QUOTE(thefinisher @ Jan 26 2021, 05:52 PM)

Hi sifus,

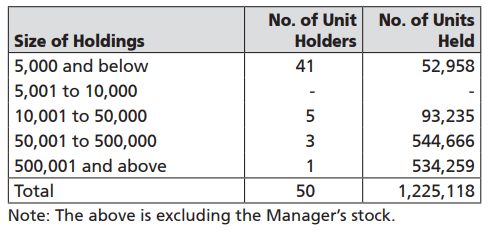

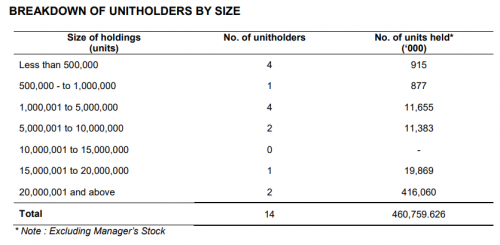

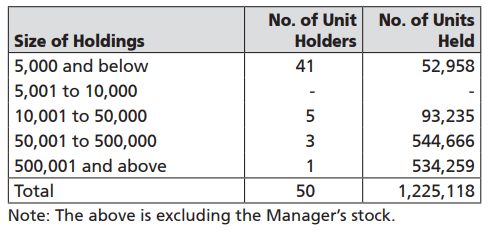

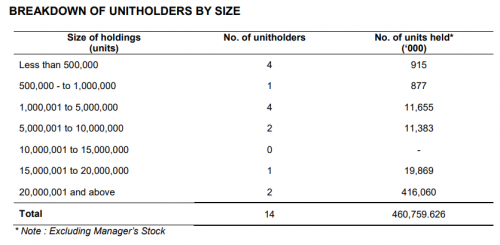

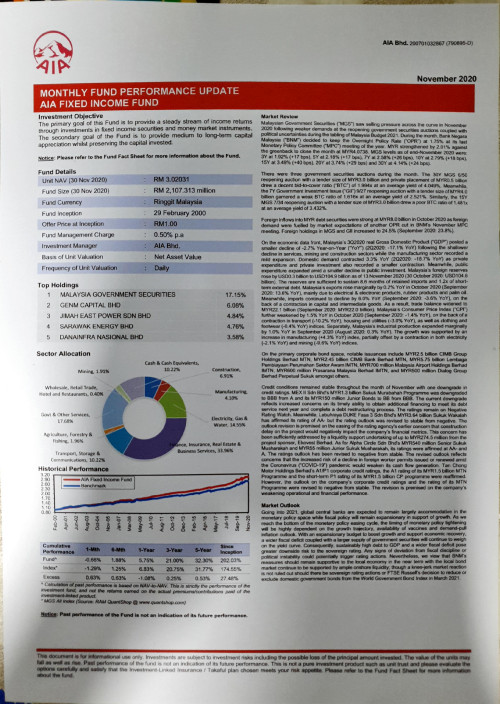

Sorry in advance for the newbie questions. This is my first time trying out ut investments. I have been researching on bond funds on FSM and the two funds I have been looking at is KAF Bond Fund and Nomura Bond Fund for their low annual expense ratio. I was looking at their annual report and found the analysis of unit holders as shown below

for KAF

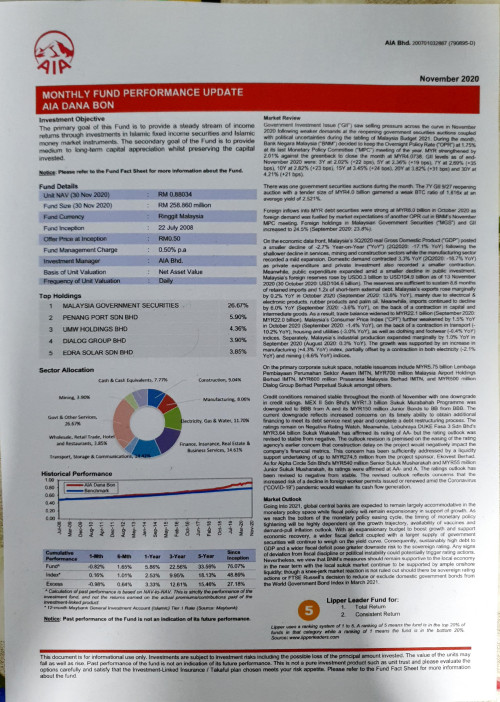

for Nomura

I am very interested in knowing why these funds have like one or two unit holders that can control more than 90% of the unit holdings and is this a cause for concern in UT in general?

In regards to FSM bond funds, I noticed that some bond funds (like the above 2) do not have the quarterly platform fees stated under charges. Is it part of the expense ratio? The other funds are stated under charges.

Also not sure if it is stated anywhere, for FSM is the annualized return calculation inclusive of the annualized fees?

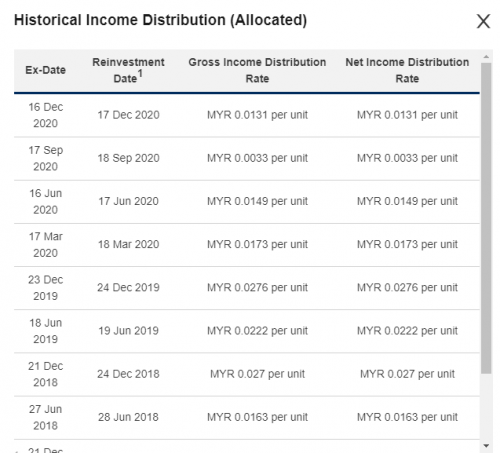

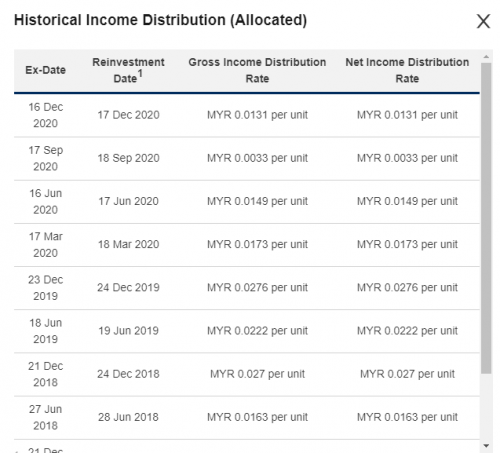

For distribution for Nomura, it is stated in the view history that the distribution is reinvested. Does it mean that automatically all distribution is reinvested into the fund?

Anything else to look out for or be cautious for in bond funds?

Sorry for the many many questions and thanks in advance!

They only list the institution. not every single tom dick and harrySorry in advance for the newbie questions. This is my first time trying out ut investments. I have been researching on bond funds on FSM and the two funds I have been looking at is KAF Bond Fund and Nomura Bond Fund for their low annual expense ratio. I was looking at their annual report and found the analysis of unit holders as shown below

for KAF

for Nomura

I am very interested in knowing why these funds have like one or two unit holders that can control more than 90% of the unit holdings and is this a cause for concern in UT in general?

In regards to FSM bond funds, I noticed that some bond funds (like the above 2) do not have the quarterly platform fees stated under charges. Is it part of the expense ratio? The other funds are stated under charges.

Also not sure if it is stated anywhere, for FSM is the annualized return calculation inclusive of the annualized fees?

For distribution for Nomura, it is stated in the view history that the distribution is reinvested. Does it mean that automatically all distribution is reinvested into the fund?

Anything else to look out for or be cautious for in bond funds?

Sorry for the many many questions and thanks in advance!

Jan 29 2021, 01:59 PM

Jan 29 2021, 01:59 PM

Quote

Quote

0.0206sec

0.0206sec

1.07

1.07

6 queries

6 queries

GZIP Disabled

GZIP Disabled