QUOTE(sandkoh @ Sep 22 2014, 07:07 PM)

nahhttp://www.wisegeek.com/what-is-plastic-resin.htm

Fixed Deposit Rates in Malaysia V7, Please Read Post# 1 & 2

|

|

Sep 22 2014, 07:32 PM Sep 22 2014, 07:32 PM

|

All Stars

48,446 posts Joined: Sep 2014 From: REality |

|

|

|

|

|

|

Sep 22 2014, 07:47 PM Sep 22 2014, 07:47 PM

|

All Stars

26,524 posts Joined: Jan 2003 |

QUOTE(BoomChaCha @ Sep 22 2014, 06:46 PM) As you wish, SCB has extended the FD promo until 31 October 2014: wah, this is real good news. this time no need to open CASA ? not stated at the terms anymore This time SCB want to hit RM 500 Million target.. https://www.sc.com/my/campaign/special-rate-td/ (can meet the lenglui again This post has been edited by Human Nature: Sep 22 2014, 08:18 PM |

|

|

Sep 22 2014, 08:10 PM Sep 22 2014, 08:10 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(Human Nature @ Sep 22 2014, 07:47 PM) wah, this is real good news. this time no need to open CASA ? not stated at the terms anymore You are not eyeing the FD rate but eyeing some other lovely things ! (can meet the lenglui again |

|

|

Sep 22 2014, 08:25 PM Sep 22 2014, 08:25 PM

|

Junior Member

163 posts Joined: Apr 2010 |

QUOTE(BoomChaCha @ Sep 22 2014, 06:46 PM) As you wish, SCB has extended the FD promo until 31 October 2014: However, do take note that the 15 months tenure earlier had been revised to 18 months instead.This time SCB want to hit RM 500 Million target.. https://www.sc.com/my/campaign/special-rate-td/ [B]Place a minimum of RM5,000 in fresh funds into a fixed deposit for 18 months and earn 4.25% p.a.[ Tenure 6 months 3.75% p.a. 12 months 4.00% p.a 18 months 4.25% p.a. This post has been edited by nomen: Sep 22 2014, 08:30 PM |

|

|

Sep 22 2014, 08:35 PM Sep 22 2014, 08:35 PM

|

All Stars

26,524 posts Joined: Jan 2003 |

QUOTE(nomen @ Sep 22 2014, 08:25 PM) However, do take note that the 15 months tenure earlier had been revised to 18 months instead. Good catch [B]Place a minimum of RM5,000 in fresh funds into a fixed deposit for 18 months and earn 4.25% p.a.[ Tenure 6 months 3.75% p.a. 12 months 4.00% p.a 18 months 4.25% p.a. 18 m works for me too. |

|

|

Sep 22 2014, 08:42 PM Sep 22 2014, 08:42 PM

|

Junior Member

163 posts Joined: Apr 2010 |

|

|

|

|

|

|

Sep 22 2014, 09:53 PM Sep 22 2014, 09:53 PM

|

Senior Member

1,178 posts Joined: Oct 2005 From: Sunway / Ipoh |

QUOTE(nomen @ Sep 22 2014, 08:25 PM) However, do take note that the 15 months tenure earlier had been revised to 18 months instead. https://www.sc.com/my/campaign/special-rate...ampaign-tnc.pdf[B]Place a minimum of RM5,000 in fresh funds into a fixed deposit for 18 months and earn 4.25% p.a.[ Tenure 6 months 3.75% p.a. 12 months 4.00% p.a 18 months 4.25% p.a. in the PDF it is still stated as 15mth edit: oops, the pdf is old This post has been edited by youliang: Sep 22 2014, 09:54 PM |

|

|

Sep 22 2014, 09:55 PM Sep 22 2014, 09:55 PM

|

All Stars

48,446 posts Joined: Sep 2014 From: REality |

QUOTE(nomen @ Sep 22 2014, 08:25 PM) However, do take note that the 15 months tenure earlier had been revised to 18 months instead. Ha.. to catch & lock-up "cheap" money b4 OPR rate change year end [B]Place a minimum of RM5,000 in fresh funds into a fixed deposit for 18 months and earn 4.25% p.a.[ Tenure 6 months 3.75% p.a. 12 months 4.00% p.a 18 months 4.25% p.a. |

|

|

Sep 22 2014, 10:28 PM Sep 22 2014, 10:28 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(HJebat @ Sep 22 2014, 08:53 AM) Petrol kena GST??? This is what I heard from another forum, but we will find out the truth next month.. QUOTE(HJebat @ Sep 22 2014, 08:53 AM) I think it's best to wait for extra infos during the Budget 2015 presentation. Need to identify which purchases are under GST & which are exempted. After those are identified, you can go on a buying spree that you have hold back since 2 decades ago Agree..buy something first before GST, like upgrade PC, change to a new TV, eat in restaurants...etc..But by right can save money if use GST: minus 10% sales tax then add 6% GST= consumers can save 4%..? Quite confusing.. QUOTE(HJebat @ Sep 22 2014, 08:53 AM) This is quite true also.. |

|

|

Sep 22 2014, 11:03 PM Sep 22 2014, 11:03 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

|

|

|

Sep 22 2014, 11:37 PM Sep 22 2014, 11:37 PM

|

Junior Member

637 posts Joined: Jul 2012 |

QUOTE(youliang @ Sep 22 2014, 09:53 PM) https://www.sc.com/my/campaign/special-rate...ampaign-tnc.pdf Anybody knows whether StanChart allows FD withdrawal from other branch? So far know that Maybank and Hong Leong do not allow withdrawal other than the branch where FD is opened.in the PDF it is still stated as 15mth edit: oops, the pdf is old |

|

|

Sep 22 2014, 11:39 PM Sep 22 2014, 11:39 PM

|

Senior Member

860 posts Joined: Jan 2003 From: Petaling Jaya |

QUOTE(BoomChaCha @ Sep 22 2014, 06:46 PM) As you wish, SCB has extended the FD promo until 31 October 2014: Thank you Thank you! This time SCB want to hit RM 500 Million target.. https://www.sc.com/my/campaign/special-rate-td/ Hopefully indeed do not need to open any bank account, will be a busy day for me tomorrow. |

|

|

Sep 23 2014, 01:11 AM Sep 23 2014, 01:11 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

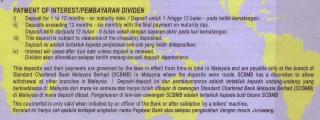

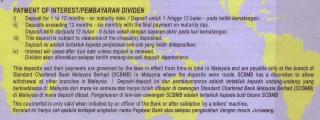

QUOTE(gchowyh @ Sep 22 2014, 11:39 PM) Thank you Thank you! Hopefully indeed do not need to open any bank account, will be a busy day for me tomorrow. QUOTE(bbgoat @ Sep 22 2014, 06:57 PM) You guys are welcome..but this time need to "lock" for 18 months wor..Today I am very frustrated with SCB. I needed to call Leng Chai staff twice and waited until afternoon then only received the temporary ID from his sms, this temporary ID is for logging-in internet banking. In this morning, SCB did not sms me the temporary password, but they sms me somebody else One Time Activation Code (OTAC) instead... So I had to call to SCB Call Center to request for another temporary password. My SCB internet banking is finally registered successfully in the evening... While asked for the temporary ID, I also asked Leng Chai staff about the Renewal Instruction issue: Me: How soon can we receive the FD interest? Leng Chai: Upon maturity Me: Can you tell me what does "1" mean under Renewal Instruction on the FD cert..? Leng Chai: Oh.. that one is to add interest to the principle. Me: Then how about 2? Leng Chai: Ha..? What 2..? 1 is a standard setting in this FD package.. Me: But my friend got a 2 under Renewal Instruction on his FD cert wor.... Leng Chai: Oh..Ya ka..? Hold on please, let me check... Oh..Okay, I see it here, 2 means to deposit interest into saving account. Me: Can I change it to 2 for my FD..? Leng Chai: Cannot lah... system has been set, cannot change Me: Ok, Thank you. Bye.. Leng Chai: Hello..hello..Mr. Boom, how about the corporate bond? Have you gone thru the info sheet? Me: Now let's take a look at the Payment of FD Interest from SCB:

ii) Deposits exceeding 12 months - six monthly with the final payment on maturity day. Deposit lebih daripada 12 bulan - 6 bulan sekali dengan bayan akhir pada hari kematangan. ---> does it mean that interest will pay every 6 months? If (ii) is a standard policy for 15 months FD, why there is an option to select "1" or "2" under Renewal Instruction on the FD cert? This post has been edited by BoomChaCha: Sep 23 2014, 02:10 AM |

|

|

|

|

|

Sep 23 2014, 02:02 AM Sep 23 2014, 02:02 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(sandkoh @ Sep 22 2014, 07:06 PM) My pleasure..Young man.. QUOTE(michaelho @ Sep 21 2014, 11:00 PM) Branch told me one month from 17 Sept .... so my calculation till 16 Sept la, better call branch to check just to be sure Okay.. Thank you QUOTE(Human Nature @ Sep 22 2014, 07:47 PM) wah, this is real good news. this time no need to open CASA ? not stated at the terms anymore If you are talking about leng lui and leng chai, OCBC is absolutely NO 1... (can meet the lenglui again Public bank maybe NO 2 lah.. UOB maybe No 3 Am Bank & RHB maybe are the worst.. QUOTE(nexona88 @ Sep 22 2014, 09:55 PM) The intention of SCB's 18 months FD is quite obvious... This post has been edited by BoomChaCha: Sep 23 2014, 02:55 AM |

|

|

Sep 23 2014, 08:06 AM Sep 23 2014, 08:06 AM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(BoomChaCha @ Sep 23 2014, 01:11 AM) Today I am very frustrated with SCB. Ah Boom (better sounding name), at least you received your internet id & password. I did not receive it & may have to call the leng lui. I needed to call Leng Chai staff twice and waited until afternoon then only received the temporary ID from his sms, this temporary ID is for logging-in internet banking. In this morning, SCB did not sms me the temporary password, but they sms me somebody else One Time Activation Code (OTAC) instead... So I had to call to SCB Call Center to request for another temporary password. My SCB internet banking is finally registered successfully in the evening... Update: 10.30am Received SMS from leng lui on the temp ID and OTAC. So at least I am not disappointed. Except their system is a bit wierd from all the internet banking that I have signed up so far. QUOTE(BoomChaCha @ Sep 23 2014, 01:11 AM) While asked for the temporary ID, I also asked Leng Chai staff about the Renewal Instruction issue: So yours is not auto renew and deposit interest to principal only after maturity ? Mine is interest paid for the first 6 mths. Talking about inconsistency even for a foreign bank ! Me: How soon can we receive the FD interest? Leng Chai: Upon maturity Me: Can you tell me what does "1" mean under Renewal Instruction on the FD cert..? Leng Chai: Oh.. that one is to add interest to the principle. Me: Then how about 2? Leng Chai: Ha..? What 2..? 1 is a standard setting in this FD package.. Me: But my friend got a 2 under Renewal Instruction on his FD cert wor.... Leng Chai: Oh..Ya ka..? Hold on please, let me check... Oh..Okay, I see it here, 2 means to deposit interest into saving account. Me: Can I change it to 2 for my FD..? Leng Chai: Cannot lah... system has been set, cannot change QUOTE(BoomChaCha @ Sep 23 2014, 01:11 AM) Leng Chai: Hello..hello..Mr. Boom, how about the corporate bond? Have you gone thru the info sheet? Still trying to sell Mr Boom the bond ? Me: QUOTE(BoomChaCha @ Sep 23 2014, 01:11 AM) Now let's take a look at the Payment of FD Interest from SCB: I don't think I am the only one getting the "2". Anyone else ?

ii) Deposits exceeding 12 months - six monthly with the final payment on maturity day. Deposit lebih daripada 12 bulan - 6 bulan sekali dengan bayan akhir pada hari kematangan. ---> does it mean that interest will pay every 6 months? If (ii) is a standard policy for 15 months FD, why there is an option to select "1" or "2" under Renewal Instruction on the FD cert? This post has been edited by bbgoat: Sep 23 2014, 10:37 AM |

|

|

Sep 23 2014, 08:13 AM Sep 23 2014, 08:13 AM

|

Senior Member

817 posts Joined: Mar 2014 |

QUOTE(nexona88 @ Sep 22 2014, 07:32 PM) joker ka? |

|

|

Sep 23 2014, 08:19 AM Sep 23 2014, 08:19 AM

|

Senior Member

817 posts Joined: Mar 2014 |

|

|

|

Sep 23 2014, 08:41 AM Sep 23 2014, 08:41 AM

|

Senior Member

852 posts Joined: Jan 2003 |

no news from BR yet?

|

|

|

Sep 23 2014, 09:05 AM Sep 23 2014, 09:05 AM

|

Senior Member

6,614 posts Joined: Mar 2011 |

|

|

|

Sep 23 2014, 09:35 AM Sep 23 2014, 09:35 AM

|

Senior Member

6,614 posts Joined: Mar 2011 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0211sec 0.0211sec

0.52 0.52

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 08:04 PM |