QUOTE(LNYC @ Jul 15 2016, 11:01 PM)

Then don't buy it lo if it's going to cause you financial burden.I'm not saying this to tease you but really please look into the overall financial management of yours and decide.

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

Jul 15 2016, 11:32 PM Jul 15 2016, 11:32 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(LNYC @ Jul 15 2016, 11:01 PM) Then don't buy it lo if it's going to cause you financial burden.I'm not saying this to tease you but really please look into the overall financial management of yours and decide. |

|

|

|

|

|

Jul 16 2016, 09:44 AM Jul 16 2016, 09:44 AM

|

Senior Member

1,597 posts Joined: Apr 2009 |

Guys,

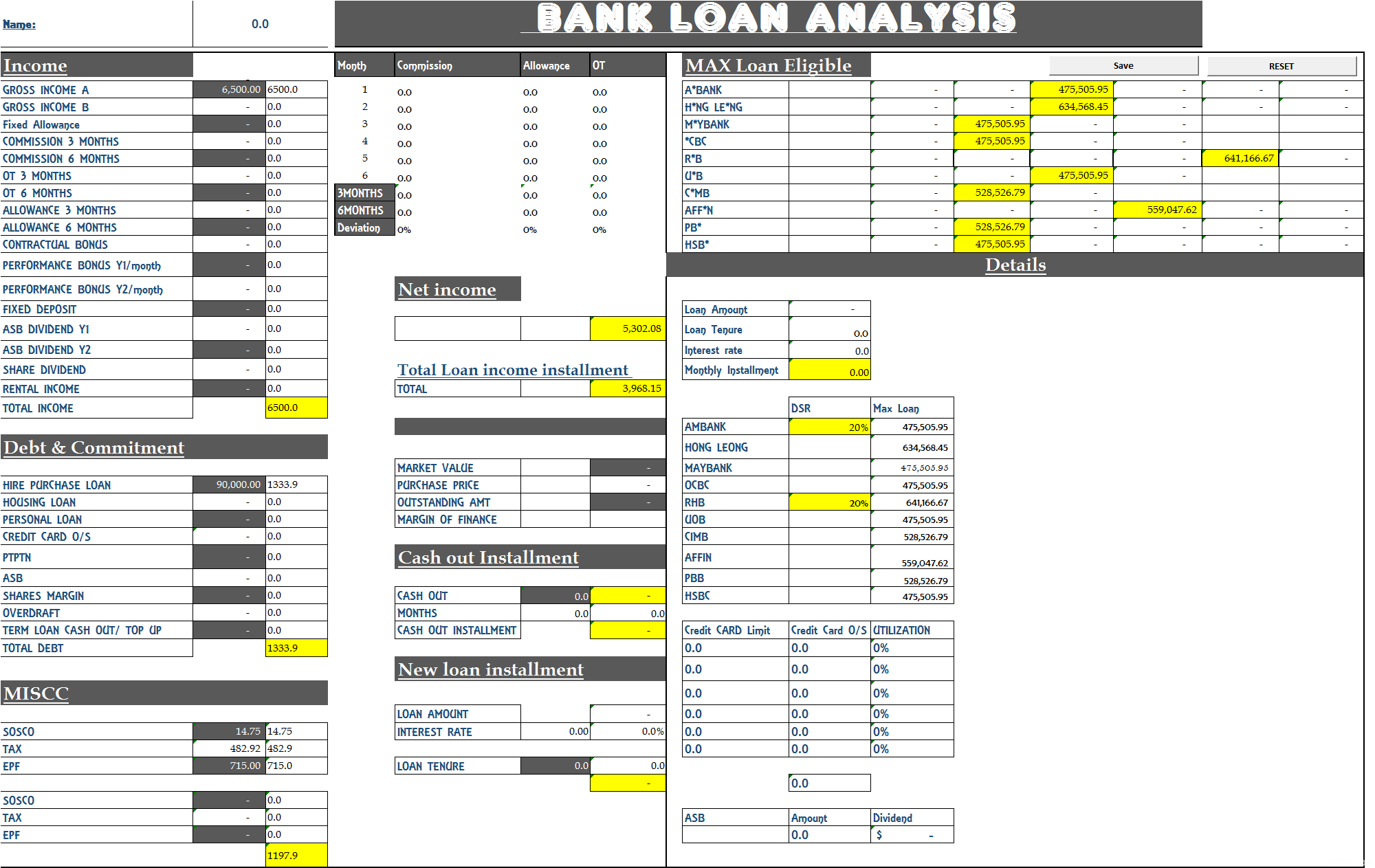

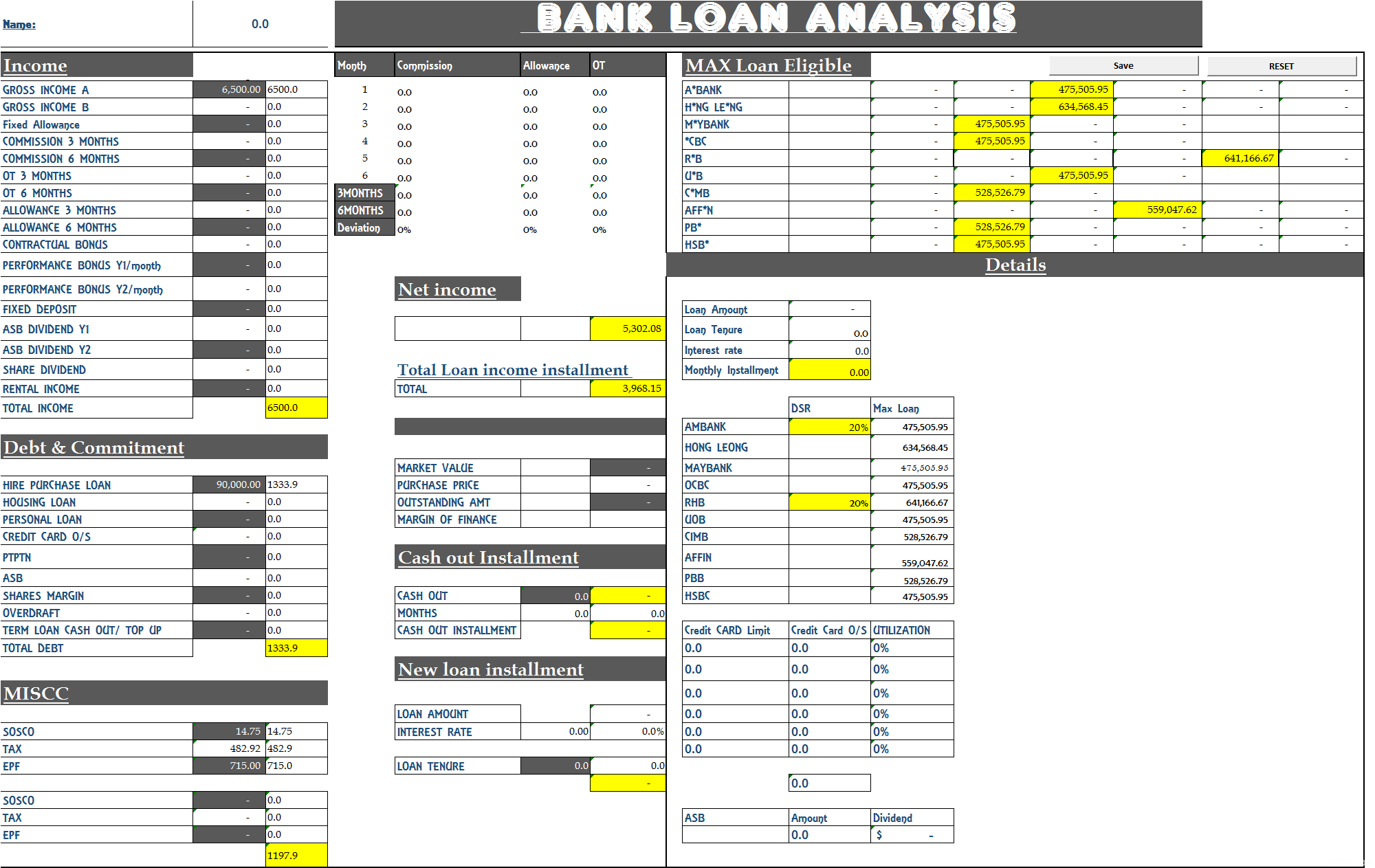

Let say, gross salary rm6500/month Car loan rm1200/month No PL No Mortgage What is the loan eligibility? Thanks |

|

|

Jul 16 2016, 09:47 AM Jul 16 2016, 09:47 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jul 16 2016, 10:00 AM Jul 16 2016, 10:00 AM

|

Junior Member

53 posts Joined: May 2016 |

Will there be reduction of housing loan rate due to the decrease by BNM?

|

|

|

Jul 16 2016, 10:16 AM Jul 16 2016, 10:16 AM

|

Senior Member

982 posts Joined: Dec 2009 |

QUOTE(meonkutu11 @ Jul 16 2016, 09:44 AM) Guys, Good day Meonkutu11,Let say, gross salary rm6500/month Car loan rm1200/month No PL No Mortgage What is the loan eligibility? Thanks You max loan eligibility is RM 670,000 based on info given. However, in order for me to calculate more accurately, please provide me details as below. Also, may i know if this property purchase falls into under construction or subsales. You will need to consider entry cost as well. You will need to fork out for subsales 1. Valuation fees 2. Legal Loan fees 3 Legal SPA fees 1) Borrower Age No of borrowers No of housing loan 2) Income Basic pay Fixed Allowance Variable Allowance OT Bonus - contractual (1 year bonus amount) Bonus - performance (2 years bonus amount) Commission (latest 6 months comm slip calculated in average amount) 3. Supporting Document Rental ASB (2 years total DIV) Shares/Dividend Fixed Deposit 4. Monthly Commitment (Individual/Joint) Housing loan Hire Purchase loan 1200 Personal loan PTPTN loan Other Term loan such as Commercial Loan/ASB loan Credit card Overdraft Cheers |

|

|

Jul 16 2016, 10:19 AM Jul 16 2016, 10:19 AM

|

Senior Member

982 posts Joined: Dec 2009 |

QUOTE(slickskills21 @ Jul 16 2016, 10:00 AM) Well, Maybank had reduced their Base rate from 3.20% to 3.00%. I suppose banks will take this opportunity to reduce their BR but increase their spread (aka Margin) in same time in order to maximize their profits. Just my 2 cents sahaja. |

|

|

|

|

|

Jul 16 2016, 11:39 AM Jul 16 2016, 11:39 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jul 16 2016, 02:09 PM Jul 16 2016, 02:09 PM

Show posts by this member only | IPv6 | Post

#4628

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

|

|

|

Jul 16 2016, 02:12 PM Jul 16 2016, 02:12 PM

Show posts by this member only | IPv6 | Post

#4629

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(meonkutu11 @ Jul 16 2016, 10:44 AM) Guys, DearLet say, gross salary rm6500/month Car loan rm1200/month No PL No Mortgage What is the loan eligibility? Thanks 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 475,505.95 H*NG LE*NG 634,568.45 M*YBANK 475,505.95 *CBC 475,505.95 R*B 641,166.67 U*B 475,505.95 C*MB 528,526.79 AFF*N 559,047.62  2. The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. It will be higher if you have a. Bonus b. Fixed deposit c. Allowance or commission d. Unit trust/ shares Cheers |

|

|

Jul 16 2016, 02:14 PM Jul 16 2016, 02:14 PM

Show posts by this member only | IPv6 | Post

#4630

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(slickskills21 @ Jul 16 2016, 11:00 AM) Dear,1. Yes and No 2. Financial sector for housing loan practice Base rate. Bank has full autonomy whether to reduce their base rate according to OPR reduced. Hence if the bank decided to reduce their base rate like Maybank and ambank, the housing loan rate will decrease. 3. In succinct, it depends on the bank itself. Cheers |

|

|

Jul 16 2016, 06:59 PM Jul 16 2016, 06:59 PM

|

Junior Member

17 posts Joined: Jul 2010 |

QUOTE(Madgeniusfigo @ Jul 16 2016, 02:12 PM) Dear Hi,1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 475,505.95 H*NG LE*NG 634,568.45 M*YBANK 475,505.95 *CBC 475,505.95 R*B 641,166.67 U*B 475,505.95 C*MB 528,526.79 AFF*N 559,047.62  2. The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. It will be higher if you have a. Bonus b. Fixed deposit c. Allowance or commission d. Unit trust/ shares Cheers Im planning to purchase my 1st property for investment purpose but im not really clear on the eligibility as i heard some said 60% and others said 80% , hope u can help me on this. My gross salary just RM3200 no other commitment and staying with parent. Thks |

|

|

Jul 16 2016, 07:18 PM Jul 16 2016, 07:18 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(munkey77 @ Jul 16 2016, 06:59 PM) Hi, Hi Im planning to purchase my 1st property for investment purpose but im not really clear on the eligibility as i heard some said 60% and others said 80% , hope u can help me on this. My gross salary just RM3200 no other commitment and staying with parent. Thks Your eligibility to loan is 380k. And you'll be eligible to get 50% discount on MOT for subsale property. Feel free to let me know what other advise you need. Tq |

|

|

Jul 16 2016, 07:40 PM Jul 16 2016, 07:40 PM

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(munkey77 @ Jul 16 2016, 07:59 PM) Hi, DearIm planning to purchase my 1st property for investment purpose but im not really clear on the eligibility as i heard some said 60% and others said 80% , hope u can help me on this. My gross salary just RM3200 no other commitment and staying with parent. Thks 1. Yes it's quite confusing as different bank has different dsr calculation Some had 50% some 60,70,85 That's why you can see my calculation for different bank has different Max loan result. 2. Do you have at least credit card? |

|

|

|

|

|

Jul 16 2016, 08:34 PM Jul 16 2016, 08:34 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

|

|

|

Jul 16 2016, 08:44 PM Jul 16 2016, 08:44 PM

|

Senior Member

1,597 posts Joined: Apr 2009 |

|

|

|

Jul 16 2016, 08:45 PM Jul 16 2016, 08:45 PM

|

Senior Member

1,597 posts Joined: Apr 2009 |

QUOTE(ngph988 @ Jul 16 2016, 10:16 AM) Good day Meonkutu11, Thanks Bro.You max loan eligibility is RM 670,000 based on info given. However, in order for me to calculate more accurately, please provide me details as below. Also, may i know if this property purchase falls into under construction or subsales. You will need to consider entry cost as well. You will need to fork out for subsales 1. Valuation fees 2. Legal Loan fees 3 Legal SPA fees 1) Borrower Age No of borrowers No of housing loan 2) Income Basic pay Fixed Allowance Variable Allowance OT Bonus - contractual (1 year bonus amount) Bonus - performance (2 years bonus amount) Commission (latest 6 months comm slip calculated in average amount) 3. Supporting Document Rental ASB (2 years total DIV) Shares/Dividend Fixed Deposit 4. Monthly Commitment (Individual/Joint) Housing loan Hire Purchase loan 1200 Personal loan PTPTN loan Other Term loan such as Commercial Loan/ASB loan Credit card Overdraft Cheers |

|

|

Jul 17 2016, 05:52 PM Jul 17 2016, 05:52 PM

|

Senior Member

2,173 posts Joined: May 2010 |

Hi All,

I'm just thinking, is it actually possible to secure a loan first before having purchase order form? Because often times people submit their loans and then failed to secure a 90% loan hence gotta wait for booking refund which is really a lengthy process.. usually takes up to a month or more.. |

|

|

Jul 17 2016, 06:11 PM Jul 17 2016, 06:11 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Kilohertz @ Jul 17 2016, 05:52 PM) Hi All, Normally you need booking form to submit for loan otherwise cannot as it serves as an intention to purchase.I'm just thinking, is it actually possible to secure a loan first before having purchase order form? Because often times people submit their loans and then failed to secure a 90% loan hence gotta wait for booking refund which is really a lengthy process.. usually takes up to a month or more.. This is a standard procedure You can't get pre approve loan nowa days |

|

|

Jul 17 2016, 06:15 PM Jul 17 2016, 06:15 PM

|

Senior Member

2,173 posts Joined: May 2010 |

QUOTE(lifebalance @ Jul 17 2016, 06:11 PM) Normally you need booking form to submit for loan otherwise cannot as it serves as an intention to purchase. I see, thanks! So to make sure can get the best deal, what do you recommend? Compile all the docs and submit to multiple banks? or look for a highly experience mortgage consultant?This is a standard procedure You can't get pre approve loan nowa days |

|

|

Jul 17 2016, 06:31 PM Jul 17 2016, 06:31 PM

|

Senior Member

982 posts Joined: Dec 2009 |

QUOTE(Kilohertz @ Jul 17 2016, 06:15 PM) I see, thanks! So to make sure can get the best deal, what do you recommend? Compile all the docs and submit to multiple banks? or look for a highly experience mortgage consultant? Is up to your preference, you can submit to few banks to secure loan application. Alternatively, seek for an experienced mortgage consultant to guide your loan application, to let you understand the loan package and overall process. If you need further assistance, I'm glad you to help you anytime. Peace |

| Change to: |  0.0585sec 0.0585sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 03:00 PM |