Same problem happen to me when i purchase a bag and cloth from A&F USA

Below is the trailing email between me and Malaysia Custom, I found out that those CIF is by FedEX, anyone know how to get the latest 2014 calculation chart??

Perhaps I call and write to FedEX, but seen no answer from them

From: KLIA ADMIN <admin.klia@customs.gov.my>

Date: July 4, 2014 at 4:45:01 PM GMT+8

To: Alex >

Subject: RE: Pertanyaan Mengenai Pengecualian Duties Kastam

Salam Sejahtera.

Setelah merujuk kepada cawangan yang berkaitan dimaklumkan tuan perlu merujuk kepada egen FedDex ini kerana Pihak Kastam tidak menentukan Kadar Tambang bagi setiap dagangan.

Sekian, terima kasih.

Cawangan Perancangan Korporat,

JKDM LTA KL

From: Alex ]

Sent: Thursday, July 03, 2014 5:37 PM

To: KLIA ADMIN; Al

Subject: Re: Pertanyaan Mengenai Pengecualian Duties Kastam

Salam 1 Malaysia Cik Siti,

Berpandukan kepada perbualan telepon pada 3 Julai 2014, jam 4.23pm , bersama-sama ini dilampilkan juga surat maklumbalas dari pihak kastam KLIA bertarikh 27 Jun 2014.

Saya juga nak minta tanya berkenaan penakrifan "Pelarasan Kos Tambang dan insurans bagi dagangan yang dihantar melalui syarikat-syarikat kurier ke malaysia 2014". Bolehkah kak siti bagi saya jadual terbaharu 2014???

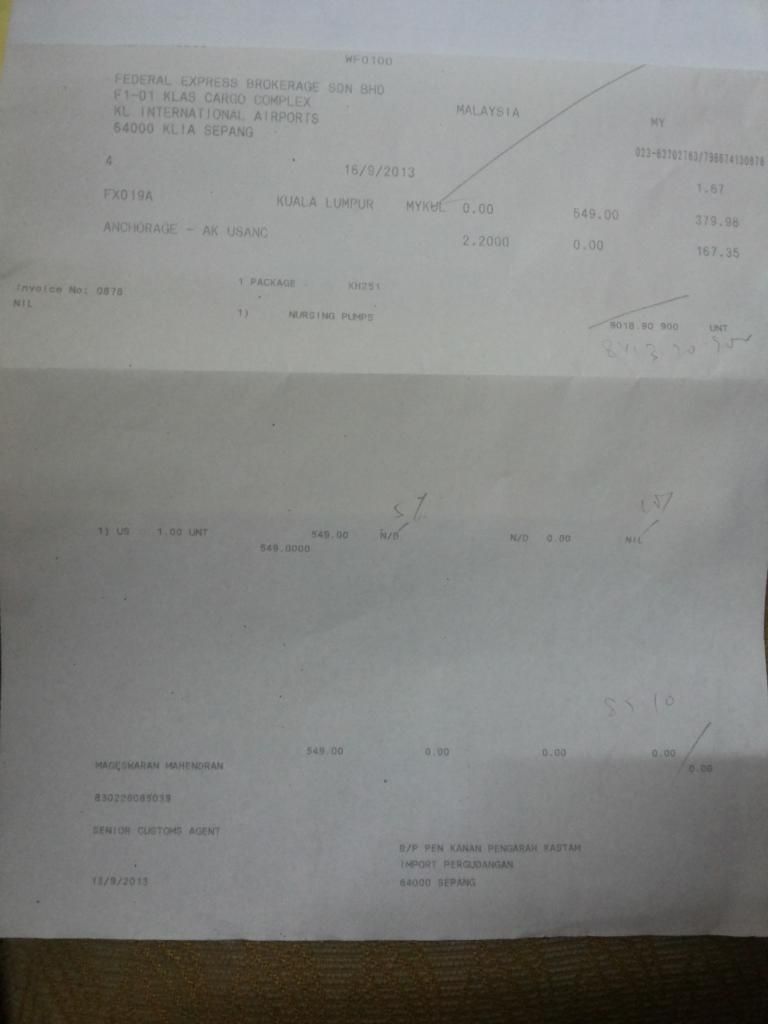

Berdasarkan sistem C.I F (Cost, Insurance & Freight) tidak melebihi RM 500.00, Bagaimanakah penakrifan "FX 19- Kuala Lumpur - MYKUL - 0.00 - 795.13 -403.08" yang ada pada Bill W 20106049865 (dilampilkan). Dari pada jadual pihak kastam yang ada online, Min Wt bagi negara USA 9.7 kg, manakala caj min ialah 379.98 dan Normal ialah 39.37. Macam mana penakrifan berdasarkan freight jika "free shipping"??? bukankah ia sepatutnya 0.00???? dan macam mana jika Kos penghantran (shipping fees) dikenakan berdasarkan lingkungan kos penghantaran???

Diharap pihak kastam dapat memberi maklumbalas kepada saya tentang kemusykilan yang timbul.

Regards,

W

On Wednesday, June 27, 2014 4:40 PM, KLIA ADMIN <admin.klia@customs.gov.my> wrote:

Salam Sejahtera.

Setelah merujuk kepada cawangan yang berkaitan dimaklumkan bahawa pengecualian untuk dagangan atau barang-barang yang diimport melalui Express Handling Unit (EHU) diberikan kepada nilai C.I.F (Cost, Insurance & Freight) tidak melebihi RM500.00.

Pertanyaan mengenai pengecualian duti kastam yang didakwa oleh tuan ini adalah nilai F.O.B (Free On Board).

Oleh yang demikian, tuan tidak layak mendapat pengecualian dari duti / cukai di bawah Seksyen 103(1) Akta Kastam 1967.

Sekian, terima kasih.

Cawangan Perancangan Korporat,

JKDM LTA KL

On Wednesday, June 25, 2014 5:05 PM, KLIA ADMIN <admin.klia@customs.gov.my> wrote:

Salam sejahtera.

Pertama sekali terima kasih kerana menghubungi Jabatan kastam Diraja Malaysia Lapangan Terbang Antarabangsa Kuala Lumpur untuk mengetahui lebih lanjut mengenai perkara ini.

Kami akan memajukan perkara ini kepada cawangan yang berkaitan dan maklumbalas akan diberikan dalam kadar segera.

Sekian, terima kasih.

Cawangan Perancangan Korporat,

JKDM LTA KL

From: Alex ]

Sent: Wednesday, June 25, 2014 12:35 PM

To: KLIA ADMIN

Cc: Alex

Subject: Pertanyaan Mengenai Pengecualian Duties Kastam

JABATAN KASTAM DIRAJA MALAYSIA.

LAPANGAN TERBANG ANTARABANGSA KUALA LUMPUR.

PEJABAT PENGARAH KASTAM KLIA.

Salam 1 Malaysia

Tuan,

Pertanyaan Mengenai Pengecualian Duties Kastam

Merujuk Kepada perkara diatas, saya telah menbuat pesanan baju dan Bag secara online dan menerima bungkusan daripada Fed Ex AWB No : 586717131337 bertarkh : 16 Jun 2014.

Untuk Makluman Tuan, bungkusan saya dikenakan cukai jualan sebanyak RM 84.51 Resit Rasmi : AM0186692 berno. Siri 2014-06067464(18-06-2014 22:24:17).Saya ingin menbuat Pertanyaan Mengenai pengecualian cukai jualan bawah nilai RM500 berdasarkan Invois penjual.

Dari maklumbalas perbualan telefon dengan pihak kastam KLIA pada 23 dan 24 Jun 2014 jam 11.30 pagi, saya difahamkan bahawa Barangan Peribadi Yang Dikecualikan Dari Duti / Cukai Di bawah Seksyen 103(1) Akta Kastam 1967,adalah barangan denagn jumlah nilai dibenarkan untuk pengecualian tidak melebihi RM500. Adakah cukai jualan tidak patut dicaj atas bungkusan saya kerana nilai asalnya adalah USD 119.00 (RM 388.17) berdasarkan invois penjual berno.60000006102907 (Dilampil bersama).

Untuk makluman tuan, pihak kastam juga telah menyuruh saya menbuat panggilan kepada Fed Ex tentang "Custom Duty Tax Advice). Daripada jawapan pegawai senior FedEX Ms Mala Subramanian -Staff No. 408558 beliau memberitahu bahawa,

berpandukan Resit Import/Eksport dan Zon Bebas KLIA (W20106049865), segala takrifan adalah dari pihak Kastam KLIA dan saya perlu menbuat Aduan kepada Pihak kastam untuk mendapat penjelasan dan menuntut balik jumlah yang telah dibayar.

Dari penjelasan pihak kastam yang lepas saya pernah diberitahu bahawa berpandukan Sistem GATT valuation, hanya nilai asal invois dikenakan cukai, saya ingin mendapatkan penjelasan pihak tuan tentang IATA maximum charge rate, bukankah jika shipment fees is 0.00 dan harga barangan tidak melebihi RM 500, maka Cukai tidak dikenakan??

Diharap pihak tuan dapat menberikan maklumbalas kepada saya tentang Kemusykilan yang timbul, saya juga berbesar hati jika pihak kastam dapat mengembalikan cukai yang terlebih bayar

Jasa dan budi baik pihak tuan amatlah saya hargai. Bersama-sama ini disertakan salinan asal invois-invois dan surat aduan saya kepada FedEx

Yang Benar,

W

Jun 26 2013, 02:01 PM, updated 11y ago

Jun 26 2013, 02:01 PM, updated 11y ago

Quote

Quote

0.0752sec

0.0752sec

1.07

1.07

6 queries

6 queries

GZIP Disabled

GZIP Disabled