QUOTE(Yggdrasil @ Jul 14 2020, 04:48 PM)

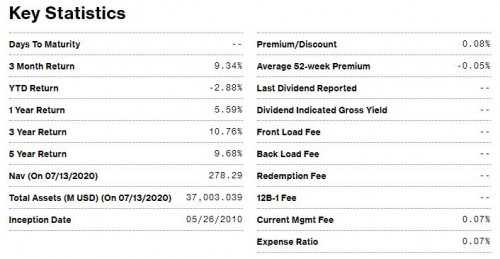

Returns calculated are based "point in time" which may be misleading.

Let's say the ETF price today is $110. Price 1 year ago is $100.

However, the price 3 months ago was $105 because people panic sell but it recovered almost immediately.

The returns will be:

1 year: 10% (110/100)-1

3 month: 19.05% [(110/105)-1] x 12/3

Thank you for your reply.

We should not rely on those point in time based return, however, I notice that it is commonly use in mutual fund, mmf,... etc.

In this case, what are the indicators that we should look for to determine whether the ETF is performing well? Is it a wise ethod to check the performance of the majority stocks underlying this ETF?

Regarding liquidity, what is your advise?

I am thinking, if we are buying foreign ETF by ourself, since all dividend generated from it will incur withholding tax then we shuld invest in Ireland issued ETF since it is the lowest tax to foreigner. Do you agree?

Jul 14 2020, 02:30 PM

Jul 14 2020, 02:30 PM

Quote

Quote

0.0824sec

0.0824sec

0.89

0.89

7 queries

7 queries

GZIP Disabled

GZIP Disabled