1. I have see many withdraw and with sudden splash of free cash, either spent it, make wrong investment decision or fall into quick rich scheme.

So also must becareful. A year or two ago, my aunties invested into one unit trust that invested globally, me also think wise move as diversification as some forumers here.

The unit trust portfolio consist of microsoft and Nvidia also, until now, still losing about 5%, last year even worst nearly -25%. Even though the unit trust has Nvidia in its 5 top portolio, but unit trust has a mandate to diversify its portfolio, cannot be investing all its fund into one stock.

The Nvidia performance alone pull up the unit trust from -25% to -5% while drag down by others.

Many said US market new high, should make profit, but actual, Nasdaq, S&P new high are pulled up by magnificent Nvidia and Microsoft, other stocks actually so so only, Russelll 2000 only gain less than 5% this year. While Nvidia alone shoot up from 100+ to 850 now.

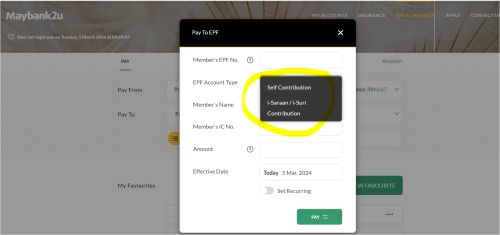

So look back 2 years, for her, may be she better off by putting the money in EPF.

2 year EPF +11%, her unit trust -5%.

We do not know when next stock market crash or any crisis happen. But we know when we will retire.

So EPF is still an important to have, I agree with diversification, but EPF still is an important role in retirement planning.

After wishness how FTX fall, Credit Suisee ATI bond default, and a little far behind, Lehman, I realised we should not take for granted investment is easy.

Most people who diversify here do their own investment. UT is the worst place to put your money. Most can't beat EPF at all, some even lose money. I don't think anyone here is recommending UT for diversification against EPF...

Mar 4 2024, 06:02 PM

Mar 4 2024, 06:02 PM

Quote

Quote

0.0555sec

0.0555sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled