QUOTE(blackseed202 @ May 22 2016, 02:36 AM)

thanks for the link!

that means if i want to get a profit, i should target like more than 2.12% yield or else i wont get any profit right?

and the YTD like 1m/6m at the website, does that minus the sales fee or not?

like for example 1y yield is 7% does that mean my net profit is 7-2.12%= 4.88%??

and that is like 1-2% more than fixed deposit in most major banks right?

that doesnt look very worth it?

please advise.

thanks!

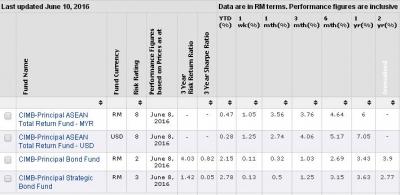

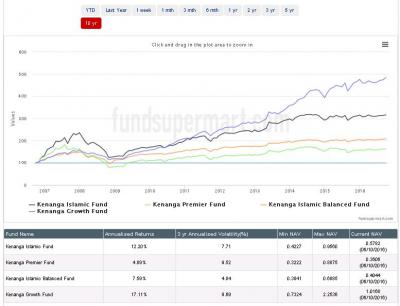

use the Fund Return tools in the FSM page to see the returns over a period of specified time period.

FSM MY main page >> FUNDS INFO>>>FUND RETURN

then click FUNDS INFO>>>FUND PRICES ...this will shows the price of particular date.

compare the data from the 2 tools to see how the returns are calculated?

does the RETURN shown excludes the Sales Charges or inclusive?

I may be wrong...but my monitored ROI data is almost similar to FSM. and my data are comparing the NAVs...and NAV is already net (after minus Sales charges and other charges).

if you wanted to invest UT with this "that is like 1-2% more than fixed deposit in most major banks right?

that doesnt look very worth it?" in mind.....(nothing wrong with what you think...most people are doing that).

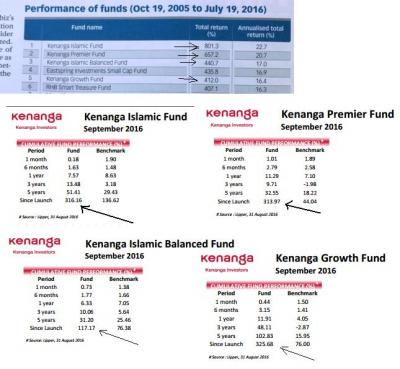

Hope you had not stepped into UTs investing......for one,.....UTs investing is not FD.....(eventhough some UTs are behaving like FDs in terms of returns)...to be on extreme for discussion sake....some funds can get 10% per month (some can go to MINUS and some can go to POSITIVE)

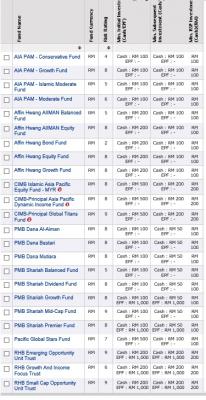

Goto FSM MY again.

FUNDS INFO>>>FUND RANKING

"that doesn't look very worth it?".....

my talk (would not say "advice") is explore and get to know more investment vehicles out there that be it legal or "LEGAL" that suits individuals risks & rewards expectation and diversity in one net asset building.

Oct 4 2015, 12:13 AM

Oct 4 2015, 12:13 AM

Quote

Quote

0.0686sec

0.0686sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled