QUOTE(feimoon @ Aug 17 2021, 11:54 AM)

There will be an increase in my Prudential premiums, from Aug onwards. If I want to maintain the same premium payment as before the increase, Prudential will take out the waiver rider. Should I remove the rider from PRULink Assurance Account? Is the rider in insurance really important? Please advise.

hi

feimoon you can get agent to assist you on this matter , using e-endorsement to edit the policy.

If you want to maintain the same premium / lower down , you can either :

Option 1: maintain rider , reduce sustainability

Option 2: reduce rider , maintain sustainability

Option 3: reduce rider + reduce sustainability

Try to mix and match to find the best budgets that suits you with the coverage you want for now.

Rider can be totally removed / reduced coverage says from 50k to 10k for example.

In future if you got budget again, you can upgrade again provided you are healthy.

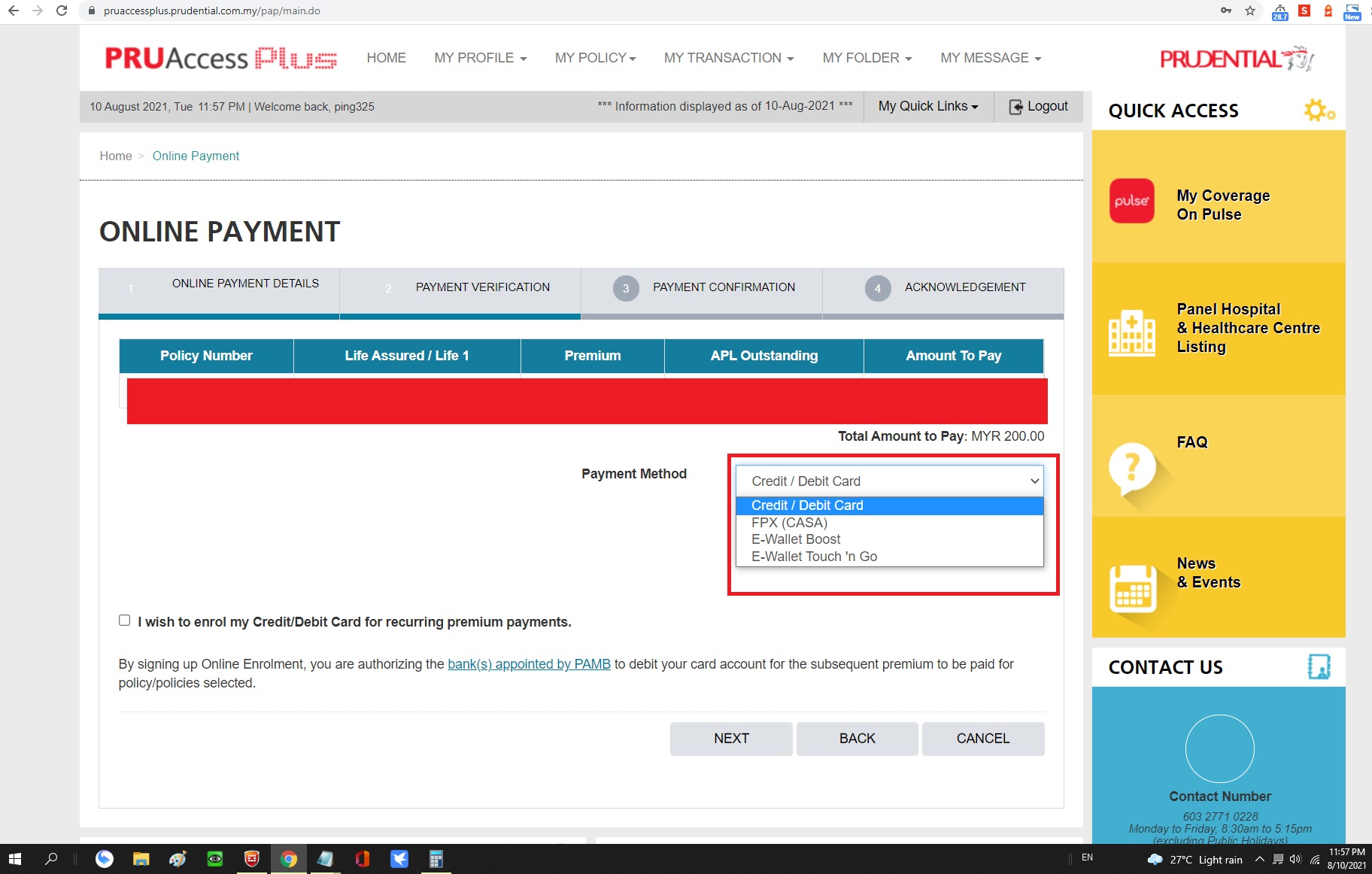

Below are the exact scenario on what i did for my client last month , he is facing income disruption due to covid.

Basically prudential send letter around march and notify that premium will increase from RM2219 to RM2507 in July.

After endorsement by reducing coverage during June , his premium now reduced from RM2219 to RM1900.

Better don't last minute do endorsement , do it earlier like one month before premium will increase because need processing time.

This post has been edited by ping325: Aug 17 2021, 06:16 PM

Jul 26 2021, 02:20 PM

Jul 26 2021, 02:20 PM

Quote

Quote

0.0333sec

0.0333sec

0.63

0.63

6 queries

6 queries

GZIP Disabled

GZIP Disabled