Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

dwRK

|

Jul 2 2025, 08:53 AM Jul 2 2025, 08:53 AM

|

|

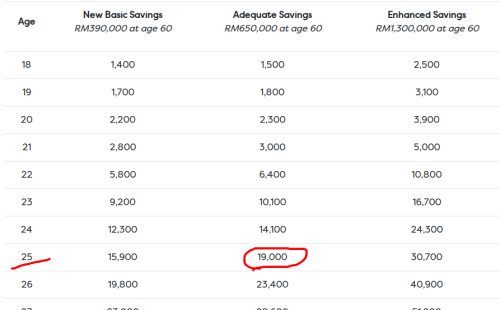

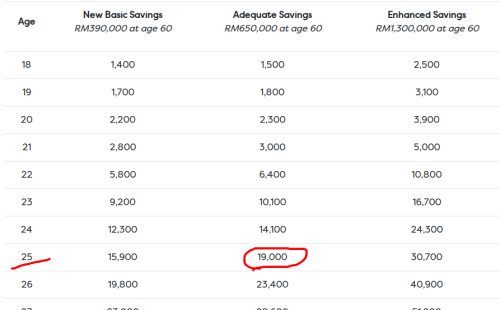

QUOTE(hdroxy @ Jul 1 2025, 09:55 PM) Yes. That is the main point of my discussions 1) it seems mathematically, majority of us can't afford to retire. 2) The problem with EPF recommendations is telling the people to save this and that amount of money, based on current ringgit value. It is wrong to tell 25 years old that you need target to save 476k in 30 years. EPF should take into account inflation to those numbers, when he/she hit the age. your understanding and basis/assumptions are flawed, hence lead to incorrect conclusions... this table that you've used isn't showing the amount you need when you retire... it is how much you should have as savings for the respective retirement class of basic/adequate/enhanced next year on 1 Jan 2026... so if you are 25 next jan, you should have savings (epf+fd+...) of 19k for adequate retirement... it is not telling a 25 yo to save 476k in 30 yrs which you have incorrectly used to work out starting pay... these are real numbers adjusted for inflation... hence it is tied to a date, 1 jan 2026... the 240k we so talked about this year 2025... will be 294k next year 2026 bc they also move it to 60...   This post has been edited by dwRK: Jul 2 2025, 10:34 AM This post has been edited by dwRK: Jul 2 2025, 10:34 AM |

|

|

|

|

|

dwRK

|

Jul 2 2025, 09:54 AM Jul 2 2025, 09:54 AM

|

|

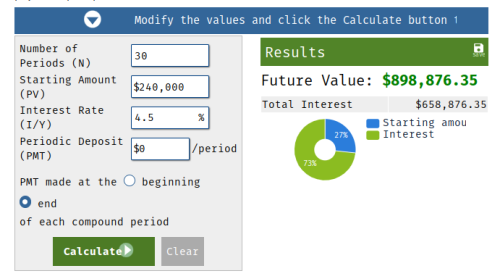

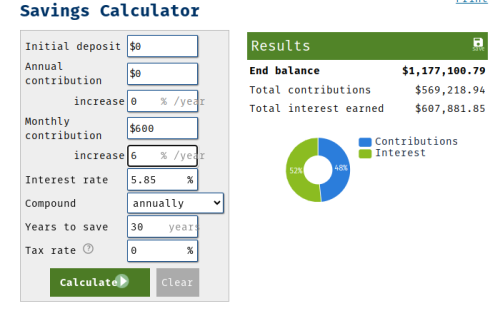

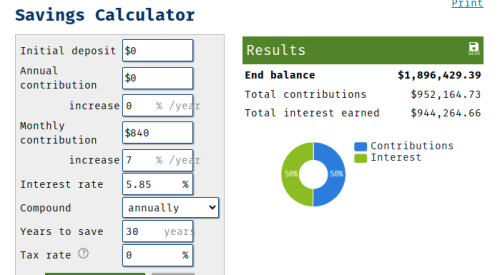

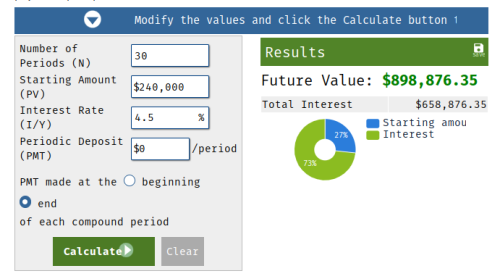

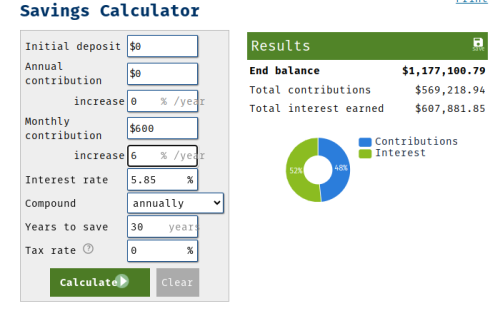

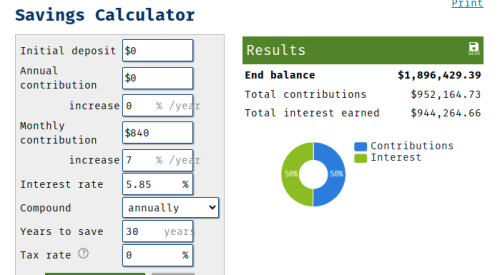

come... i do simple maths... basic retirement 240k... will be 900k in 30 yrs escalated at 4.5% inflation  epf savings... starting pay 2.5k per month, 6% pay rise, epf div 5.85%, no withdrawal...  OK bah...  doing same for the "adequate" future value 1.8mil... this from starting pay 3.5k, slightly better 7% increment...  |

|

|

|

|

|

dwRK

|

Jul 2 2025, 12:10 PM Jul 2 2025, 12:10 PM

|

|

guys... stop bashing him lah... hahaha...

5.4% is worked backwards from the basic sum required for retirement mentioned by epf throughout the years... this would indeed be "inflation" if one doesn't have any other data point...

ps... just saying... i didn't check his calc...

This post has been edited by dwRK: Jul 2 2025, 12:18 PM

|

|

|

|

|

|

dwRK

|

Jul 2 2025, 12:49 PM Jul 2 2025, 12:49 PM

|

|

QUOTE(fuzzy @ Jul 2 2025, 12:26 PM) I'm just tired of this push to blame EPF for someone not being able to retire, and how they are 'withholding' our money. EPF is not responsible for our retirement, we are. EPF should not be your only source of retirement income, which is why financial literacy is important. People have no issue when EPF force employers to contribute 12% of our salary each month, but somehow has issue when the condition of that is you can only withdraw it upon retirement. Also, the maths checks out. If you earn like 3k at 24 and only have 2% increment until you retire at 60 with a salary of RM6k (which is not high), your EPF will be around RM1.36mil. Assuming 20 years left, that gives you an annual spend of around 5.6k a month. If you only earn RM6k when you are actively working, RM5.6k in retirement is not enough? ive read his post a few times... it doesn't read like he blames epf... more like he did some wrong math... panic at his own numbers... did a video and share it here with wrong conclusions... lol... but he did make an effort... that's the reason i reply...  |

|

|

|

|

|

dwRK

|

Jul 2 2025, 12:51 PM Jul 2 2025, 12:51 PM

|

|

QUOTE(justanovice @ Jul 2 2025, 12:28 PM) More bashing also no impact as long as he get more views 😆 if you have checked his channel... you'll know this is not true...  |

|

|

|

|

|

dwRK

|

Jul 3 2025, 08:16 PM Jul 3 2025, 08:16 PM

|

|

QUOTE(Wedchar2912 @ Jul 3 2025, 06:23 PM) next year, the threshold is 1.1 million... 2027 is 1.2 million 2028 is 1.3 million 2029... TBD by EPF in future date. so, you have until Dec to decide if u want to keep 1.1 or take everything above 1.0 in Dec at 55 this "limitation" vanishes...  this is actually a "gift" by epf... there is no such thing as can withdraw anything >1m before... now you guys have it good with more withdrawal options... the moving 1.0 1.1 1.2 1.3 is just money of the day considering inflation... nothing to it... anyways, let see who wanna withdraw... i see the opposite of ppl wanting to deposit more than withdraw... lol... |

|

|

|

|

|

dwRK

|

Jul 3 2025, 08:20 PM Jul 3 2025, 08:20 PM

|

|

QUOTE(Wedchar2912 @ Jul 3 2025, 08:03 PM) i know some mentioned that EPF fixed the non-div on the full annual sum of the auto monthly withdrawal option, but best to double check if this is true... else waste the div only... epf has always given out the div... it was just misinformation and fearmongering... epf didn't need to fix anything... it wasn't broken to begin with... This post has been edited by dwRK: Jul 3 2025, 08:24 PM |

|

|

|

|

|

dwRK

|

Jul 6 2025, 09:44 AM Jul 6 2025, 09:44 AM

|

|

QUOTE(CommodoreAmiga @ Jul 6 2025, 08:14 AM) meanwhile, folks in this thread ask how to auto transfer from Acc3 back to Acc 1.  bought into lower div fud...  |

|

|

|

|

|

dwRK

|

Jul 9 2025, 11:05 AM Jul 9 2025, 11:05 AM

|

|

imho...

only when reach 50 or 1.5m... can one consider epf as CASA...

max can self pump is 0.1m per yr... 55 can withdraw all liao...

one is really moving backup/emergency funds from banks to epf...

if one dun have enough backup... dont even consider pumping into epf...

|

|

|

|

|

|

dwRK

|

Jul 9 2025, 11:59 AM Jul 9 2025, 11:59 AM

|

|

QUOTE(guanteik @ Jul 9 2025, 08:29 AM) The RIA is supposed to be a guidance/study information but in order to 'lock' your EPF, it became a Framework. Would the Gov be able to support the framework by enforcing higher contributions from the employer, or would they declare a higher % to boost up our retirement sum, well no. Some people wouldn't agree with the word lock because the argument is EPF is a retirement and not an investment. Or simply, their self contribution has been locked indefinitely till 55 (or >1.3m for now) a way to console themselves. originally... there was unlimited self contributions... and funds are 100% locked until retirement... now one can argue that when enhanced retirement savings has been achieved... excess funds are fully unlocked...  |

|

|

|

|

|

dwRK

|

Jul 10 2025, 08:32 AM Jul 10 2025, 08:32 AM

|

|

QUOTE(fuzzy @ Jul 9 2025, 01:19 PM) I genuinely don't think many people view EPF as a HYSA. And for those who do, liquidity and ability to retire should not be an issue, given if they have access money to pump into EPF as when they like, they could just stop doing that and put in KDI or some FD instead? I can only find data that out of all the contributors in EPF, only 130k people have RM1mil or more while no indication of the person being active or inactive. Given they have like 16mil total members, this like 1-2%. yeah... most ppl think of epf as a prison locking down their money  can see cannot touch... just waiting on 55 to finish sentence for full withdrawal myself didn't pay attention until triggered by waifu moving funds around chasing fresh fund fd... so much hassle imho... managed to convince her to max everything into epf... lol... for some ppl... epf can be an ideal vessel... doesnt have to wait on age or 1+ mil... just have to plan properly... |

|

|

|

|

|

dwRK

|

Jul 12 2025, 08:26 AM Jul 12 2025, 08:26 AM

|

|

QUOTE(kevyeoh @ Jul 11 2025, 09:31 AM) I don't plan to use up my capital in EPF by age of 60 also... If possible I still will only use the dividend money generated... So they want to lock to 60... I think still okay... QUOTE(virtualgay @ Jul 11 2025, 11:04 PM) if you die by 55 then how? not worth it... you need to learn how to use money dont be like me my mentality and your mentality is the same and i dont know how to change dont be like me no good it's quite hard to start spending lavishly when one lives a frugal life... ive been trying to spend more but it has been quite a challenge... lol most likely the kids can retire early with our epf money after we gg... |

|

|

|

|

|

dwRK

|

Jul 12 2025, 08:46 AM Jul 12 2025, 08:46 AM

|

|

QUOTE(romuluz777 @ Jul 11 2025, 05:26 PM) I would worry more about the MYR losing its value down the road. QUOTE(Wedchar2912 @ Jul 11 2025, 06:58 PM) personally, i just assume that ringgit will be weakening for the foreseeable future and do some diversifications out of ringgit denom assets. Plus, there is always the risk of political shifts in Malaysia swinging toward the Green... all money loses value... its a natural phenomenon so why worry...  if its spending power... epf gives 5.85% while inflation 2%... so keeping in epf still gets you 3.85%... no problem here... diversification outside carries not only fx risks but also policy and other risks too... and repatriating your gains is subjected to fsi tax which a lot of ppl are unconsciously or conveniently evading... anyway folks pls dun go off tanget... tq |

|

|

|

|

|

dwRK

|

Jul 12 2025, 11:03 AM Jul 12 2025, 11:03 AM

|

|

QUOTE(Cubalagi @ Jul 12 2025, 08:43 AM) Work so hard, save so much, invest wisely so your kids can FIRE 😆 Thats very wrong bro. You need to relearn the habit of spending by planning accordingly. One way is to split your remaining years into buckets of 5 years. You probably then realize that you dont have that many buckets left, and much fewer healthy buckets. In each bucket than you plan what you want to do and what to spend on. The big ticket things. thanks bro... yes have already split into 5 yr bucket... each target what i wanna do and drawdown... last bucket on assisted living n such... all factored in associated inflation  also have started moving some funds and lock into kid's epf... this way they can never blow all their inheritance away...  anyways... i have started spending more... we also spend on charities... just saying its a challenge to spend on ourselves... lol |

|

|

|

|

|

dwRK

|

Jul 12 2025, 04:45 PM Jul 12 2025, 04:45 PM

|

|

QUOTE(Wedchar2912 @ Jul 12 2025, 03:09 PM) Looks like we have someone who is not just very pro Epf, but also pro Malaysia and pro Ringgit. Diversification can take a back seat. Have to say this is refreshing. Good...  i am pro... using brain...  QUOTE(dwRK @ May 29 2025, 08:01 PM) when young... minimum epf... max outside when old... maximum epf... min outside zero risk... 2.5% div guaranteed... 6.5% casa is hard to beat  happy to keep my $ in epf...  i chose to retire in malaysia... so the system and ringgit is part of the package... no need/too late to bitch and moan about it...  ps... i do and still have a stash of usd sitting somewhere that i am repatriating... just saying diversification outside is inherently more risky... additionally say you gg without a proper will or lost 2fa phone, all your overseas monies can be lost forever...  |

|

|

|

|

|

dwRK

|

Jul 13 2025, 08:59 AM Jul 13 2025, 08:59 AM

|

|

QUOTE(Wedchar2912 @ Jul 12 2025, 11:33 PM) I don't really understand... do you mean that you subscribe to the idea that all in into just 1 asset is the optimal solution for you? so since this is EPF's thread, so you mean all your wealth into just EPF? isn't that a bit too aggressive a asset allocation? epf manages a diversified portfolio... in many asset classes and different allocation amount... with some classes not even open to the public... you are saying.... putting all money in epf is risky, should spread it out to say moomoo, m+, ibkr, mbb, public mutual, etc... and you call this asset allocation? you are so wrong here  |

|

|

|

|

|

dwRK

|

Jul 13 2025, 09:30 AM Jul 13 2025, 09:30 AM

|

|

QUOTE(kevyeoh @ Jul 13 2025, 09:08 AM) I think actually EPF itself already diversified also. Hence if we put in EPF, kinda diversified as well already. his concern is future policy changes restricting withdrawal... so he doesn't want to keep everything in epf... in reality the gov and epf has been relaxing withdrawal throughout the years... but we dunno if this will change in the future epf adjusted the withdrawal >1m excess upwards, so ppl just take this as the sign epf wanna restrict ppl from withdrawal... but to me is just realignment with their retirement framework for enhance savings... anyway... |

|

|

|

|

|

dwRK

|

Jul 13 2025, 09:38 AM Jul 13 2025, 09:38 AM

|

|

QUOTE(MUM @ Jul 13 2025, 09:14 AM) I don't care how diversified epf portfolio are. Since epf have been consistently been giving out abt at least 5.4 - 5.8%pa. I would just consider epf as a kind of fixed asset portion of my investment portfolio. I am using my other money for other asset allocations in my portfolio. quite sure everyone is doing the same... just different % in epf vs outside... |

|

|

|

|

|

dwRK

|

Jul 13 2025, 02:34 PM Jul 13 2025, 02:34 PM

|

|

QUOTE(Wedchar2912 @ Jul 13 2025, 10:54 AM) And there I thought you were pro brain.  But telling everyone it is OK to throw everything into just one asset. One platform. One body. One entity. Just chill and sit down and think about it. No matter how safe something is, it is never a good idea to put everything into just that one thing. Edit: I just realised. So in your opinion, future policy changes restricting withdrawal (risk of changes) is not a concern at all? And hence it is acceptable to just put all your funds in EPF? QUOTE(Wedchar2912 @ Jul 13 2025, 10:56 AM) I didn't realize you are so right. Lol. It is always smart to throw everything into just one platform. So right. Haha. nope... never have i said such thing or advice as such... you read/assumed wrongly and imagination gone wild...  |

|

|

|

|

|

dwRK

|

Jul 13 2025, 02:43 PM Jul 13 2025, 02:43 PM

|

|

QUOTE(MGM @ Jul 13 2025, 12:41 PM) One feature Epf lack in is units inheritance unlike ASMx. yup... des why am moving some excess funds into kids epf now... can depart this world with one less worry  |

|

|

|

|

Jul 2 2025, 08:53 AM

Jul 2 2025, 08:53 AM

Quote

Quote

0.0497sec

0.0497sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled