QUOTE(virtualgay @ Jul 23 2025, 08:58 AM)

i only worry what i can control... deposit vs withdrawaldiv% cannot control... no need to worry

EPF DIVIDEND, EPF

|

|

Jul 23 2025, 09:53 AM Jul 23 2025, 09:53 AM

Return to original view | Post

#421

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

|

|

|

Aug 1 2025, 08:17 AM Aug 1 2025, 08:17 AM

Return to original view | Post

#422

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(nexona88 @ Jul 31 2025, 09:35 PM) probably will follow the retirement framework...lock in basic amount 390k for 3k per month annuity for 20 yrs... excess amount can lump sum withdraw as before... will have to see the details... gov should reform the retirement age thingy too... if no money, cannot retire |

|

|

Aug 1 2025, 08:33 AM Aug 1 2025, 08:33 AM

Return to original view | Post

#423

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(MUM @ Aug 1 2025, 06:16 AM) Many many years ago, before they had this Emas account things, ...I remembered there are also many people ho har, making kopitiam noises, started to take out money from epf (if possible) in preparations, after getting winds of epf is planning to move the withdrawal age to 60 from 55. retirement age used to be 50... then 55... now 60... future 65 is certain...It ended with, ...... epf coming up with account 55 and account emas is a genius move imho when it was changed to 60... as changes and progress are inevitable, will be interested to see how the annuity plan works |

|

|

Aug 1 2025, 08:48 AM Aug 1 2025, 08:48 AM

Return to original view | Post

#424

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(jasontoh @ Jul 31 2025, 11:09 PM) That is why the goal post shifting is dangerous. I never thought happen in my lifetime, not to mention just within the year goalpost shifting story props up. I think just withdraw the rest first. As long as uncertainty props up it shows how dire EPF/Government want to lock the money with the excuse scams etc. gov doesn't really need to revamp the epf scheme to lock in your money... too much work... all they need to do is just increase your caruman by 1%... just two days ago was sitting at mixue and next table was some guys trying to scam two aunties... scams are a real problem, not an excuse imho... |

|

|

Aug 1 2025, 11:09 AM Aug 1 2025, 11:09 AM

Return to original view | Post

#425

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

Aug 3 2025, 09:50 AM Aug 3 2025, 09:50 AM

Return to original view | Post

#426

|

Senior Member

6,248 posts Joined: Jun 2006 |

purpose of epf... is when you retire, you do not become a menace to society and a burden to the gov for the rest of your life... is not all about giving you a lump sum money to do as pleased... but clearly the whole/current system is broken... people not enough money to retire... people lose all after retirement... Singapore... a smart, successful and progressive country has changed their cpf system years ago... so should our madani gov do the necessary to protect everyone asap... Barricade liked this post

|

|

|

|

|

|

Aug 3 2025, 01:18 PM Aug 3 2025, 01:18 PM

Return to original view | IPv6 | Post

#427

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(imceobichi @ Aug 3 2025, 01:09 PM) This is a big wake up call for EPF savers who treat it as a risk free investment nothing is risk free... but epf is the lowest risk...EPF saving is not risk free. Regulatory risk is very very real. guaranteed capital + 2.5% div... you will get back all your money... CommodoreAmiga liked this post

|

|

|

Aug 3 2025, 03:54 PM Aug 3 2025, 03:54 PM

Return to original view | IPv6 | Post

#428

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Wedchar2912 @ Aug 3 2025, 01:40 PM) really? so now you are ok to put all of your wealth into EPF? have always been ok putting money into epf... posted here in lyn many times for a few years already, getting waifu to increase her direct deduction from 11% to currently 70%...since you said so confidently that "you will get back all your money" my guesstimate around 80% of our cash is in epf... justanovice, HolyCooler, and 4 others liked this post

