Outline ·

[ Standard ] ·

Linear+

All about ETFs / Foreign Brokers, Exchange traded funds

|

simplylegendary

|

May 2 2020, 09:04 PM May 2 2020, 09:04 PM

|

Getting Started

|

QUOTE(Ramjade @ May 2 2020, 08:57 PM) Yes. Find for alternative for Irish domiciled etf listed on LSE. You are taxxed 15% only. How to find? First find the index which the etf tracks. 2nd google the index name with Irish domiciled (eg S&P 500 etf irish domiciled) Third don;t use iOCBC. You are being charged extra dividend charges, very high commision. Thanks! What's a "extra dividend charges" ? |

|

|

|

|

|

simplylegendary

|

May 2 2020, 09:04 PM May 2 2020, 09:04 PM

|

Getting Started

|

QUOTE(Sumofwhich @ May 2 2020, 08:54 PM) I can only answer #2, yes 30% is only the dividend withheld, same goes for US stocks Thanks! Appreciate. |

|

|

|

|

|

Ramjade

|

May 2 2020, 09:26 PM May 2 2020, 09:26 PM

|

|

QUOTE(simplylegendary @ May 2 2020, 09:04 PM) Thanks! What's a "extra dividend charges" ? QUOTE Cash dividend

1% on net dividend (min S$3, max S$50)

7% GST or equivalent depending on payment currency QUOTE Foreign custodian fees

S$2 per counter (per month) This post has been edited by Ramjade: May 2 2020, 09:27 PM |

|

|

|

|

|

zenquix

|

May 2 2020, 10:00 PM May 2 2020, 10:00 PM

|

|

QUOTE(simplylegendary @ May 2 2020, 08:52 PM) Hi, this question probably have been asked to death, but here goes. I always bought four US-domiciled ETFs through Dollar Cost Averaging. They are VOO, VTI, IWF and VNQ. Lately I just realized that my dividends are withheld 30%. I have questions below 1) Is there any offshore/overseas equivalent ETFs that I should buy over their US equivalent 2) It's the dividend that they withhold but not the capital gain right? I buy them through Singapore's brokerage iOCBC, if that's any help, since I work and live there nowadays even though not PR and not Sg citizen. this thread will help with 1) https://forum.lowyat.net/topic/4744515/This post has been edited by zenquix: May 2 2020, 10:00 PM |

|

|

|

|

|

tadashi987

|

May 3 2020, 12:08 AM May 3 2020, 12:08 AM

|

|

QUOTE(simplylegendary @ May 2 2020, 08:52 PM) Hi, this question probably have been asked to death, but here goes. I always bought four US-domiciled ETFs through Dollar Cost Averaging. They are VOO, VTI, IWF and VNQ. Lately I just realized that my dividends are withheld 30%. I have questions below 1) Is there any offshore/overseas equivalent ETFs that I should buy over their US equivalent 2) It's the dividend that they withhold but not the capital gain right? I buy them through Singapore's brokerage iOCBC, if that's any help, since I work and live there nowadays even though not PR and not Sg citizen. for (1) You can use justetf website ETF screener too JustETF ETF Screener |

|

|

|

|

|

tadashi987

|

May 23 2020, 10:53 AM May 23 2020, 10:53 AM

|

|

just realized that nowadays ETF has long expanded to kinds of active management like mutual funds in US there are active managed ETF like ARK series etc, thou the structure is different compared to mutual funds. https://wealthtender.com/insights/investing...vs-mutual-fund/This post has been edited by tadashi987: May 23 2020, 10:54 AM |

|

|

|

|

|

sl3ge

|

May 25 2020, 03:28 PM May 25 2020, 03:28 PM

|

|

Hi,

Anyone using Firstrade?

is it good..

|

|

|

|

|

|

tadashi987

|

May 25 2020, 04:12 PM May 25 2020, 04:12 PM

|

|

QUOTE(sl3ge @ May 25 2020, 03:28 PM) Hi, Anyone using Firstrade? is it good.. opened an account before I would the drawback of all these no commission brokers are the funding part which u need to do TT to their oversea bank. (unlike TradeStation Global which u can fund through SG bank) TT aint cheap |

|

|

|

|

|

mapeyeo1

|

May 27 2020, 07:28 PM May 27 2020, 07:28 PM

|

Getting Started

|

Hi, if I were to trade Hong Kong stocks, which brokerage firm with low or nil brokerage fees should i go to? I asked maybank earlier, the remisier said its HKD 150 or 0.4%, whichever is higher, for me the fees are high.

|

|

|

|

|

|

ProxMatoR

|

May 27 2020, 08:45 PM May 27 2020, 08:45 PM

|

|

QUOTE(mapeyeo1 @ May 27 2020, 07:28 PM) Hi, if I were to trade Hong Kong stocks, which brokerage firm with low or nil brokerage fees should i go to? I asked maybank earlier, the remisier said its HKD 150 or 0.4%, whichever is higher, for me the fees are high. I was using TSG white label IB. i think someone mentioned before FSM SG can buy HK stocks too. perhaps you can look into both. |

|

|

|

|

|

rotloi

|

May 28 2020, 05:01 PM May 28 2020, 05:01 PM

|

|

Is stashaway consider etf ?? And mirror the same platform like ib ?? I mean in earning.

|

|

|

|

|

|

Ramjade

|

May 28 2020, 05:35 PM May 28 2020, 05:35 PM

|

|

QUOTE(rotloi @ May 28 2020, 05:01 PM) Is stashaway consider etf ?? And mirror the same platform like ib ?? I mean in earning. Yes and no. Yes because it only invest in etf. No because it's basically you pay someone to buy etf for you and that someone will try to predict market based available data. |

|

|

|

|

|

michaelangelo

|

Jun 4 2020, 01:06 AM Jun 4 2020, 01:06 AM

|

Getting Started

|

did tradestation global increase the commission fee?last month i traded with USD1 commission but this month it has increased to USD1.50 per trade.

Last month i also got hit with USD0.35 commission fee. Dont know how they derived that

|

|

|

|

|

|

SUSMNet

|

Jun 4 2020, 08:36 AM Jun 4 2020, 08:36 AM

|

|

Its $1.5 for TSG

|

|

|

|

|

|

alexkos

|

Jun 23 2020, 11:15 AM Jun 23 2020, 11:15 AM

|

|

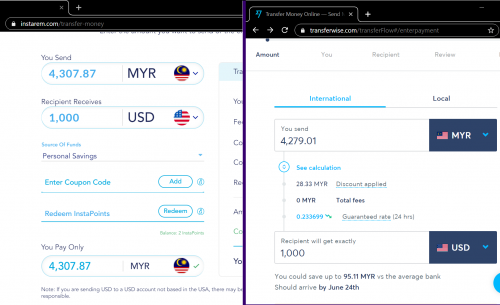

QUOTE(alexkos @ Jan 8 2020, 06:58 PM) Reporting to mothership. Sp500 diy thread garnered 36 pages of attention. Special thanks to many sifu here who help with questions on sp500 thread. As an appreciation, I have a paid online survey only for those who are currently invested passively (you are qualified as long as you deem yourself a passive rather than active investor). Thank u and semua Mali ong 2020! hehe, second round of paid survey coming soon  only for those who have not participated the first time ya..... i find that the best way to buy usa etf is still via irish domiciled, IBKR, via instarem myr-eur route. |

|

|

|

|

|

SUSwendygoh

|

Jun 23 2020, 12:23 PM Jun 23 2020, 12:23 PM

|

Getting Started

|

QUOTE(alexkos @ Jun 23 2020, 11:15 AM) hehe, second round of paid survey coming soon  only for those who have not participated the first time ya..... i find that the best way to buy usa etf is still via irish domiciled, IBKR, via instarem myr-eur route. why not using transferwise route? transferwise cost higher than intarem? |

|

|

|

|

|

alexkos

|

Jun 23 2020, 02:05 PM Jun 23 2020, 02:05 PM

|

|

QUOTE(wendygoh @ Jun 23 2020, 12:23 PM) why not using transferwise route? transferwise cost higher than intarem? Instarem cheaper yo |

|

|

|

|

|

nguminhuang P

|

Jun 23 2020, 02:10 PM Jun 23 2020, 02:10 PM

|

New Member

|

means i dun need singapore bank account ?

Gonna register instarem and IBKR then.

|

|

|

|

|

|

pigscanfly

|

Jun 28 2020, 06:24 PM Jun 28 2020, 06:24 PM

|

Getting Started

|

Hi. Can anyone recommend a good performing Global Technology ETF? Are there any ETFs that tracks the MSCI World Information Technology Index? Apparently the MSCI World Information Technology Index can outperform S&P 500.

I discovered that Franklin Technology Fund (unit trust) uses the MSCI World Information Technology Index as it's benchmark. But I prefer investing in ETF, since the Franklin Technology fund doesn't really outperform it's benchmark.

|

|

|

|

|

May 2 2020, 09:04 PM

May 2 2020, 09:04 PM

Quote

Quote

0.0305sec

0.0305sec

1.38

1.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled