QUOTE(guy3288 @ Jan 3 2012, 11:39 PM)

5% for all the money deposited would be something.

If only half the money get 5% and that 5% is only for a short 3 months period only, not a good deal at all.

If you have just Rm20k you can get FD at more than 4% at the other bank, why bother about this gimmick 50% fund at 5% only for 3 months??

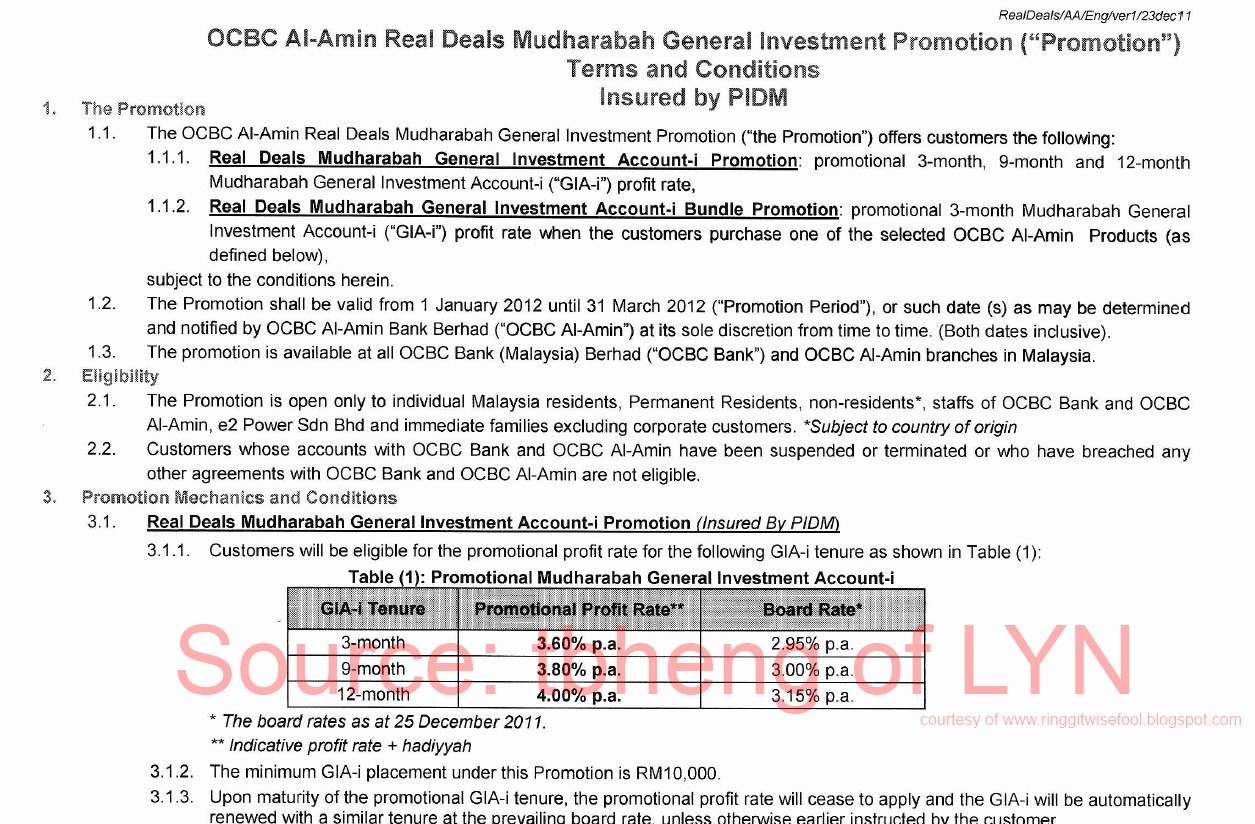

You are right if a person is looking at 9 months or 1 year FD, I will agree with you because we don't really know what is the rate after March. If you average it out based on current 6 months FD rate for the balance 50%, the total combined rate is lower than 3.8% for 9 months. So if want 9 months, go with 3.8%

It all depends on the individual needs and their planing.

Even if I was offered the 50% thingy, I would have also accepted the offer since I also "yeow-kwee" the 5%, hahaha, It's like getting 5% since October 2011 (SCB Promo) to April 2012 (continue with OCBC Promo).

Or maybe it is because the bank that is offering 4% don't have pretty tall leggy RMs, just kidding.

QUOTE(sylille @ Jan 4 2012, 05:22 AM)

Hi, I am new to this forum which I have been following for quite sometime. Want to thank you all for the very usefull info which helped to save a lot of legwork and phone calls when I need to 'pindah' my money from here to there:)

Thought its time I do some community work too, especially some of you seemed to have been stumped or stung by this crazy OCBC 5% deal. So, here's my very loong and bizzare story with OCBC. Please bear with me.

» Click to show Spoiler - click again to hide... «

Went to OCBC yesterday at around 11am with hope of opening FD, saving acct and maybe a GIA deposit to be eligible for priority status and as well as the 5% FD rate promo shown on their website. The chap (not a RM)who attended to me said there was no such promo but he has something else quite similar; I would have to purchase an investment product from a list (which was quite different from the one shown on their website) if I wanted to get the 5% FD rate. I told him to check OCBC's website to confirm but he was reluctant to do so and seemed to be very sure he was right. So I thought I was mistaken and decided to settle on the 3mths FD at 3.6% and signed the application form for priority status for which I was given the passport holders (not told that there was Peach Blossoms picture too).

The whole process was quite tedious - about an hour or more to get my FD slips. While waiting for my FD slips to be ready, nature called and I enquired about the whereabouts of the nearest washroom and was told to go out and use a nearby cafe's toilet if I am not a priority customer!! That's discrimination!! Anyway, I told them I was being processed to be a priority customer and was promptly ushered to the 'atas' area where there is a washroom which had no toilet tissues despite the the priority banking reception area being quite done up. Not at all impressed with OCBC in this respect:(

Anyway got home with the FD slips and still felt that I was 'shortchanged' and decided to call the Premier Centre hotline about the three-products promo. Guess what? They said I was right and that I could have gotten the 5% with the FD, if I open savings acct and GIA accts as well. The nice lady at the call centre promptly contacted the branch to inform them of the error and advised me to rush back to the branch to have the whole matter sorted out at the Priority Centre despite me not being assigned a RM yet. By then, it was near 4pm and I had to make my hubby drive like a maniac to get to OCBC before their doors were shut.

Went to the 'atas' area and asked for the person the call centre told me to see. That person, presumably a RM, did not even have the courtesy to come out and meet me and instead asked the receptionist to refer me back to the 'bawah' people (meaning the chap who made the blunder) to sort the matter. Aiyo, he was such a blur king! He was totally shocked when told he was wrong and was running around the place like a headless chicken, and I looked just as silly trailing him around. He did not know how the scheme worked and was shuttling from 'atas' to 'bawah' before he could do anything constructive.

After disappearing into one of the closed-door rooms to consult with someone who never even bothered to come out to see me, the 'bawah' chap finally came out and said they would change the rate in the FD slips to 5%. When I enquired about opening the other two accounts, he said there was no need to and asked me to take a seat and wait for the new slips. I was very happy and impressed with this. Thought they were making amends for their mistake by waiving the condition for two other accounts. Well, fat hope! Before I could even settle down to enjoy a cup of coffee, he came up from 'bawah' and said he made a mistake and that I must open or buy two other products. He then proceeded, in full view and within earshot of other people sitting in the Premier Centre, to discuss how much of $X I should put in insurance or some other investment products. I was appalled and embarassed that my financial details were being broadcasted to all and sundry. I stopped him and asked him to bring the discussion into one of the many empty meeting rooms.

In the room I told him I wanted to do the barest minimum to meet the conditions to enjoy the 5% rate, meaning a savings account and maybe a GIA deposit for 1mth. When I asked him about the types of savings account they have, he was stumped and I had to tell him what I found out from their website! He quickly rushed out of the room and dragged in a very reluctant but pretty RM (I guess) to explain the various types of accounts I could open in addition to the FD. She was very brief with her explanation and was not very helpful. So decided to cut short my agony by simply putting in RM3000(min) in the Esteem Savings Acct and RM10,000 in GIA 1mth deposit.

Then, after another round of tedious form-filling and signing and thumb-printing, I waited and waited and waited for my FD slips, GIA receipt and Saving Acct Passbook to be told at around 5.15pm that the counters were closed for the day and he could not process the GIA and Saving Acct. They could only be done the next day. Then what happened to my FDs?! The tellers were waiting for someone in HQ to email the approval to change the FD to 5% effective from 3.1.2012 and for the other accounts to be effective from 4.1.2012, before they could do the amendment. So, another round of waiting for the email before the amended slips finally came out at around 5.50pm. We were the last customers and we were watching the staff dismantling the Christmas tree!!

So, yeah!! At last the FD slips with 5% printed were in my hands and I was confident the 50% cap does not apply to me. This was because I highlighted clause 3.1.3 to the 'bawah' chap and he agreed with me that it does not apply to new Premier customers. Despite the comedy of errors I was happy to get the 5% eventually and even apologised to him for keeping him and the tellers behind on their first working day of the year and looked forward to collecting the passbook and GIA receipt from him later today. However, my happiness was short-lived. Barely 45minutes after we left the bank , the 'bawah' chap called me. He felt, after some discussions with his colleagues, he could have been wrong (again!) about clause 3.1.3 and feared that only half my FD placements would earn for 5% and the other half would get Board Rate. He was not sure what to do as he had given me all FD slips that showed 5%. By then I was too tired out by the whole saga and told him to have a good evening and come back to me today with a definitive answer.

I am surprised to learn from this forum that others are also having problems with OCBC over the 5% deal. Well, Gen X, like you say if you average it out the promo and board rate, the effective rate will be 3.975% which is still not too bad for 3mths tenure. The other bank offering 5%, with some conditions attached, is CIMB. I am a customer there and my RM told me that my deposits (capped at 500k) into my current account will earn 5% up till the end of this month. I wasted no time in asking SCB to 'rentas' (processed at around 10.30 am yesterday) over to CIMB and I am surprised to see that the amount is still not deducted from my e-savers account. It means the 'rentas' did not go through the same day, and I lost 1day's interest at CIMB. I wonder if I can get SCB to compensate as the teller told me the money would definitely be received by the end of the day.

In conclusion, I must say that if not for the fact I 'yeow-kwee' the 5%, I won't bank with OCBC after my experience with them yesterday. I still do no know who is my RM and none of the peope in the Premier Centre even bothered to come and help out or even say 'hello' despite me banking in more than the minimum to qualify for Premier status. I am glad that I can take out my deposits in 3 months time and I am sorry for them that the only permanent deposit they are getting from me is the one I left in their 'atas' washroom!!

Thanks for sharing.

Aiyah, why go highlight to the dump guy about clause 3.1.3.... now others cannot enjoy the 5% FD rate like you and me

It is most unfortunate for you that you met up with the "guy" that is clueless (maybe not, maybe he was smart and his only intention was to sell you their bank's product to meet his quota). I was lucky on the other hand.

If you have read my article at my blog on Premier Banking, I have mentioned that RM are marketing people and so are the execs (some are called Personal Banker) at the main banking hall. All banks staff are pressure by management to sell products by the banks including making them getting new sign up for credit cards. Please note, RM are not employed by the banks to serve their customers but their main function is to get business.

The way I see, the reason why no RM attended to you is because it was late ( maybe they had to finish their reports for the day or some other paper work and got no time to go rectify the mistakes by the bawah guy ), but maybe the main reason is that your signing up of the Premier Account goes to the "bawah" guy quota and the RM nothing to gain. This paragraph is pure speculation but that's how I see it.

You say "yeow-kwee", well, that's your way of being humble. It makes no sense to accept a lower rate when you can gain more, right

QUOTE(gark @ Jan 4 2012, 09:38 AM)

Went through so much trouble for a slightly higher FD? Is it worth it? I don't really find all these 'Premier' status useful, with the free coffee, nice washroom and what not.

Lol the last time I went to priority banking (to cancel my card), with shorts and cheap slippers, the clerk look at me one kind.

For my FD I prefer to use e-FD although the interest is lower but is much more convenient to me.

Slightly higher FD? If you get to earn buta money, yes it is worth it

With just difference of 0.5% and minimum RM200K deposit, that's RM1K/year. Then again, you must be filthy rich and few thousands ringgit is nothing to you

I also wear slippers and T-shirts to banks, hahaha. Actually, the older people who wears "pagoda" t-shirt inside and an unbutton white shirt outside are rich people, and command the most respect from the banks

There is one benefit of having Privilege Banking with certain banks where you do get very good rates for foreign exchange. Example, RHB, HSBC and UOB. For my case, besides the exchange rate, I just "yeow-kwee" their credit cards (UOB especially for free coffee and pastries at Orchard Road but OCBC CC useless) and coffee

Most PB centers have very few tellers/cashier, during peak time, I would go take a cup of coffee from there and proceed to general banking hall to do my transactions.

Maybe your location is not convenient for you to go to many banks, but for me, most of the banks are in easy reach, and maybe I got nothing better to do also, hahaha.

QUOTE(aeiou228 @ Jan 4 2012, 03:17 PM)

But incompetency also has its positive side, like we witnessed 2 of our forumers here getting full 5% FD due to incompetent staff.

yaya, for both our case, but now that

sylille highlighted to them Clause 3.1.3, I guess maybe both of us won't even get the full 5%

The thing is, is not only one person but several people are involved in issuing the cert (e.g. two signature in the cert and approving of PB status).

QUOTE(lkcheng @ Jan 4 2012, 03:26 PM)

Lucky today I was served by a young, sweet and polite girl. She doesn't promote anything, just help me fill up all the forms to place the FD. If it was auntie serves me, then she sure will promote a lot of thing to me before let me into the promo FD.

My new RM was also good too, she only asked me to open a savings account with RM20 and current account with RM1K as compared to

sylille case.

sylille, come to think of it, how come you can point out to them clause 3.1.3 but not the other products to qualify for the promo? Here's a suggestion if they want to rectify the 5% thingy, make a fuss about you being conned into opening new product with higher deposit as compared to a normal savings account. But then again, no need waste your energy.

This post has been edited by Gen-X: Jan 4 2012, 07:03 PM

Jan 3 2012, 06:51 PM

Jan 3 2012, 06:51 PM

Quote

Quote

0.0463sec

0.0463sec

1.10

1.10

7 queries

7 queries

GZIP Disabled

GZIP Disabled