|

|

|

Aug 3 2025, 06:11 PM Aug 3 2025, 06:11 PM

Return to original view | Post

#429

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(nexona88 @ Aug 3 2025, 04:41 PM) But same time... With freedom given... Some just lose their hard earned EPF $$$ to some scam investment offers... let say the pencen plan locks in 390k for basic retirement... ppl with a few mils above that can still be scammed and make news...but this plan helps the more vulnerable b40 and some m40... scammers need to come up with ansuran schemes... hopefully the small money is too much risk and not worth the effort... |

|

|

Aug 3 2025, 06:38 PM Aug 3 2025, 06:38 PM

Return to original view | Post

#430

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Wedchar2912 @ Aug 3 2025, 06:05 PM) But its not just retirees and their funds from EPF... many across the board, age and professions also kena.... scammers have already teach brainwashed victims how to evade epf and bank questioning...hence why gov should fortify at banking level... not EPF. It is just selective observation (purposely gov/epf) in order to activate our own confirmation biasness... plus lotsa sensationalization... cos why not.... telling news of how a 25 years old adult kena scammed 30K rm from MLM is not as "SHOCKING" as a "old" 52 years old woman who lost say 1.3 million due to love struck scam... right? the woman did not send 1.3 mil one shot... scammers are really smart and sophisticated... also they use western union n other remittance services that are less stringent and less traceable... |

|

|

Aug 4 2025, 03:39 PM Aug 4 2025, 03:39 PM

Return to original view | IPv6 | Post

#431

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(bobafett @ Aug 4 2025, 03:19 PM) no |

|

|

Aug 5 2025, 08:24 AM Aug 5 2025, 08:24 AM

Return to original view | Post

#432

|

Senior Member

6,248 posts Joined: Jun 2006 |

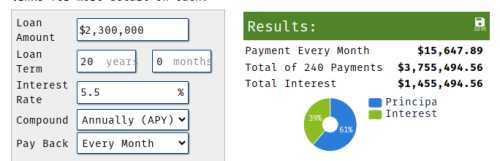

your estimates are high... and your div calc is low...

for 15k/mth you need 2.3mil... since you require only 80k more to hit 2.5mil... congrats, you already have enough funds for the high side...  for 11.5k/mth... you only need 1.7mil... QUOTE(virtualgay @ Aug 4 2025, 11:16 PM) 2.5 million is our goal if we want to retire comfortable now i use to focus on 1.5M but after knowing that medical cost is so expensive i think 2.5M is needed even with insurance it wont help especially when you old you need to take supplement, you need physiotherapy, you need domestic helper i start to plan all this as now i am at 52 this year and why 1.25M per person as i need to cover for my wife so i need to have 2.5M for 2 future cost in 10 years - hopefully this number maintains! domestic helper - RM3.5k per month physiotherapy for 2 - RM1k per month insurance for 2 - RM1.2k per month tnb - RM500 per month water bill - RM50 per month supplement for 2 - RM500 (milk powder, omega, vitamins, ect) medicine for 2 - RM500 (depend on your sickness - just assume u have heart problem, cholesterol problem, diabetic problem, high bp) phone bill for 2 - RM100 unifi - RM150 other misc - RM1000 (clinic visit, travel cost) makan for 3 - RM3000 (me, my wife, domestic helper) Total 11.5k Estimate i think on the safe side just make sure put 15k per month for expenses 2.5M x 5.5% = RM137,500 per year dividend 137500 / 12 = RM11458 per month so need to take out additional 3.5k per month to top it up until RM15k per month chatgpt projected as long as i have 2.5M and i consistently withdraw RM15k per month and with dividend of 5.5% after 20 years i should still have 900k left... if you think the above number is not realistic i really welcome you to comment so i can adjust and plan accordingly i have 8 more years till retirement but if i continue to work for the next 8 years and do not withdraw any money from EPF and continue to slowly pump like RM10k per year i might hit it base on my calculation |

|

|

Aug 7 2025, 09:17 AM Aug 7 2025, 09:17 AM

Return to original view | IPv6 | Post

#433

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(lock_82 @ Aug 6 2025, 11:35 PM) while this maybe out of topic, as a parent with kids i found it hard to save money for their tertiary education. So question is, is it norm to depend on my own EPF for their teriary fund, which can be easily 200k+ per pax. yes i will use my epf for their studies... they need money now... my retirement can wait... QUOTE(BboyDora @ Aug 7 2025, 12:08 AM) EPF = retirement funds or investment tools . depends how you look at it. (for me, I dunno what will happen tomorrow. dunno got chance to enjoy the epf or not) my friend ended up as char siew kid... his parent wasted 1 bungalow to fund his studies... he is now living hand to mouth... he was top 10 in secondary and chief librarian to boot... can never be sure how one will end up...if you put it as a fund for your kids as tertiary education, it's an investment too. if you spend Rm 200k + and after they graduate, they work in Singapore for SGD 3.5k basic pay, (Around RM 10k) , the money you spend break even after 2+ years after they work. nexona88 liked this post

|

|

|

|

|

|

Aug 14 2025, 05:03 PM Aug 14 2025, 05:03 PM

Return to original view | Post

#434

|

Senior Member

6,248 posts Joined: Jun 2006 |

and members >55 dun count... no acc 3...

|

|

|

Aug 19 2025, 10:36 AM Aug 19 2025, 10:36 AM

Return to original view | Post

#435

|

Senior Member

6,248 posts Joined: Jun 2006 |

epf is run like business... will retain more profit not 100% given out as dividend when there are opportunities to pursue...

when market crash... i support they retain more to BTFD,,, this way one gets better return for the long term... too bad if one has to withdraw at the wrong timing... you are just collateral damage... |

|

|

Aug 19 2025, 11:21 AM Aug 19 2025, 11:21 AM

Return to original view | Post

#436

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(boyboycute @ Aug 19 2025, 11:10 AM) poor dun pay tax lah... rich pays more...and epf treats every member equally... for now CommodoreAmiga liked this post

|

|

|

Aug 19 2025, 12:36 PM Aug 19 2025, 12:36 PM

Return to original view | IPv6 | Post

#437

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Rinth @ Aug 19 2025, 09:32 AM) I remember reading an article about the payout ratio. boss you forget 6% earnings... need to pay salary and wages, utilities, rentals, land and building/expansions, etc...Actually EPF are supposed to utilise all the payout as dividend, because every moment there’ll be contributor withdraw their saving from EPF. If the payout retained in EPF, which means that the contributor received lesser dividend then it supposed to get… Example the ACTUAL earning of EPF was translate to 6%, your RM 1mil should get RM 60k, but that year EPF announce 5% at maybe 90% payout rate, hence your dividend is RM 50k only. Then you withdraw all RM 1.05mil out, hence your 1% which supposed to payout to you was retained and given to the other contributor. But I remember reading also the actual payout was not 100% also due to the accounting related recognition, as there’ll be unrealised gain record in the particular years, and this amount cannot be distributed as dividend because it’ unrealised. |

|

|

Aug 19 2025, 12:48 PM Aug 19 2025, 12:48 PM

Return to original view | IPv6 | Post

#438

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

Aug 19 2025, 08:16 PM Aug 19 2025, 08:16 PM

Return to original view | IPv6 | Post

#439

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(MUM @ Aug 19 2025, 02:32 PM) my understanding is they will pay 2.5% first as required by law, and pay remainder adjusted for div announcement... not based on previous yrs div...i think i read this on their faq but can't be sure... anyways... |

|

|

Sep 11 2025, 09:52 AM Sep 11 2025, 09:52 AM

Return to original view | Post

#440

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(virtualgay @ Sep 11 2025, 12:07 AM) stupid question age plays a part too... 55 maybe... 35 unlikely...let just say now u have 5M in EPF will u stop working or u will still give excuse like i still working to keep me occupied as i have too much free time or my work is my hobby? my answer - i will quite for sure... but if i ever hit 5M maybe my answer will be different nobody knows only answer this question if you are a worker and not a boss / business owner as my question is targeting to workers (actual epf contributors) |

| Change to: |  0.0740sec 0.0740sec

0.98 0.98

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 08:13 PM |