QUOTE(qilaf @ Jul 17 2016, 07:37 PM)

guys i have a shared name property with my mom. I wanna by over her share. this is second prop under my name.

will the loan i take to buy over be 70% loan ?

Dear qilaf,

1. if your personal profile doesn't have more than 2 mortgage loan, then you are still eligible for 90% loan margin of financing.

Hence, it is still 90% MOF

QUOTE(qilaf @ Jul 17 2016, 07:49 PM)

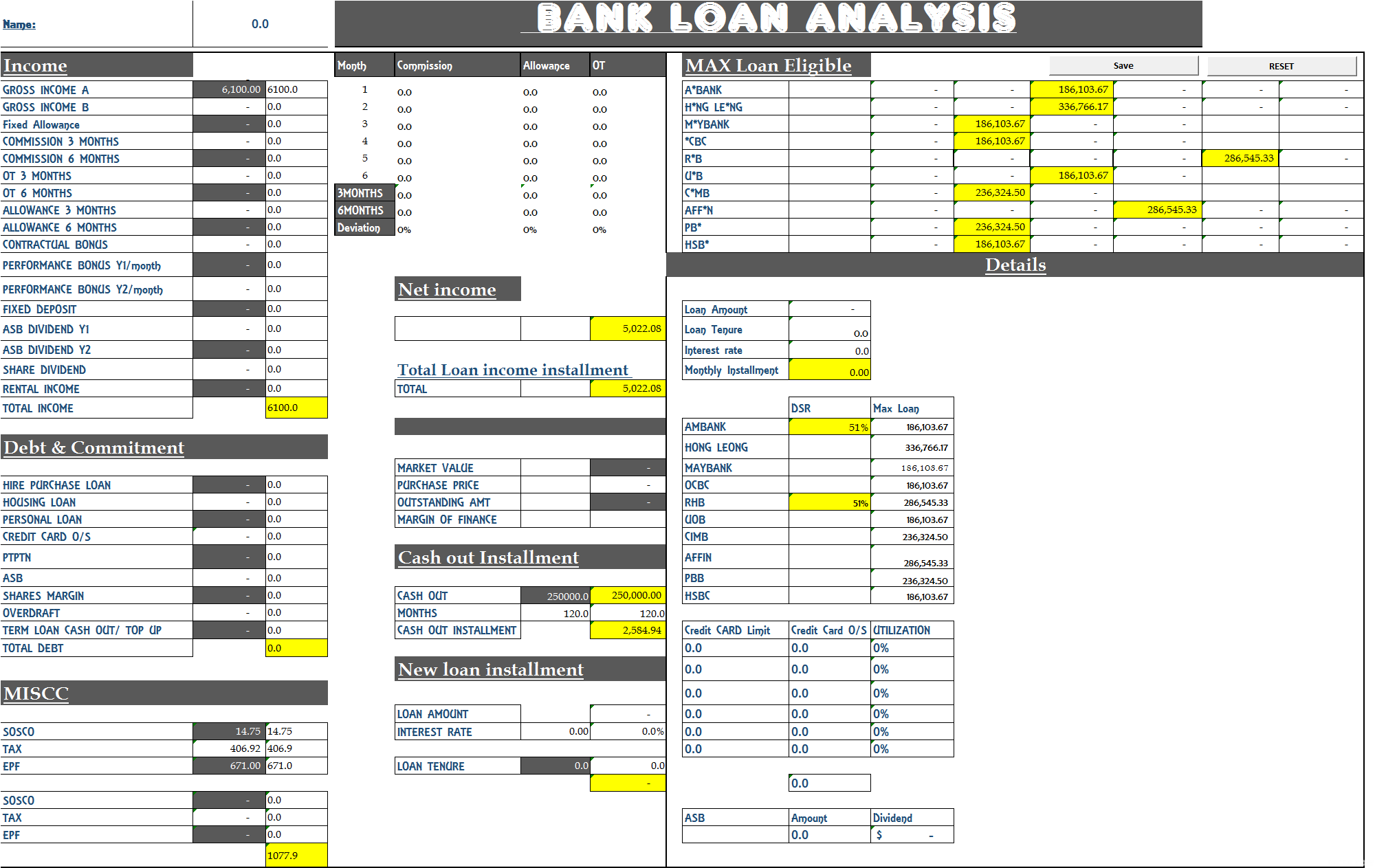

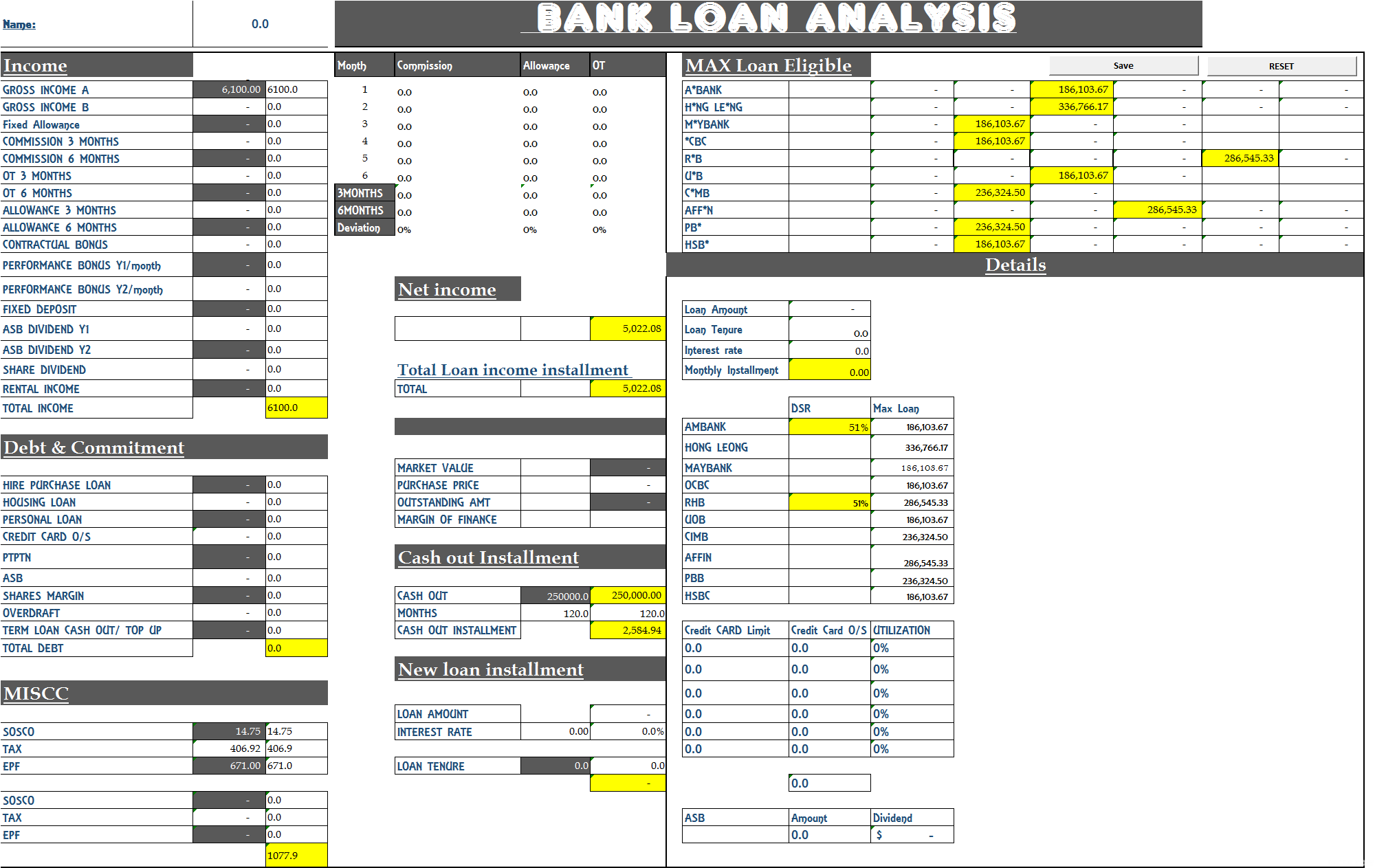

well its RM 600/month monthly ASB income.

although its shared name, I'm not paying. just my name is there. i wanna buy the whole property at RM250k

Dear,

1. Based on your income, Refinancing RM250,000 shouldn't be a problem. Hence, you can even CASH OUT extra RM250,000 if your property market value allows.

2. If you want to cash out, I need to check your property value as with below details:

a. property address

b. square feet

c. property type

d. any renovation

3. Do be aware that if you refinance with SPA name transfer, there this few cost that you need to pay:

a. Legal loan

b. legal spa

C. valuation

D. RPGT IF LESS THAN 5 years.

LEGAL LOAN

CODE

Loan amount: 250000 Sub Total

Professional Charges

Facilities Agreement 2,200.00

Charge Annexure 150

Discharge of charge

Entry and Withdrawal of Private Caveat 350

Consent to charge 300

Statutory Declaration 100

Professional Charge 3100

Disbursement

Stamp duty on the Facility Agreement (Original) 1250

Stamp duty on the Facility Agreement (Copies) 20

Stamp duty on the Charge Annexure 40

Stamp duty on the Discharge of charge

Stamp duty on Letter of Offer 20

Registration Fee on Charge 120

Registration Fee on Entry and Withdrawal of Private Caveat 450

Registration fees on Discharge of charge

Registration fees on Caveator Consent

Affirming Fee/Bankruptcy Search 100

Stamping on Statutory Declaration (Owner Occupation/not a bankrupt) 40

CTC Title 50

Application and Registration fees for Consent to Charge 100

Land Search 120

Documentation Fee 318

Transportation 300

Telephone Calls, Facsmile, Printing charges and couriers and etc 300

Miscellaneous 50

GST 6% 225

TOTAL 6603

CODE

SPA amount 250000 Sub Total

Professional Charges

Sales and purchase agreement 2,200.00

Entry and Withdrawal of Private Caveat 350

Statutory Declaration (P.U.(A) 361) 100

CKHT 2A 200

Professional Charge 2650

Disbursement

Stamp duty on the Memorandum of Transfer (subject to valuation) 4,240.00

Stamp duty on the Sale and Purchase Agreement 40

Registration Fee on Transfer 400

Affirming Fee/Bankruptcy Search 100

Registration fee on entry and withdrawal of private caveat 450

Land Search 120

Transportation 300

Telephone Calls, Facsmile, Printing charges and couriers and etc 300

Miscellaneous 50

GST 6% 198

Total 8848

RM8848 + RM6603 + Rm900(valuaton fees) = RM16,351

cHEERS

Jul 17 2016, 06:34 PM

Jul 17 2016, 06:34 PM

Quote

Quote

0.0835sec

0.0835sec

0.90

0.90

6 queries

6 queries

GZIP Disabled

GZIP Disabled