QUOTE(dudester @ Dec 12 2024, 04:00 PM)

Thats 39 years later.

30 years ago 200k house is 1mil today.

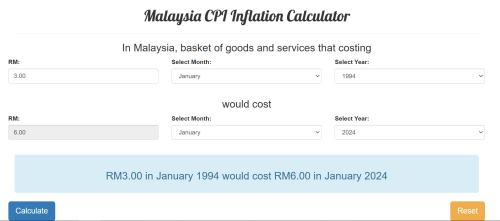

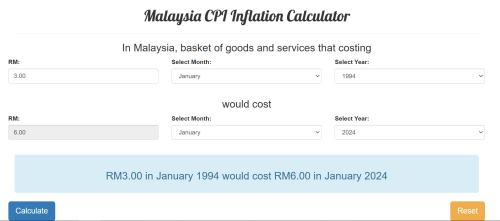

Lunch was 3rm, today 10rm.

Technically by then you would need 550k x 3 to retire. and we are not even looking at exponentially inflation.

Inflation is "only" double from 30 years ago.

You don't look because most don't understand inflation. The historical CPI is there to be calculated.

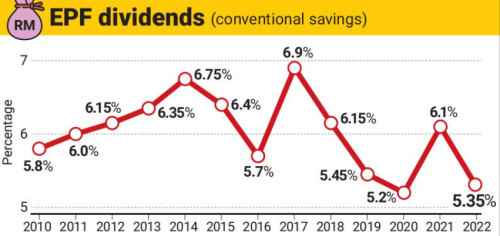

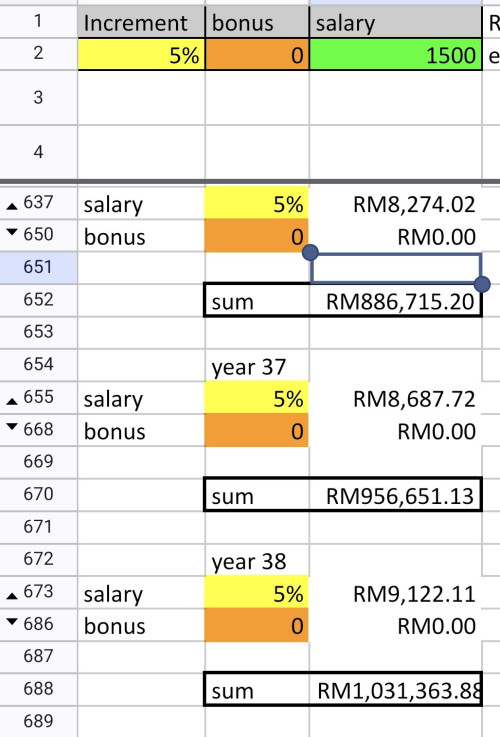

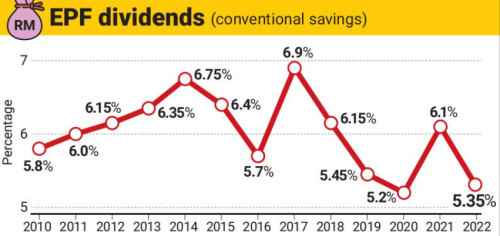

Furthermore, EPF tracks inflation. The calculation is using 5.5% as a benchmark, assuming the person at 23yo earning RM1.7k having zero increment until retirement. It's the extreme end of things and he still comes out with 600k for retirement because minimum wage will rise, salary will rise.

If inflation rises, EPF returns generally rises in tandem. Take 2017 for example, inflation was at 3.8%, but it also gave us 6.9% EPF and it feel in tandem the years after.

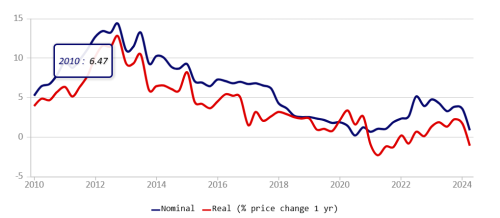

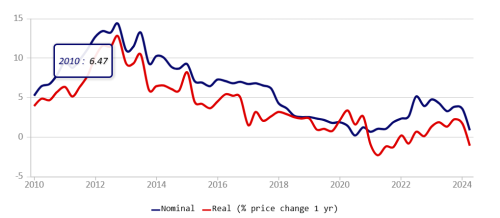

Even your point on housing doesn't really track. If you look here, housing prices have largely trended down:

https://www.globalpropertyguide.com/asia/ma...a/price-history

A Proton in 90's was around 40k, a Proton in 2024 is also around 40k. There's essentially zero inflation despite it being a better car. The inflation we see is we think Proton is no longer good enough, but we need a beemer instead. Same for houses.

You see Bangsar price is now millions, but in the 70's, it was not a popular place at all:

QUOTE

Zerin Properties chief executive officer Previndran Singhe said Bangsar started to develop in the 1970s as a housing suburb. By 1980s, it has become a sought-after location.

“The 1970s was the opening of Bangsar. It was not the preferred location due to floods but soon, people saw it as a strategic location.

“Bangsar Park terrace houses were selling for about RM18,000 each. The same terrace house now is going for at least RM1.7 million,” he told NST Property.

So the inflation is not because the housing price went up, its because the location we deem desirable went up.

Sorry for the rambling. I generally don't like the doom and gloom version without context in it. This country has a lot of improve, but it's only hopeless if we strip away all context of things.

Nov 13 2024, 11:03 AM

Nov 13 2024, 11:03 AM

Quote

Quote

0.0497sec

0.0497sec

0.77

0.77

7 queries

7 queries

GZIP Disabled

GZIP Disabled