Outline ·

[ Standard ] ·

Linear+

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

WilliamSun

|

Jul 16 2015, 02:15 AM Jul 16 2015, 02:15 AM

|

Getting Started

|

QUOTE(MAC-tronome @ Jul 14 2015, 09:08 PM) hi u mean semi-flexi or full flexi? I am going for semi flexi..just want to ask in terms of loan period..shorter or longer better? example 25 years loan vs 35 years loan? which wan i can save more interest. Indeed shorter loan would be lesser the interest you pay off. Let say : E.g 500k prop with 10% d/p (50k) - BR 4.6 % you need to pay around 2.1k+ per month for 35 yrs 2.5K+ per month for 25 yrs It will like saves you around 150k+ interest$ itself which flexi haven't apply in this sample yet. |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 02:27 AM Jul 16 2015, 02:27 AM

|

Getting Started

|

QUOTE(sss123 @ Jul 15 2015, 07:19 PM) public bank told me if apply home loan without mrta, interest rate lowest will b 4.60.. is it true? Worth to buy mrta with 3.5k for 5 yrs to get lower interest rate? she cant guarantee how much lower the rate for buying mrta.. It depending on bank, but in most cases, MLTA is better (but expensive) then MRTA in term of insurance, and secure yourself. MRTA (is protection) will have reducing cash value and drop to 0 when end of tenure while MLTA (is protection+ cash value) fixed cash value thought-out the loan tenure Actually you ask me worth buying, I would say it;s necessary when it come to protect/secure you and your family, unless you buying for investment purpose. |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 02:50 AM Jul 16 2015, 02:50 AM

|

Getting Started

|

QUOTE(Neo Light @ Jul 15 2015, 02:36 AM) I am looking for loan to purchase my first house for own stay, but I don't know why all the interest rate are the same -> https://www.imoney.my/home-loanWhy some BR + 0.46, some BR + 0.78 but end up total interest rate same?!!! Then which one is better? +0.46 or + 0.78? My property was about RM 737,000. I am looking to borrow loan RM700,000 with tenure 30 years. I prefer flexi loan, as I have some extra cash to "park". Age 35. Full time employee in MNC. My annual income about RM96k gross. I have no other commitment as I finish pay up everything(car,credit card etc). Questions: 1) Am I eligible to apply the above loan amount? Based on given statement, you still good for the loan  2) Which two banks suited me best currently? if you would go for Fully flexi, HSBC, StdChrt & CIMB as far as i know they're having FULLY flexi (other's bank may not have the 100% flexibility) 3) And the their lowest interest rate are? the rate is nothing compare if you going to park extra $ to offset the Principle, you earn it way better from FD already/  4) MLTA or MRTA? again, it depends what protection/insurance you needs ... HI there bro, the interest rate would be your second concern since you choosing flexi plan, so you would need to Choose which bank have Full Flexi plan first and then only compare the rate and details. And btw, according to your scenario, you only can borrow up to 660k+ instead of 700k This post has been edited by WilliamSun: Jul 16 2015, 02:51 AM |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 02:56 AM Jul 16 2015, 02:56 AM

|

Getting Started

|

QUOTE(luminaryxi @ Jul 15 2015, 12:52 PM) Hi all, below is my financial details Gross earning per month : 4k Guarantor for a car,monthly : 800 have credit cards with mbb No mortgage loan at all Question : how much of loan (35Years) am i eligible for? please gimme the conservative and optimistic loan amount. Thank you so much for enlightening me Suggested prop value will be estimate around 350++k~450++k provided you have repayment ability of 1.5~1.8k per month. |

|

|

|

|

|

WilliamSun

|

Jul 16 2015, 06:28 PM Jul 16 2015, 06:28 PM

|

Getting Started

|

QUOTE(t3n @ Jul 16 2015, 09:14 AM) So when will the loan disbursed? After name transfer or before? In most case, disbursement occurred only after lawyer side settle everything, doc etc & confirmed with bank. |

|

|

|

|

|

WilliamSun

|

Jul 17 2015, 02:00 AM Jul 17 2015, 02:00 AM

|

Getting Started

|

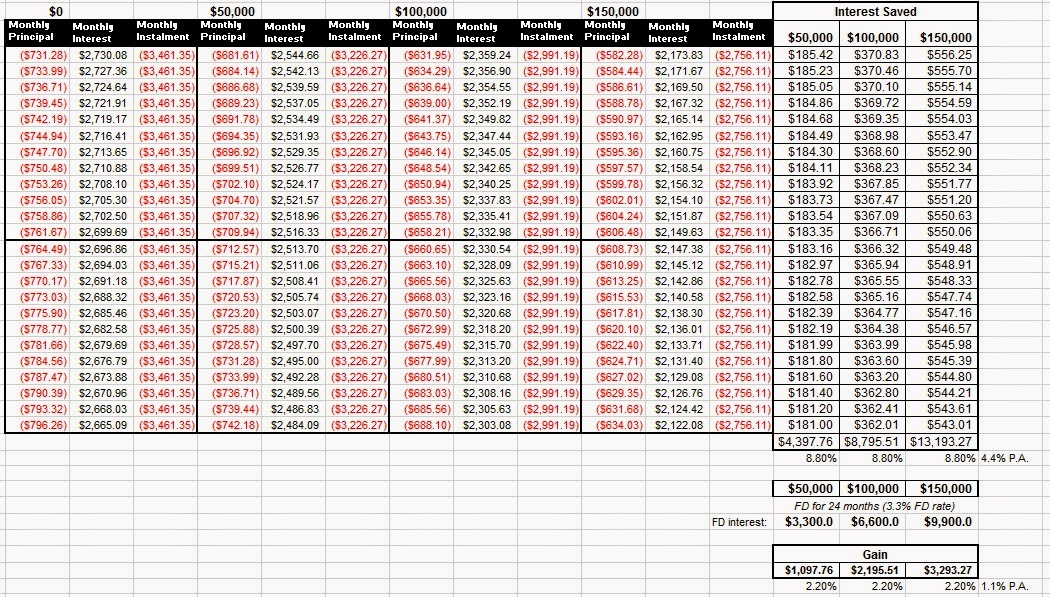

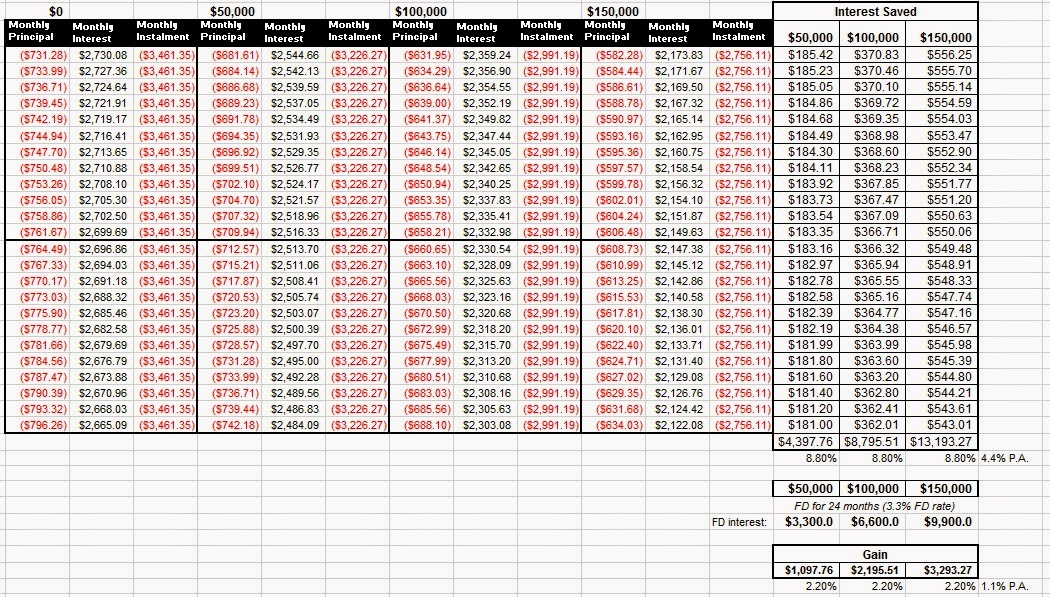

QUOTE(Neo Light @ Jul 16 2015, 04:31 PM) I see. So if I go for full flexi loan(And as a start, lets say I "park" about RM10k in that account), and my monthly installment is RM3500, do I have the flexibility to pay for like the below? This month - RM3700 Next Month - RM2300 Third Month - RM4500 Fourth Month - RM900 Fifth Month - RM0 Sixth Month - RM 7000 and etc etc........ Besides that, ny admin fees, processing fees, etc every month charge by bank? Hi bro, maybe you may refer to this for better understand : http://jkfund.blogspot.com/2014/10/cimb-ho...using-loan.htmlI found it very useful and easy to understand how full flexi works and there are three scenarios shown : (1) You place RM 50,000 into the current account (2) You place RM 100,000 into the current account (2) You place RM 150,000 into the current account  This post has been edited by WilliamSun: Jul 17 2015, 02:06 AM This post has been edited by WilliamSun: Jul 17 2015, 02:06 AM |

|

|

|

|

|

WilliamSun

|

Jul 19 2015, 04:04 PM Jul 19 2015, 04:04 PM

|

Getting Started

|

QUOTE(prema2277 @ Jul 19 2015, 04:01 AM) Hi there, I am Malaysia living in UK. Is it possible of me to get a housing loan in Malaysia please? I earn a good wage here and am looking for 90% loan for a property worth RM600k. Please advise. Thanks HI there, are You still holding a Malaysian Citizenship ? |

|

|

|

|

|

WilliamSun

|

Jul 20 2015, 05:50 AM Jul 20 2015, 05:50 AM

|

Getting Started

|

QUOTE(hhhchamps @ Jul 19 2015, 11:27 PM) Thank you very much. I am looking for mortgage banker? R u a panel for certain banks? HI Champs, perhaps I can try to help you out from there. Let's chat in PM if you dont mind. QUOTE(prema2277 @ Jul 19 2015, 11:55 PM) Clean ccris - maximum ltv is how much? Clean ccris - can be Case by case basis, and for your case is quite complex abit, so maybe need more input from yourside to justify QUOTE(prema2277 @ Jul 20 2015, 12:03 AM) Any loan advisors? Please pm me- i am keen to get the purchase. Thanks Kindly update me when you're ready. Cheers This post has been edited by WilliamSun: Jul 20 2015, 05:51 AM |

|

|

|

|

|

WilliamSun

|

Jul 22 2015, 01:34 PM Jul 22 2015, 01:34 PM

|

Getting Started

|

QUOTE(wild_card_my @ Jul 22 2015, 08:34 AM) The choice of banks would usually go down to the ones giving the best rates. But board rates for most banks are pretty much the same these days, after appeal (non-guaranteed) you may get better rates. Then it boils down to your preferred banks which is not necessarily the bank your salary is deposited into as inter bank transfers are only 20sen nowadays. Sometimes you may face a lack of choice too as not all banks will finance your property because of multiple reasons: 1. Condition and location of the property, some banks wont finance props older than 10 years that has to strata/individual title Under certain condition and location of the property, some banks wont finance props older than 10 years that has NOT YET convert to strata/individual title, HOWEVER, PUBLIC & CIMB bank can do

2. Your income levels too low, or commitment levels too high. In this case it would be best to go for banks with higher debt-service-ratio limits like Hong Leong with DSR limit of 85% compared to others which typically maxes out at 70% FYI, CIMB also have the DSR maxed at 85%

So my suggestion is to go for multiple banks, there are a few brokers her and there are many banks out there. The most important thing is service, as the rates are the same between brokers and bankers as the rates are considered and approved by the HQ. |

|

|

|

|

|

WilliamSun

|

Jul 22 2015, 02:16 PM Jul 22 2015, 02:16 PM

|

Getting Started

|

QUOTE(wild_card_my @ Jul 22 2015, 01:41 PM) Sure bro, lots of ims2628 & your info provided is quite helpful too  It's better to gather more info for house buyer and loan applicant to have better understanding and knowledge too. =) This post has been edited by WilliamSun: Jul 24 2015, 04:57 PM |

|

|

|

|

|

WilliamSun

|

Jul 27 2015, 12:49 PM Jul 27 2015, 12:49 PM

|

Getting Started

|

QUOTE(misnail @ Jul 26 2015, 10:34 PM) Hi! I have an existing home loan with SCB (rate of BLR - 2.3%) which was taken in Dec 2010. Current balance is RM200k and I tried asking SCB to review the interest rate but my application for interest reduction has been rejected. My current interest is higher than the interest offer d by other banks. Any advise on how can I convince SCB to reduce my interest rate? Or should I switch to other banks for home loan? Thanks! The most common option is to request a restructure loan from your bank or refinance with others bank. You may then compare the restructure & the refinance pakcage offered to you and see which suit your need the most. |

|

|

|

|

|

WilliamSun

|

Jul 27 2015, 01:16 PM Jul 27 2015, 01:16 PM

|

Getting Started

|

QUOTE(cooldownguy86 @ Jul 26 2015, 11:06 PM) I'm looking for construction loan to build a house on land that I fully-own. So far I heard UOB (up to 70%), OCBC (up to 80%) and PBB (up to 90%) provide such loan. Hoping to get some further details on the loan. Hi cooldownguy,may i know what type of land(title of the land)that you're owning to build ya? This post has been edited by WilliamSun: Jul 27 2015, 01:46 PM |

|

|

|

|

|

WilliamSun

|

Jul 27 2015, 01:19 PM Jul 27 2015, 01:19 PM

|

Getting Started

|

QUOTE(Syd G @ Jul 27 2015, 09:41 AM) I have this loan. It's legit. Can pay as much as you want. Reduce interest. Withdrawal is RM25 charge, in RM1000 repeats My current loan - yes, interest rate is horrible (taken 2006). Anyone wants to offer for refinance?  [attachmentid=4651608] When you click 'Advance Payment Withdraw' [attachmentid=4651611] [attachmentid=4651613] It's a semi-flexi as with your explanationn. |

|

|

|

|

|

WilliamSun

|

Jul 28 2015, 12:06 PM Jul 28 2015, 12:06 PM

|

Getting Started

|

QUOTE(Neo Light @ Jul 28 2015, 12:58 AM) Any bank in the market currently allow to borrow 95% MOF? So far, I have inquired three banks. All three only up to 90%. Please enlighten me as I wish to borrow 95%, so that I can allocate some cash for renovation. Thanks. Hi Neo, For 95% financing, actually bank only help finance up to 90%, as for the 5% actually is the legal fees, MRTA/MLTA and valuation (if any). |

|

|

|

|

Jul 16 2015, 02:15 AM

Jul 16 2015, 02:15 AM

Quote

Quote

0.4122sec

0.4122sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled