Outline ·

[ Standard ] ·

Linear+

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

Asmasw2020

|

Jul 20 2016, 08:24 AM Jul 20 2016, 08:24 AM

|

Getting Started

|

Hi sifus,

If let say my

gross salary - 2800

Allowance - 400

Cc- 800 (pay on time no outstanding)

Car loan - no

Current property 350k - (monthly 1577) rented out

Side income - 4000 ( never deduct epf )

What are the eligible amount of property i can loan?

Tq

|

|

|

|

|

|

Asmasw2020

|

Jul 20 2016, 10:34 AM Jul 20 2016, 10:34 AM

|

Getting Started

|

QUOTE(lifebalance @ Jul 20 2016, 08:31 AM) What's your rental income for this 1577 property. How long is ur side income business edi ? Working as ? What's ur nett income from ur real job For your rental. Do you have the latest tenancy agreement and at least 3 months bank statement to show its bank to u. If collect by cash then not considered Rental 1.7k Side income not consistent. But will have around total 4k received from few parties. Nett income from real job around 2.8k (allowance added-payslip) For rental yea. They will bank in to me everymonth. This post has been edited by Asmasw2020: Jul 20 2016, 10:34 AM |

|

|

|

|

|

Asmasw2020

|

Jul 20 2016, 10:36 AM Jul 20 2016, 10:36 AM

|

Getting Started

|

QUOTE(Madgeniusfigo @ Jul 20 2016, 09:02 AM) 1. CC 800 is monthly payment or credit limit? 2. Rented out, do you have tenancy agreement? to show proof of your tenant income 3. RM4000, what kind of income is this? Do you atleast bank into your bank account or receive voucher receipt? Cheers Monthly payment Yupe. We signed tenancy aggreement. Legal income. They will bank in to me. |

|

|

|

|

|

Asmasw2020

|

Jul 20 2016, 01:28 PM Jul 20 2016, 01:28 PM

|

Getting Started

|

QUOTE(lifebalance @ Jul 20 2016, 10:38 AM) You should be entitled up to 1.1 mil but need to know what kind of side income is it, I need to know further on the company and role and how long you've been working there. Need atleast 6 months bank statement to find out your real average. However, tentatively you're able to loan up to RM1.1 mil until further inspection on ur documents. Icic.. okay. I'll enquire more if Im happen to find one soon. Thanks for the reply. 👍 |

|

|

|

|

|

Asmasw2020

|

Aug 8 2016, 07:47 PM Aug 8 2016, 07:47 PM

|

Getting Started

|

Wanna ask about lock in period.

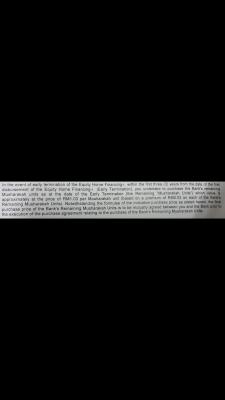

"In the event of early termination of the equity home financing-i within the first three years from the date of the first disimbursement of the equity home financing-i "

I wanna ask the first year starting when we pay the first interest during construction or starting from the day when we pay full installment loan amount?

Anyone can advise? Thanks in advance.

|

|

|

|

|

|

Asmasw2020

|

Aug 8 2016, 08:41 PM Aug 8 2016, 08:41 PM

|

Getting Started

|

QUOTE(lifebalance @ Aug 8 2016, 08:33 PM) Yeap in this case is first 10% out already start counting Thanks. 😁 |

|

|

|

|

|

Asmasw2020

|

May 16 2017, 06:21 PM May 16 2017, 06:21 PM

|

Getting Started

|

Hi Sifus,

Nett 3200

Other income(5000)

Monthly Commitment

Car Loan - nil

Housing loan- 1577(currently renting out 1700)

Credit Card

800

May i know what's my maximum amount of loan i can take? (Assuming 90%)

Thanks.

|

|

|

|

|

|

Asmasw2020

|

May 16 2017, 07:30 PM May 16 2017, 07:30 PM

|

Getting Started

|

QUOTE(lifebalance @ May 16 2017, 06:24 PM) The other income 5000 is yearly or monthly? Got any payslip and bank statement to show ? Got declare income into income tax for the 5000 ? Also the rental income is it collect more than 3 months ? the credit card outstanding is 800 or installment is 800 per month ? Monthly ( not fixed but around there everymonth for few years d) Nvr declare(part time) Yes. This post has been edited by Asmasw2020: May 16 2017, 07:31 PM |

|

|

|

|

Jul 20 2016, 08:24 AM

Jul 20 2016, 08:24 AM

Quote

Quote

0.0538sec

0.0538sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled