To read my brief comments on HSBC CNY Promo, go to my blog (towards the end just before summary).

Fixed Deposit Rates in Malaysia V2, Read 1st post to find highest rate.

|

|

Jan 9 2012, 08:51 AM Jan 9 2012, 08:51 AM

Return to original view | Post

#61

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

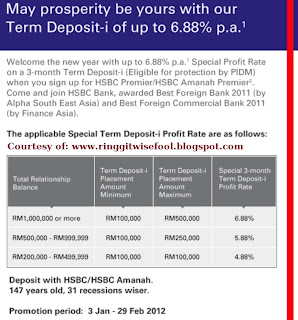

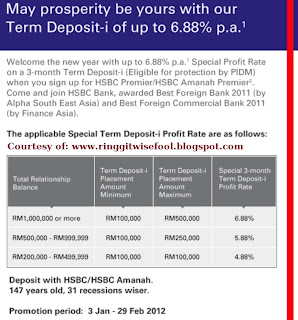

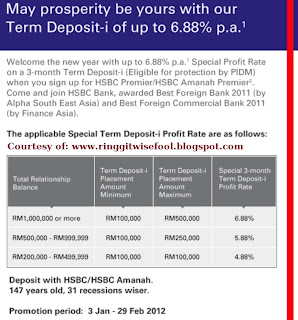

Got a Million Ringgit in cash? If yes you get to enjoy 6.88% for 3 months with HSBC NEW Premier Account, but for only half of it.

To read my brief comments on HSBC CNY Promo, go to my blog (towards the end just before summary). |

|

|

|

|

|

Jan 9 2012, 06:34 PM Jan 9 2012, 06:34 PM

Return to original view | Post

#62

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(ultraman29 @ Jan 9 2012, 03:40 PM) if i read this right, this hsbc u have to leave the total funds (the part which is not in FD) with the bank for 3 months, to enjoy up to 6.88%. yes, for HSBC case, your other half of the funds have to remain with HSBC for 3 months.whereas for ocbc, u can enjoy 5% but the funds not in FD u can take it out and use it elsewhere. QUOTE(taitai29 @ Jan 9 2012, 06:01 PM) hello all, i am a bit confuse about the current FD package, I dont find those good rates you guys mentioned from bank websites, most of their website still showing annual rate of 3.1% - 3.15%, I dont see any FD rate at 4%, 5% etc. Another guy to be spoon fed I am asking on behalf of my mother, she lost quite a bit from public mutual and now she wants to put all her money into FD. But I don't know which one is a best package. From this topic I see OCBC 5%, HSBC 5%, UOB and stanchart etc, but when I go to their website, all 3.1%-3.15% only. So, if you have a cash of around RM1,300,000, which bank and which FD package? hosrt term 3 months also can, so that it wont get locked in, in case here are some better package, my mother can change to other bank. I try to search this topic but still a bit confuse. So, all tai kor and tai jie, please lend me your hand, advise me which one is a best package on the market now. thank you very much!!!! and with you posting you have RM1.3M cash, either you love to be receiving PM by the many con men and maybe one or two overly eager insurance agents lurking around this forum or you just want to let us know you're freaking rich And welcome to the FDMCG club **Edited** For your case, it is best you go talk directly to a Premier/Priority/Privelige Banking Relationship Manager directly instead of just anyone in the banking hall to avoid what sylille gone thru. click below link and read Post#404 http://forum.lowyat.net/topic/2070535/+400 And if your place got no Premier Banking, with RM1.3M, the Bank Manager himself/herself would be more than happy to attend to you and your mother. With your amount and for 3 months tenure, look into HSBC promo above. But after that, you can close the account because they usually don't have good promotions for existing Premier Account holders. This post has been edited by Gen-X: Jan 9 2012, 08:03 PM |

|

|

Jan 9 2012, 10:08 PM Jan 9 2012, 10:08 PM

Return to original view | Post

#63

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(MilesAndMore @ Jan 9 2012, 09:20 PM) Guys, how can you all forget about Kuwait Finance House ? It's been offering 4% return since last month for 6, 12 and 24 months tenure and this promotion is due to expire at the end of next month. It needs a minimum deposit of RM20,000 and there doesn't seem to be a maximum limit for this promotion. There is no need to split your money between normal board rate and this promotion rate either! wah, 6 months too I saw the banner when i walked pass a KFH branch this morning. I was on my way to UOB to buy new banknotes and to get their ang pow for this year O.T. You changing new notes - you are married and giving Ang Pows or you just like new notes QUOTE(BoomChaCha @ Jan 9 2012, 09:33 PM) All right, let's check it out here... Thanks. And it pays the interest in "advance" and you need to open a current or savings account.http://www.kfh.com.my/kfhmb/ Click here for T&C Posted in Post #1  QUOTE(MilesAndMore @ Jan 9 2012, 09:29 PM) Actually, HSBC will first send out letters to you to remind you to top up your fund in HSBC but you will have to pay the RM150 account service fee on the first month your total relationship balance falls below RM200k. My ex-SCB RM told me that SCB will charge RM100/month, but she said she can always appeal to get it waived for me if I have intention to top up soon. But I don't think I will be depositing anytime soon with them so asked her to close my account instead of me requesting the monthly charges to be waived and her having work to do. So, she said she will first downgrade my account before I can close.A HSBC Premier account will only be converted to an Advance or any other normal savings account types upon the customer's request or when the customer fail to top up the balance to at least RM200k for three consecutive months. This post has been edited by Gen-X: Jan 9 2012, 10:34 PM |

|

|

Jan 10 2012, 06:58 AM Jan 10 2012, 06:58 AM

Return to original view | Post

#64

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(turion64 @ Jan 10 2012, 12:07 AM) To be honest, I have friends that worked in the marketing line and shockingly, they told me banks do sell their information to marketeers. Its not really the bank that have sold it, but the staff sold it without the company's knowledge. Actually nothing can be done about it, probably just give your housephone instead to avoid getting spams on your cellphone. Yah, someone mentioned that there are syndicates that purchase names and numbers for like RM2.50 each or was it RM0.50. For those of you who have credit cards, click my link at my Signature to read about Fraudulent calls experienced by LYN members. You will sure learn a thing or two. And now with caller spoofing, you just cannot be sure if a call is genuine. QUOTE(BoomChaCha @ Jan 10 2012, 12:54 AM) I have received many phone calls from foreign con women who Bro, click here and read my artilce on Fraud at RWF blog. Maybe you should be like me and kiasu where I have different phones for different usage.called to my house phone, they said I won a lottery and bla..bla.. I am not saying I am rich, but I want to try my best to protect my privacy... QUOTE(MilesAndMore @ Jan 10 2012, 01:11 AM) And also Air Asia - there's a billboard along the road when we are heading towards KL from KLIA. |

|

|

Jan 10 2012, 10:12 AM Jan 10 2012, 10:12 AM

Return to original view | Post

#65

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(TSOM @ Jan 10 2012, 10:05 AM) You need to revisit your form 5 add maths!! No need even Add Maths, form 3 maths is more than adequate. I hope no one here will spoonfeed you with answers .. let him learn! QUOTE(tifosi @ Jan 10 2012, 10:07 AM) Please read up before you click on the easy way out. haha, so kind of you to spoon feed him » Click to show Spoiler - click again to hide... « |

|

|

Jan 12 2012, 01:45 PM Jan 12 2012, 01:45 PM

Return to original view | Post

#66

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(BoomChaCha @ Jan 7 2012, 05:45 PM) I heard 3.85% FD promo for 12 months from HLB is no longer available since you are right Broafter yesterday (Friday, 6 Jan 2012), they said they have achieved their target..  Those of you interested still can look into HLB GIA-i QUOTE(aeiou228 @ Jan 12 2012, 12:24 PM) http://www.standardchartered.com.my/edm/de...0112/index.html haha, anyone going to take terminate their recent FD and shift back to SCB?   » Click to show Spoiler - click again to hide... « http://www.standardchartered.com.my/edm/de...2/pdf/terms.pdf However is not as straight forward as previous offer where we only need to have Average DAily Balance of RM3K. This offer is based on incremental ADB. And below is what is state in the T&C. “Incremental ADB” means the increase in the ADB in an account in a month, as compared to the ADB in that account during the comparison month of December 2011. |

|

|

|

|

|

Jan 12 2012, 07:16 PM Jan 12 2012, 07:16 PM

Return to original view | Post

#67

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(MilesAndMore @ Jan 12 2012, 06:54 PM) - CIMB is asking for RM1 Million. There is news going around that UOB Bank is going to raise the required AUM for UOB Privilege Banking to RM500K soon. There goes my UOB Privilege Banking Credit Cards. And I guess that is why a fellow Bro in Credit Card section mentioned that UOB launching the Visa Infinite in Malaysia. - HSBC MY doesn't offer Private Banking service in Malaysia, citing strict BNM rules and regulations make the unit unprofitable. In countries where HSBC does offer Private Banking service such as Hong Kong, Singapore, UK etc., the minimum deposit required is different. HSBC SG for instance, is asking for USD1 Million. - UOB SG and DBS SG are asking for SGD5 Million. - Credit Suisse SG is asking for USD2 Million but they have been rejecting new account opening with just USD2 Million since sometime last year as they are now targeting those ultra high net worth customers with USD15 - USD20 Million. Those of you guys that want to check out some of the Chinese New Year Red Packets by Banks, click here to see Dragon Ang Pows. |

|

|

Jan 13 2012, 01:29 PM Jan 13 2012, 01:29 PM

Return to original view | Post

#68

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(TSOM @ Jan 13 2012, 12:47 AM) Get to taste different coffee at various banks when playing FD musical chair, hahaQUOTE(ronnie @ Jan 13 2012, 11:42 AM) Okay, I go join you try luck at Jackpot QUOTE(aeiou228 @ Jan 13 2012, 01:02 PM) Here is something more realistic, put rm5000 and get rm124 return every month. More then 30% p.a. effectively. Datuk seri Najib guarantee one. SARA 1Malaysia. That is way better than any FD. Must go find more info on it.QUOTE(MilesAndMore @ Jan 12 2012, 10:40 PM) You don't like dragons do you Went to the banks again today. Updated photos of Chinese New Year Ang Pows from AmBank and Alliance. |

|

|

Jan 13 2012, 03:27 PM Jan 13 2012, 03:27 PM

Return to original view | Post

#69

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(tifosi @ Jan 13 2012, 02:56 PM) Then you are not classified as poor How is it a savings scheme? I would think most would just go with the loan and earn RM50 from nothing, which is like infinity interest. And, in my opinion, selected banks that are the ones that is making money out from this scheme! It would save us more money if the government were to just pay out RM50/month to 100,000 hardcore poor household. This post has been edited by Gen-X: Jan 13 2012, 03:28 PM |

|

|

Jan 13 2012, 05:27 PM Jan 13 2012, 05:27 PM

Return to original view | Post

#70

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(MilesAndMore @ Jan 13 2012, 04:13 PM) I don't just like Dragons. I worship Dragons Walaueh! U a Dragon baby and somemore double No.8. No wonder lah you are so always ahead of others and prosperous QUOTE(MilesAndMore @ Jan 13 2012, 04:13 PM) By the way, no one has seen the Public Bank and HSBC ang pow for this year yet ? I was thick skin enough to go ask for Ang Pows from Citibank where I have closed my account with them and StanChart Bank even tho I already no more Priority Banking Status, haha. But my ex-CB Personal Banker was nice enough to give me few packets How nice of you to take the time to upload all the ang pow and share them with us Getting HSBC's next week. I got no account with Public Bank anymore so won't be getting any from them. Maybe if I not too lazy wil drop by Maybank. This post has been edited by Gen-X: Jan 13 2012, 05:31 PM |

|

|

Jan 15 2012, 04:01 PM Jan 15 2012, 04:01 PM

Return to original view | Post

#71

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(bearbear @ Jan 15 2012, 01:53 PM) another kiasu bro like me QUOTE(lkcheng @ Jan 15 2012, 03:39 PM) Can't find any better rate than OCBC 3.8% 9 months if exclude exclude premier / priority banking and Bank Rakyat. So OCBC 3.8% 9 months should be the best now. QUOTE(kwokwah @ Jan 15 2012, 03:55 PM) How about OCBC 4% 12 months for their GIA-i? No need PB nor opening of CASA. |

|

|

Jan 15 2012, 11:02 PM Jan 15 2012, 11:02 PM

Return to original view | Post

#72

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(bearbear @ Jan 15 2012, 04:13 PM) another fellow Bro inaugurated into the FDMCG Club and your reply have been adopted as the Motto of the club Updated FDMCG Club » Click to show Spoiler - click again to hide... « QUOTE(tifosi @ Jan 15 2012, 10:49 PM) Sorry, you didn't get me. I was just trying to joke around hence the Ya I was also kidding with the smiley BTW, on Friday, an outsourced survey company appointed by OCBC called me and asked 5 min of my time to rate my satisfactory level on their OTC customer service when I deposited my FD. Told them what they gotta improve on especially on their product knowledge and gave them a pretty average score. Now, I am awaiting the token of appreciation to be sent to my house as promised. Wondering what it is. How come I did not get any calls from OCBC? Let us know what gift you got. |

|

|

Jan 16 2012, 01:34 PM Jan 16 2012, 01:34 PM

Return to original view | Post

#73

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

Today the banks really crowded, luckily I got the new notes last week.

Click here to view my updated post on CNY Ang Pows 2012 where I have added Affin Bank, HSBC, Coach, Metrojaya, The Gardens Popular and several where children would just go WOW! |

|

|

|

|

|

Jan 16 2012, 01:51 PM Jan 16 2012, 01:51 PM

Return to original view | Post

#74

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(gark @ Jan 16 2012, 01:39 PM) No CIMB Preffered and Public Bank Red Carpet (Got ah?) ang pows?.. must go get so can complete your collection. haha, I don't even have the standard issued Ang Pows from the above mentioned banks. You go get lah and then share with me to help me make the collection complete To add, the above mentioned banks' FD Promotions not competitive And thanks for checking out my blog This post has been edited by Gen-X: Jan 16 2012, 01:55 PM |

|

|

Jan 16 2012, 04:16 PM Jan 16 2012, 04:16 PM

Return to original view | Post

#75

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

read the article below, not so good news for us FDMCG if SCB Research Head is correct:

http://www.themalaysianinsider.com/malaysi...-2.7pc-in-2012/ But good news, he predicted inflation rate will also go down And we will know a week after CNY if interest rates will go up or down or stay the same for now. This post has been edited by Gen-X: Jan 16 2012, 04:23 PM |

|

|

Jan 17 2012, 10:30 AM Jan 17 2012, 10:30 AM

Return to original view | Post

#76

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(hackwire @ Jan 16 2012, 10:59 PM) No new FD Promotion lah, so discuss about side benefits of playing FD Musical Chair QUOTE(smsbusiness2u @ Jan 17 2012, 09:37 AM) And how does your post on GST has to do with Balance Transfer in BT Thread QUOTE(hackwire @ Jan 17 2012, 10:15 AM) that's right when my new post was closed and ask to move here by the moderator, i wonder if he is even doing his job to moderate this thread as i find pretty much redundant of information posted here. hope he is doing his job first before asking people to follow this thread. Bro, Chinese New Year just around the corner, guess you not into CNY spirit yet QUOTE(MilesAndMore @ Jan 16 2012, 05:13 PM) By the way, many people went to PBB this morning to open new FD (Prosperity Rates). The power of a good/well-known/reliable brand I wonder if those people knows that the 3.98% is for the 12th and final month only.This post has been edited by Gen-X: Jan 17 2012, 10:38 AM |

|

|

Jan 17 2012, 05:38 PM Jan 17 2012, 05:38 PM

Return to original view | Post

#77

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(gsc @ Jan 17 2012, 11:13 AM) Yes, if you do not consider below:1) Bank Raykat's Islamic investment (got conflicting reports, some reported interest payable can fluctuate) and MBSB 5 years FD, both not covered by PIDM. 2) HSBC 3 months FD (max half of deposited amount to enjoy promo rate) for new Premier Banking Customer.  QUOTE(tifosi @ Jan 17 2012, 11:27 AM) I think most people don't know the 3.98 is for the 12th month only. I told my mom that I placed 9 months for 3.8 she then told me that PBB is offering 3.98 for 12 months. I then showed her the effective rate and ask her to put in OCBC Yah, many not aware it is a step up interest rate promo. Just to let you guys know, say if you PBB FD matures on a Saturday, Sunday or Public Holidays, PBB may deduct 1 or 2 days interest due to you when you withdraw your FD on the next working day. Happened to me, had to insist the Manager check with HQ if this was their policy and subsequently they paid me the interest.QUOTE(stanny @ Jan 17 2012, 11:50 AM) To transfer money from 1 bank to another bank which I don't have an account yet, just go over the counter from initial bank and make a bank draft then give to other bank? Yes. not only that, you can most probably split the amount to CASA and FD too.QUOTE(ESeong @ Jan 17 2012, 02:43 PM) QUOTE(ronnie @ Jan 17 2012, 03:22 PM) Standard charges for bank cheque:Alliance and OCBC FOC if cheque written in your name. Can't remember if Citibank was free. HLB and PBB RM2.15. RHB and MBB RM5! And for those of you who want to see Maybank Private Banking Golden Dragon Ang Pow, click here. This post has been edited by Gen-X: Jan 17 2012, 05:39 PM |

|

|

Jan 17 2012, 06:21 PM Jan 17 2012, 06:21 PM

Return to original view | Post

#78

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(gchowyh @ Jan 17 2012, 06:09 PM) Yah SCB is RM2.15, I forgot about that. Once I wanted to shift my funds to another bank from RHB, so asked them to write the cheque and got charged for it (didn't know until I got the cheque). The joke is that I should have asked them to transfer the funds into my RHB current account (which will be instantly credited) and I then write a new cheque to the other bank thus saving me money, really a fool To add, OCBC, when you go withdraw your FD, ask them to write more than 1 cheque (e.g. 2 cheques) in your name also FOC This post has been edited by Gen-X: Jan 17 2012, 06:40 PM |

|

|

Jan 18 2012, 12:25 AM Jan 18 2012, 12:25 AM

Return to original view | Post

#79

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(mIssfROGY @ Jan 17 2012, 10:16 PM) Talking aboyt withdraw fd in cheque, I kena hlb 5bucks woh.... Junior fd. Maybe junior fd more exp? Odd that HLB charge you RM5 for Junior FD. Yours Ex-Eon Bank? For HLB PB customers, they charge RM0.15. Citibank is 0.15. Ambank is 2+ cant rmb exact amt I have yet to withdraw from my HLB Junior FD but have done so many times with normal FD and from Junior Savings Account and they charge me RM2.15 for cheques previously prior to my PB status. Maybe next time ask if you transfer first to Junior Savings Account, will the cheque be cheaper. QUOTE(gsc @ Jan 18 2012, 12:25 AM) I encountered the same short change of 1-2 days of interests if your FD due on Sat/Sun or Public holidays. I told the counter is it is incorrect to 'cheat' on customers in this way. The assistant mgr came out and agreed to pay the interests. So all PB FD holders do watch out on your interest amounts which you entitled Yah, imagine how much "extra" PBB earns from their customers who are not aware of this or those who do not read the receipt nor calculate the interest before they withdraw but blindly accept what PBB give them.This post has been edited by Gen-X: Jan 18 2012, 12:32 AM |

|

|

Jan 18 2012, 09:09 AM Jan 18 2012, 09:09 AM

Return to original view | Post

#80

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(tbheng @ Jan 18 2012, 07:39 AM) QUOTE(kwokwah @ Jan 18 2012, 08:39 AM) I have not met any banks in Malaysia that do not accept personal cheques. Very impractical to carry around large amount of cash. Care to name any? In fact they even credit you the same day if you bank in before 4pm. I also have not encounter what tbheng mentioned and would like to know which bank does not accept personal cheque. And also the date of the FD starts from the same day I deposit with cheque and not after cheque is cleared.QUOTE(MGM @ Jan 18 2012, 07:48 AM) More like Antarctic Bank.This post has been edited by Gen-X: Jan 18 2012, 09:11 AM |

|

Topic ClosedOptions

|

| Change to: |  0.0468sec 0.0468sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 06:13 PM |