Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

CommodoreAmiga

|

Mar 3 2024, 11:12 AM Mar 3 2024, 11:12 AM

|

|

QUOTE(victorian @ Mar 3 2024, 11:09 AM) That’s why when gov announced EPF withdrawal, I took it without a second thought. It wasn’t a popular decision within my circle, but I knew what I was doing. This is what happens when your money is locked with someone else, you do not have any say in it. Yeah, for younger guys, think again now. Us old fags nearing 55 or already exceeded is still ok coz we can withraw. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 11:13 AM Mar 3 2024, 11:13 AM

|

|

QUOTE(blue_maniac @ Mar 3 2024, 11:11 AM) On a side note, iAkaun is up.. Cannot see my money liao. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 11:27 AM Mar 3 2024, 11:27 AM

|

|

QUOTE(victorian @ Mar 3 2024, 11:19 AM) Game over for the zero risk tolerance apek and aunty to dump all their savings into EPF for guaranteed returns. Time to learn how to invest in the real world. Can see it coming already when the increase the annual contribution from 60 to 100k. Lucky this apek already started diversifying way before.  |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 11:31 AM Mar 3 2024, 11:31 AM

|

|

QUOTE(coolguy_0925 @ Mar 3 2024, 11:24 AM) they can increase to whatever amount but definately from today onwards the voluntary cont will be affected Increase to RM10 million. See which water fish come. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 11:35 AM Mar 3 2024, 11:35 AM

|

|

Also remember our RM like lost 10% already from RM 4.3 So your EPF already lost 10%. Niamah Dividend can't even cover currency lost. QUOTE(ikanbilis @ Mar 3 2024, 11:33 AM) This gomen is definitely playing robin hood thingy. Becareful bro...It's North Korea here btw...do you have a Wifi called "ikanbilis" as well? I know where you stay....  This post has been edited by CommodoreAmiga: Mar 3 2024, 11:36 AM This post has been edited by CommodoreAmiga: Mar 3 2024, 11:36 AM |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 11:38 AM Mar 3 2024, 11:38 AM

|

|

QUOTE(Sihambodoh @ Mar 3 2024, 11:32 AM) This is bad. Luckily I didn't add another 100k to it. I guess it's time to withdraw all my excess to put somewhere. This gomen is not giving me the confidence. Yes, thinking to start go EPF to withdraw already. I think i will do it. We all do together, show middle finger to EPF. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 11:40 AM Mar 3 2024, 11:40 AM

|

|

QUOTE(Sihambodoh @ Mar 3 2024, 11:37 AM) Whole country is doing that. From EPF, to OPR. I don't know, I had high hopes. But now there's only one thing in mind - Run while I still can. Bro SihamTakBodoh.  |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 12:09 PM Mar 3 2024, 12:09 PM

|

|

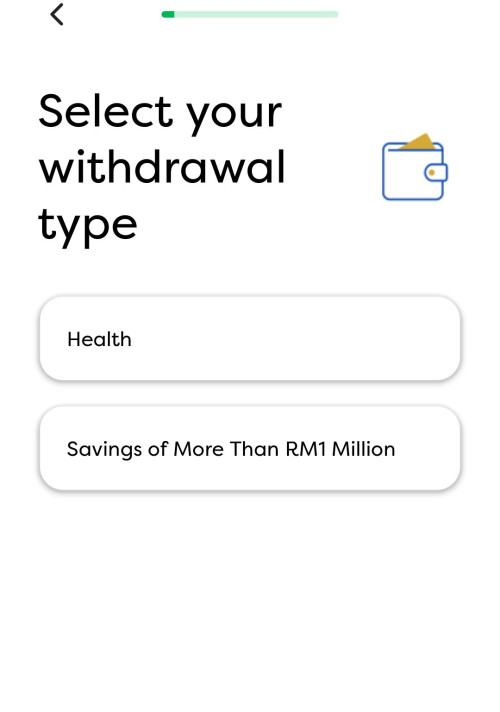

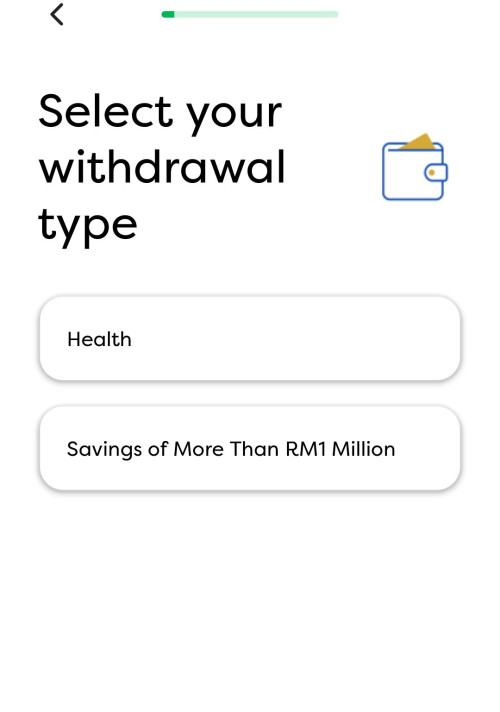

QUOTE(MUM @ Mar 3 2024, 11:58 AM) If, ....only if. Can withdraw the excess only If excess 5000, then take out 5000 while the earlier 100k put inside still kena locked If excess RM1 mil, withdraw from which account? Account 2? |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 12:11 PM Mar 3 2024, 12:11 PM

|

|

QUOTE(magika @ Mar 3 2024, 12:07 PM) Most of this waterfish are more well off than you.  Yeah...100k to them is like RM100 only. Loose change. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 12:12 PM Mar 3 2024, 12:12 PM

|

|

QUOTE(fuzzy @ Mar 3 2024, 12:03 PM)  Can, but also rm30k max per day. If go OTC can withdraw more? |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 12:13 PM Mar 3 2024, 12:13 PM

|

|

QUOTE(Sihambodoh @ Mar 3 2024, 12:03 PM) Those without 1m can take out all amount in account 2 to purchase bouse. After purchasing sell it to convert to cash. I think this will.work. But rugi RPGT. Not worth it lah. Just don't self contribute anymore. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 12:51 PM Mar 3 2024, 12:51 PM

|

|

QUOTE(nexona88 @ Mar 3 2024, 12:38 PM) not sure how they pay for education purposes? pay directly to the University / College account??  You setup University of Lowyat. We withdraw using Lowyat U. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 01:00 PM Mar 3 2024, 01:00 PM

|

|

QUOTE(ronnie @ Mar 3 2024, 12:54 PM) I win as TIKAM master for EPF DIVIDEND 2023 I know it’s sad to be that low…. But I think it got be some earnings move to Syariah Tikam Master only applies when Dividend is high. Low Dividend, you are Tikam Tikus!! |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 01:19 PM Mar 3 2024, 01:19 PM

|

|

QUOTE(beLIEve @ Mar 3 2024, 12:52 PM) Cannot see how much dividend earned woh, unlike last year. Have to manually count comparing statements Can. Just that now app and website sot sot. Sekejap can see, sekejap cannot see. Server pecah now. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 01:20 PM Mar 3 2024, 01:20 PM

|

|

QUOTE(contestchris @ Mar 3 2024, 01:19 PM) Can we initiate a class action lawsuit against EPF for "transferring" returns from Conventional to Syariah? If there is whistle blower evidence...else you masuk jail for spreading false news... |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 01:22 PM Mar 3 2024, 01:22 PM

|

|

QUOTE(Wedchar2912 @ Mar 3 2024, 01:18 PM) yay... no fireworks for you... haha Tikam must tikam, high, if high kena, you are Hero. If low kena, everybody curse you. This is rule of Lowyat. |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 01:44 PM Mar 3 2024, 01:44 PM

|

|

Now account 3 sign up will be hot...

|

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 02:12 PM Mar 3 2024, 02:12 PM

|

|

QUOTE(contestchris @ Mar 3 2024, 01:53 PM) Is this legal? It's literally stealing, is it not? At this rate, why not just make EPF shariah compliant. Can non Muslim choose Syariah option? Any drawbacks? Why want to choos shariah for nons? Shariah can never beat conventional if really done correctly. Aji ajoh ini itu Tarak halal, how to invest in good opportunites and companies? |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 02:56 PM Mar 3 2024, 02:56 PM

|

|

QUOTE(diffyhelman2 @ Mar 3 2024, 02:36 PM) He’s saying that a higher proportion of the sharia portfolio is invested in tech stocks compared to conventional. So let’s say sharia have 50% of their funds invested in meta nvdia etc while conventional only 30%invested in these same companies. And why the fark is this even logical? Is it just an excuse to hide something? |

|

|

|

|

|

CommodoreAmiga

|

Mar 3 2024, 03:52 PM Mar 3 2024, 03:52 PM

|

|

QUOTE(prophetjul @ Mar 3 2024, 03:40 PM) Thing is I already have Singapore banks in my portfolio. It's a matter how much more to allocate. Plus you have to be aware that the greedy government may tax overseas dividends in the future. Yes, possible. But basically whatever moved out, not gonna move back in until i die and heir took over. Wonder if there's a way for heir to move to their accounts overseas as well? Hmmm...need to explore. |

|

|

|

|

Mar 3 2024, 11:12 AM

Mar 3 2024, 11:12 AM

Quote

Quote

0.0513sec

0.0513sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled