Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

dwRK

|

Oct 19 2024, 01:00 AM Oct 19 2024, 01:00 AM

|

|

QUOTE(nexona88 @ Oct 18 2024, 10:45 PM) No details on that part.. Need EPF official announcement But from the minimum news information that posted... It's more likely from Parents to Children first... Directly... Like those i-suri style... Husband to Wife 😁 i suri i sayang... is salary to spouse... not epf to epf... |

|

|

|

|

|

dwRK

|

Oct 19 2024, 08:54 AM Oct 19 2024, 08:54 AM

|

|

QUOTE(!@#$%^ @ Oct 19 2024, 08:49 AM) if the high networth move their assets out of the country then guess what happens. imho not happening... wanna move already moved... those staying behind got tahan power... |

|

|

|

|

|

dwRK

|

Oct 19 2024, 06:07 PM Oct 19 2024, 06:07 PM

|

|

QUOTE(romuluz777 @ Oct 19 2024, 05:47 PM) I think whats stopping them is becoz of the possibility of HNWI abusing this. no lah... if salary 1mil a month... can already direct 0.7mil into epf... no need to bother about 100k per yr... |

|

|

|

|

|

dwRK

|

Oct 23 2024, 04:24 PM Oct 23 2024, 04:24 PM

|

|

i like this direct xfer... this is good plan... i support...

can bypass 100k limit... hahaha

|

|

|

|

|

|

dwRK

|

Oct 24 2024, 12:24 PM Oct 24 2024, 12:24 PM

|

|

QUOTE(virtualgay @ Oct 24 2024, 11:15 AM) with NVIDIa stock reaching new high most likely it will benefits shariah so i expect this year Shariah will be higher vs converntional who is switching to shariah? conventional held back a lot for distribution... did they invested it well for future dividend ?... sure syariah gave out a lot more but also means less funds in the war chest... until got proven record... for now no compelling reason to swith imho... |

|

|

|

|

|

dwRK

|

Oct 29 2024, 11:42 AM Oct 29 2024, 11:42 AM

|

|

QUOTE(nexona88 @ Oct 29 2024, 11:20 AM) Personally One better not solely depends on EPF for retirement... Need some others alternative too... But biggest portion can be in EPF... It's safe investment place as for now... If you don't listen to all those BS from years ago till now... ya... also imho cannot fully rely on epf as casa... at least have some fd outside... by logic we supposed to get rich with money outside of epf... but sadly many have neither... |

|

|

|

|

|

dwRK

|

Oct 29 2024, 12:50 PM Oct 29 2024, 12:50 PM

|

|

QUOTE(nexona88 @ Oct 29 2024, 12:36 PM) Actually many lose $$$ outside EPF... Not everyone is successfully made it.... Wrong timing, high entry cost, forex losses etc. ya... waifu fd kaki... fd also lose money to epf... but i have convinced her to 70% direct epf... hahaha myself last time noob ut kaki... buy with cash n epf... lost so much oh... nowadays i tell my kids... invest epf n s&p500 only... lol |

|

|

|

|

|

dwRK

|

Oct 29 2024, 12:52 PM Oct 29 2024, 12:52 PM

|

|

QUOTE(drmundo @ Oct 29 2024, 12:14 PM) How much do you think is sufficient to have in EPF savings by the age of 60, assuming you own a house with no remaining loan and have an economy car this was hot discussion in the financial independence retire early tered a few pages back... |

|

|

|

|

|

dwRK

|

Oct 30 2024, 11:23 PM Oct 30 2024, 11:23 PM

|

|

QUOTE(Cubalagi @ Oct 29 2024, 02:07 PM) My target at retirement age will be a 60:40 split. 60% epf and 40% DIY portfolio. good enough plan as any  ... myself not so bothered about splits... once dividends enough to cover spending, have not looked at it for a while now... waifu on the other hand was fd kaki... now epf to the max... i think something like 90:10, if not higher... lol... |

|

|

|

|

|

dwRK

|

Nov 2 2024, 10:05 PM Nov 2 2024, 10:05 PM

|

|

QUOTE(Cubalagi @ Nov 2 2024, 03:02 PM) Epf is great retirement fund. But I still believe in not putting all eggs in one basket. In addition, the diy portfolio allows me to tweak exposure to other asset classes that epf doesnt have or doesnt adequately have. yup... different strokes for different folks... for risk averse and zero interest with investments... epf is superior... |

|

|

|

|

|

dwRK

|

Nov 5 2024, 11:46 PM Nov 5 2024, 11:46 PM

|

|

QUOTE(fuzzy @ Nov 5 2024, 10:59 PM) Also I just realised, the 100k cap was just introduced last year. So how did she contributed 100k a year for few years back?  if you read again properly... that is not what she said... for some ppl their stars just lined up... anyways... no need to analyze further... she is way beyond standard deviation...  cheers... |

|

|

|

|

|

dwRK

|

Nov 6 2024, 02:52 PM Nov 6 2024, 02:52 PM

|

|

QUOTE(nexona88 @ Nov 6 2024, 02:13 PM) Nothing to be jealous or wrong in saying about "tongkat"... Because it's truth... If one living expenses is being "supported" by others sources... So you can just maximize your EPF monthly deduction to at least 70% to 75%.... And show off you got 2mil in EPF... Only would gain my full respect when you start from zero, your expenses is paid by yourself by monthly salary... And yet you managed to get 1mil in EPF... By mid 30... if i is 35 yr unmarried... i will definitely stay with parents, eat their cooking, use their internet... if inherited a house... will definitely rent it out also for extra income...  i am apex predator in the rat race... dun need nobody's respect... hahaha... epf dividend... more than average income liao...  This post has been edited by dwRK: Nov 6 2024, 02:54 PM This post has been edited by dwRK: Nov 6 2024, 02:54 PM |

|

|

|

|

|

dwRK

|

Nov 10 2024, 05:25 PM Nov 10 2024, 05:25 PM

|

|

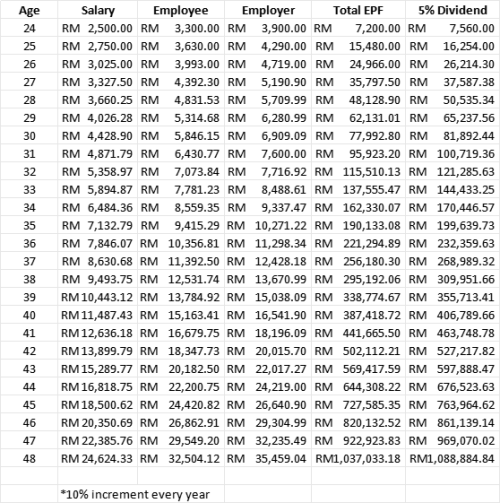

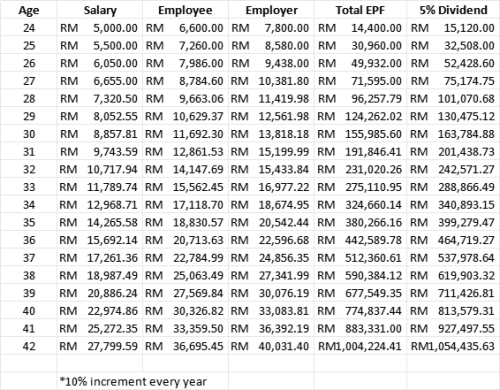

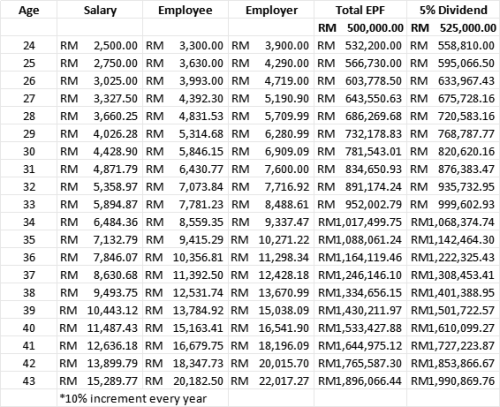

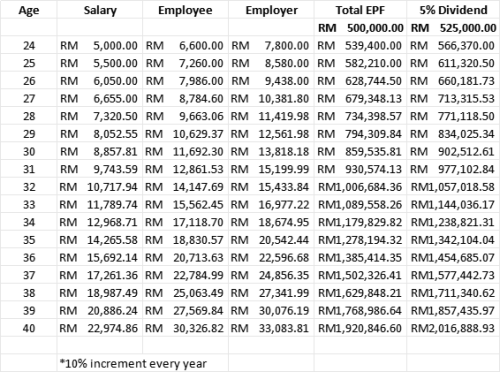

QUOTE(ronnie @ Nov 10 2024, 04:23 PM) not sure what you are trying to achieve... but anyways my 2 sens... we only know a few facts... 35 old, 50k salary, 500k inheritance, 2 mil in epf... learn about self contribution not that long ago, so only max out recently... your models need to start working backwards at 35 yr old matching 50k salary... also your starting pay and increment too low... myself doubled my starting pay in 5 yrs... my rivals double in 4 yrs... my first increment was 35%... increments are flat to descending year on year... but you do get promotions and step change in salary... 500k is unlikely to start in yr 1 but not impossible... so another model is to spread it out... instead of statutory limits, epf contribution can be modeled higher... high flyers will get additional employer epf%... also you missed out on bonus... etc... i do have a proper epf model built but cant get to it just now... one day i will send it to takudan... anyways good luck... |

|

|

|

|

|

dwRK

|

Nov 12 2024, 09:19 AM Nov 12 2024, 09:19 AM

|

|

QUOTE(!@#$%^ @ Nov 12 2024, 08:13 AM) does epf keep earnings for future use? definitely... only depends how much... example last year they kept a lot from conventional but much less from syariah... i expect them to do the same this year... reinvesting more locally... |

|

|

|

|

|

dwRK

|

Nov 12 2024, 10:10 AM Nov 12 2024, 10:10 AM

|

|

QUOTE(nexona88 @ Nov 12 2024, 09:48 AM) Which one needs to look at?? The most right side?? That have percentage?? Correct?? Then I see 1 year the payout is 105% yo... from cash account... |

|

|

|

|

|

dwRK

|

Nov 13 2024, 10:55 AM Nov 13 2024, 10:55 AM

|

|

projecting higher is good... the more professors and economists doing it openly the better... we must support... 6.25 to 6.5%... this give gov and epf some pressure...  aim high... fall a bit short is ok... tembak 6.1%... hahaha... |

|

|

|

|

|

dwRK

|

Nov 13 2024, 11:09 AM Nov 13 2024, 11:09 AM

|

|

QUOTE(CommodoreAmiga @ Nov 13 2024, 10:56 AM) Then aim 10%, get 8%....auntie at pasar beli sayur.  if one is reasonable... is worth considering... otherwise is ignored...  |

|

|

|

|

|

dwRK

|

Nov 13 2024, 01:19 PM Nov 13 2024, 01:19 PM

|

|

QUOTE(gamenoob @ Nov 13 2024, 01:09 PM) Can one shift between back and forth between conventional or shariah after a certain tenure or its a permanent thing? hotel california... |

|

|

|

|

|

dwRK

|

Nov 13 2024, 01:55 PM Nov 13 2024, 01:55 PM

|

|

QUOTE(romuluz777 @ Nov 13 2024, 01:52 PM) Thats scary, in this case no way I will swap, not even for higher div. Siao meh let say starting next year... year on year it out performs conv... switch? |

|

|

|

|

|

dwRK

|

Nov 13 2024, 02:37 PM Nov 13 2024, 02:37 PM

|

|

QUOTE(kechung @ Nov 13 2024, 02:17 PM) It is a tough decision to make as this is a one way ticket. Just always bear in mind high tech won't outperform forever, as it happened in 2001. one hopes that ppl learn from it, especially ppl in epf... but yeah... will need to study hard the syariah portfolio before switching... for some folks >1m or >60 and don't really need epf... there is always sp500... i would seriously consider when the time comes... for now its a non issue... |

|

|

|

|

Oct 19 2024, 01:00 AM

Oct 19 2024, 01:00 AM

Quote

Quote

0.0607sec

0.0607sec

1.09

1.09

7 queries

7 queries

GZIP Disabled

GZIP Disabled