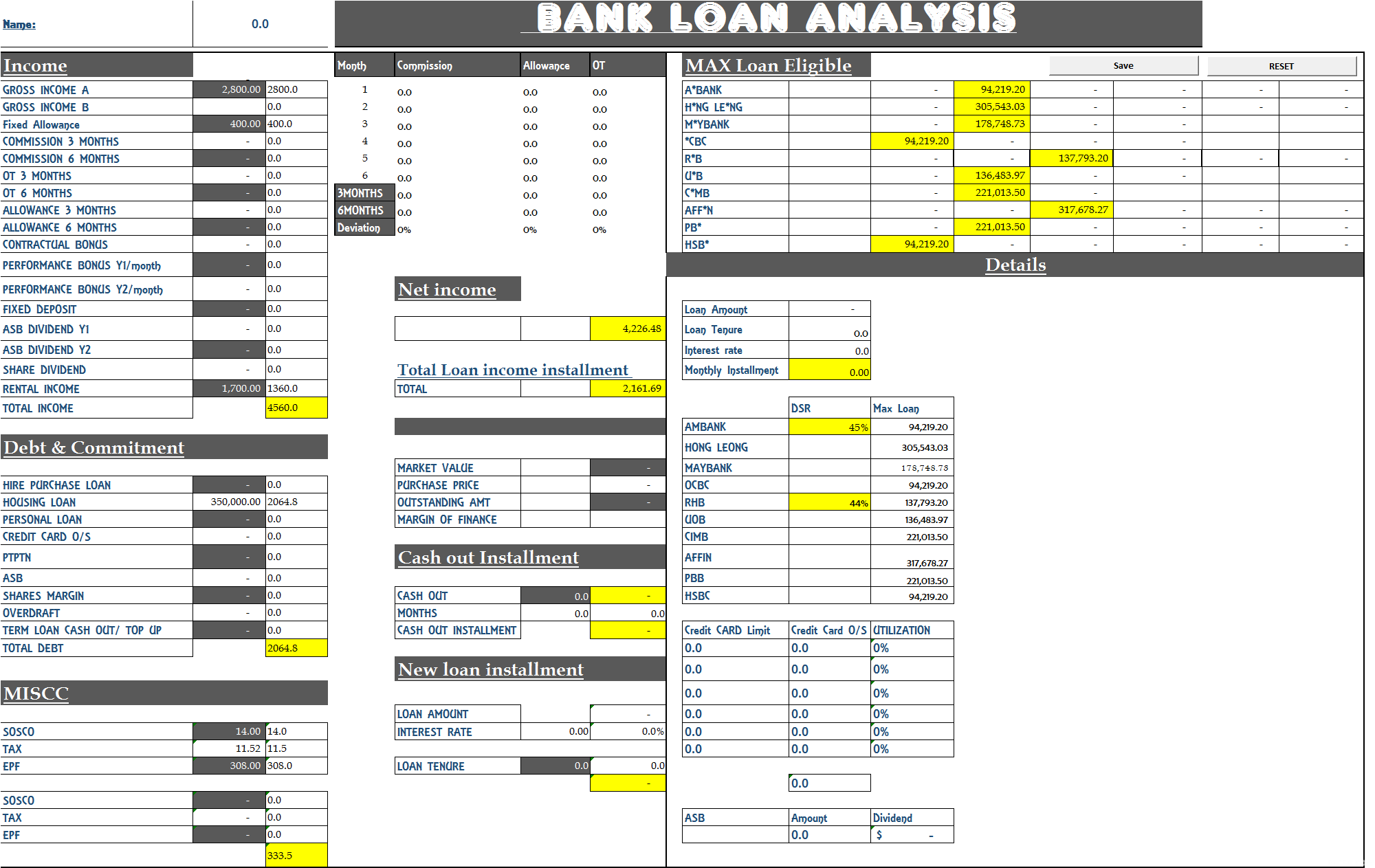

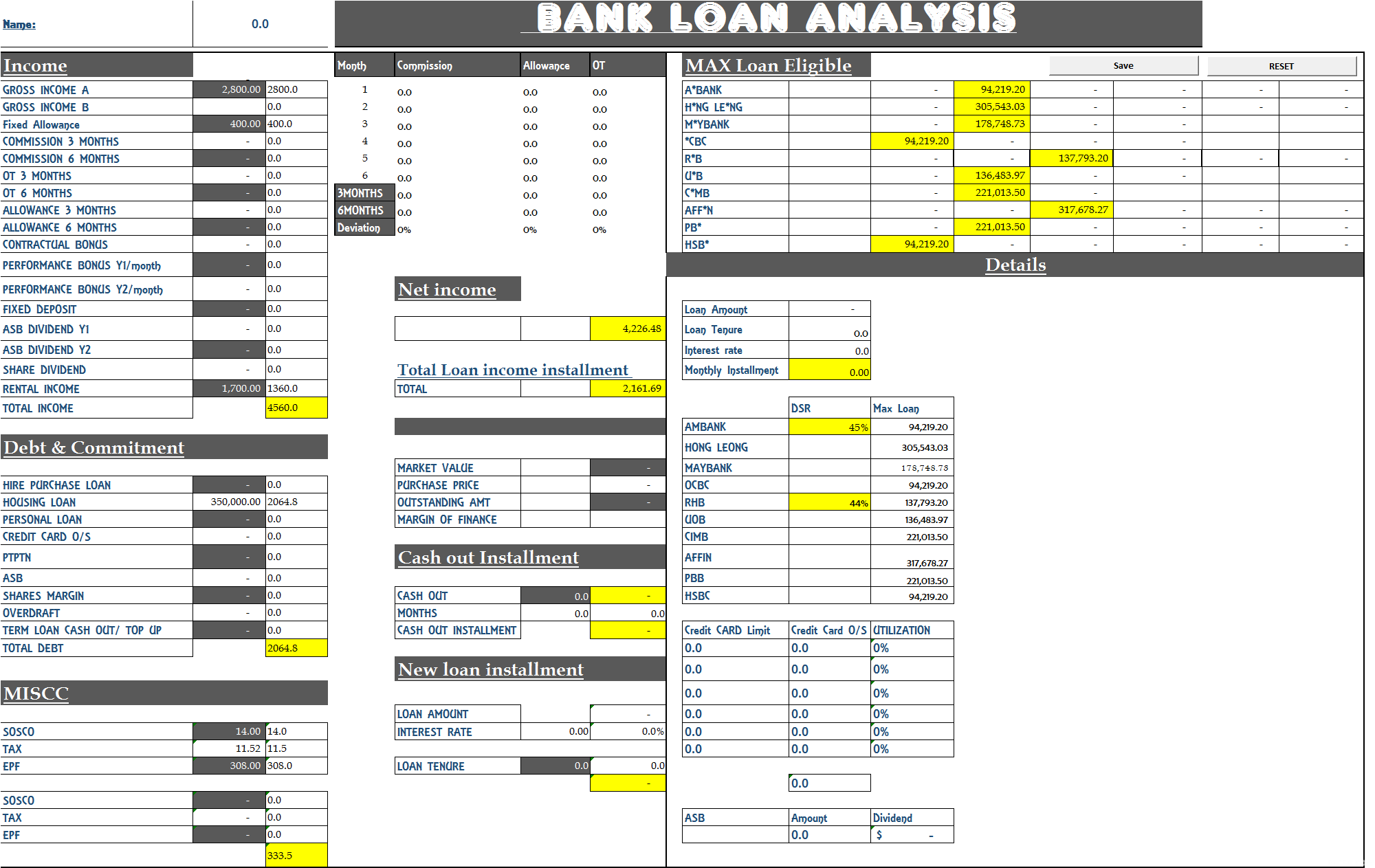

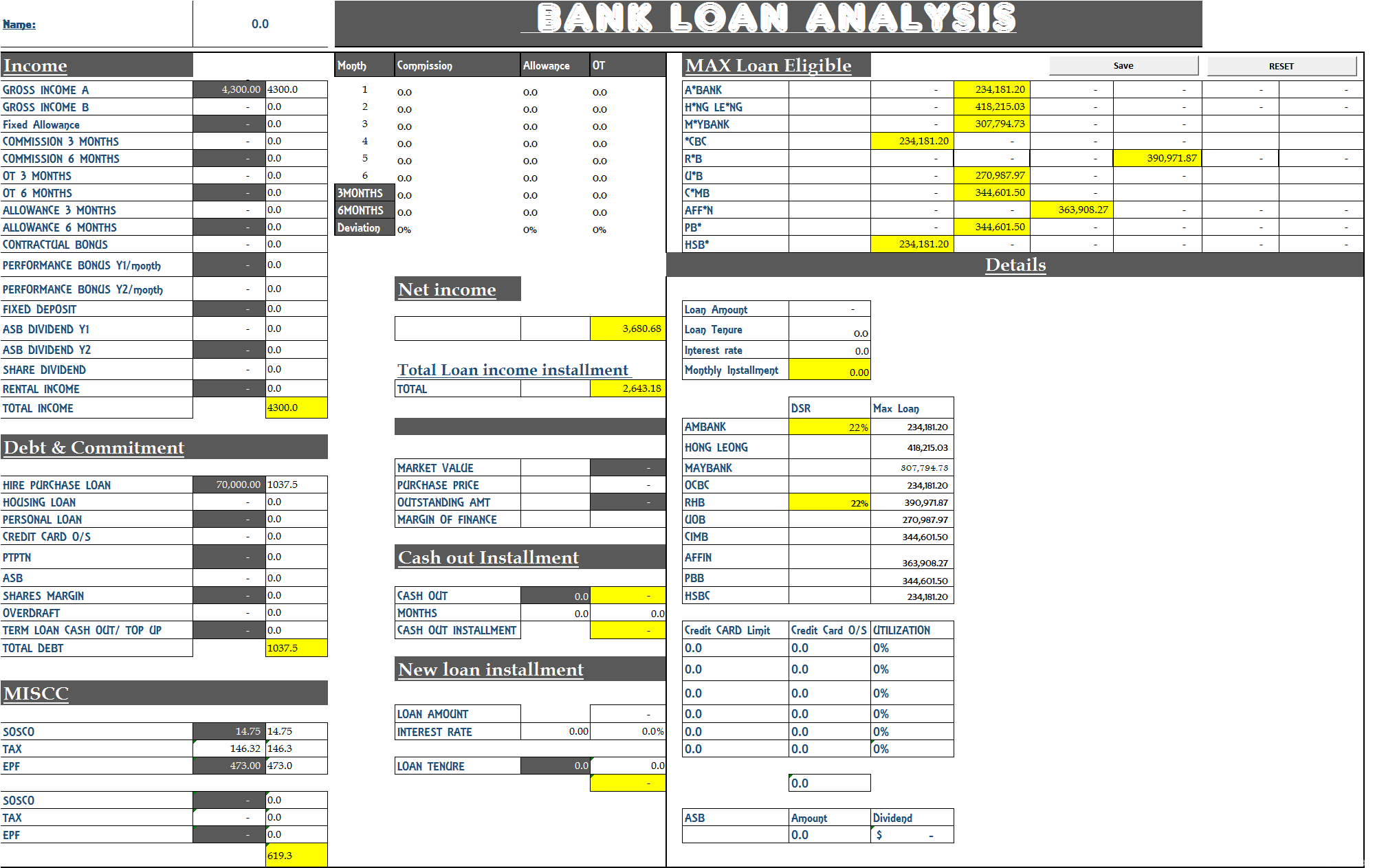

with YOUR income without side income added.

Rm

A*BANK 94,219.20

H*NG LE*NG 305,543.03

M*YBANK 178,748.73

*CBC 94,219.20

R*B 137,793.20

U*B 136,483.97

C*MB 221,013.50

AFF*N 317,678.27

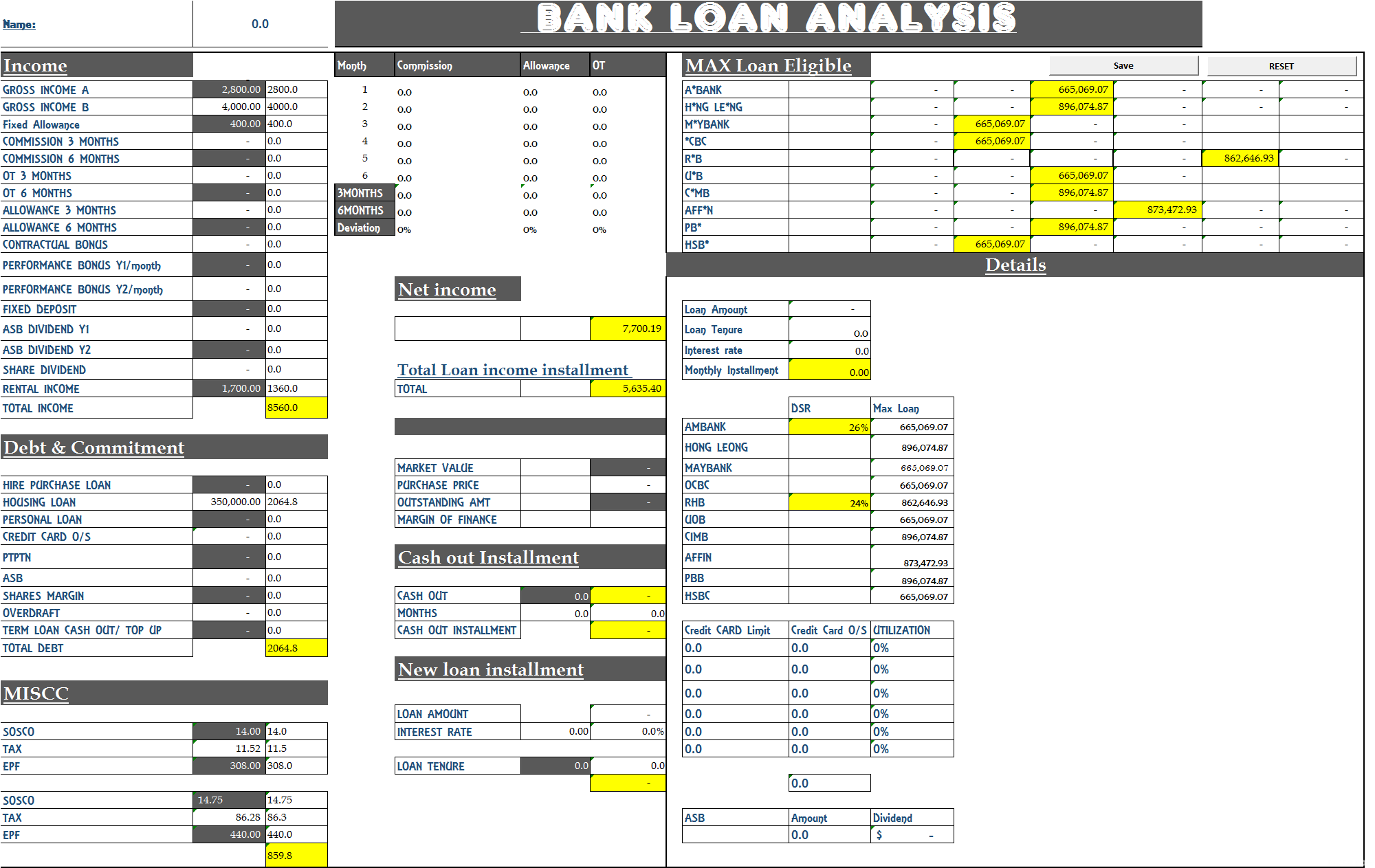

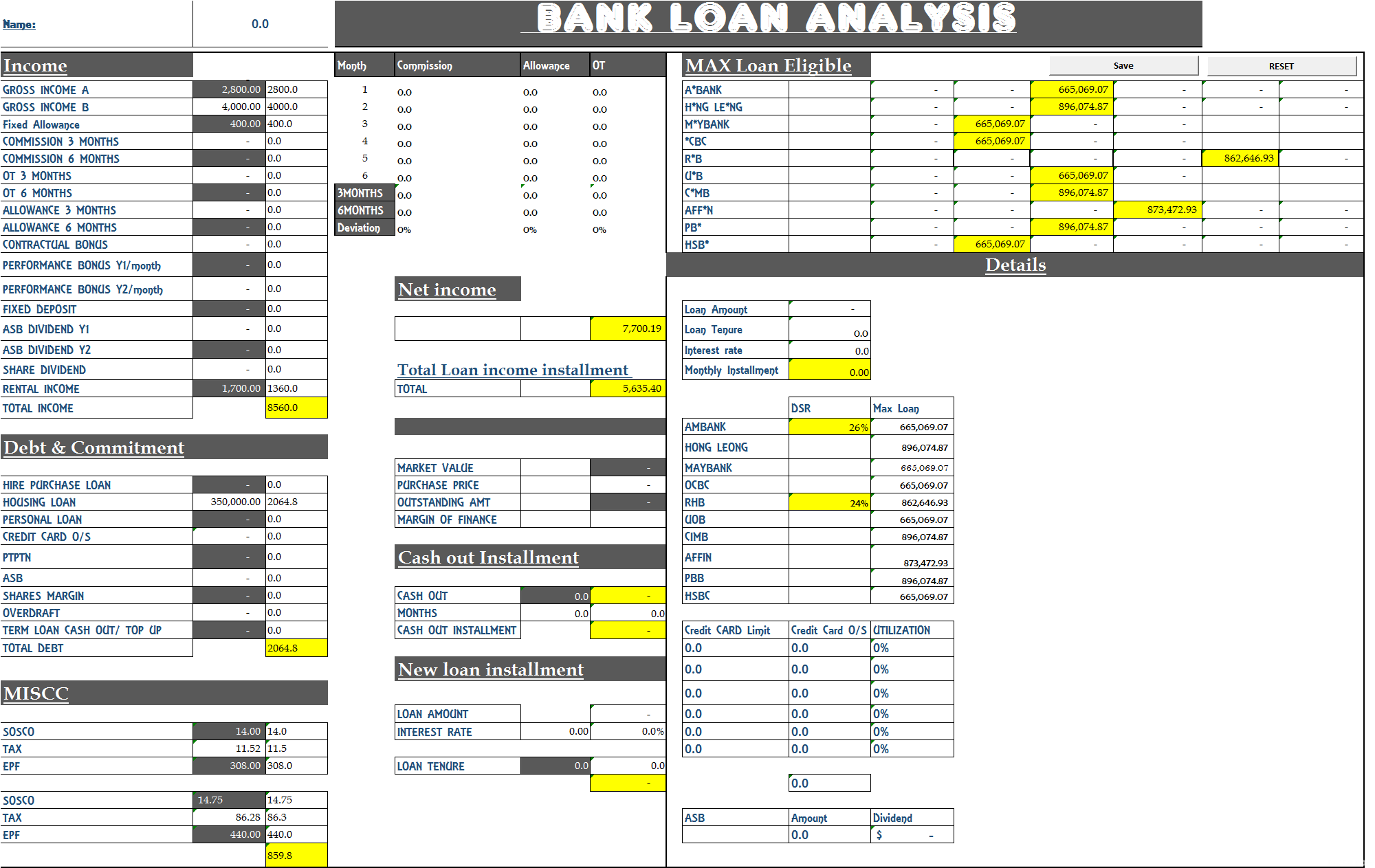

2. For your side income RM4000 added.

Rm

A*BANK 665,069.07

H*NG LE*NG 896,074.87

M*YBANK 665,069.07

*CBC 665,069.07

R*B 862,646.93

U*B 665,069.07

C*MB 896,074.87

AFF*N 873,472.93

2B. For side income to be qualified you need to give me few details below, so that I can assess whether it is eligible for bank calculation inclusion:

a. 6months consistent bank statement crediting the income

b. any voucher or receipt regard to the income you receive from various parties?

c. DO you have SSM registered for this business and how many years?

d. what type of business are you in?

Sofar, I don't see how your income calculation max loan can reac 1.1mil.. that's quite overstated with my calcualtor..

Anyway, If you have anymore questions, do ask. For your side income part, do provide me with enough info, so that I could provide solid suggestions whether it will be calculated.

Cheers

QUOTE(Asmasw2020 @ Jul 20 2016, 11:36 AM)

Monthly payment

Yupe. We signed tenancy aggreement.

Legal income. They will bank in to me.

That's great. Tenancy income will be valid

QUOTE(puputeh24 @ Jul 20 2016, 12:43 PM)

Hi, may I ask that normally the full flexi loan, if I want to pay more or deposit all available cash to save interest, I need to go to counter only or it can be done via internet banking or ATM? Thanks.

Dear

1. Depends which bank you are currently with, certain bank full flexi is quite cacat.

2. Usually you can do it via atm and online, Over the counter is optional for you. That's the benefits of having full flexi, as you will be paying the facility for Current account, whereby it will provide benefits of credit and withdrawing cash through atm, cheque, online or OTC

Difference between semi and full flexi

» Click to show Spoiler - click again to hide... «

Full flexi:

1) current account tied to loan account

2) auto debit from current account at month end and interest is calculated based on outstanding balance minus amount in current account

3) maintenance charge of RM10 per month

4) setup/ processing fee of Rm200 (certain bank)

5)The liquidity comes in the form of an ATM card or a linked CASA account to the housing loan.

Example: You have a shop that is opened Monday to Satuday, rest on Sunday. On Saturday, you deposit all your proceeds of the week into the flexi account, on Sunday, you would save [(your-HL-interest-rate)/365]*AmountDeposited worth of interest. On Monday, you withdraw the money to run your business

6) Withdrawal of money or crediting of money through ATM,CHEQUE,OVER THE COUNTER, or online

Semi Flexi

semi flexi package typically has these features:

1) requires you to phone in to indicate the extra payment as early settlement of advance payments

2) if you fail to indicate, you will be charged 1% (some banks do this afaik)

3) if you indicate advance payment, no additional interest is saved as "advance" payment will only be credited to your loan account when it reaches your cycle date, so it is plain advance payments. and must be in multiple of your monthly payment.

4) For redrawable prepayments, you need to indicate separately and Redraw charge of RM50 is imposed (M*B charge Rm25)

5) Withdrawal of money or crediting of money through Cheque or Over the counter

Cheers

QUOTE(puputeh24 @ Jul 20 2016, 12:56 PM)

Hi, sorry, my main concern is after transferring from internet banking, my principal loan amount will be lesser and I can save interest right? I saw many cases that people tend to pay more to decrease principal loan amount but eventually bank considered their extra money as advanced money to pay interest only. Thanks.

Dear

1. Usually you just put in current account and it will deduct interest as what flexi account offers, because loan account is link with current account for full flexi.

However do be aware, different bank have different method with full flexi, certain bank needs you to transfer the cash from current account to loan account inorder for you to reduce the iterest charges on your principal. Hence, that's the reason Why I ask which bank you are with now.

Different bank full flexi is different

Cheers

QUOTE(puputeh24 @ Jul 20 2016, 01:17 PM)

Thanks for your prompt reply.

QUOTE(Asmasw2020 @ Jul 20 2016, 02:28 PM)

Icic.. okay. I'll enquire more if Im happen to find one soon. Thanks for the reply. 👍

Jul 20 2016, 10:34 AM

Jul 20 2016, 10:34 AM

Quote

Quote

0.0494sec

0.0494sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled