I think one day FSM Malaysia will charge platform fees like FSM Singapore.

Singapore FSM Platform FeesCODE

Fixed Income Funds Holdings* 0.05% per quarter

Equity Funds Holdings* - first $50,000 0.125% per quarter

Equity Funds Holdings* - next $150,000 0.11% per quarter

Equity Funds Holdings* - next $300,000 0.09% per quarter

Equity Funds Holdings* - remaining amount above $500,000 0.05% per quarter

All CPF Holdings Exempted

As

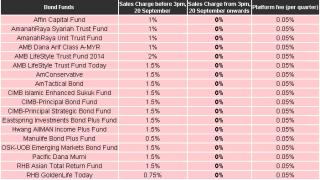

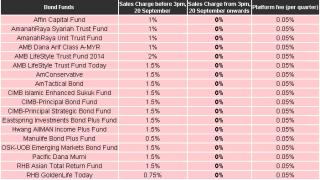

appetizer, FSM Malaysia has started Platform Fees for Bonds at

0.05% per quarter effective 20 September 2013.

Malaysia FSM Platform Fees

Wonder when the

main course will come to Malaysia!

When it does, it's going to be a real turn off

If you are a long term investor, and has a huge sum invested, platform fees will cause a drag.

The difference between Malaysia and Singapore investors is that, Singapore investors has alternatives (ex. ETFs or other online UT distributors)

"The reality is that it is a global trend for the industry to see a shift of the fees that distributors of unit trust earn. The shift is away from the upfront sales charge towards an ongoing recurrent fee. That is, in general, sales charges are declining, but distributors and advisers will have to increasingly rely on some ongoing fees to ensure that their business remains viable." - Lim Chung Chun CEO, iFAST Financial Pte Ltd Singapore

Source:

https://secure.fundsupermart.com/main/commu...=002156&page=11» Click to show Spoiler - click again to hide... «

Dear investors,

Allow me to answer some queries here. I am the CEO of iFAST Financial (Fundsupermart.com is a division of iFAST Financial).

I understand that many of you are unhappy about the introduction of the platform fee. It is understandable, because platform fee is something completely new in Singapore. Hence most of you are questioning the thinking behind this.

However, in the more developed markets for unit trust investing, wealth management, and platforms, such as Australia and UK, platform fees are the norm or becoming the norm. Platform fees are often the main form of revenue streams for the platforms, including online unit trust distributors.

I notice that the discussions in this forum has focused on just on the introduction of the platform fee. However, that is only half the picture. The other half of the picture is that upfront sales charges are declining.

The reality is that it is a global trend for the industry to see a shift of the fees that distributors of unit trust earn. The shift is away from the upfront sales charge towards an ongoing recurrent fee. That is, in general, sales charges are declining, but distributors and advisers will have to increasingly rely on some ongoing fees to ensure that their business remains viable.

The shift is happening partly because of regulatory forces, and partly because of commercial forces. Singapore has been seeing this trend too in recent years, and clearly, the trend will accelerate in the next year or two. The trend will accelerate because regulations governing the sales processes of investment products will be tighten significantly. This will significantly increase compliance costs.

We are ahead of the industry in taking this step of introducing the platform fee. And as is evident in this forum, we are therefore the one facing the stream of complaints from many of you.

Clearly, we would have preferred not to have to anger our customers who have supported us in the past 10 years by introducing a new layer of fees. However, we foresee major changes in the next 1-2 years in the industry, and we have to tweak our pricing model accordingly to face the upcoming changes.

We foresee that upfront sales charges will be reduced significantly further in the next 2 years, and we believe that only players who are foreseeing this changing trend and reacting accordingly will be able to thrive. Those that rely mainly on revenue from upfront commissions from new businesses will increasingly find it very difficult going forward.

Lim Chung Chun

CEO, iFAST Financial Pte Ltd

(Fundsupermart.com is a division of iFAST Financial)

This post has been edited by creativ: Oct 27 2013, 04:35 PM

Oct 26 2013, 11:35 AM

Oct 26 2013, 11:35 AM

Quote

Quote

0.0319sec

0.0319sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled