Once I open SG bank account, I send money to Tradestation Singapore bank account correct? No need TT?

But what if I want to buy US stocks, need to convert SGD to MYR again?

If yes then before I can invest, I lost 1% already.

All about ETFs / Foreign Brokers, Exchange traded funds

|

|

Oct 30 2019, 02:31 AM Oct 30 2019, 02:31 AM

Return to original view | Post

#1

|

Senior Member

2,210 posts Joined: Jan 2018 |

I am planning to open Tradestation Global account.

Once I open SG bank account, I send money to Tradestation Singapore bank account correct? No need TT? But what if I want to buy US stocks, need to convert SGD to MYR again? If yes then before I can invest, I lost 1% already. |

|

|

|

|

|

Oct 30 2019, 12:22 PM Oct 30 2019, 12:22 PM

Return to original view | Post

#2

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

Mar 29 2020, 01:05 AM Mar 29 2020, 01:05 AM

Return to original view | Post

#3

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(Icehart @ Mar 28 2020, 06:36 PM) Guys need a confirmation from the veterans here. No hidden costs. The only catch is if you buy on margin, IBKR is 2.5% p.a. cheaperI'm planning to open an IB account for dividend stocks from US. I've opened an account with IBKR but found out they have this $10 inactive fee unless your net value stocks are more than $100k. Thanks to Ramjade, I was introduced to Tradestation. It seems promising, a front for the similar backend of IBKR with low fees and no inactivity fee (This one very important!). Any hidden cost that I should know? Lastly, what an exciting time to pick up some good dividend-paying stocks at this time. |

|

|

Apr 16 2020, 03:18 PM Apr 16 2020, 03:18 PM

Return to original view | Post

#4

|

Senior Member

2,210 posts Joined: Jan 2018 |

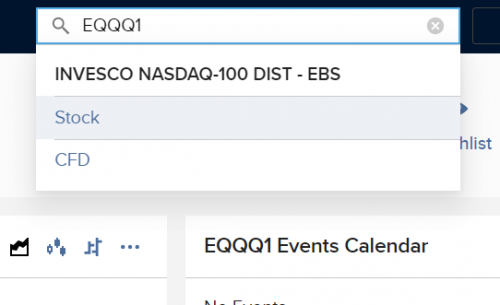

QUOTE(tadashi987 @ Apr 16 2020, 03:05 PM) Sorry to spam same question through different threads, just wanna try my luck in case any sifu from here can help Use IBKR app/client to trade. Don't use browser or TradeStation Global's website.Hi guys would like to enquire, i found out that some ETF are available in an exchange (checking through IB ETF list in the exchange), but through TradeStation Global, i can't find the ETF in that exchange but it is only available in another exchange, why is this so? Is it because TradeStation Global doesn't offer to trade that ETF in that particular exchange, even though it is offered by IB? Example: EQQQ1 is shown to be available through LSE ETF LIST, checking through IB website https://ndcdyn.interactivebrokers.com/en/in...567&exch=lseetf  However, when search through TradeStation Global web client portal, it is not available but only offered through another exchange which is SIX SWISSS EBS  Edit: Make sure you have permission to trade all stocks. You can buy in other exchange. This post has been edited by Yggdrasil: Apr 16 2020, 03:24 PM |

|

|

Apr 16 2020, 03:24 PM Apr 16 2020, 03:24 PM

Return to original view | Post

#5

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

Apr 16 2020, 03:38 PM Apr 16 2020, 03:38 PM

Return to original view | Post

#6

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

|

|

|

Apr 17 2020, 10:40 AM Apr 17 2020, 10:40 AM

Return to original view | Post

#7

|

Senior Member

2,210 posts Joined: Jan 2018 |

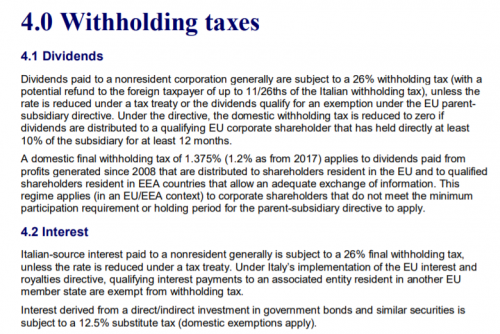

QUOTE(tadashi987 @ Apr 16 2020, 07:54 PM) BVME ETF withholdings tax Have you found the answer? I can't seem to find the ETF using another account. Weird.https://ibkr.info/article/2091 Maybe I will go with LSE thou it is traded in GPx because it seems the BVMR has this withholdings tax which I tried to do research and still remain vague, not sure if non Italian resident would being charged Edit: Whoops I forgot that EQQQ.MI is EQQQ INVESCO NASDAQ-100 DIST BVME.ETF BVME is Milan Exchange. This post has been edited by Yggdrasil: Apr 17 2020, 10:53 AM |

|

|

Apr 17 2020, 11:54 AM Apr 17 2020, 11:54 AM

Return to original view | Post

#8

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(tadashi987 @ Apr 17 2020, 11:43 AM) Some info i can get online Italy doesn't change anymore WHT.Page 23  I think the leveling is at such that LEVEL1: EQQQ underlying US-based company pays dividend, US treaty with ireland-domiciled fund e.g. EQQQ -> Charge 15% LEVEL2: EQQQ listed in Italy BVME, for the remaining 15% of the dividend, does Italy Exchange charges witholdings tax? Italy’s New Capital Gains Tax Regime for Nonresident Companies Italian regulations on capital gain taxes So in the end, after reading all these, i just felt it is getting more and more complicated for us to confirm on how Italy define "qualified" for witholdings tax on BVME listed Irish-domiciled ETF. Personally feel Italy tax system is as on par with US's ones which is foreign investment unfriendly. I wasn't taxed beyond that. BVME is EQQQ.MI because it's Italy Exchange in Milan. Btw the link you put is for companies not us. I don't think there is capital gains tax too because it's not an Italian stock. This post has been edited by Yggdrasil: Apr 17 2020, 11:55 AM |

|

|

Jun 28 2020, 06:37 PM Jun 28 2020, 06:37 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

Jun 29 2020, 12:49 AM Jun 29 2020, 12:49 AM

Return to original view | IPv6 | Post

#10

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(pigscanfly @ Jun 29 2020, 12:29 AM) Very interesting Ramjade. I need to do more research on QQQ (NASDAQ) and iShares S&P 500 Information Technology Sector. If you want pure tech in US, you can consider VGT (Vanguard Information Technology ETF).I was hoping SGX offers technology sector ETFs. Unfortunately, there are none in SGX. I rather buy ETF/stocks in Singapore, as I have a local broker there. Note that it's highly volatile despite having 500+ constituents. Then, again, high risk, high return. This ETF is usually enough for diversification because they have operations internationally. E.g. Microsoft, Apple, Adobe all sell their products overseas. |

|

|

Jun 29 2020, 01:52 AM Jun 29 2020, 01:52 AM

Return to original view | IPv6 | Post

#11

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

Jun 29 2020, 11:02 AM Jun 29 2020, 11:02 AM

Return to original view | Post

#12

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

Jun 29 2020, 11:38 PM Jun 29 2020, 11:38 PM

Return to original view | Post

#13

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(dynames41 @ Jun 29 2020, 11:31 PM) Right now I'm trying to open a TS Global account but somehow stuck in terms of providing a valid ID (one that lists your DOB). Apparently my driving license and NRIC doesn't count as they do not display the DOB (tried explaining to them that my DOB is in the IC number itself but, yeah no comment from them). This happened to me. They don't believe or understand whatever you say about IC.Hence, only a passport would do. Mine has just expired in April this year, & if I can help it, I don't want to make a new one right now. Not mistaken, passport is required to verify identity as international investor. IC can only be used to verify address. You can try your luck with birth cert. |

|

|

|

|

|

Jul 14 2020, 03:48 PM Jul 14 2020, 03:48 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

2,210 posts Joined: Jan 2018 |

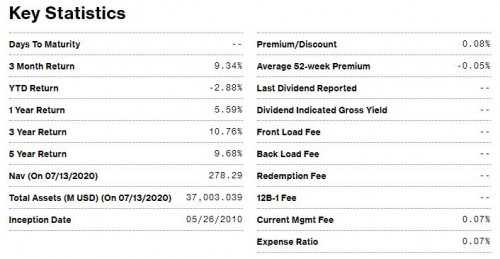

QUOTE(rocketm @ Jul 14 2020, 02:30 PM) This is the info from an Ireland etf. Returns calculated are based "point in time" which may be misleading.May I know why the reported 3 month return is higher than the 1 year return? Does it mean that we should invest less or about 3 months then sell this ETF? Same thing goes to 3 years vs 5 years.  Let's say the ETF price today is $110. Price 1 year ago is $100. However, the price 3 months ago was $105 because people panic sell but it recovered almost immediately. The returns will be: 1 year: 10% (110/100)-1 3 month: 19.05% [(110/105)-1] x 12/3 |

|

|

Jul 14 2020, 05:38 PM Jul 14 2020, 05:38 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(rocketm @ Jul 14 2020, 04:50 PM) Thank you for your reply. 10 or 5 year average should be a good estimate.We should not rely on those point in time based return, however, I notice that it is commonly use in mutual fund, mmf,... etc. In this case, what are the indicators that we should look for to determine whether the ETF is performing well? Is it a wise ethod to check the performance of the majority stocks underlying this ETF? Alternatively, you can take the data and calculate the return you would get had you invest a small amount everyday. Popular index like S&P500 is known to generate around 4.8% p.a. consistently for 40 years. QUOTE(rocketm @ Jul 14 2020, 04:50 PM) You shouldn't be too worried if you invest less than 10000 units.QUOTE(rocketm @ Jul 14 2020, 04:50 PM) I am thinking, if we are buying foreign ETF by ourself, since all dividend generated from it will incur withholding tax then we shuld invest in Ireland issued ETF since it is the lowest tax to foreigner. Do you agree? Irish domiciled ETFs are preferred but do check whether if there are any hidden taxes in future. |

|

|

Jul 29 2020, 11:54 PM Jul 29 2020, 11:54 PM

Return to original view | Post

#16

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

Aug 26 2020, 04:30 PM Aug 26 2020, 04:30 PM

Return to original view | Post

#17

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(edwin1002 @ Aug 26 2020, 04:23 PM) Anyone have the step of open account IBKR? It's USD10 per month minimum (reduced by commissions) if you put in more money, this monthly fee is waived.I heard that IBKR must trade few transactions every month if not it will charge USD1 per month? Then normal broker like maybank is USD25, altough expensive but they solve all problem to us such like withdraw money or write letter. Do you all still more prefer open account IBKR? If you don't want this monthly charge, you can register under for IBKR under Tradestation Global. This one no monthly fee but there's a fall below fee if balance <$1000 |

|

|

Aug 31 2020, 03:58 PM Aug 31 2020, 03:58 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

2,210 posts Joined: Jan 2018 |

|

|

|

Sep 4 2020, 12:23 AM Sep 4 2020, 12:23 AM

Return to original view | IPv6 | Post

#19

|

||||||||||||||||||||||||||||||||||||

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(pigscanfly @ Sep 3 2020, 11:08 PM) Does the currency even matter? Any advantages to hold USD over EUR or GBP? As a Malaysian investor, none of these are my secondary currencies, and I have no preference. The Vanguard FTSE All-World ETF holds a basket of securities (over 3000) across 50 markets in various currencies. Currency only matters if you plan to lump sum without DCA and matters when you exit.If a US stock is priced in EUR, it will give you the same return in MYR terms as compared to USD. Example: You have RM1,000 to invest today.

Since we know the USD/EUR exchange rate, the European equivalent of QQQ (which is EQQQ) will be EUR180 ($200 x 0.9). Now, let's compare investing in US ($200) vs EUR equivalent (EUR180). The amount of units you get:

You can see that both gives you the same amount of units but they are quoted in different prices/currency. Now let's say after 1 year, QQQ rises 10%. EUR appreciated against USD. Now it's

EQQQ will be EUR187 ($220 x 0.85). You bought same amount of units so your portfolio value will be:

Now, let's convert back to MYR to see how much we actually made. Note that USD/MYR did not change.

Notice that investing in either EQQQ or QQQ gives us the same return in MYR terms as long as USD/MYR rate does not change. Your returns only change if USD/MYR changes. Meaning if you bought US ETF when MYR was weak and sold when MYR is strong, you lose a due to exchange rate (suppose ETF did not change). However, if you bought US ETF when MYR was strong and sold when MYR was weak, you gain due to exchange rate (suppose ETF did not change). However, this currency fluctuation tends to be around 10% only. If you lump sum RM30,000 today and in 10 years it's RM60,000 (a 100% return), you can expect to either make 110% return or 90% return after converting back to MYR. pigscanfly and Ramjade liked this post

|

||||||||||||||||||||||||||||||||||||

|

|

Sep 4 2020, 01:16 AM Sep 4 2020, 01:16 AM

Return to original view | IPv6 | Post

#20

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(pigscanfly @ Sep 3 2020, 11:08 PM) I agree the average volumes for the distributing classes are much higher. Both VWRD (USD) and VWRL (GBP) listed on LSE have average daily volumes of 49k each. Daily volume is not really important. Calculate how much value flows instead. Example: If 49,000 units done daily and price is EUR81 per unit, that's RM19,500,000 worth of stocks daily. Meanwhile you only plan to invest RM30,000 which is 0.15% of the total flow. If an ETF is delisted, you will likely be notified. You either sell before they liquidate or wait for them to liquidate the stocks and give you the remaining NAV. IMO, it's more important that you choose the ETF that gives you the higher expected return than obsessing with liquidity/currency issues. Choosing a shit ETF will give you shit returns even if you have the best liquidity/currency rate. But then again, no one can predict the future. Also, beware of expense fees. Unpopular ETFs tend to have higher expense fees. IMO, anything above 0.25% p.a. is high. |

| Change to: |  0.1303sec 0.1303sec

0.65 0.65

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 03:03 PM |