QUOTE(wongmunkeong @ Feb 10 2023, 03:29 PM)

whole salary deduction into EPF isn't part of the $60K self-contribution coz via employer's system.

my exHR said wan - 100% pun boleh XD

technically not possible to set to 100% because the % is on gross income.

everyone has to pay tax, so it will be a percentage up to like 80%.

Just to share for readers:

The net salary must at least be positive (I don't know if this is a policy by EPF or just my ex-firm's policy. If think about it, makes sense employer don't want to wait for employee to pay money to the firm every month rite? ).

Keep in mind that Bonus and "entitled" Allowance are basically treated like salary to EPF and hence subject to all the features of salary. Ie, if one set the contribution % to 40%, then the contribution % will become Mandatory % + 40% = 51%, assuming Mandatory is 11.

This will be applied to all income regardless.

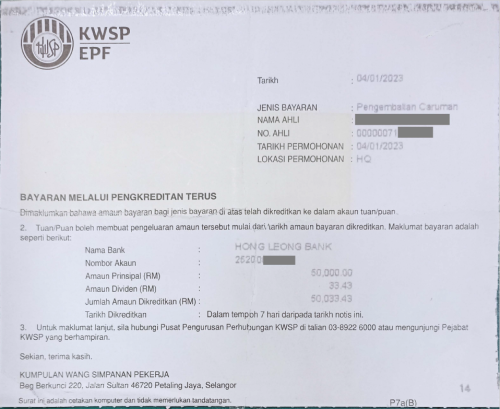

For the 60K self contribution, this falls under a completely separate category and has nothing to do with the usual salary deduction, which is Mandatory Contribution. So no need to link both together.

Feb 4 2023, 08:58 PM

Feb 4 2023, 08:58 PM

Quote

Quote

0.5182sec

0.5182sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled