This post has been edited by pisces88: Oct 23 2013, 09:06 PM

Fundsupermart.com v4, Manage your own unit trust portfolio

Fundsupermart.com v4, Manage your own unit trust portfolio

|

|

Oct 23 2013, 09:01 PM Oct 23 2013, 09:01 PM

|

Senior Member

3,968 posts Joined: Nov 2007 |

little bit more then my portfolio become +.

This post has been edited by pisces88: Oct 23 2013, 09:06 PM |

|

|

|

|

|

Oct 23 2013, 09:25 PM Oct 23 2013, 09:25 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(TakoC @ Oct 23 2013, 06:04 PM) For my side, my profit/(loss) ROI and IRR figures are calculated in seperate tabs. Is that an insult or a compliment? So I headache how to calculate for my IRR figures. Btw, I don't remember your worksheet looking like that. Much messier than that. My worksheet has always been that, just that I deleted some data, else u guys will know how much is my portfolio My holding of Hwang funds on continuing weakness...past 6-months period, they underperformed Eastspring GEM, Pacific GSF and OSK-UOB GEY. That's why, NEVER assume that past winners will continue its winning streak This post has been edited by Pink Spider: Oct 23 2013, 09:32 PM |

|

|

Oct 24 2013, 08:11 AM Oct 24 2013, 08:11 AM

|

Senior Member

2,081 posts Joined: Mar 2012 |

QUOTE(Pink Spider @ Oct 23 2013, 09:25 PM) Is that an insult or a compliment? Neither. Just remember the whole column being more cramped up My worksheet has always been that, just that I deleted some data, else u guys will know how much is my portfolio My holding of Hwang funds on continuing weakness...past 6-months period, they underperformed Eastspring GEM, Pacific GSF and OSK-UOB GEY. That's why, NEVER assume that past winners will continue its winning streak |

|

|

Oct 24 2013, 09:24 AM Oct 24 2013, 09:24 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Oct 24 2013, 10:27 AM Oct 24 2013, 10:27 AM

|

Junior Member

42 posts Joined: Feb 2013 |

Guess where the FBM KLCI will end on 25 Oct and stand a chance to win a Häagen-Dazs voucher worth RM50!

How to participate? 1. Submit your answer in the 'comment' section of this post. 2. Follow this answer format: I’m Soros. The FBM KLCI will hit 1769.76 points on 25/10. (Closing price of the FBM KLCI in 2 decimal points). With Malaysia’s Budget 2014 being tabled on 25 October 2013, we seek the next George Soros to tell us where the FBM Kuala Lumpur Composite Index (FBM KLCI) will end on the said date. 3 participants with the right answer or the answer nearest to the FBM KLCI’s closing price on 25 October 2013 will each win a Häagen-Dazs voucher worth RM50. Terms and conditions: 1) Submit your answer in the ‘comment’ section of this post latest by 25 October 2013, 12pm. 2) Participants are welcome to submit more than once but only the most recent submission will be taken into account. 3) In the event that two or more participants submit the same answer, we will select the participant who submitted his/her answer the earliest. 4) The winners will be announced on our Facebook page on 25 October 2013 after the FBM KLCI closes on the said date. 5) Fundsupermart.com will contact the winners with regards to the delivery arrangement of the vouchers. 6) Fundsupermart.com reserves the right to disqualify any entry at any time. 7) Fundsupermart.com reserves the right to amend any necessary stipulations and all contest decisions are final. Check this out at FSM Facebook! Really fun thing |

|

|

Oct 24 2013, 11:21 AM Oct 24 2013, 11:21 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

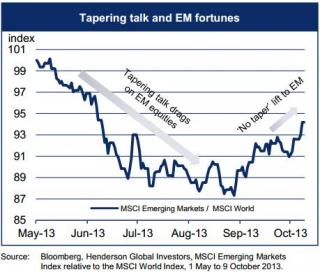

Co relation of tapering talk with Emerging Mkt Equities

Start of Tapering is just delayed..... Henderson Global snapshot Oct 2013 https://secure.fundsupermart.com/main/resea...?articleNo=8836 comparing some of FSM s'pore GEM funds performance...... https://secure.fundsupermart.com/main/resea...?articleNo=8837 Attached thumbnail(s)

|

|

|

|

|

|

Oct 25 2013, 03:57 PM Oct 25 2013, 03:57 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

Investments To Benefit From A Steepening Yield Curve

FED REFRAINS FROM TAPERING BUT END TO QE IS INEVITABLE YIELD CURVE STEEPENS AS END OF QE APPROACHES -- STEEPENING YIELD CURVE TENDS TO PRECEDE ECONOMIC UPTURNS HOW CAN INVESTORS BENEFIT FROM THE END OF QE? http://www.fundsupermart.com.hk/hk/main/re...?articleNo=7300 |

|

|

Oct 25 2013, 05:09 PM Oct 25 2013, 05:09 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

unconfirmed report

#MyBudget2014 RM500 one off for 20 to 30 yr olds who save RM1000 a year in the Private Retirement Scheme. This to go on for five years. 4:56 PM - 25 Oct 2013 |

|

|

Oct 25 2013, 05:28 PM Oct 25 2013, 05:28 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Oct 25 2013, 05:35 PM Oct 25 2013, 05:35 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Oct 25 2013, 06:07 PM Oct 25 2013, 06:07 PM

|

Senior Member

2,525 posts Joined: Sep 2013 |

Anyone listening to budget..property like kena le

|

|

|

Oct 25 2013, 06:34 PM Oct 25 2013, 06:34 PM

|

Senior Member

6,373 posts Joined: May 2007 |

|

|

|

Oct 25 2013, 09:55 PM Oct 25 2013, 09:55 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

|

|

|

Oct 25 2013, 10:40 PM Oct 25 2013, 10:40 PM

|

Senior Member

6,373 posts Joined: May 2007 |

|

|

|

Oct 25 2013, 10:43 PM Oct 25 2013, 10:43 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Oct 26 2013, 08:12 AM Oct 26 2013, 08:12 AM

|

Senior Member

2,525 posts Joined: Sep 2013 |

After new budget reit will kena anot..

|

|

|

Oct 26 2013, 09:05 AM Oct 26 2013, 09:05 AM

|

Senior Member

1,144 posts Joined: May 2012 |

QUOTE(yklooi @ Oct 25 2013, 05:09 PM) unconfirmed report If every year rm1000 and they top up rm500 every year then is worth it.#MyBudget2014 RM500 one off for 20 to 30 yr olds who save RM1000 a year in the Private Retirement Scheme. This to go on for five years. 4:56 PM - 25 Oct 2013 But if rm500 is only one shot then maybe have to rethink due to the money will getting lock down |

|

|

Oct 26 2013, 09:53 AM Oct 26 2013, 09:53 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(lunarwolf @ Oct 26 2013, 09:05 AM) If every year rm1000 and they top up rm500 every year then is worth it. Najib also announced the one-off incentive of RM500 to EPF contributors who participated in the Private Retirement Scheme.But if rm500 is only one shot then maybe have to rethink due to the money will getting lock down The incentive would be for those with a minimum cumulative investment of RM1,000 within a year. “The incentive, which is available for individuals aged between 20 and 30 years, is expected to attract 420,000 youth contributors nationwide. It will be implemented from Jan 1 for a period of five years involving an allocation of RM210mil,” he said. http://www.thestar.com.my/News/Nation/2013...ntribution.aspx so I interpret as every year for 5 years....how do you interpret it? This post has been edited by yklooi: Oct 26 2013, 10:01 AM |

|

|

Oct 26 2013, 10:53 AM Oct 26 2013, 10:53 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

“Bonds are completely safe investments”. “Investors cannot lose money if they hold bonds to maturity”.

These are some of the common misconceptions surrounding bonds. Eastspring Investments's Tutorial on "Key Bond Risk" https://secure.fundsupermart.com/main/artic...t-2013-41--8838 |

|

|

Oct 26 2013, 11:31 AM Oct 26 2013, 11:31 AM

|

Senior Member

1,144 posts Joined: May 2012 |

QUOTE(yklooi @ Oct 26 2013, 09:53 AM) Najib also announced the one-off incentive of RM500 to EPF contributors who participated in the Private Retirement Scheme. To me the term seem to be not very clear, I interpret it as rm500 only given one shot and the "promotion" will be available for 5 years meaning as below:The incentive would be for those with a minimum cumulative investment of RM1,000 within a year. “The incentive, which is available for individuals aged between 20 and 30 years, is expected to attract 420,000 youth contributors nationwide. It will be implemented from Jan 1 for a period of five years involving an allocation of RM210mil,” he said. http://www.thestar.com.my/News/Nation/2013...ntribution.aspx so I interpret as every year for 5 years....how do you interpret it? 1st year: i contribute rm700 on that year, so no incentive 2nd year: i contribute rm1200 on that year, so got rm500 incentive 3rd year: i contribute rm2000 on that year, no incentive since i already gotten it on 2nd year Uncle looi seem like you cannot participate? Because you already pension and not epf contributor anymore |

|

Topic ClosedOptions

|

| Change to: |  0.0939sec 0.0939sec

0.18 0.18

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 12:24 PM |