QUOTE(rocketm @ Jul 14 2020, 04:50 PM)

Thank you for your reply.

We should not rely on those point in time based return, however, I notice that it is commonly use in mutual fund, mmf,... etc.

In this case, what are the indicators that we should look for to determine whether the ETF is performing well? Is it a wise ethod to check the performance of the majority stocks underlying this ETF?

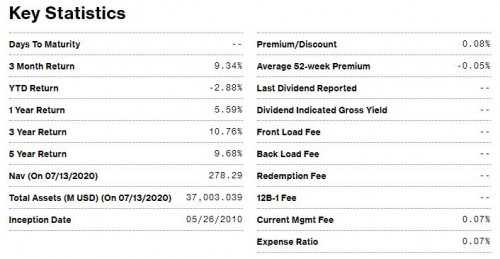

10 or 5 year average should be a good estimate.

Alternatively, you can take the data and calculate the return you would get had you invest a small amount everyday.

Popular index like S&P500 is known to generate around 4.8% p.a. consistently for 40 years.

QUOTE(rocketm @ Jul 14 2020, 04:50 PM)

Regarding liquidity, what is your advise?

You shouldn't be too worried if you invest less than 10000 units.

QUOTE(rocketm @ Jul 14 2020, 04:50 PM)

I am thinking, if we are buying foreign ETF by ourself, since all dividend generated from it will incur withholding tax then we shuld invest in Ireland issued ETF since it is the lowest tax to foreigner. Do you agree?

Irish domiciled ETFs are preferred but do check whether if there are any hidden taxes in future.

Jul 4 2020, 01:08 PM

Jul 4 2020, 01:08 PM

Quote

Quote

0.0179sec

0.0179sec

0.53

0.53

6 queries

6 queries

GZIP Disabled

GZIP Disabled