Gold high this morning was $3,920.60

This post has been edited by prophetjul: Oct 6 2025, 08:42 AM

Gold Investment Corner V8, All About Gold

Gold Investment Corner V8, All About Gold

|

|

Oct 6 2025, 08:41 AM Oct 6 2025, 08:41 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

Gold high this morning was $3,920.60 This post has been edited by prophetjul: Oct 6 2025, 08:42 AM romuluz777 liked this post

|

|

|

|

|

|

Oct 6 2025, 09:02 AM Oct 6 2025, 09:02 AM

Show posts by this member only | IPv6 | Post

#5902

|

Senior Member

2,215 posts Joined: Oct 2010 |

|

|

|

Oct 6 2025, 10:45 AM Oct 6 2025, 10:45 AM

Show posts by this member only | IPv6 | Post

#5903

|

Senior Member

4,717 posts Joined: Jan 2003 |

|

|

|

Oct 6 2025, 10:49 AM Oct 6 2025, 10:49 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(kevyeoh @ Oct 6 2025, 10:45 AM) bro...i have bought gold long time ago and glad I bought it... Normally, i wlll wait for a correction.but now...it's at ATH....can still continue buy? having second thoughts now buying at ATH... But with gold, one never knows when correction will happen. No. I don't know. |

|

|

Oct 6 2025, 11:58 AM Oct 6 2025, 11:58 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

GOLD $3930/oz; RM532.50/g SILVER $48.55/oz; RM6.57/g RM4.214/$; DXY 98.06 happy or not?! This post has been edited by AVFAN: Oct 6 2025, 12:00 PM chewysoon82, azlim, and 2 others liked this post

|

|

|

Oct 6 2025, 01:40 PM Oct 6 2025, 01:40 PM

Show posts by this member only | IPv6 | Post

#5906

|

Junior Member

431 posts Joined: Apr 2010 |

QUOTE(kevyeoh @ Oct 6 2025, 10:45 AM) bro...i have bought gold long time ago and glad I bought it... buy but split your capital.. DCAbut now...it's at ATH....can still continue buy? having second thoughts now buying at ATH... kevyeoh liked this post

|

|

|

|

|

|

Oct 6 2025, 02:32 PM Oct 6 2025, 02:32 PM

|

Senior Member

1,979 posts Joined: Jan 2003 From: Kuala Lumpur |

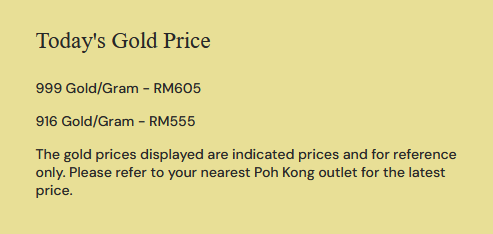

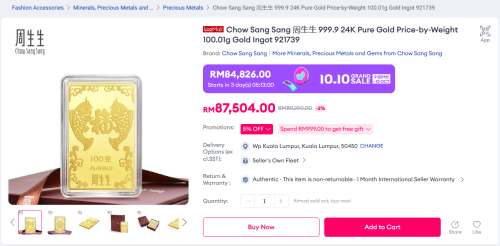

QUOTE(prophetjul @ Oct 6 2025, 08:41 AM) Jewellery shop spread high and selling way above spot price.Spot around RM530 per gram, Poh Kong is RM605 as of today  Other jewellery shop RM874 per gram  QUOTE(kevyeoh @ Oct 6 2025, 10:45 AM) bro...i have bought gold long time ago and glad I bought it... Buy during a market dip/correction and dollar cost average over time.but now...it's at ATH....can still continue buy? having second thoughts now buying at ATH... Deepavali just around the corner, higher seasonal demand. This post has been edited by aaronpang: Oct 6 2025, 02:50 PM kevyeoh liked this post

|

|

|

Oct 6 2025, 04:10 PM Oct 6 2025, 04:10 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

new record high for gold.

GOLD $3946/oz; RM535/g silver last high was $49 in 2011 SILVER $48.74/oz; RM6.61/g RM4.216/$; DXY 98.42 |

|

|

Oct 6 2025, 04:31 PM Oct 6 2025, 04:31 PM

Show posts by this member only | IPv6 | Post

#5909

|

Senior Member

2,361 posts Joined: Feb 2008 |

this gold macam property...the earlier you born. the better you can collect.

younger generation GG ady. |

|

|

Oct 6 2025, 05:05 PM Oct 6 2025, 05:05 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(BboyDora @ Oct 6 2025, 04:31 PM) this gold macam property...the earlier you born. the better you can collect. the timeline is very long.younger generation GG ady. post ww2 and bretton woods, there's been only 3 major gold bull runs. the previous ones were triggered by nixon abandoning the gold std in 1971, and 2008 financial crisis. we're in the 3rd one now triggered by taco tariffs, $ weaponization leading to de$, central banks stocking gold again. in between these cycles, gold price keep dropping for years if not decades - not many have the stomach to hold gold which has no yield. while gold price is at ATH, most experts say it's still early in the cycle, the bull may run for anther 3-5 years. so, it's all about your own judgement & appetite for long term holding. what's coming up next? likely more fed rate cuts, quantitative easing. USA gold revaluation? "gold QE"? china gold backed digital yuan for BRICS? some global monetary reset? no readily available answers, but it's good to hear what some of the well known gold analysts & gurus say on youtube. my favs are andy schetman, peter schiff, michael oliver, gary wagner, andrew macguire. one thing i can say about them - they all tell you silver is about to explode! This post has been edited by AVFAN: Oct 6 2025, 05:38 PM devilmaycry9 liked this post

|

|

|

Oct 6 2025, 11:02 PM Oct 6 2025, 11:02 PM

Show posts by this member only | IPv6 | Post

#5911

|

Senior Member

4,717 posts Joined: Jan 2003 |

yeah...you brought up a good point...there were long periods when gold price either stagnant or even went down...

but luckily for me I just buy with the mindset of keeping it forever unless i really need to use it as money... QUOTE(AVFAN @ Oct 6 2025, 05:05 PM) the timeline is very long. post ww2 and bretton woods, there's been only 3 major gold bull runs. the previous ones were triggered by nixon abandoning the gold std in 1971, and 2008 financial crisis. we're in the 3rd one now triggered by taco tariffs, $ weaponization leading to de$, central banks stocking gold again. in between these cycles, gold price keep dropping for years if not decades - not many have the stomach to hold gold which has no yield. while gold price is at ATH, most experts say it's still early in the cycle, the bull may run for anther 3-5 years. so, it's all about your own judgement & appetite for long term holding. what's coming up next? likely more fed rate cuts, quantitative easing. USA gold revaluation? "gold QE"? china gold backed digital yuan for BRICS? some global monetary reset? no readily available answers, but it's good to hear what some of the well known gold analysts & gurus say on youtube. my favs are andy schetman, peter schiff, michael oliver, gary wagner, andrew macguire. one thing i can say about them - they all tell you silver is about to explode! |

|

|

Oct 7 2025, 06:24 AM Oct 7 2025, 06:24 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

We see $3,973.60 high this morning.

$3,977.10 now This post has been edited by prophetjul: Oct 7 2025, 06:32 AM |

|

|

Oct 7 2025, 07:08 AM Oct 7 2025, 07:08 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(kevyeoh @ Oct 6 2025, 11:02 PM) yeah...you brought up a good point...there were long periods when gold price either stagnant or even went down... right, e.g. the period 2011-2016 saw gold price dropped 35% or so.but luckily for me I just buy with the mindset of keeping it forever unless i really need to use it as money... not many held on to their gold then, physical or otherwise. personally, i take e-gold, ETFs as short-mid term play; physical for long/v long term hold. HOT FROM THE PRESS: Funding bill falls short again in Senate, extending government shutdown https://www.cnbc.com/2025/10/06/government-...ouse-trump.html |

|

|

|

|

|

Oct 7 2025, 07:13 AM Oct 7 2025, 07:13 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

Oct 7 2025, 09:27 AM Oct 7 2025, 09:27 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

As of early October 2025, there is strong evidence suggesting a significant

squeeze in the silver market, while analysts also indicate a potential, though less acute, short squeeze dynamic in gold. Silver market squeeze The silver market is experiencing a powerful squeeze driven by a combination of tight physical supply, persistent demand, and market factors. This has propelled the price of silver to multi-year highs and near record levels. Key indicators of the silver squeeze include: Physical supply deficits: The Silver Institute projected a fifth straight year of supply deficits for 2025, meaning demand continues to outstrip mine production. Depleted inventories: Stockpiles held by the London Bullion Market Association (LBMA), the most important wholesale market for precious metals, have fallen to " critically low" levels. Surging borrowing costs: The interest rate charged to borrow physical silver, known as lease rates, has risen to " extreme levels," signaling acute scarcity in the market. Explosive demand: Industrial demand from the green energy sector (solar panels, EVs) and technology, along with increased safe-haven investment, has driven up buying. Investor positioning: Significant capital inflows into silver ETFs and growing institutional short interest have created the conditions for a potential short squeeze, where a rapid price increase forces short sellers to buy, further accelerating the rally. Gold market dynamics While silver' s situation is described as a " potent squeeze mode," gold is also experiencing upward price pressure due to factors that include a potential short squeeze dynamic. However, the dynamics are somewhat different because gold' s market is much larger, making it less susceptible to the acute physical squeeze seen in silver. Factors contributing to gold' s situation include: A " paper gold" bubble: Some analysts argue that a massive amount of " paper gold" (derivatives and futures contracts) has been sold over many years, creating an artificial imbalance with the limited physical supply. Central bank buying and repatriation: Central banks have been net buyers of gold for years and have been repatriating reserves. This adds a layer of stress to the heavily shorted paper market as real physical metal becomes scarcer. Short covering: The persistent rise in gold prices has led some to believe that large bullion banks, which have held significant short positions, are being forced to cover their bets. This creates a short squeeze dynamic that drives prices higher. Safe-haven demand: Broad-based safe-haven demand due to global economic volatility, coupled with central bank easing expectations, has pushed gold to record nominal highs. Market implications The situation has led to significant market activity: In early October 2025, gold and silver are trading near or at record highs, with silver' s percentage gains for the year significantly outpacing gold' s. The disconnect between the physical market and the derivatives market has become a major point of discussion, with some arguing that silver' s true value is being suppressed by " paper" trading. For investors, the potential for a continued short squeeze means that holding physical metal is a way to hedge against the risks of the paper market and potentially benefit from future price appreciation. |

|

|

Oct 7 2025, 09:48 AM Oct 7 2025, 09:48 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

the above describes current gold & silver market dynamics very well.

in addition, most analysts say the RETAIL segment of the precious metals market is not moving yet. that is, the common person hasn't been buying, largely due to the media keeping a lid on some the news mentioned above. why? becos if a lot more people buy & hoard physical gold, the $ will decline even faster which is something the US gomen doesn't want. but slowly, it's happening. institutional funds and v wealthy individuals are now buying. this may be followed by the masses. fiat currencies fast losing purchasing power is real. the need to protect & preserve wealth is just as real. UBS just raised forecast: "We see both fundamental and momentum-based reasons for gold to rally further, and now expect bullion to reach $4,200/oz by the end of this year," UBS said in a note. https://www.reuters.com/world/india/gold-sa...ids-2025-10-06/ |

|

|

Oct 7 2025, 06:08 PM Oct 7 2025, 06:08 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

for SILVER stackers:

Physical Silver and Gold Shortage Pointing to Loss of Faith and Confidence in the System. https://www.youtube.com/watch?v=iIfycwMh3DU silver spot $48.38, futures $48.17 = Backwardation. Silver Bullion in kelana jaya has no more silver bullion in stock, there's still some 2.5g in penang and ipoh! https://www.silverbullion.com.my/Shop/Buy/Silver_Bars |

|

|

Oct 8 2025, 07:31 AM Oct 8 2025, 07:31 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

We see $3,993.20 high this morning. Update: $4,000 was hit. This post has been edited by prophetjul: Oct 8 2025, 08:43 AM romuluz777 liked this post

|

|

|

Oct 8 2025, 07:53 AM Oct 8 2025, 07:53 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

Gold $3995/oz; RM541.50/g.

RM4.2145/$; DXY 98.60. i had thought 4000 would come tmr when china markets resume. looks like we'll get there today. the concern we should have is such gold price rise can only mean either the world is fast losing trust in fiat currencies or hyperinflation is coming or both. This post has been edited by AVFAN: Oct 8 2025, 07:54 AM |

|

|

Oct 8 2025, 10:08 AM Oct 8 2025, 10:08 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

mark this day and time!

Spot Gold $4,000/oz, RM543/g RM4.225/$; DXY 98.883 |

| Change to: |  0.0192sec 0.0192sec

0.39 0.39

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 03:29 PM |