QUOTE(sandkoh @ Dec 1 2017, 10:36 PM)

guys, do you hold ut for years or take profit with a goal (like reach 10%, 20% profit) in mind?

ut agent tend to ask us to sell when profit say 10 to 20%. more like business for them, more sales charge that they can gain? not to all advantage?

so hold or sell then buy again?

if a fund had climbed to a certain level, I would review the valuation of that fund's coverage mandate.

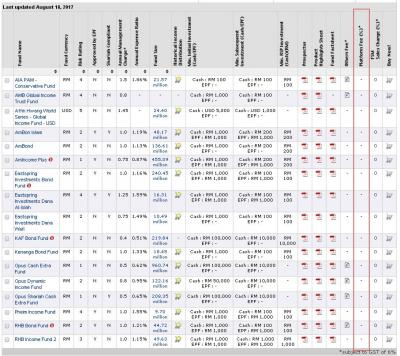

example from here.....

Star Ratings For The Various Markets

https://www.fundsupermart.com.my/main/resea...tarRatings.svdoif still ok...I will leave it there

but "What To Do If Certain Markets Are Getting Expensive?".....this guy did it this way...

https://secure.fundsupermart.com/main/resea...SJBlog_20150402finally, at the end of the day......

WHEN TO TAKE PROFITS?

https://secure.fundsupermart.com/main/artic...e-Profits--1783I would not simply set a goal to sell a fund when it had made (10% or 20% profit)...for

a) I would have missed more opportunity that may have come from that fund,

b) if I sold that fund, which similar area of coverage fund would I buy? would not the valuation of that similar fund that I am going to buy in be the same as the fund that I had just sold?

Don't Let The High Fund Price Deter You

https://www.fundsupermart.com.my/main/resea...?articleNo=2288Disclaimer:

This post does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this post without obtaining specific professional advice.

Investment involves risk. The NAV price of a fund may go down as well as up, and under certain circumstances an investor may sustain a total or substantial loss of investment. Past performance is not necessarily indicative of the future or likely performance of the fund. Investors should read the relevant fund's prospectus for details before making any investment decision. An Investor should make an appraisal of the risks involved in investing in these products and should consult their own independent and professional advisors, to ensure that any decision made is suitable with regards to their circumstances and financial position.This post has been edited by T231H: Dec 2 2017, 11:01 AM

Jul 2 2017, 11:55 AM

Jul 2 2017, 11:55 AM

Quote

Quote

0.0947sec

0.0947sec

0.22

0.22

7 queries

7 queries

GZIP Disabled

GZIP Disabled