QUOTE(wengherng @ Feb 8 2017, 12:46 AM)

Yes, only limited branches currently.

Good for you then. You obviously know the industry much better than I do, where to buy and sell.

I am only speaking from a layman point of view, where we buy and sell from goldsmith/jeweler shops like Poh Kong, etc.

They made it very clear to me that if the gold piece is removed from the plastic casing and there are any damages/scratches on the gold itself, there would be a certain percentage taken off from the listed buy price.

Several different shops gave me the same caution.

Depends if there's deep gauges or chips, buyers might knock down the price because it weighs less. Good for you then. You obviously know the industry much better than I do, where to buy and sell.

I am only speaking from a layman point of view, where we buy and sell from goldsmith/jeweler shops like Poh Kong, etc.

They made it very clear to me that if the gold piece is removed from the plastic casing and there are any damages/scratches on the gold itself, there would be a certain percentage taken off from the listed buy price.

Several different shops gave me the same caution.

Troublesome to resell open packages, others might not want open package due to tampering fears.

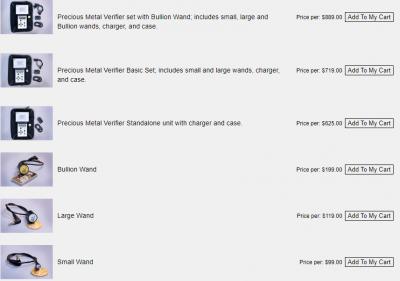

There's fake PAMP bars floating so it's understandable buyers don't want to go through the trouble.

QUOTE(zamans98 @ Feb 8 2017, 02:17 AM)

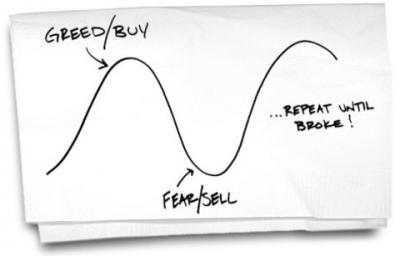

Those leeches just wanna earn fast bucks. I never trade with leeches.

Gold is gold, in the case of jewellery, u can liquidate it and remake into new piece. 24K is rare jewellery, as it can break easily.

For gold bar, there are few reputable company that buy it, even it's already open case, as long u supply the certificate.

Stay away from Poh Kong and bastards.

Agree stay away from Goldsmith shops Pong Kong etc kutuk consumers bloody high spread Gold is gold, in the case of jewellery, u can liquidate it and remake into new piece. 24K is rare jewellery, as it can break easily.

For gold bar, there are few reputable company that buy it, even it's already open case, as long u supply the certificate.

Stay away from Poh Kong and bastards.

Feb 13 2017, 01:55 PM

Feb 13 2017, 01:55 PM

Quote

Quote

0.1021sec

0.1021sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled