QUOTE(fuzzy @ Nov 9 2023, 07:04 PM)

Maybe HSBC customers all RM10 mil and above....who knows.EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Nov 9 2023, 08:30 PM Nov 9 2023, 08:30 PM

Return to original view | Post

#441

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(fuzzy @ Nov 9 2023, 07:04 PM) Maybe HSBC customers all RM10 mil and above....who knows. Wedchar2912 liked this post

|

|

|

|

|

|

Nov 13 2023, 11:37 AM Nov 13 2023, 11:37 AM

Return to original view | Post

#442

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(Cubalagi @ Nov 10 2023, 02:24 PM) Citizens of countries like UK, US, Europe get a pension by the government after they retire (not just civil servant), funded by state social security system. Not a lot, but usually enough to meet basic needs. This pension can supplement whatever savings they have. I have watched a Youtube video...old man , hard to survive in US....but he has USD1K pension/UBI whatever.In other words, they get tongkat for life. For Singapore I would imagine that the number exclude CPF savings, which works different than Malaysia epf. If he comes to Malaysia, he can lives a nice decent life already. There are some ang mohs doing just that, receive UBI/pension and comes to Asia (especially Thailand...because of Thai Mois...lol) to retire. They just need to make use of the power of the USD and EURO and GBP. QUOTE(maxxng12 @ Nov 13 2023, 10:59 AM) hi, for epf member passed away : 1. It will continue to receive dividend. Pay monthly i dunno.1. can the epf fund continue to grow inside? and pay monthly to the family member ? 2. can we directly transfer to the kids name under epf account, and continue to grow the epf fund? 3. use epf as a tool of living trust fund? 4. EPF wiill close the account once they know the member is passed away? or the fund can continue to grow inside for next 10 years? thank you 2. The money will goes to whoever is nominee. If kid is part of the nominee, they will get their share. Better just leave it inside to grow until kid graduate. 3. Dunno. 4. Will continue to grow This post has been edited by CommodoreAmiga: Nov 13 2023, 11:42 AM |

|

|

Nov 13 2023, 02:44 PM Nov 13 2023, 02:44 PM

Return to original view | Post

#443

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(Wedchar2912 @ Nov 13 2023, 01:42 PM) just sharing what i think i know, but best you go to EPF and ask them directly. Bro. I can confirmed that is incorrect. The money keeps getting dividend as usual as long as inside epf. No special account needed. You don't need to take out upon reach 18 either.this is what i think I remember reading somewhere and some "info" from ex-colleagues (about a colleague who passed away leaving a young kid and wife). I may recall some info wrong also. 1. short answer is no. all will be credited to the bene (if no nomination, then follow some processes. some claim follow will, but i am not sure). if bene is underage, then the funds can be kept in a special account until kid reach 18 years old 2. no, except the abv underage scenario. but i believe must take out upon reaching 18. 3. no. 4. they will try to find the bene, and no idea if the funds will continue to enjoy div. the story about the colleague who passed away: if not mistaken, the wife takes out her portion, while the kid's remain in epf. |

|

|

Nov 13 2023, 03:00 PM Nov 13 2023, 03:00 PM

Return to original view | Post

#444

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(Wedchar2912 @ Nov 13 2023, 02:50 PM) ah ok. Npt sure what you mean here, but as long you have nominee, it will goes to your nominee. Don't even need a will, i believe the EPF nominee will overwrite the Will as well. Ex: if will says goes to ABC, but nominee is XYZ.but then won't this mean that one can technically let one's child(ren) inherent everything in EPF and this is no longer fully just for retirement? It can be used in estate planning. imagine using this method to pass generational wealth... Some info i dug up: https://www.gavinjayapal.com/post/can-a-wil...on%20Act%201958. QUOTE In my view, an EPF nomination is an express statutory nomination which exists independently and is not a Will or testamentary disposition. It does not come under the ambit of s 6(1) of the Inheritance (Family Provision) Act 1971 and the Distribution Act 1958. Conclusion From the above, it is manifest that a Nomination Form falls into its own niche category. It is able to supersede a Will and one must be particularly careful to ensure that the same is updated accordingly, should the need arise. QUOTE also, i have the impression that the bene cannot request the funds to be transferred into the bene's own EPF account. That i don't know. I don't think it's possible. You can either take out the money to your bank account or leave it there. I don't think you can suka suka transfer from EPF Account to EPF account. AFAIK.Say for example a young couple, wife has 500K rm and only put husband as sole bene. Wife passed away. I have the impression that the hubby must take all 500K rm out into his own bank account. This post has been edited by CommodoreAmiga: Nov 13 2023, 03:06 PM |

|

|

Nov 13 2023, 03:21 PM Nov 13 2023, 03:21 PM

Return to original view | Post

#445

|

Senior Member

3,864 posts Joined: Jun 2022 |

|

|

|

Nov 13 2023, 04:00 PM Nov 13 2023, 04:00 PM

Return to original view | Post

#446

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(Wedchar2912 @ Nov 13 2023, 03:28 PM) regarding the nomination in EPF superceeding whatever written in the deceased's will, we are in agreement. Ah, i see what you are trying to say. But i am thinking...what if (a) and (b), just leave it there and not take until a later date? Because for © is possible, so logically should be same for (a) and (b).I also have the impression that once EPF knows the member is deceased, they will try to distribute the funds. ie cannot just leave it there. (then again, so many 100 years old accounts rite?) The point I was trying to say is that EPF's function is to help one for retirement, and not really to be used in estate planning. Which i continue below: Maybe an example would put all of us on the same page: Say there is a chap (45) who has 3 million in EPF and he put the following nomination: a) wife (45) : 33.3333...% b) kid 1 (22) : 33.3333...% c) kid 2 (12) : 33.3333...% My understanding is wife and kid 1 must take out their respective 1 million ringgit into their respective bank accounts. no such thing as put into own EPF accounts and continue. However, i have the impression that for kid 2, EPF will create a special account for kid 2 which will earn div. upon reaching legal age 18, kid 2 will also have the take out the funds. This is like EPF taking the role of trustee. hence the estate planning part is really limited to minors only. |

|

|

|

|

|

Nov 13 2023, 07:17 PM Nov 13 2023, 07:17 PM

Return to original view | Post

#447

|

Senior Member

3,864 posts Joined: Jun 2022 |

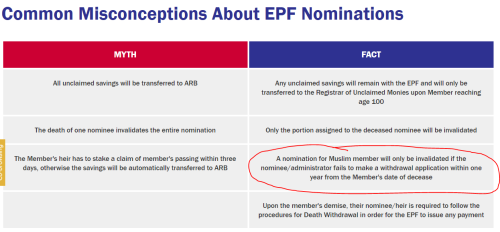

QUOTE(Wedchar2912 @ Nov 13 2023, 06:15 PM) I would think if ( a ) and ( b ) are allowed, then ( c ) can automatically be allowed. This only for Muslim right? WTF. Rompak saudara?( c ) case is special because kid 2 is a minor. nontheless, I do believe if any of the bene went to EPF and inform them of the member's demise, then EPF will try to disburse all the funds. Similar to how banks will freeze all the accounts of the deceased once they know about it. I went to kwsp site and saw this: https://www.kwsp.gov.my/member/nomination  scary... |

|

|

Nov 15 2023, 09:34 PM Nov 15 2023, 09:34 PM

Return to original view | Post

#448

|

Senior Member

3,864 posts Joined: Jun 2022 |

|

|

|

Nov 20 2023, 09:51 AM Nov 20 2023, 09:51 AM

Return to original view | Post

#449

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(Rinth @ Nov 20 2023, 09:37 AM) I'm not a book guy, but i'll give it a try if have chance. I think differently. Although i would definitely leave my fortune to my heir, most importantly i need to help them to stand on their own feet. No point giving your kids fish for whole life, they will just be useless person. The bigger tasks is teach your kids how to fish.But i still wanted to leave my legacy to my descendant if possible so that they can enjoy what i didnt...call me old fashion but i wished them able value their life and enjoy their life without worrying about money... If my quantum is big enough i wish to find some trust fund etc to provide my descendant a controlled stream of funds example RM 300k annually so that they get the money steadily, at the same time unable to splurge it.. |

|

|

Nov 20 2023, 10:11 AM Nov 20 2023, 10:11 AM

Return to original view | Post

#450

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(Rinth @ Nov 20 2023, 10:02 AM) True, that why i'll educate them to value money along the way, and not giving them whatever they want...They'll still have to work for it, get their own job, studying postgrade using PTPTN lol, repay it back themselves, buy their own car,house etc....Of course their journey will be much easier compared to me where I'll support them for all the kickstart, unlike myself... Wah...next next generation somemore. I tak kisah already. All in all the mindset is the most important criteria....If they can understand why i do it this way and appreciates it, instead of giving them large chunk of $$ when i pass away, then at least i think i had done my part...next is for them to passes it down to next generation.. This post has been edited by CommodoreAmiga: Nov 20 2023, 10:12 AM |

|

|

Nov 20 2023, 10:25 AM Nov 20 2023, 10:25 AM

Return to original view | Post

#451

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(ronnie @ Nov 20 2023, 10:20 AM) I want to R.I.P....please don't dig me out of my grave. I am an old man, not superman. Besides, i shouldn't take the responsibilities off from my descendant to provide for their families. It is a privilige and their joy, duties to find their own way in this world. |

|

|

Nov 21 2023, 09:29 AM Nov 21 2023, 09:29 AM

Return to original view | Post

#452

|

Senior Member

3,864 posts Joined: Jun 2022 |

OMG...i got 2 extra ZEROES!!!!!

...XXX.0000 This post has been edited by CommodoreAmiga: Nov 21 2023, 09:29 AM |

|

|

Nov 24 2023, 08:33 AM Nov 24 2023, 08:33 AM

Return to original view | Post

#453

|

Senior Member

3,864 posts Joined: Jun 2022 |

|

|

|

|

|

|

Nov 28 2023, 05:38 PM Nov 28 2023, 05:38 PM

Return to original view | Post

#454

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(ccschua @ Nov 28 2023, 01:02 PM) is it better to borrow more loans (4.3%) and park the money in EPF (5.5%)? All these hassle and risks for 1.2%. I won't bother.or i miss out something ? compound interest ? wongmunkeong liked this post

|

|

|

Nov 29 2023, 11:43 AM Nov 29 2023, 11:43 AM

Return to original view | Post

#455

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(ronnie @ Nov 29 2023, 11:22 AM) With the selling of Giant hypermarkets to UEM & Sunway REIT, would it be possible to get more dividend ? https://www.nst.com.my/property/2023/05/912...net-epf-rm46mil46milllion only. Not a big amount. |

|

|

Nov 29 2023, 01:19 PM Nov 29 2023, 01:19 PM

Return to original view | IPv6 | Post

#456

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(ronnie @ Nov 29 2023, 12:17 PM) KUALA LUMPUR: Property developer UEM Sunrise Berhad has signed a sale and purchase agreement with Employee Provident Fund unit Kwasa Properties Sdn Bhd to takeover 3.7 hectares of freehold land in Kelana Jaya, which currently houses Giant hypermarket, for RM155 million. Where you got that figure 201m? 155m is for one property. But total PROFIT for 6 properties are only RM46m as per earlier link.Total RM201 million |

|

|

Nov 29 2023, 01:20 PM Nov 29 2023, 01:20 PM

Return to original view | IPv6 | Post

#457

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(jimbet1337 @ Nov 29 2023, 12:33 PM) Should be 3 - 4 days as usual ..but not sure if year end more busy...just transfer before Christmas 🎄🎄🎄 jimbet1337 liked this post

|

|

|

Dec 1 2023, 12:32 PM Dec 1 2023, 12:32 PM

Return to original view | Post

#458

|

Senior Member

3,864 posts Joined: Jun 2022 |

|

|

|

Dec 2 2023, 11:51 AM Dec 2 2023, 11:51 AM

Return to original view | Post

#459

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(virtualgay @ Dec 1 2023, 11:24 AM) 6% no issue la this time I think differently, US has stop raising rates or at least one more rate hike...now is preparing for market rally next year.20B for Q4 is expected is a matter of how much they want to payout this time... i scare they want to withhold 15% and continue payout lousy dividend and give buffer for next year next year will be teruk But of course, if local BURSA kantoi, then will drag everything down. This post has been edited by CommodoreAmiga: Dec 2 2023, 11:52 AM |

|

|

Dec 4 2023, 09:56 AM Dec 4 2023, 09:56 AM

Return to original view | Post

#460

|

Senior Member

3,864 posts Joined: Jun 2022 |

|

| Change to: |  0.0605sec 0.0605sec

0.63 0.63

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 10:08 AM |