QUOTE(a-ei-a @ Dec 2 2013, 09:47 PM)

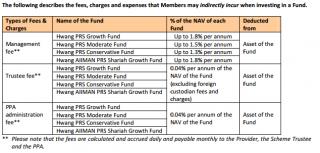

Ya, for PRS the sales charge is 0%, and 1.3-2.25 Management fee, and we can see the charges % in the prospectus.

http://www.fundsupermart.com.my/main/admin...tusMYHPRSGF.pdfJust wondering if it's okay to pick Hwang growth fund compare with other. Any advice?

I think all or most of the unit trust funds in Malaysia has this kind of charges levied on the funds.....

they are to pay for the mgmt. of the funds. These cost are deducted from the asset of the fund...therefore the daily NAV would have "displayed" the deducted amount.

comparing with others?....

All the PRS funds are still new,.. read the prospectus to see more details on how they are going to manage the fund.

if your want to compare performance...

go to FSM website, under Funds Info

click Fund selector,

in the private retirement scheme (prs) provider field box,

click All PRS Providers Only

click Generate table.

(past performance may not be an indication of future performance)

Dec 2 2013, 05:53 PM

Dec 2 2013, 05:53 PM

Quote

Quote

0.0333sec

0.0333sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled