Outline ·

[ Standard ] ·

Linear+

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

samuelmulia2

|

Jul 14 2015, 09:15 PM Jul 14 2015, 09:15 PM

|

New Member

|

QUOTE(ims2628 @ Jul 14 2015, 04:46 PM) Bank will approve loan base on min requirement selling price, I believe for JB is 1 million instead of 2 million. And if bank approve also loan margin will be max 60% from selling price for foreigner. Thank you for the repply, do you know what are the documents required from foreigner to apply mortgage in Malaysia Bank ? And which banks in Malaysia give mortgage to foreign customer? I've been googling it but I can't find muçh reference. |

|

|

|

|

|

Neo Light

|

Jul 15 2015, 02:36 AM Jul 15 2015, 02:36 AM

|

Getting Started

|

I am looking for loan to purchase my first house for own stay, but I don't know why all the interest rate are the same -> https://www.imoney.my/home-loanWhy some BR + 0.46, some BR + 0.78 but end up total interest rate same?!!! Then which one is better? +0.46 or + 0.78? My property was about RM 737,000. I am looking to borrow loan RM700,000 with tenure 30 years. I prefer flexi loan, as I have some extra cash to "park". Age 35. Full time employee in MNC. My annual income about RM96k gross. I have no other commitment as I finish pay up everything(car,credit card etc). Questions: 1) Am I eligible to apply the above loan amount? 2) Which two banks suited me best currently? 3) And the their lowest interest rate are? 4) MLTA or MRTA? |

|

|

|

|

|

luminaryxi

|

Jul 15 2015, 12:52 PM Jul 15 2015, 12:52 PM

|

|

Hi all, below is my financial details

Gross earning per month : 4k

Guarantor for a car,monthly : 800

have credit cards with mbb

No mortgage loan at all

Question : how much of loan (35Years) am i eligible for? please gimme the conservative and optimistic loan amount.

Thank you so much for enlightening me

|

|

|

|

|

|

sss123

|

Jul 15 2015, 07:19 PM Jul 15 2015, 07:19 PM

|

Getting Started

|

public bank told me if apply home loan without mrta, interest rate lowest will b 4.60.. is it true? Worth to buy mrta with 3.5k for 5 yrs to get lower interest rate? she cant guarantee how much lower the rate for buying mrta..

|

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 02:15 AM Jul 16 2015, 02:15 AM

|

Getting Started

|

QUOTE(MAC-tronome @ Jul 14 2015, 09:08 PM) hi u mean semi-flexi or full flexi? I am going for semi flexi..just want to ask in terms of loan period..shorter or longer better? example 25 years loan vs 35 years loan? which wan i can save more interest. Indeed shorter loan would be lesser the interest you pay off. Let say : E.g 500k prop with 10% d/p (50k) - BR 4.6 % you need to pay around 2.1k+ per month for 35 yrs 2.5K+ per month for 25 yrs It will like saves you around 150k+ interest$ itself which flexi haven't apply in this sample yet. |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 02:27 AM Jul 16 2015, 02:27 AM

|

Getting Started

|

QUOTE(sss123 @ Jul 15 2015, 07:19 PM) public bank told me if apply home loan without mrta, interest rate lowest will b 4.60.. is it true? Worth to buy mrta with 3.5k for 5 yrs to get lower interest rate? she cant guarantee how much lower the rate for buying mrta.. It depending on bank, but in most cases, MLTA is better (but expensive) then MRTA in term of insurance, and secure yourself. MRTA (is protection) will have reducing cash value and drop to 0 when end of tenure while MLTA (is protection+ cash value) fixed cash value thought-out the loan tenure Actually you ask me worth buying, I would say it;s necessary when it come to protect/secure you and your family, unless you buying for investment purpose. |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 02:50 AM Jul 16 2015, 02:50 AM

|

Getting Started

|

QUOTE(Neo Light @ Jul 15 2015, 02:36 AM) I am looking for loan to purchase my first house for own stay, but I don't know why all the interest rate are the same -> https://www.imoney.my/home-loanWhy some BR + 0.46, some BR + 0.78 but end up total interest rate same?!!! Then which one is better? +0.46 or + 0.78? My property was about RM 737,000. I am looking to borrow loan RM700,000 with tenure 30 years. I prefer flexi loan, as I have some extra cash to "park". Age 35. Full time employee in MNC. My annual income about RM96k gross. I have no other commitment as I finish pay up everything(car,credit card etc). Questions: 1) Am I eligible to apply the above loan amount? Based on given statement, you still good for the loan  2) Which two banks suited me best currently? if you would go for Fully flexi, HSBC, StdChrt & CIMB as far as i know they're having FULLY flexi (other's bank may not have the 100% flexibility) 3) And the their lowest interest rate are? the rate is nothing compare if you going to park extra $ to offset the Principle, you earn it way better from FD already/  4) MLTA or MRTA? again, it depends what protection/insurance you needs ... HI there bro, the interest rate would be your second concern since you choosing flexi plan, so you would need to Choose which bank have Full Flexi plan first and then only compare the rate and details. And btw, according to your scenario, you only can borrow up to 660k+ instead of 700k This post has been edited by WilliamSun: Jul 16 2015, 02:51 AM |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 02:56 AM Jul 16 2015, 02:56 AM

|

Getting Started

|

QUOTE(luminaryxi @ Jul 15 2015, 12:52 PM) Hi all, below is my financial details Gross earning per month : 4k Guarantor for a car,monthly : 800 have credit cards with mbb No mortgage loan at all Question : how much of loan (35Years) am i eligible for? please gimme the conservative and optimistic loan amount. Thank you so much for enlightening me Suggested prop value will be estimate around 350++k~450++k provided you have repayment ability of 1.5~1.8k per month. |

|

|

|

|

|

t3n

|

Jul 16 2015, 05:45 AM Jul 16 2015, 05:45 AM

|

|

Hi wanna ask my situation:

1) bought bumi quota unit

2) i am non bumi

3) leasehold

4) master title

Normally this case will take longer time for name transfer.. My question is when do i need to start paying bank loan? After sucessful name transfer which means few months to few years time? Or before that?

|

|

|

|

|

|

Jasoncat

|

Jul 16 2015, 07:28 AM Jul 16 2015, 07:28 AM

|

|

QUOTE(t3n @ Jul 16 2015, 05:45 AM) Hi wanna ask my situation: 1) bought bumi quota unit 2) i am non bumi 3) leasehold 4) master title Normally this case will take longer time for name transfer.. My question is when do i need to start paying bank loan? After sucessful name transfer which means few months to few years time? Or before that? You have to start the loan servicing when your loan has already been disbursed. |

|

|

|

|

|

ims2628

|

Jul 16 2015, 09:01 AM Jul 16 2015, 09:01 AM

|

|

QUOTE(sss123 @ Jul 15 2015, 07:19 PM) public bank told me if apply home loan without mrta, interest rate lowest will b 4.60.. is it true? Worth to buy mrta with 3.5k for 5 yrs to get lower interest rate? she cant guarantee how much lower the rate for buying mrta.. Depends with loan amount normally if profile grading is good banker can always request for lower rate. |

|

|

|

|

|

cdspins

|

Jul 16 2015, 09:10 AM Jul 16 2015, 09:10 AM

|

|

QUOTE(sss123 @ Jul 15 2015, 07:19 PM) public bank told me if apply home loan without mrta, interest rate lowest will b 4.60.. is it true? Worth to buy mrta with 3.5k for 5 yrs to get lower interest rate? she cant guarantee how much lower the rate for buying mrta.. Just for your info, the cost of mrta will always be higher than the saving from the lower interest rate. It is wort to buy MRTA, that really depends on your age, financial situation and your family needs. If you already have enough insurance, then there is no need, if you are the sole bread winner in the house and this is your first house... then you might consider or even extend the coverage to 2/3 of the loan tenure. |

|

|

|

|

|

t3n

|

Jul 16 2015, 09:14 AM Jul 16 2015, 09:14 AM

|

|

QUOTE(Jasoncat @ Jul 16 2015, 07:28 AM) You have to start the loan servicing when your loan has already been disbursed. So when will the loan disbursed? After name transfer or before? |

|

|

|

|

|

Neo Light

|

Jul 16 2015, 04:31 PM Jul 16 2015, 04:31 PM

|

Getting Started

|

QUOTE(WilliamSun @ Jul 16 2015, 02:50 AM) HI there bro, the interest rate would be your second concern since you choosing flexi plan, so you would need to Choose which bank have Full Flexi plan first and then only compare the rate and details. And btw, according to your scenario, you only can borrow up to 660k+ instead of 700k I see. So if I go for full flexi loan(And as a start, lets say I "park" about RM10k in that account), and my monthly installment is RM3500, do I have the flexibility to pay for like the below? This month - RM3700 Next Month - RM2300 Third Month - RM4500 Fourth Month - RM900 Fifth Month - RM0 Sixth Month - RM 7000 and etc etc........ Besides that, ny admin fees, processing fees, etc every month charge by bank? This post has been edited by Neo Light: Jul 16 2015, 04:40 PM |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 06:28 PM Jul 16 2015, 06:28 PM

|

Getting Started

|

QUOTE(t3n @ Jul 16 2015, 09:14 AM) So when will the loan disbursed? After name transfer or before? In most case, disbursement occurred only after lawyer side settle everything, doc etc & confirmed with bank. |

|

|

|

|

|

WilliamSun

|

Jul 17 2015, 02:00 AM Jul 17 2015, 02:00 AM

|

Getting Started

|

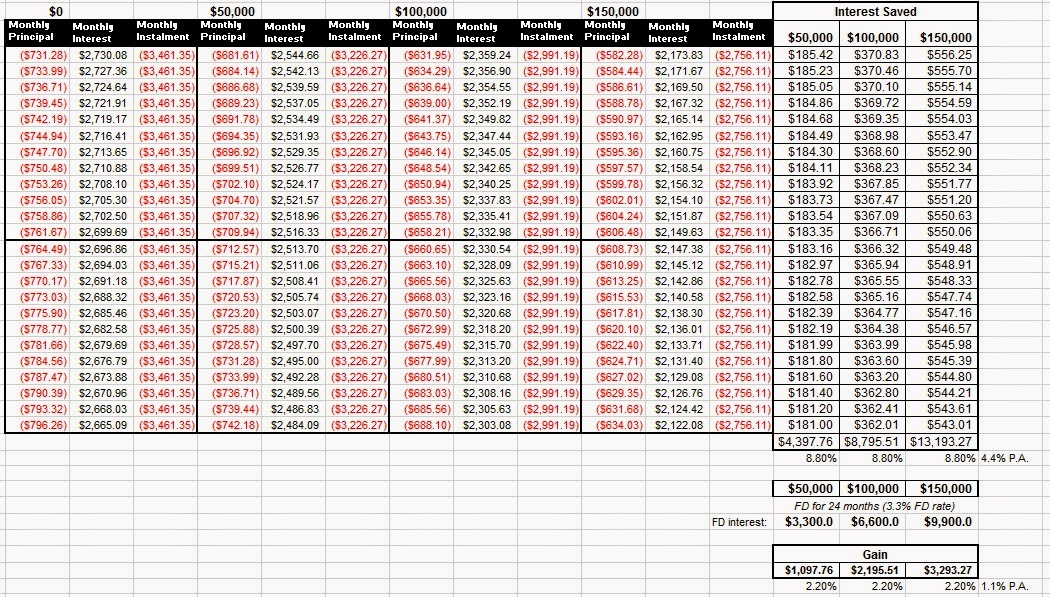

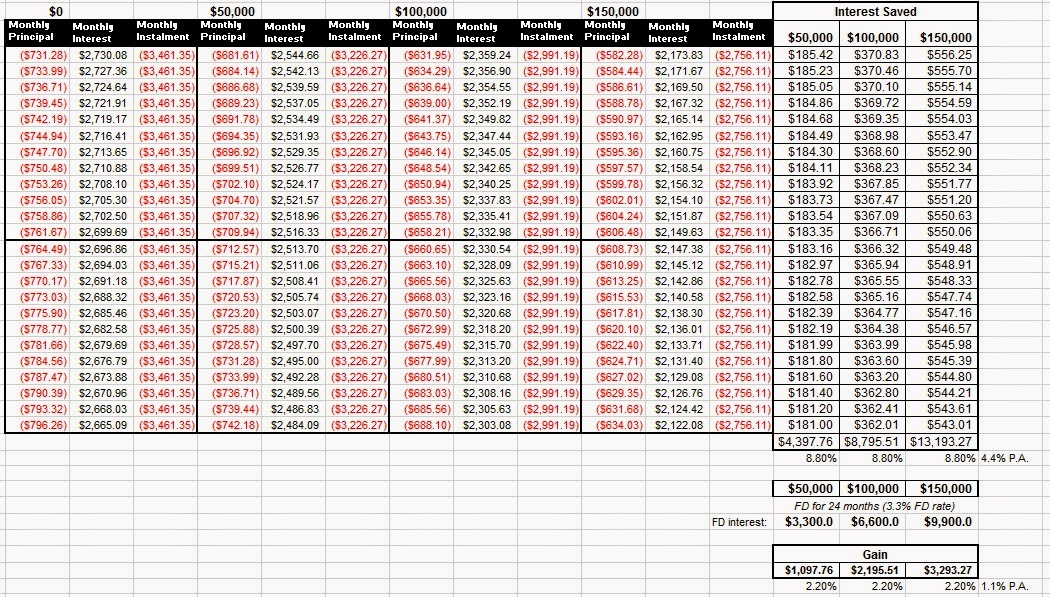

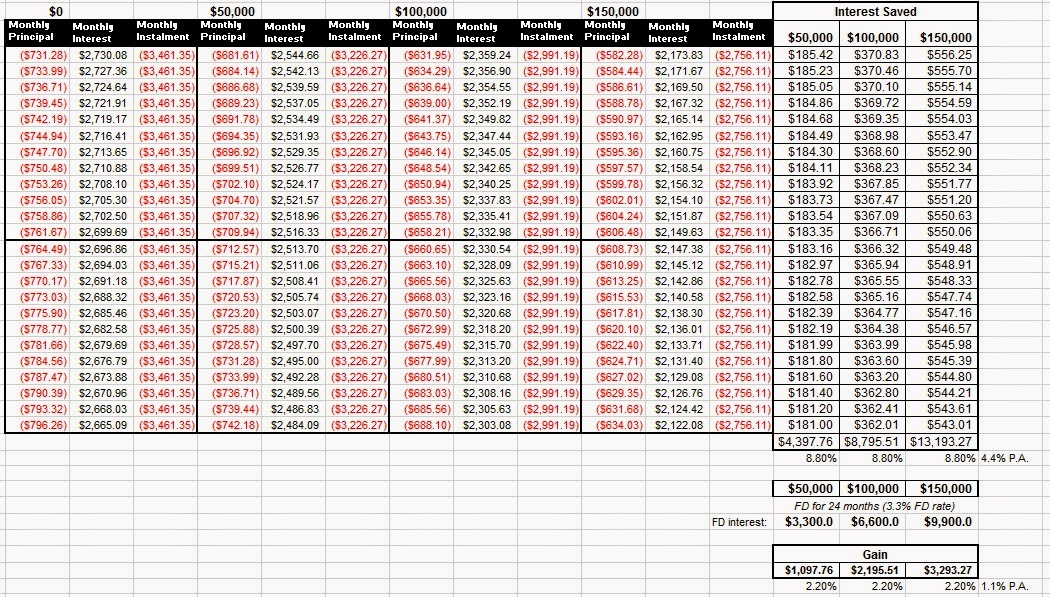

QUOTE(Neo Light @ Jul 16 2015, 04:31 PM) I see. So if I go for full flexi loan(And as a start, lets say I "park" about RM10k in that account), and my monthly installment is RM3500, do I have the flexibility to pay for like the below? This month - RM3700 Next Month - RM2300 Third Month - RM4500 Fourth Month - RM900 Fifth Month - RM0 Sixth Month - RM 7000 and etc etc........ Besides that, ny admin fees, processing fees, etc every month charge by bank? Hi bro, maybe you may refer to this for better understand : http://jkfund.blogspot.com/2014/10/cimb-ho...using-loan.htmlI found it very useful and easy to understand how full flexi works and there are three scenarios shown : (1) You place RM 50,000 into the current account (2) You place RM 100,000 into the current account (2) You place RM 150,000 into the current account  This post has been edited by WilliamSun: Jul 17 2015, 02:06 AM This post has been edited by WilliamSun: Jul 17 2015, 02:06 AM |

|

|

|

|

|

clavenk

|

Jul 17 2015, 10:36 AM Jul 17 2015, 10:36 AM

|

New Member

|

QUOTE(WilliamSun @ Jul 17 2015, 02:00 AM) Hi bro, maybe you may refer to this for better understand : http://jkfund.blogspot.com/2014/10/cimb-ho...using-loan.htmlI found it very useful and easy to understand how full flexi works and there are three scenarios shown : (1) You place RM 50,000 into the current account (2) You place RM 100,000 into the current account (2) You place RM 150,000 into the current account  Not all bank full flexi work this way, at least I know uob is not calculating this way, uob will fix the principal and interest as initial then whatever amount in your bank account credit back the interest. Which is even better because it will compound the interest in your current account. |

|

|

|

|

|

Tavia88

|

Jul 17 2015, 08:10 PM Jul 17 2015, 08:10 PM

|

|

Any Ocbc Banker here? Please pm me. Wish to submit a loan. Tqvm

|

|

|

|

|

|

diners

|

Jul 18 2015, 10:49 AM Jul 18 2015, 10:49 AM

|

|

I have 3 questions.

Q1.

can someone do a simulation for me on the loan servicing thing?

like how much i need to pay to service the loan until VP?

eg, the house price is 400k. loan 360k, 4.45%, 35 years, semi-flexi. assuming i know that i need to start servicing the loan wef jan2016. how does the calculation goes?

there's a standard table of the % like 10%, 10%, 15%, 10%, 10%, 10%, 5%, 5%, 5%, 12.5%, 2.5%, 5% right?

Q2.

say for example i take the loan of 360k, 4.45%, 35 years, semi-flexi from UOB. my monthly instalment is approx. RM1693. If let's say I pay RM2000 a month for the instalment, where does the extra RM307 does? To reduce the principal or to service the interest? any simulation?

Q3.

I understand that i can request the bank to say that I want to start paying my instalment BEFORE VP. is it a good choice? according the bank agent, i can do so when the bank had disbursed around 50% of the money to the developer. this way, i can start to pay instalment instead service the interest (it would paying like, double interest right?). but i dont know if it's a wise choice?

This post has been edited by diners: Jul 18 2015, 10:53 AM

|

|

|

|

|

|

prema2277

|

Jul 19 2015, 04:01 AM Jul 19 2015, 04:01 AM

|

Getting Started

|

Hi there,

I am Malaysia living in UK. Is it possible of me to get a housing loan in Malaysia please? I earn a good wage here and am looking for 90% loan for a property worth RM600k. Please advise.

Thanks

|

|

|

|

|

Jul 14 2015, 09:15 PM

Jul 14 2015, 09:15 PM

Quote

Quote

0.0217sec

0.0217sec

1.68

1.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled