Outline ·

[ Standard ] ·

Linear+

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

clavenk

|

Jul 9 2015, 10:01 PM Jul 9 2015, 10:01 PM

|

New Member

|

Wanna check for full flexi loan.

Let say I having 50k in current account.

Loan amount 300k.

Uob is not taking 300k -50k =250k * interest. Remaining amount from monthly installment off interest to pay principal. In fact it credit back the interest to current account. I think not all bank is practicing this way for full flexi right? Is there any other bank doing flexi calculation differently? Which bank is having the same calculation like uob? Any know?

|

|

|

|

|

|

clavenk

|

Jul 9 2015, 10:17 PM Jul 9 2015, 10:17 PM

|

New Member

|

QUOTE(ims2628 @ Jul 9 2015, 10:12 PM) I heard there's two more bank will change their br this month, can't confirm yet until official black and white is out. So far there's two bank had lower their BR for month of july Ambank to 3.8 HLB to 3.84 So what's the lowest rate now? 4.25? If getting loan soon suppose to aware for the new rate than the old rate right? |

|

|

|

|

|

clavenk

|

Jul 17 2015, 10:36 AM Jul 17 2015, 10:36 AM

|

New Member

|

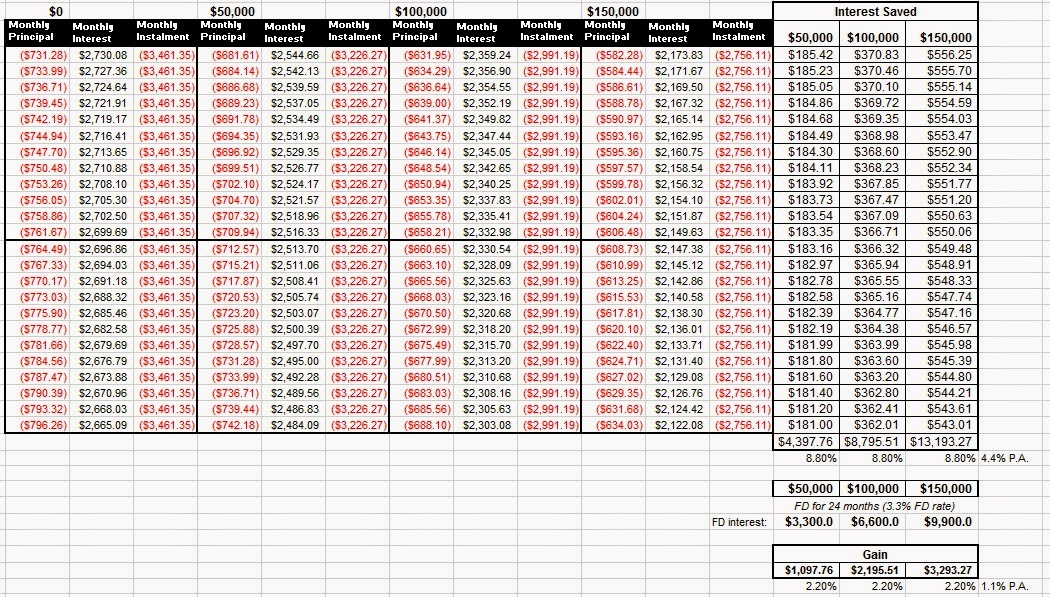

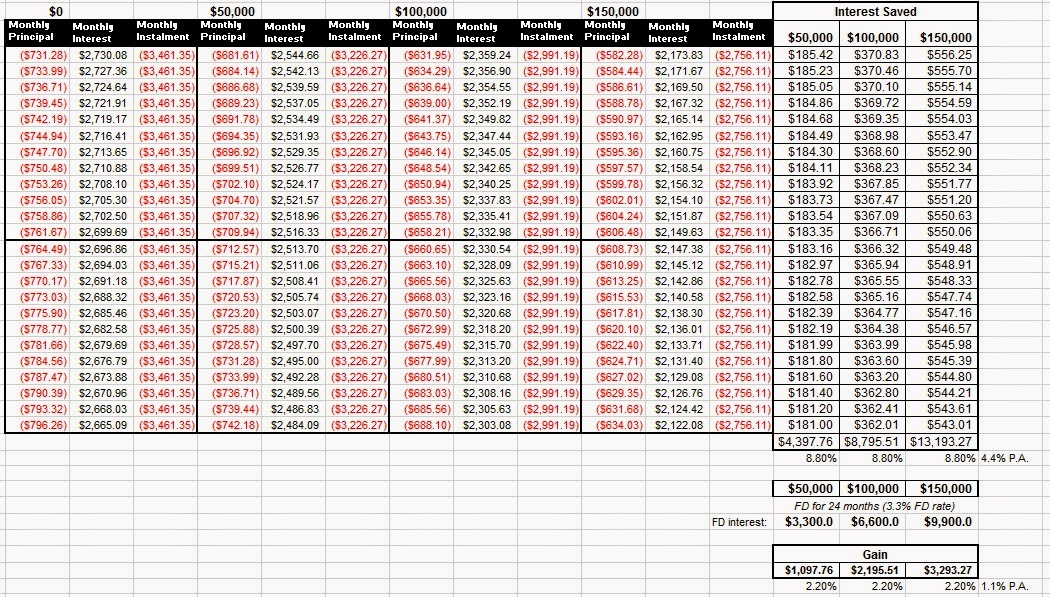

QUOTE(WilliamSun @ Jul 17 2015, 02:00 AM) Hi bro, maybe you may refer to this for better understand : http://jkfund.blogspot.com/2014/10/cimb-ho...using-loan.htmlI found it very useful and easy to understand how full flexi works and there are three scenarios shown : (1) You place RM 50,000 into the current account (2) You place RM 100,000 into the current account (2) You place RM 150,000 into the current account  Not all bank full flexi work this way, at least I know uob is not calculating this way, uob will fix the principal and interest as initial then whatever amount in your bank account credit back the interest. Which is even better because it will compound the interest in your current account. |

|

|

|

|

|

clavenk

|

Mar 29 2021, 09:46 AM Mar 29 2021, 09:46 AM

|

New Member

|

looking for banker to refinance, please pm me thanks you.

|

|

|

|

|

Jul 9 2015, 10:01 PM

Jul 9 2015, 10:01 PM

Quote

Quote

0.0510sec

0.0510sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled