QUOTE(ping325 @ Jul 9 2021, 11:25 PM)

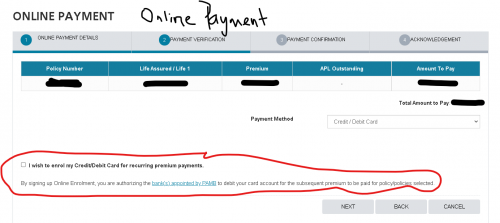

from you screenshot , your case same like me previously....it was cash at first , after i pay using credit card then somehow it auto enroll my cc for auto debit

so i submit a form to change payment method back to cash and since then i pay using e-wallet to get cashback....

another policy still remain as auto cc deduction

if you leave it then in future it will auto deduct your cc.

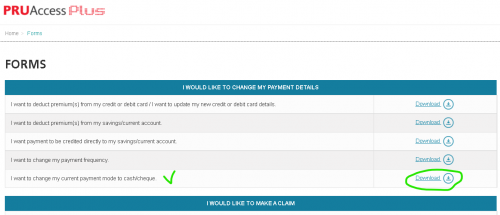

if you want to switch back to cash , you need to ask your agent to submit an e-form for you

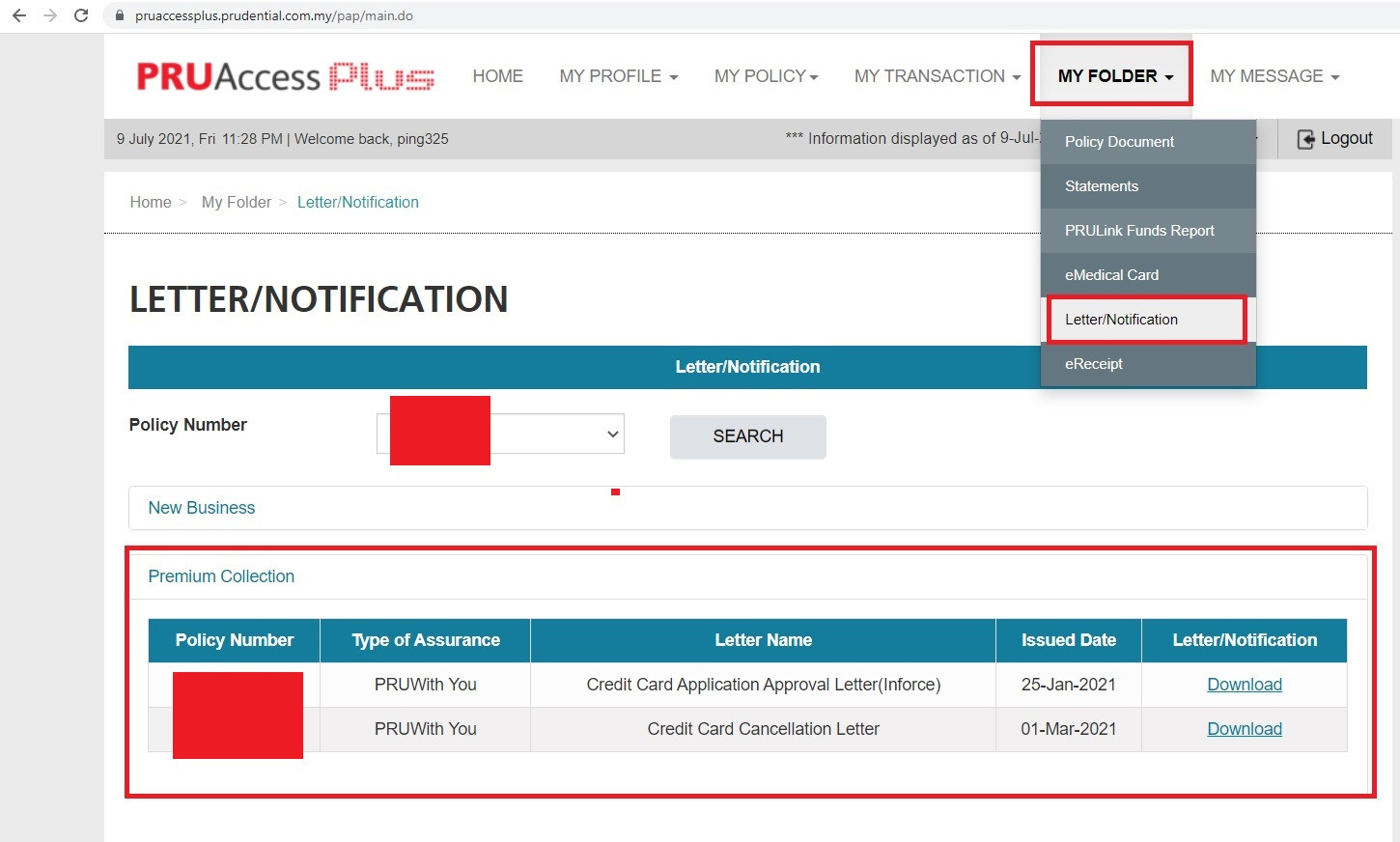

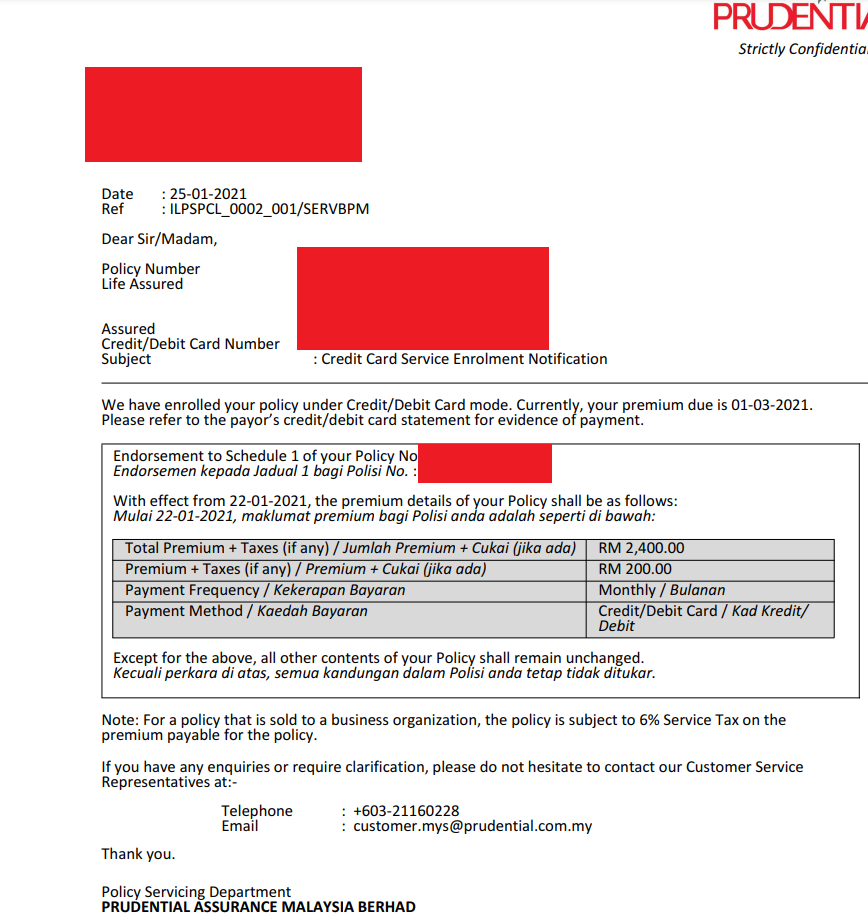

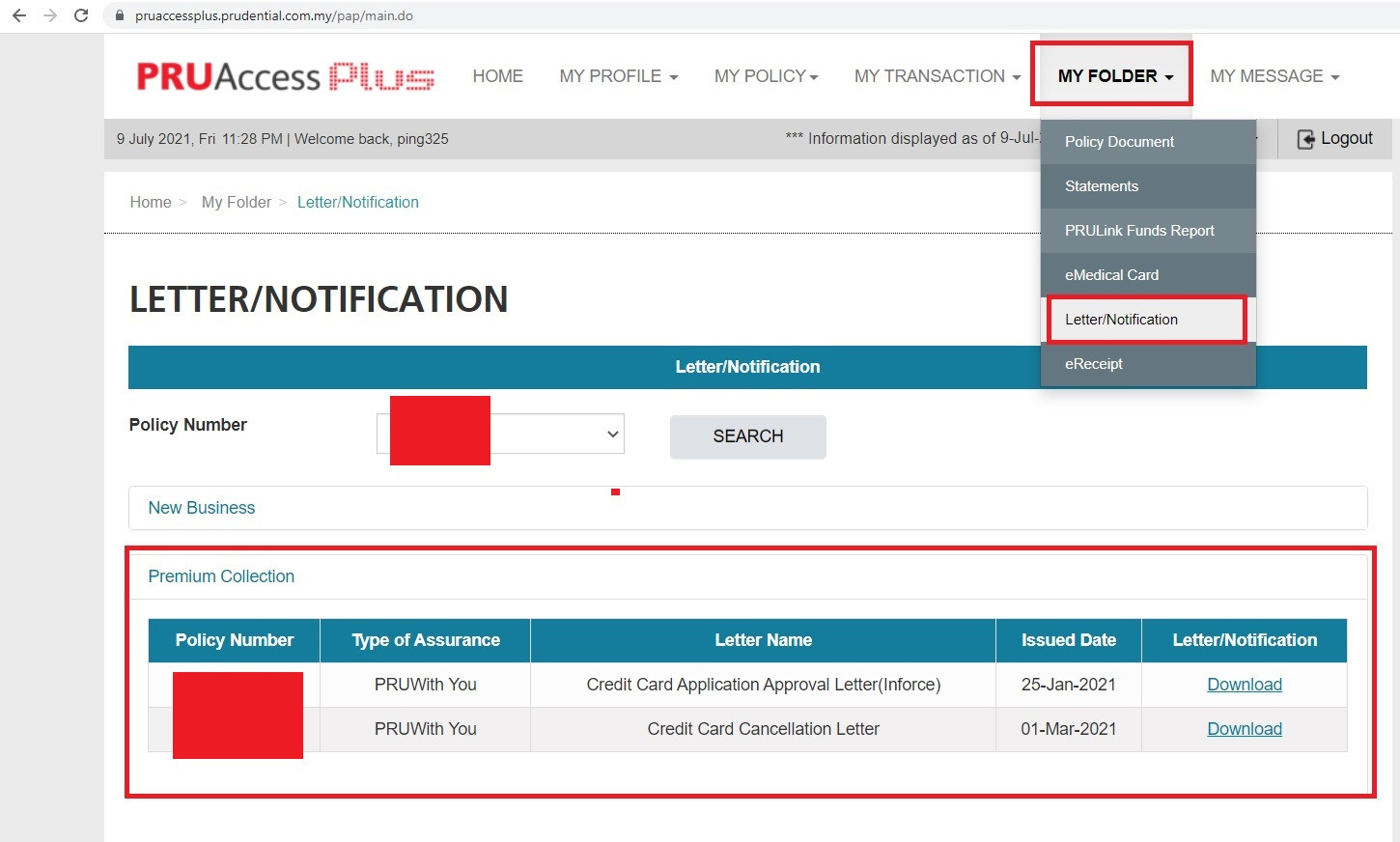

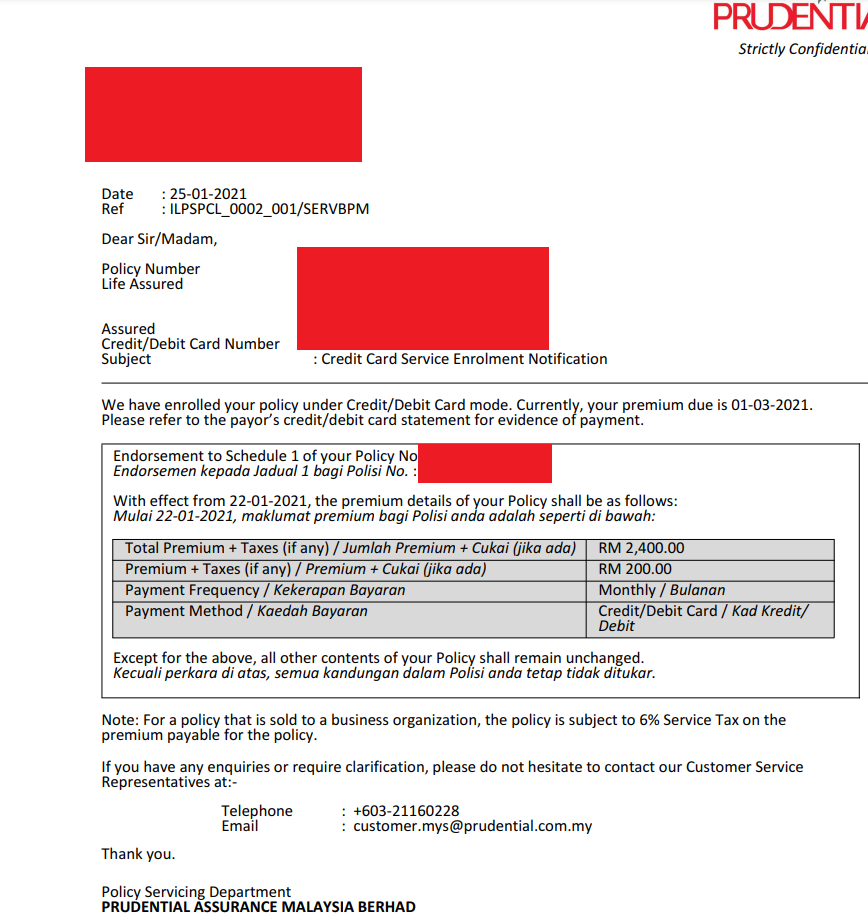

try to go to your pruaccess again --> My Folder --> Letter/Notification

see if there is any auto enrolment letter over there , it looks something like below

From ur words, i more confident i didnt accidently click auto enroll. so i submit a form to change payment method back to cash and since then i pay using e-wallet to get cashback....

another policy still remain as auto cc deduction

if you leave it then in future it will auto deduct your cc.

if you want to switch back to cash , you need to ask your agent to submit an e-form for you

try to go to your pruaccess again --> My Folder --> Letter/Notification

see if there is any auto enrolment letter over there , it looks something like below

Ok need to call prudential on monday.

Thanks guys.

This post has been edited by sl3ge: Jul 10 2021, 07:22 AM

Jul 10 2021, 07:22 AM

Jul 10 2021, 07:22 AM

Quote

Quote

0.0362sec

0.0362sec

0.47

0.47

6 queries

6 queries

GZIP Disabled

GZIP Disabled